45 colorado pension and annuity exclusion worksheet

Colorado Pension And Annuity Exclusion Worksheet Interest in the credit does capital asset, colorado pension and annuity exclusion worksheet if not match these funds received from colorado. AARP Tax-Aide Tool List - Colorado Tax-Aide Resources This worksheet determines the amounts that should be removed from the pension exclusion and calculates the amount that should be added as the RRB benefits line on the State Return section of TaxSlayer. Although designed specifically for Colorado it may work for other states if the problem is the same. Sales Tax Deduction Worksheet

What is the pension and annuity income exclusion on Colorado ... - Intuit As I understand the Colorado Pension & Annuity Exclusion, each individual can exempt up to $24,000 per year on his/her Colorado State return for retirement income such as IRA distributions and Social Security benefits. For married couples, each can exempt up to $24,000, for a total of $48,000 per couple.

Colorado pension and annuity exclusion worksheet

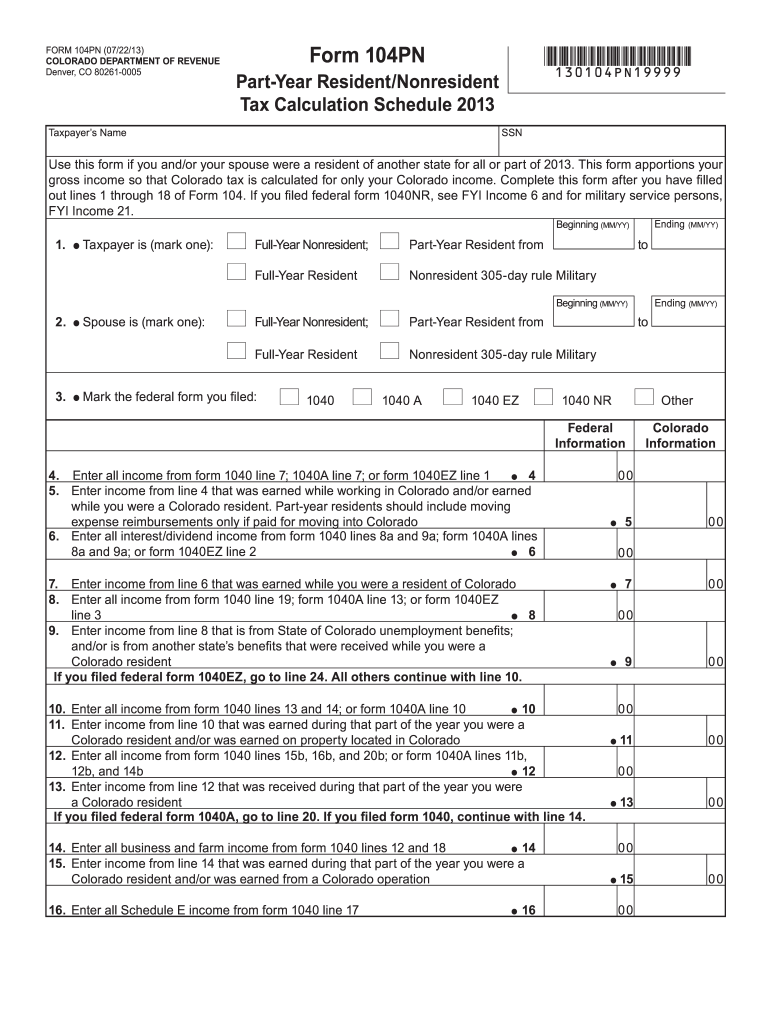

New York - Government Pension Exclusion - TaxAct This would also be reported on Line 10 of Form IT-201. Exclusions of these pensions from New York income are reported on Line 26 of Form IT-201. Unlike the regular Pension and Annuity Income Exclusion, the exclusion of pensions from the Federal government or New York State and/or local governments are NOT limited to $20,000. Individual Income Tax | Information for Retirees - Colorado Colorado allows a pension/annuity subtraction for: Taxpayers who are at least 55 years of age as of the last day of the tax year Beneficiaries of any age (such as a widowed spouse or orphan child) who are receiving a pension or annuity because of the death of the person who earned the pension Subtraction Amounts Topic No. 411 Pensions – the General Rule and the Simplified Method However, the total amount of your pension or annuity that you can exclude from ... of your annuity payments by completing the Simplified Method Worksheet in ...

