45 1040 qualified dividends and capital gains worksheet

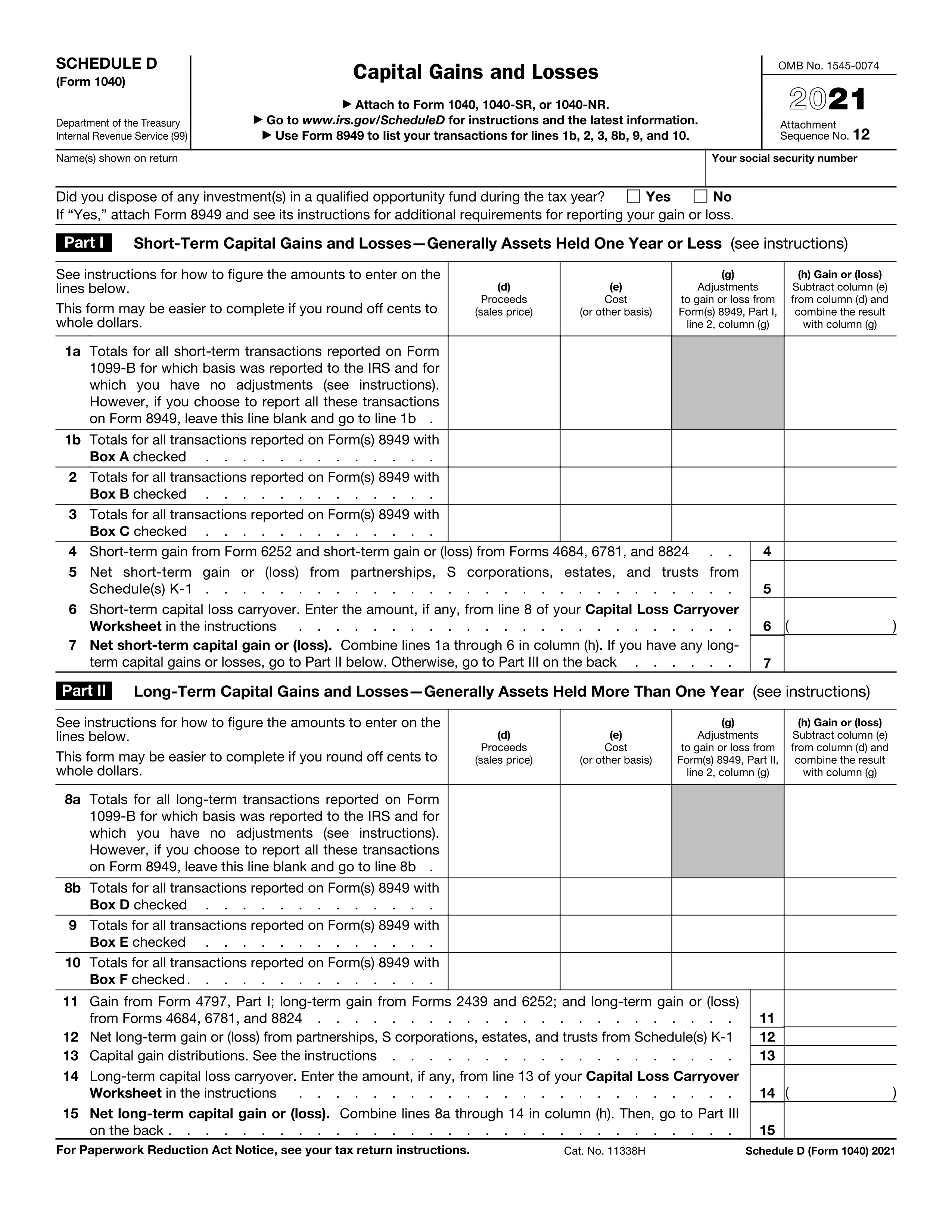

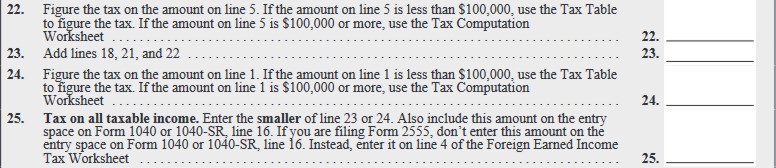

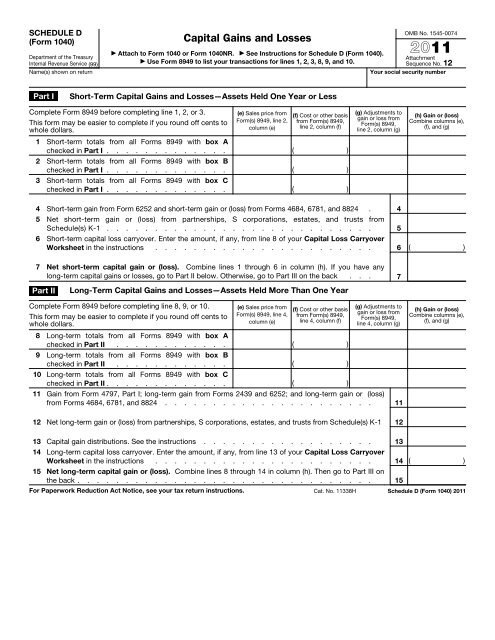

2022 Instructions for Schedule D (2022) | Internal Revenue ... Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line ... 1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

