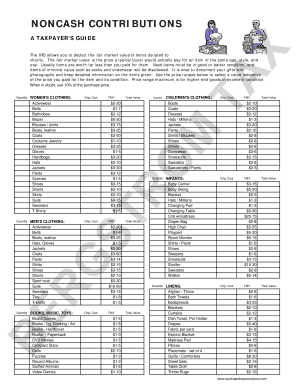

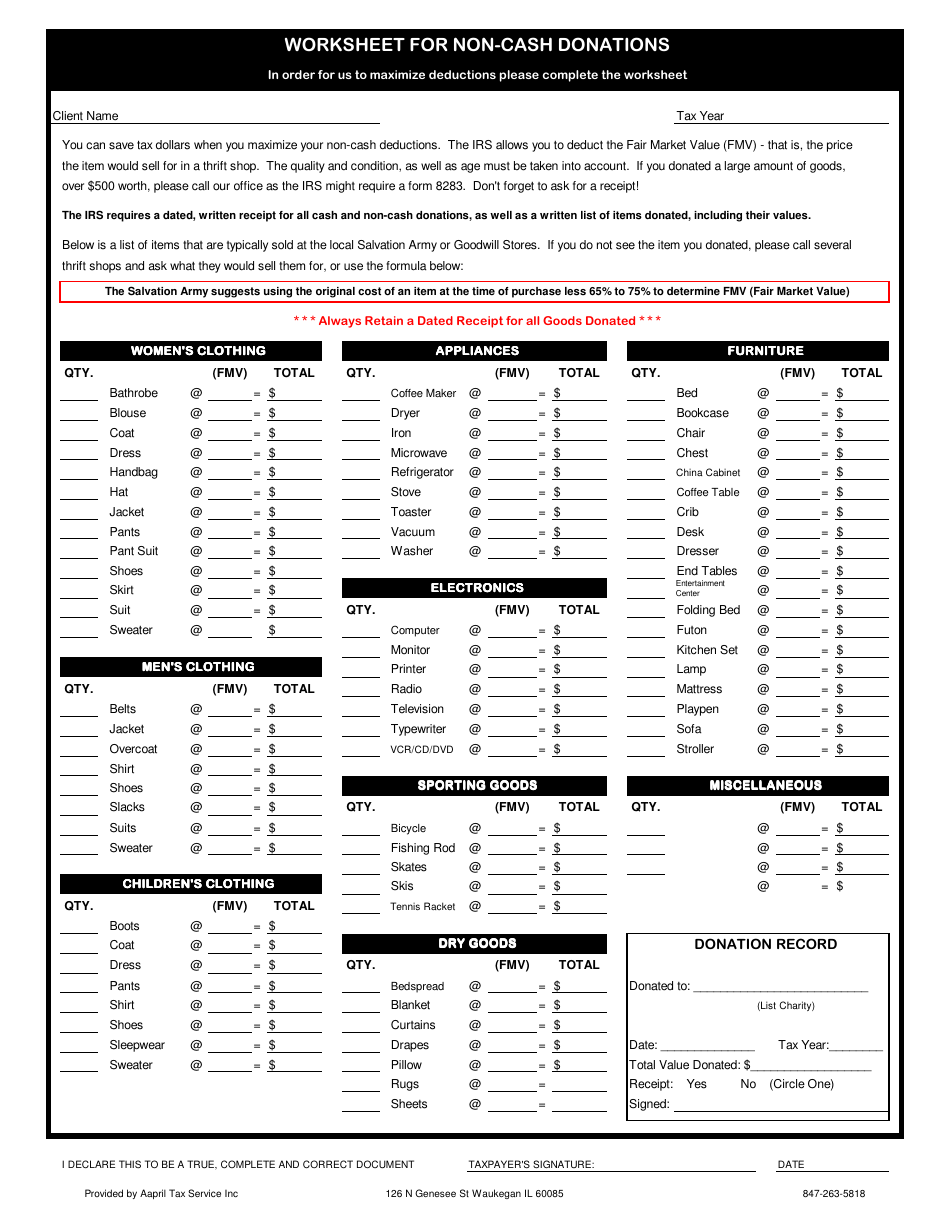

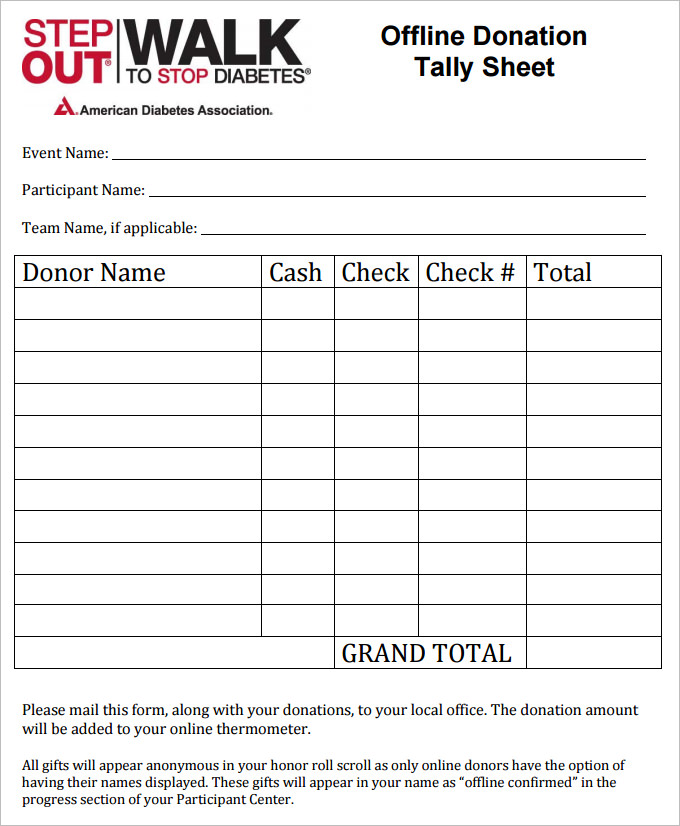

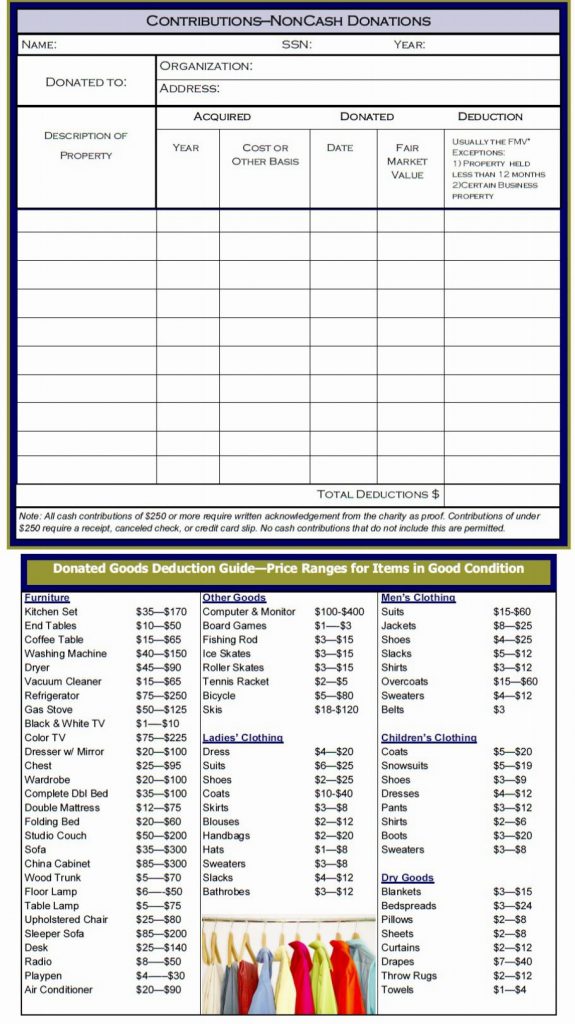

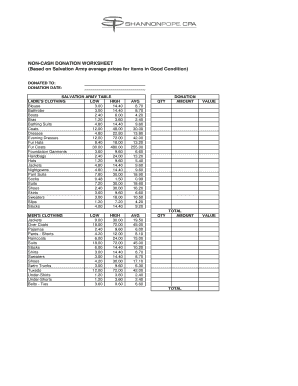

44 non cash charitable contributions worksheet

Lifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing › instructions › i1040sca2021 Instructions for Schedule A (2021) | Internal Revenue ... In general, you can elect to treat gifts by cash or check as qualified contributions if the gift was paid in 2021 to a qualified charitable organization. This election isn't available for contributions to an organization described in IRC 509(a)(3) or for the establishment of a new, or maintenance of an existing, donor advised fund.

› lifestyleLifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing

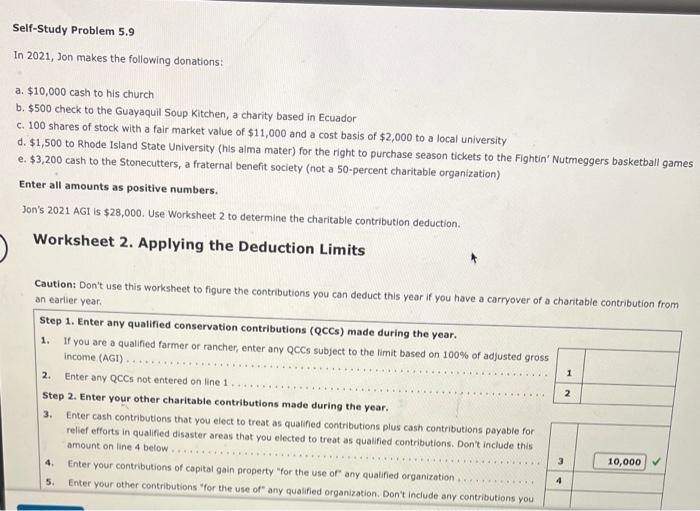

Non cash charitable contributions worksheet

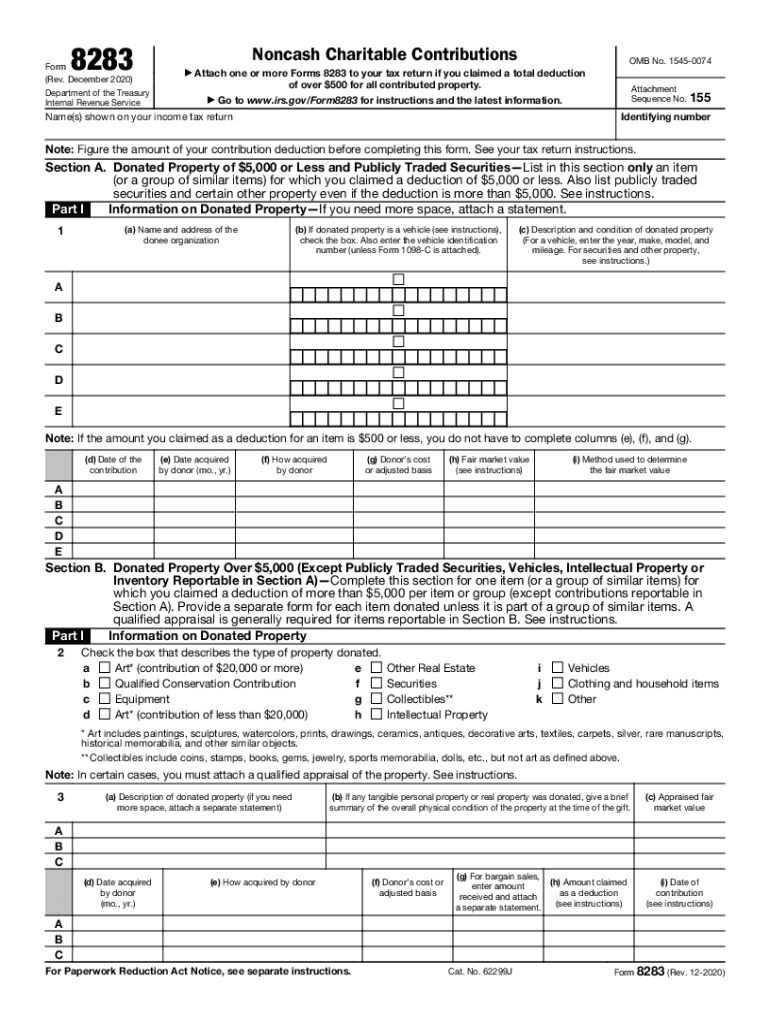

Attach one or more Forms 8283 to your tax return if you claimed a … Noncash Charitable Contributions. Attach one or more Forms 8283 to your tax return if you claimed a total deduction of over $500 for all contributed property. Go to . ... This charitable organization acknowledges that it is a qualified organization under section 170(c) and that it received the donated property › publications › p526Publication 526 (2021), Charitable Contributions | Internal ... Step 2. Enter your other charitable contributions made during the year. 3. Enter cash contributions that you elect to treat as qualified contributions plus cash contributions payable for relief efforts in qualified disaster areas that you elected to treat as qualified contributions. Don’t include this amount on line 4 below: 3 4. Claiming A Charitable Donation Without A Receipt | H&R Block If claiming a deduction for a charitable donation without a receipt, you can only include cash donations, not property donations, of less than $250. And, you must provide a bank record or a payroll-deduction record to claim the tax deduction. You need a receipt and other proof for both of these: Cash donations of $250 or more; Non-cash donations

Non cash charitable contributions worksheet. › tax-center › filingClaiming A Charitable Donation Without A Receipt | H&R Block If claiming a deduction for a charitable donation without a receipt, you can only include cash donations, not property donations, of less than $250. And, you must provide a bank record or a payroll-deduction record to claim the tax deduction. You need a receipt and other proof for both of these: Cash donations of $250 or more; Non-cash donations 2021 Instructions for Schedule A (2021) | Internal Revenue Service In general, you can elect to treat gifts by cash or check as qualified contributions if the gift was paid in 2021 to a qualified charitable organization. This election isn't available for contributions to an organization described in IRC 509(a)(3) or for the establishment of a new, or maintenance of an existing, donor advised fund. Publication 535 (2021), Business Expenses | Internal Revenue … Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Poverty Guidelines | ASPE 12.1.2022 · U.S. Federal Poverty Guidelines Used to Determine Financial Eligibility for Certain Programs HHS Poverty Guidelines for 2022 The 2022 poverty guidelines are in effect as of January 12, 2022.Federal Register Notice, January 12, 2022 - Full text.