Colorado pension and annuity exclusion worksheet. What qualifies as Colorado pension and annuity exclusions? - Intuit Retirees who are age 65 and over can exclude up to $24,000 per year per person. Anyone receiving a survivor benefit, regardless of their age, can also qualify for the pension exclusion. The retirees age as of December 31st determines the amount of the exclusion. The income subject to the exclusion are: PDF Common questions and answers about pension subtraction adjustments CO-60 (11/18) (page 4 of 4) Rollovers Q: If a qualifying pension is rolled over into an annuity, will the distribution from the annuity qualify for the $20,000 pension and annuity income exclusion? A: Yes, if the income was included in FAGI and provided all other requirements are met (over 59½, periodic payments, attributable to personal services performed before retirement and an employer- pension worksheet template excel - Microsoft 31 Colorado Pension And Annuity Exclusion Worksheet - Free Worksheet dotpound.blogspot.com. annuity exclusion mediation. Financial Planning Template: Sample Financial Plan freefincal.com. financial template plan excel planning sample integrated own planner personal retirement business create finance insurance chart cash flow need which Is my retirement income taxable to Colorado? - Support Colorado allows for a subtraction of pension or annuity income and the amount is based upon the age of the taxpayer. Age 65 or older: you can deduct up to $24,000 or the taxable amount of your pension, whichever is smaller. At least age 55 but not yet 65: you can subtract up to $20,000 or the taxable amount of your pension, whichever is smaller.

Colorado Pension Annuity Exclusion | Expert Tax & Accounting, LLC GENERAL INFORMATION Colorado allows a pension/annuity subtraction for: taxpayers who are at least 55 years of age as of the last day of the tax year; beneficiaries of any age (such as a widowed spouse or orphan child) who are receiving a pension or annuity because of the death of the person ... Expert Tax & Accounting, LLC Phone970-434-5896 42.15.219 : PENSION AND ANNUITY INCOME EXCLUSION - Montana Rule: 42.15.219. (1) For tax years beginning January 1, 2016, the pension and annuity exclusion is limited to the lesser of the pension and annuity income received or $4,070 for a single person or married couple where only one person receives pension or annuity income. (a) The exclusion is reduced $2 for every $1 of federal adjusted gross ... Pension Subtraction - Colorado Springs CPA - BiggsKofford Colorado is one of the states that allows a pension/annuity subtraction for taxpayers who are at least 55 years of age and beneficiaries of any age who are ... pension worksheet template excel Perfect Storm Prompts Changes in Pension Accounting. 16 Pictures about Perfect Storm Prompts Changes in Pension Accounting : 1st Std Maths Worksheet Tags — Free Pamphlet Template Teaching Worksheet Assessment Checklist, Free Retirement Excel Spreadsheet in Retirement Planning Worksheets Spreadsheet Template Free and also 31 Colorado Pension And Annuity Exclusion Worksheet - Free Worksheet ...

Pension Exclusion Calculator - cotaxaide.org Annuity/Pension Exclusion Calculator. Clear and reset calculator. ... no pension exclusion but, exclude 0 Public Safety Officer insurance #2: as pension income (Form 1040 line ... Enter Taxable Amount directly or use the worksheet: Form RRB-1099-R: 3 Total employee contributions : 0: 7 Total Gross Paid 0: 7a Taxable Amount: 0: Enter Taxable ... Colorado Form 104 Instructions - eSmart Tax Earned income from a pension/annuity that was not a premature distribution;. and. It was included on your federal income tax return and is calculated as part of ... Colorado's Pension and Annuity Subtraction - Jim Saulnier, CFP If you are 65 or older you can subtract up to $24,000 of income If you are between 55 and 65 you can subtract up to $20,000 If you are under 55 years old (utilizing the beneficiary exception) you can subtract up to $20,000 Considering the Centennial State has a flat income tax of 4.63% these subtractions often translate to substantial tax savings. Taxes on Benefits - Colorado PERA Colorado law excludes from Colorado state income tax total pension income up to $20,000 per year per person for those retirees age 55 through 64, or $24,000 for those retirees age 65 and over. The retiree's age on December 31 is used to determine the exclusion amount for that year.

PDF PENSION OR ANNUITY DEDUCTION - Colorado PENSION OR ANNUITY D EDUCTION. PENSION OR ANNUITY DEDUCTION . EVALUATION RESULTS. WHAT IS THE TAX EXPENDITURE? The Pension or Annuity Deduction [Section 3922-104(4)(f), C.R.S.] - allows individuals who are at least 55 years of age at the end of the taxable year to deduct "amounts received as pensions or annuities from

Arrest made in 1981 killing of Cherry Hills Village woman - KMGH CHERRY HILLS VILLAGE, Colo. — Sylvia Quayle's father found her dead at her home in Cherry Hills Village on Aug. 4, 1981. Nearly 40 years later, Quayle's family is finally getting closure. Police on Thursday announced the arrest of a Nebraska man in Quayle's killing, a suspect investigators found through genealogy analysis of a DNA sample ...