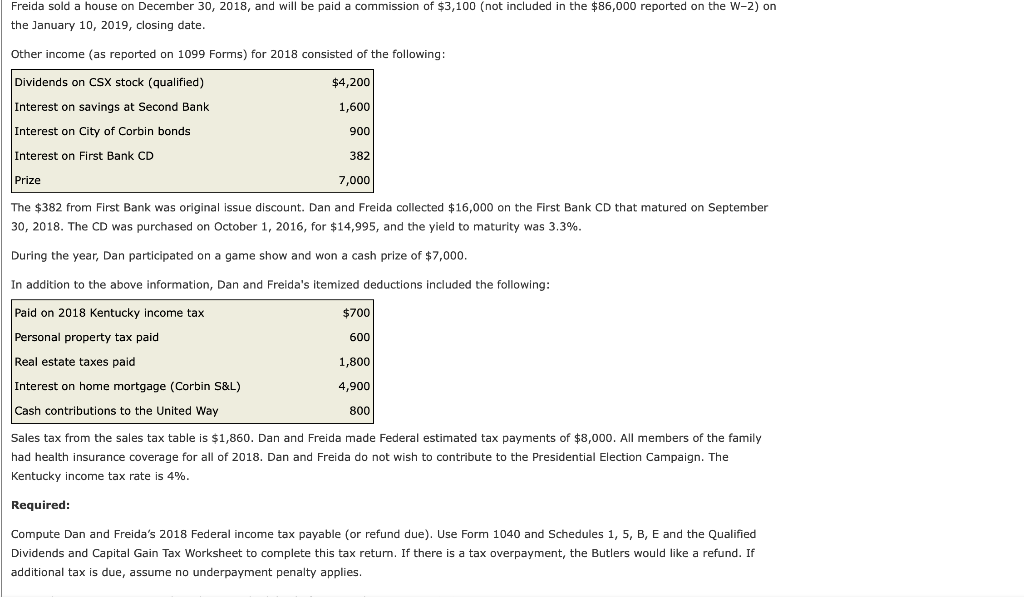

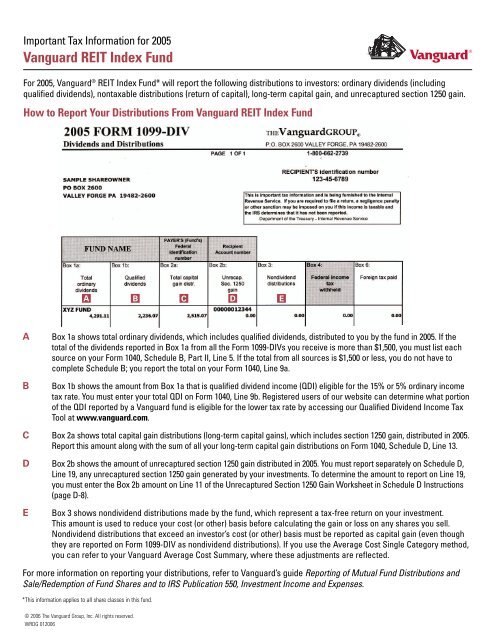

How Dividends Are Taxed and Reported on Tax Returns - The Balance Nov 15, 2022 · Dividends can be taxed at either ordinary income tax rates or at the lower long-term capital gains tax rates. Dividends that qualify for long-term capital gains tax rates are referred to as "qualified dividends." In 2022, ordinary income tax rates range from 10% and 37% while long-term capital gains tax rate is capped at 20%.

1040 qualified dividends and capital gains worksheet

Publication 523 (2021), Selling Your Home | Internal Revenue ... Schedule B (Form 1040) Interest and Ordinary Dividends. Schedule D (Form 1040) Capital Gains and Losses. 982 Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment) 1040 U.S. Individual Income Tax Return. 1040-NR U.S. Nonresident Income Tax Return. 1040-SR U.S. Income Tax Return for Seniors Topic No. 409 Capital Gains and Losses - IRS tax forms Nov 25, 2022 · There are a few other exceptions where capital gains may be taxed at rates greater than 20%: The taxable part of a gain from selling section 1202 qualified small business stock is taxed at a maximum 28% rate. Net capital gains from selling collectibles (such as coins or art) are taxed at a maximum 28% rate. How Your Tax Is Calculated: Qualified Dividends and Capital ... Sep 24, 2021 · In this way, the size of your ordinary income can change in which qualified bracket your qualified dividends and capital gains are taxed. Lines 6-9: Non-Taxable Qualified Income. The first qualified tax bracket is the 0% bracket. Lines 6-9 of the worksheet are figuring if any gains are taxed at the 0% rate (line 9).