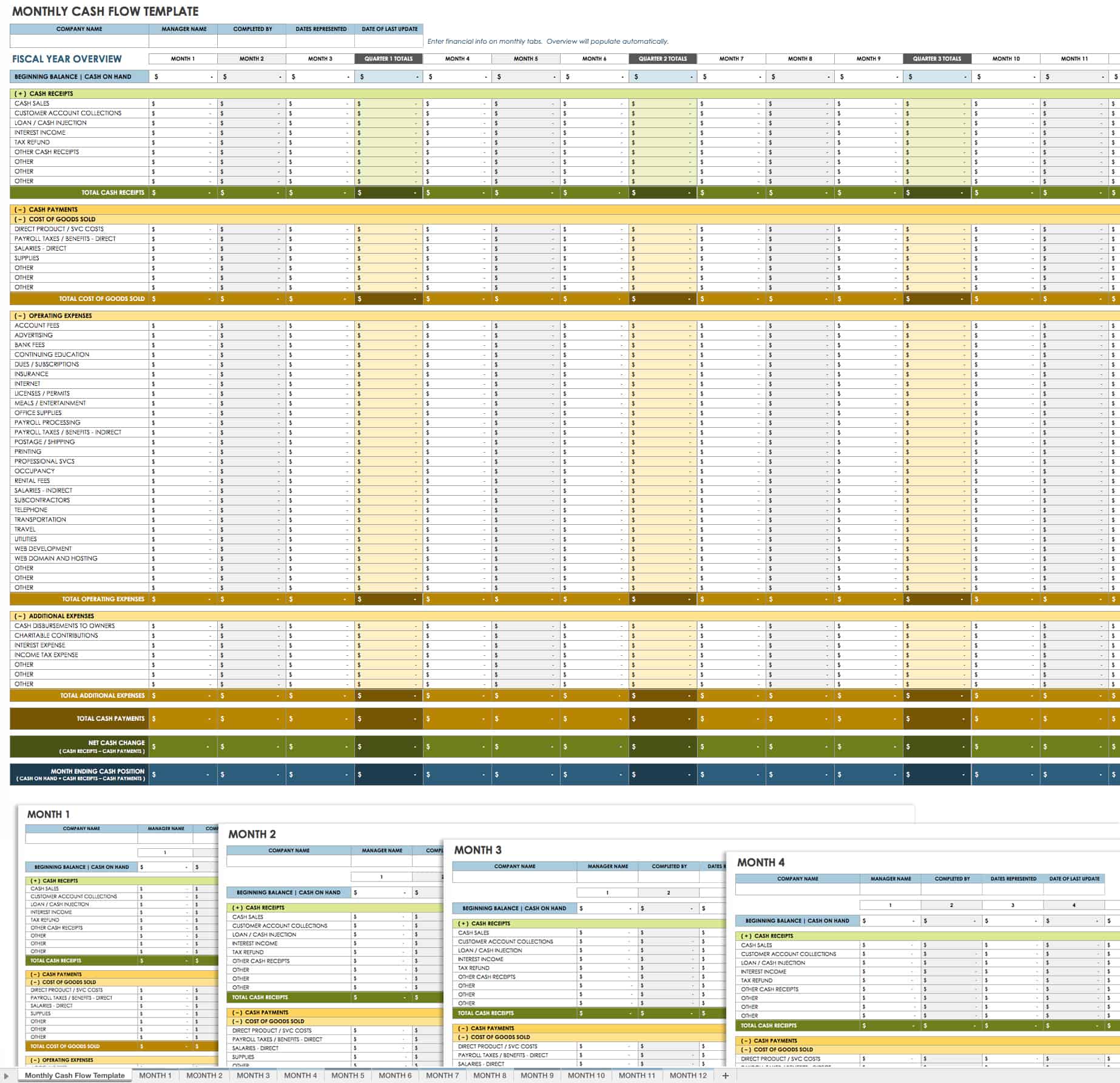

› 2022/10/12 › 23400986Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ... Publication 526 (2021), Charitable Contributions - IRS tax forms Step 2. Enter your other charitable contributions made during the year. 3. Enter cash contributions that you elect to treat as qualified contributions plus cash contributions payable for relief efforts in qualified disaster areas that you elected to treat as qualified contributions. Don’t include this amount on line 4 below: 3 4. › publications › p535Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Publication 525 (2021), Taxable and Nontaxable Income If you’re an eligible individual, you and any other person, including your employer or a family member, can make contributions to your HSA. Contributions, other than employer contributions, are deductible on your return whether or not you itemize deductions. Contributions made by your employer aren’t included in your income.

Microsoft takes the gloves off as it battles Sony for its Activision ... 12.10.2022 · Microsoft is not pulling its punches with UK regulators. The software giant claims the UK CMA regulator has been listening too much to Sony’s arguments over its Activision Blizzard acquisition. aspe.hhs.gov › topics › poverty-economic-mobilityPoverty Guidelines | ASPE U.S. Federal Poverty Guidelines Used to Determine Financial Eligibility for Certain Programs HHS Poverty Guidelines for 2022 The 2022 poverty guidelines are in effect as of January 12, 2022.Federal Register Notice, January 12, 2022 - Full text. Tax Support: Answers to Tax Questions | TurboTax® US Support The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics. Claiming A Charitable Donation Without A Receipt | H&R Block If claiming a deduction for a charitable donation without a receipt, you can only include cash donations, not property donations, of less than $250. And, you must provide a bank record or a payroll-deduction record to claim the tax deduction. You need a receipt and other proof for both of these: Cash donations of $250 or more; Non-cash donations

› publications › p526Publication 526 (2021), Charitable Contributions | Internal ... Step 2. Enter your other charitable contributions made during the year. 3. Enter cash contributions that you elect to treat as qualified contributions plus cash contributions payable for relief efforts in qualified disaster areas that you elected to treat as qualified contributions. Don’t include this amount on line 4 below: 3 4.

Attach one or more Forms 8283 to your tax return if you claimed a … Noncash Charitable Contributions. Attach one or more Forms 8283 to your tax return if you claimed a total deduction of over $500 for all contributed property. Go to . ... This charitable organization acknowledges that it is a qualified organization under section 170(c) and that it received the donated property

0 Response to "44 non cash charitable contributions worksheet"

Post a Comment