40 self employed expenses worksheet

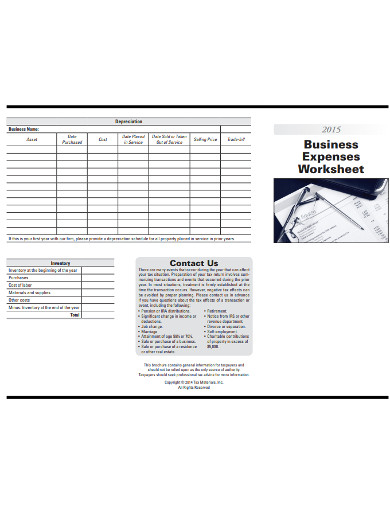

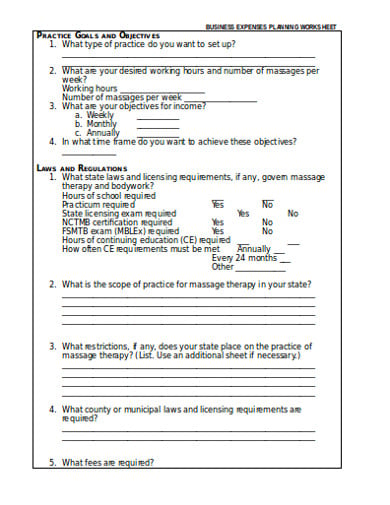

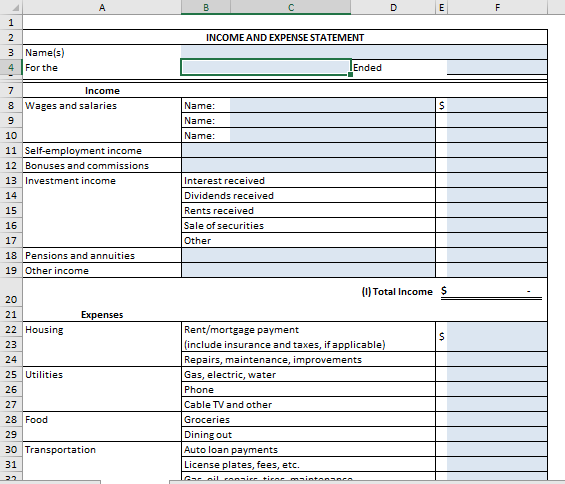

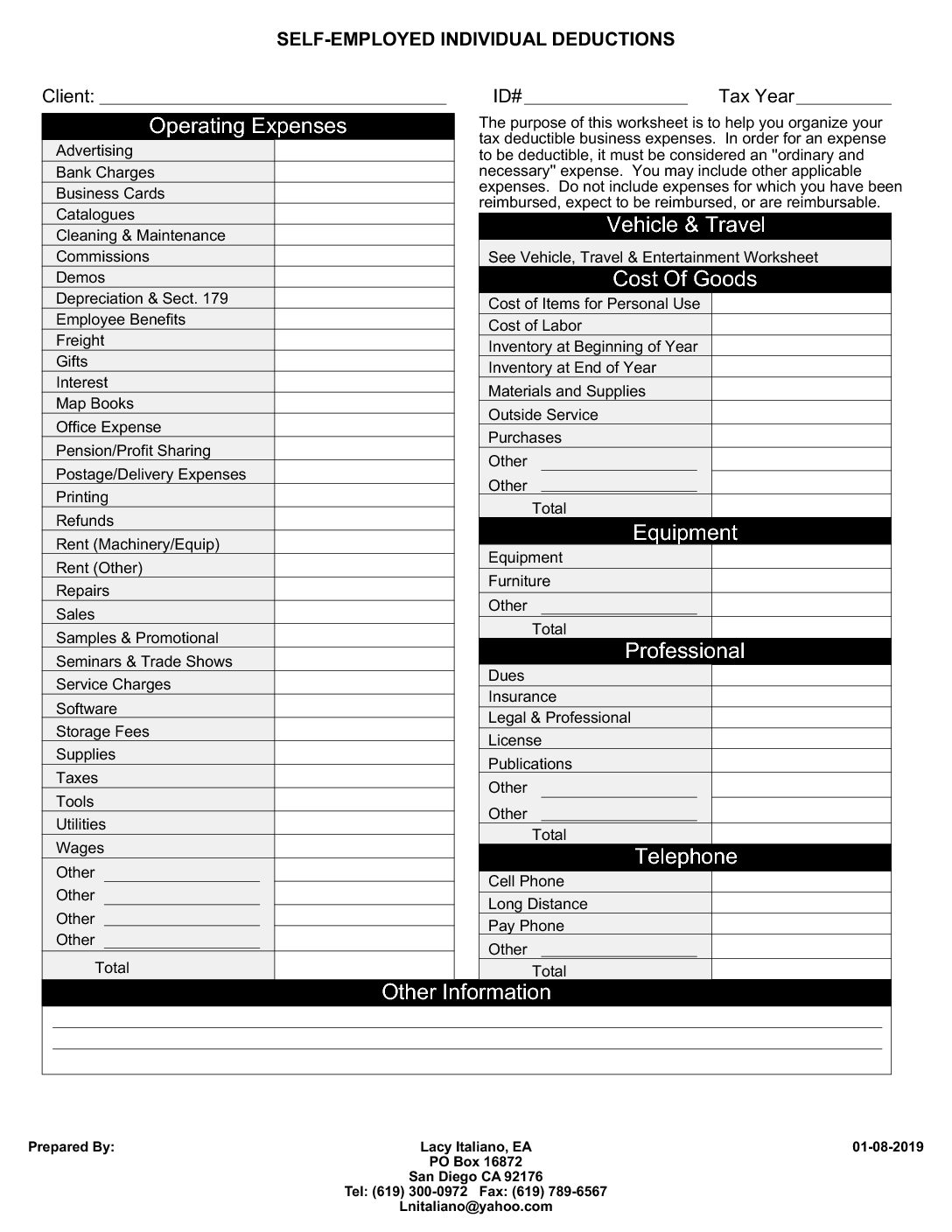

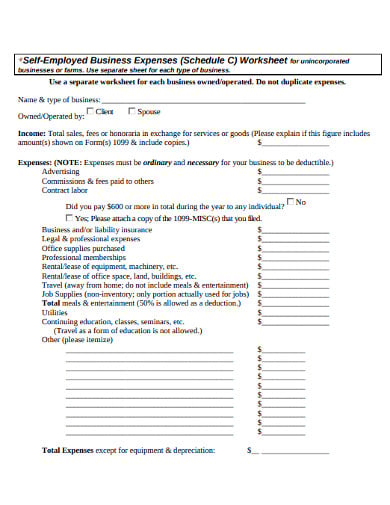

Complete List of Self-Employed Expenses and Tax Deductions Here is a list of common expenses that are ordinary and necessary for many self-employed individuals. Note that all of the lines specified are for Schedule C only, with two exceptions noted below. Also Read: Try QuickBooks Online Accounting Software for Global Less Common Expenses for the Self-Employed PDF Self-Employed Business Expenses (Schedule C) Worksheet Self-Employed Business Expenses (Schedule C) Worksheet for unincorporated businesses or farms. Use separate sheet for each type of business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse Income: Total ...