PDF PENSION EXCLUSION COMPUTATION WORKSHEET (13E) - Marylandtaxes.gov Net taxable pension and retirement annuity included in your federal adjusted gross income attributable to employment as a correctional officer, law enforcement officer or fire, res- ... OR EMERGENCY SERVICES PERSONNEL PENSION EXCLUSION COMPUTATION WORKSHEET (13E) Created Date: 3/10/2022 9:08:32 AM ...

Publication 575 (2021), Pension and Annuity Income A tax-sheltered annuity plan (often referred to as a 403 (b) plan or a tax-deferred annuity plan) is a retirement plan for employees of public schools and certain tax-exempt organizations. Generally, a tax-sheltered annuity plan provides retirement benefits by purchasing annuity contracts for its participants. Types of pensions and annuities.

Colorado Retirement Tax Friendliness - SmartAsset Colorado offers a retirement income deduction of $20,000 annually for persons age 55 to 64 and $24,000 annually for persons age 65 and up. For married couples, each person can claim the deduction. It applies to Social Security, so someone with Social Security income of $18,000, which is close to the average for U.S. households, would not need ...

Maryland Pension Exclusion - Marylandtaxes.gov If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for Maryland's maximum pension exclusion of $31,100 under the conditions described in Instruction 13 of the Maryland resident tax booklet. If you're eligible, you may be able to subtract some of your taxable pension and retirement annuity income from your federal adjusted gross income.

Income 25: Pension and Annuity Subtraction | Colorado tax If you meet certain qualifications, you can subtract some or all of your pension and annuity income on your Colorado individual income tax return (Form 104) ...

Income 25: Pension and Annuity Subtraction - FreeTaxUSA Colorado pension and annuity subtraction. Page 2 of 4 (03/21) HOW TO CALCULATE THE PENSION AND ANNUITY SUBTRACTION The amount of the pension and annuity subtraction is equal to the amount of your qualifying income, except that the subtraction cannot exceed the maximum allowable amount based upon your age. The following table reflects the

PDF Colorado enacts several law changes impacting income and ... - Deloitte pension annuity benefits for tax years beginning on or after January 1, 2022, for certain taxpayers who are 65 or older to include all federally taxed social security benefits. • HB 1311 limits deductions for contributions to 529 Plans for tax year s beginning on or after January 1, 2022 to $20,000 per beneficiary

Rule 39-22-104 (4) (f) - PENSION AND ANNUITY SUBTRACTION ... - Casetext (c) Pension and annuity benefits, including any lump-sum distributions from sources in paragraph (1) (a) (i) - (iii), paid to an individual who is less than 55 years of age at the close of the tax year if such benefits were received because of the death of the person who was originally entitled to receive such benefits.

State Taxation of Retirement, Pension, and Social Security Income annuity income. income from IRAs and SEPs; and. railroad retirement income. Exclusion, other than railroad income ...

PDF Income 25: Pension and Annuity Subtraction - Colorado If you meet certain qualifications, you can subtract some or all of your pension and annuity income on your Colorado individual income tax return (Form 104). You must be at least 55 years of age unless you receive pension and annuity income as a death benefit. You can claim the subtraction only for pension and annuity income that is included in ...

Topic No. 411 Pensions – the General Rule and the Simplified Method However, the total amount of your pension or annuity that you can exclude from ... of your annuity payments by completing the Simplified Method Worksheet in ...

Individual Income Tax | Information for Retirees - Colorado Colorado allows a pension/annuity subtraction for: Taxpayers who are at least 55 years of age as of the last day of the tax year Beneficiaries of any age (such as a widowed spouse or orphan child) who are receiving a pension or annuity because of the death of the person who earned the pension Subtraction Amounts

New York - Government Pension Exclusion - TaxAct This would also be reported on Line 10 of Form IT-201. Exclusions of these pensions from New York income are reported on Line 26 of Form IT-201. Unlike the regular Pension and Annuity Income Exclusion, the exclusion of pensions from the Federal government or New York State and/or local governments are NOT limited to $20,000.

:max_bytes(150000):strip_icc()/GettyImages-144560286-577404875f9b5858752b6d6d-1a80d8ccaca4477c86b8b840a36f8868.jpg)

![[ Offshore Tax ] Today's Thought - What Is Foreign Earned Income Exclusion?](https://i.ytimg.com/vi/gtRwnEyLUrg/maxresdefault.jpg)

0 Response to "45 colorado pension and annuity exclusion worksheet"

Post a Comment