1040 qualified dividends and capital gains worksheet. Publication 3 (2021), Armed Forces' Tax Guide | Internal ... Certain investment income must be $10,000 or less during the year. For most people, this investment income is taxable interest and dividends, tax-exempt interest, and capital gain net income. See Worksheet 1 in Pub. 596 for more information on the investment income includible in the amount that must meet the $10,000 limit. How Your Tax Is Calculated: Qualified Dividends and Capital ... Sep 24, 2021 · In this way, the size of your ordinary income can change in which qualified bracket your qualified dividends and capital gains are taxed. Lines 6-9: Non-Taxable Qualified Income. The first qualified tax bracket is the 0% bracket. Lines 6-9 of the worksheet are figuring if any gains are taxed at the 0% rate (line 9). Topic No. 409 Capital Gains and Losses - IRS tax forms Nov 25, 2022 · There are a few other exceptions where capital gains may be taxed at rates greater than 20%: The taxable part of a gain from selling section 1202 qualified small business stock is taxed at a maximum 28% rate. Net capital gains from selling collectibles (such as coins or art) are taxed at a maximum 28% rate. Publication 523 (2021), Selling Your Home | Internal Revenue ... Schedule B (Form 1040) Interest and Ordinary Dividends. Schedule D (Form 1040) Capital Gains and Losses. 982 Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment) 1040 U.S. Individual Income Tax Return. 1040-NR U.S. Nonresident Income Tax Return. 1040-SR U.S. Income Tax Return for Seniors

0 Response to "45 1040 qualified dividends and capital gains worksheet"

Post a Comment