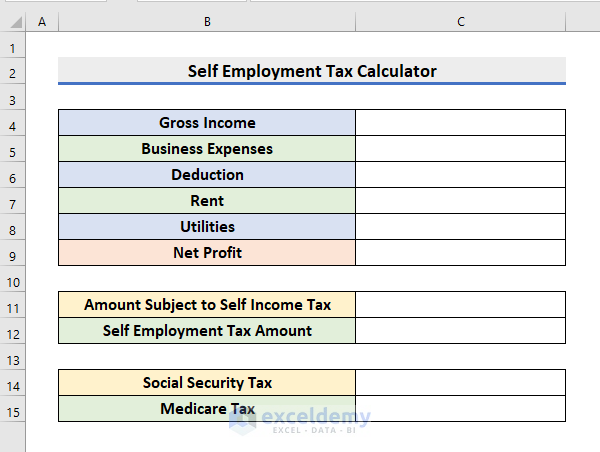

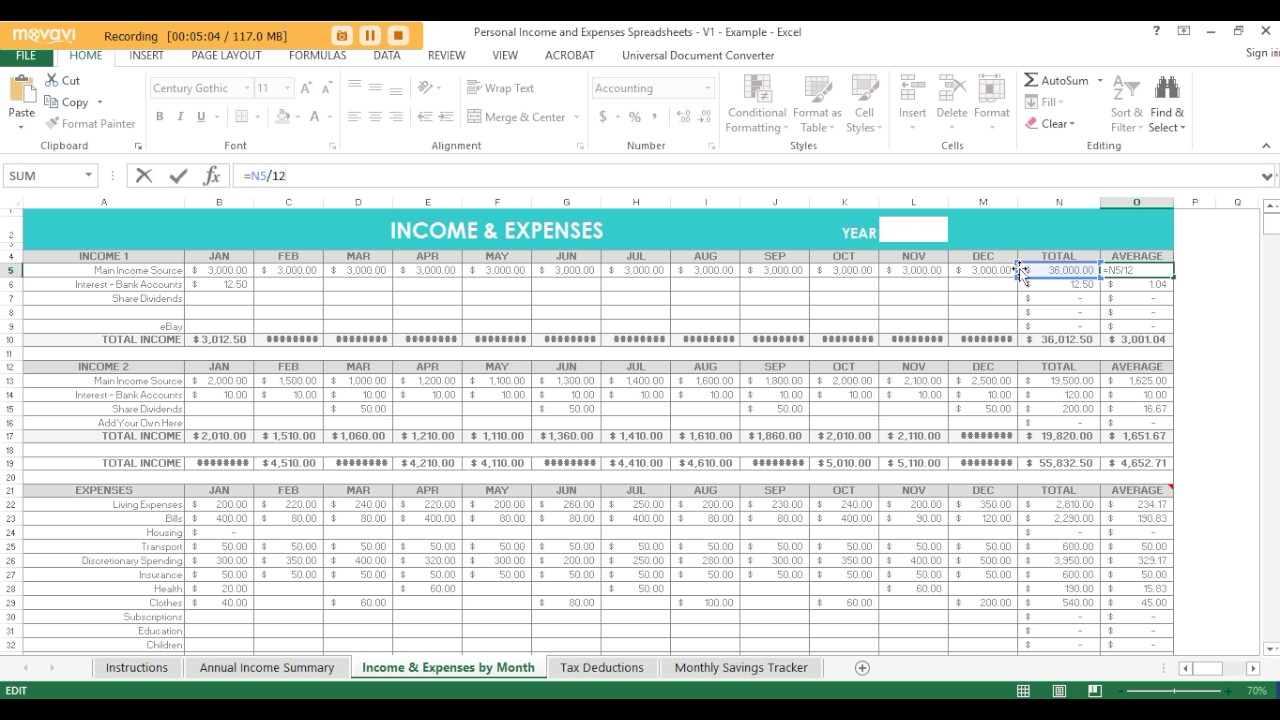

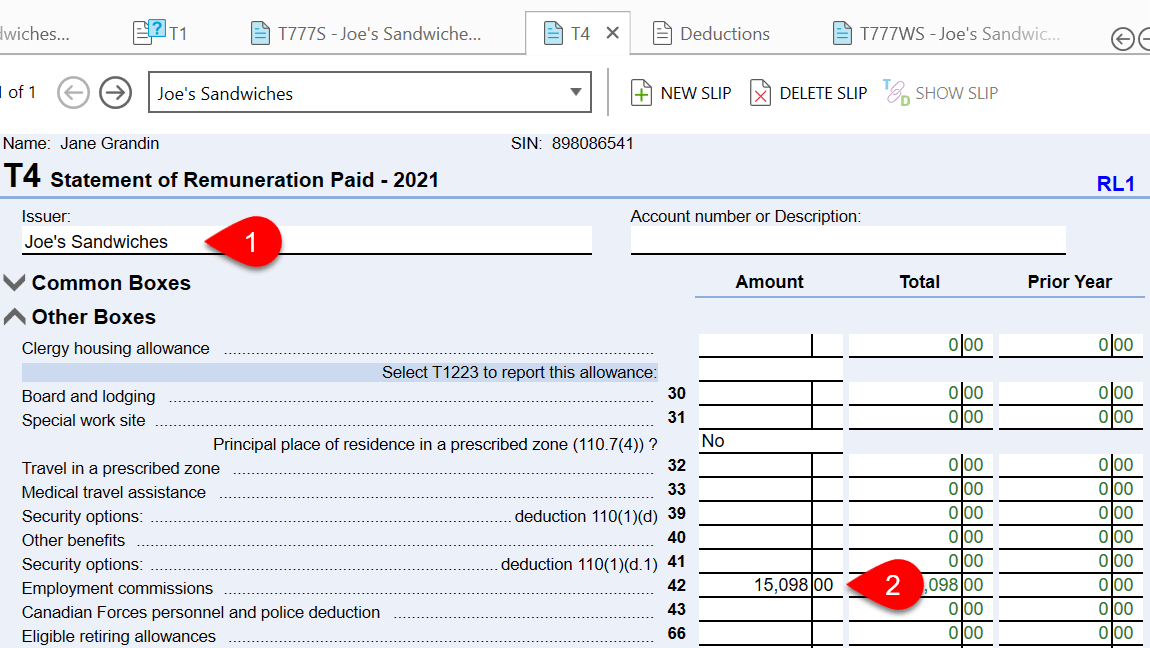

Tracking your self-employed income and expenses My "Self-employed income and expense worksheets" are available in Excel. Financial Software You can use programs like FreshBooks or QuickBooks Online to track your income and expenses. Records Generally, books, records, and source documents have to be kept for a minimum of six years from the end of the last tax year to which they relate.

