44 capital gains tax worksheet

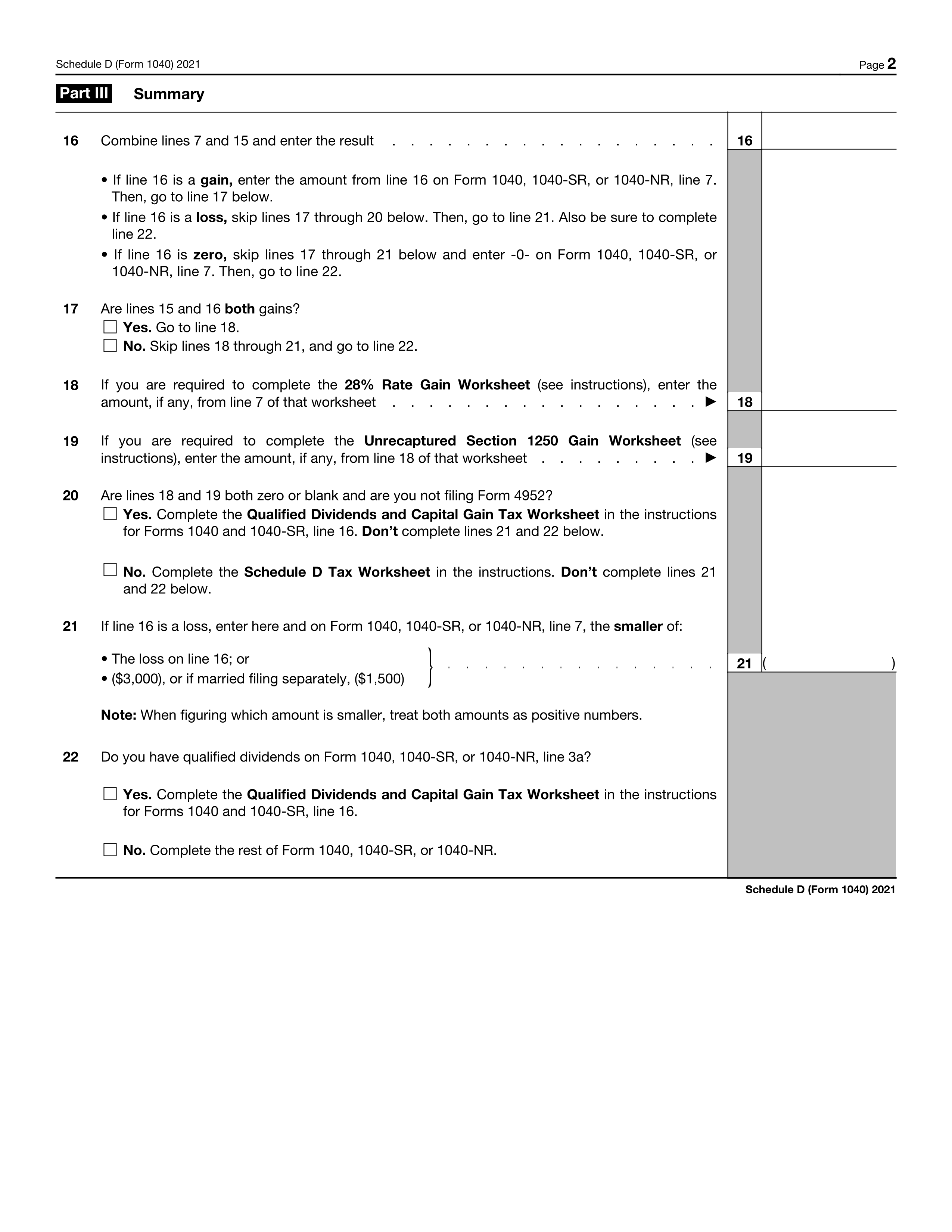

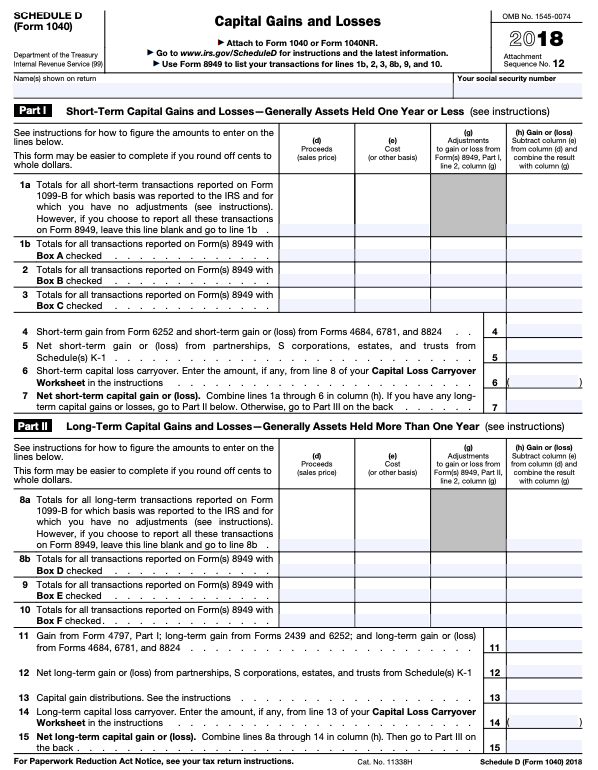

PDF and Losses Capital Gains - IRS tax forms from its net realized long-term capital gains. Distributions of net realized short-term capital gains aren't treated as capital gains. Instead, they are included on Form 1099-DIV as ordinary divi-dends. Enter on Schedule D, line 13, the to-tal capital gain distributions paid to you during the year, regardless of how long you held your investment. 1040 (2021) | Internal Revenue Service - IRS tax forms Use the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet, whichever applies, to figure your tax. See the instructions for line 16 for details.. Line 3b. Ordinary Dividends. Each payer should send you a Form 1099-DIV. Enter your total ordinary dividends on line 3b. This amount should be shown in box 1a of Form(s ...

PDF 2022 Schedule D (Form 1040) - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Form 1040, line 16. No. Complete the rest of Form 1040, 1040-SR, or 1040-NR. Schedule D (Form 1040) 2022: Title: 2022 Schedule D (Form 1040) Author: SE:W:CAR:MP Subject: Capital Gains and Losses Keywords: Fillable

Capital gains tax worksheet

About Schedule D (Form 1040), Capital Gains and Losses Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit. Capital gain distributions not reported directly on Form 1040 (or effectively connected capital gain distributions not reported directly on Form 1040-NR). Nonbusiness bad debts. Current Revision Schedule D (Form 1040) PDF Calculation of the Qualified Dividend Adjustment on Form 1116 ... - Intuit In situations where the qualified dividends and/or capital gains are taxed in multiple tax brackets, the program calculates the adjustment for Form 1116, Foreign Tax Credit, Line 1a based on a ratio of rates between 5% and 15%. The ratio is calculated from the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet. Using the capital gain or capital loss worksheet Capital gains tax Medicare and private health insurance Medicare levy Medicare levy surcharge Help and paying the ATO Your notice of assessment Why you may receive a tax bill Tax support for individuals Your situation Education and study loan When someone dies Retirement and leaving your job Coming to Australia or going overseas Super

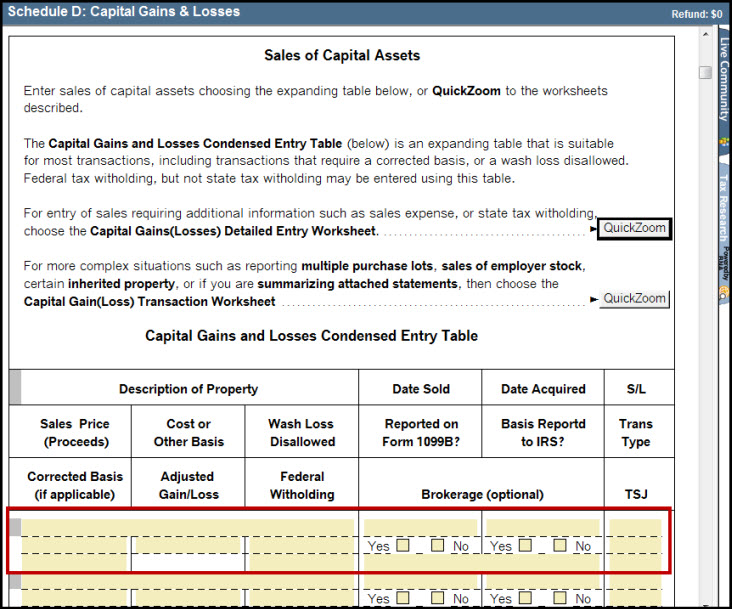

Capital gains tax worksheet. How to Calculate Capital Gains Tax | H&R Block The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your asset or property and how much you sold it for — adjusting for commissions or fees. Depending on your income level, and how long you held the asset, your capital gain will be taxed federally between 0% to 37%. Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain ... How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. Forms and Instructions (PDF) - IRS tax forms Instructions for Schedule D (Form 1120S), Capital Gains and Losses and Built-In Gains. 2021. 01/07/2022. Form 2438. Undistributed Capital Gains Tax Return. 1220. 11/30/2020. Form 2439. Notice to Shareholder of Undistributed Long-Term Capital Gains.

Canada Capital Gains Tax Calculator 2022 - nesto A Canada Capital Gains Tax Calculator formula that will allow you to manually crunch numbers and get your rate. In Canada, 50% of the value of any capital gains is taxable: If you sell an investment at a higher price than you paid, you'll have to add 50% of the capital gains to your income. Capital gains tax rates are dependent on the ... Guide to capital gains tax 2022 | Australian Taxation Office a Capital gain or capital loss worksheet (PDF 144KB) for working out your capital gain or capital loss for each CGT event a CGT summary worksheet for 2022 tax returns (PDF 235KB) (CGT summary worksheet) to help you summarise your capital gains, capital losses and produce the final net amount you need to include on your tax return. 2022-2023 Capital Gains Tax Rates & Calculator - NerdWallet The capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets:... How do I download my Qualified Dividends and Capital Gain Tax Worksheet ... Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040 or 1040-SR, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040 or 1040-SR, line 7.

Topic No. 409 Capital Gains and Losses - IRS tax forms Capital Gain Tax Rates The tax rate on most net capital gain is no higher than 15% for most individuals. Some or all net capital gain may be taxed at 0% if your taxable income is less than or equal to $40,400 for single or $80,800 for married filing jointly or qualifying widow (er). Easiest capital gains tax calculator 2022 & 2023 The capital gains tax calculator is a quick way to compute the gains on the transfer or sale of a capital asset for the tax year 2022 (filing in 2023) and tax year 2021. This capital gains tax calculator will compute gains on every kind of asset that you have sold or transferred during the tax year 2022 or tax year 2021. PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Figure the tax on the amount on line 7. If the amount on line 7 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 7 is $100,000 or more, use the Tax Computation Worksheet..... 24. 25. Add lines 20, 23, and 24..... 25. 26. Figure the tax on the amount on line 1. If the amount on line 1 is less than $100,000, use ... Calculating the capital gains 28% rate in Lacerte - Intuit Lacerte calculates the 28% rate on capital gains according to the IRS form instructions. Per the instructions, the 28% rate will generate if an amount is present on Schedule D, Lines 18 or 19. Line 18: If you checked Yes on Line 17, complete the 28% Rate Gain worksheet in these instructions (page 10) if either of the following applies for 20xx:

Using the capital gain or capital loss worksheet Capital gains tax Medicare and private health insurance Medicare levy Medicare levy surcharge Help and paying the ATO Your notice of assessment Why you may receive a tax bill Tax support for individuals Your situation Education and study loan When someone dies Retirement and leaving your job Coming to Australia or going overseas Super

Calculation of the Qualified Dividend Adjustment on Form 1116 ... - Intuit In situations where the qualified dividends and/or capital gains are taxed in multiple tax brackets, the program calculates the adjustment for Form 1116, Foreign Tax Credit, Line 1a based on a ratio of rates between 5% and 15%. The ratio is calculated from the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet.

About Schedule D (Form 1040), Capital Gains and Losses Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit. Capital gain distributions not reported directly on Form 1040 (or effectively connected capital gain distributions not reported directly on Form 1040-NR). Nonbusiness bad debts. Current Revision Schedule D (Form 1040) PDF

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

:max_bytes(150000):strip_icc()/GettyImages-907066380-0867bbed74914d3eab8d7d0c318a7577.jpg)

0 Response to "44 capital gains tax worksheet"

Post a Comment