Self employed expenses worksheet

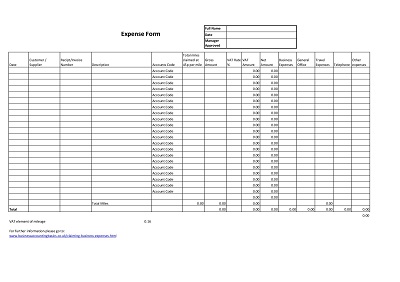

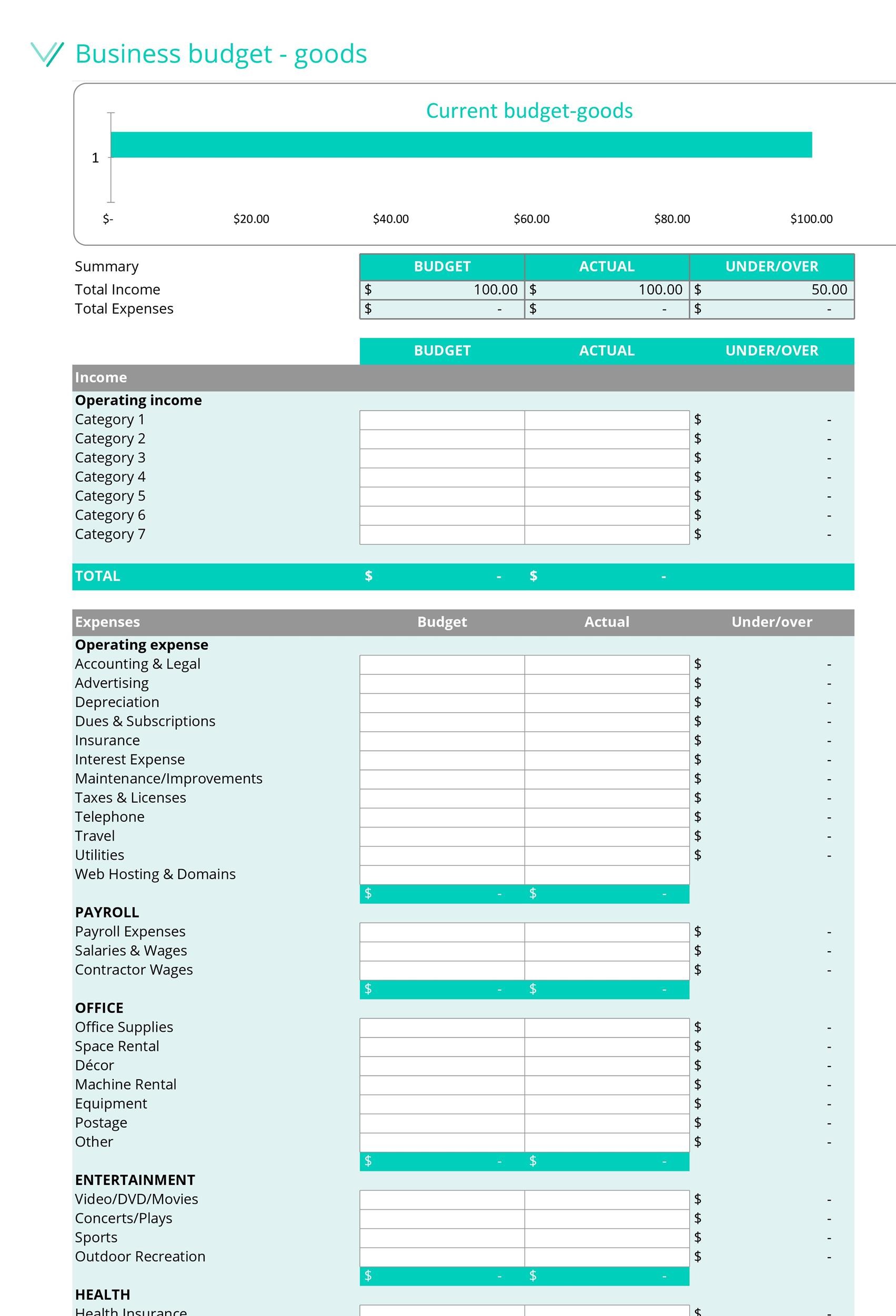

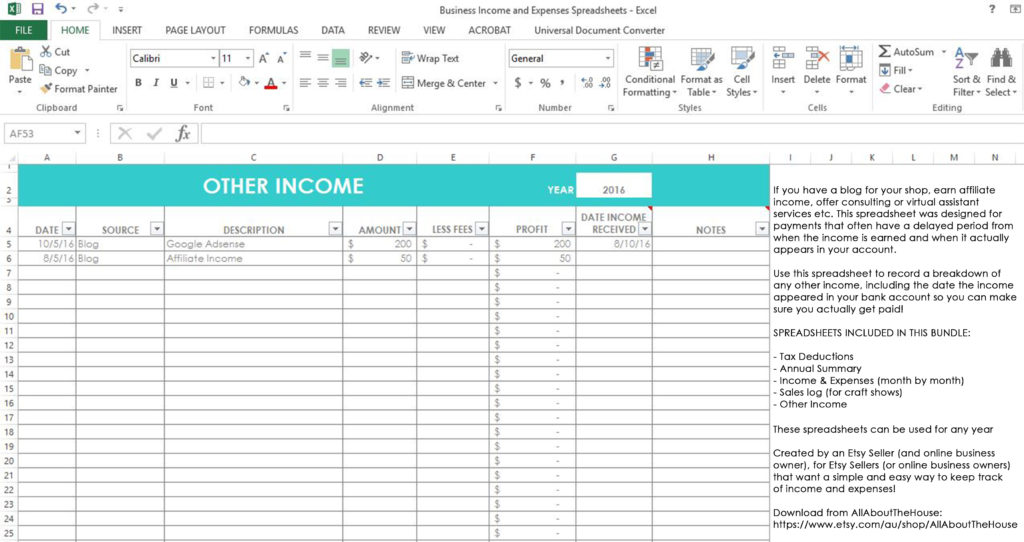

Free expenses spreadsheet for self-employed - hellobonsai.com Expenses Spreadsheet for Self-Employed Whether it's for your own accounting or to manage your billable expenses, an expenses spreadsheet can help you stay organized and maximize your tax deductions in preparation for your self employment taxes. We've built it to help you get peace of mind and get on with your work. Self-Employed Individuals Tax Center | Internal Revenue Service Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System (EFTPS). DOC Self Employment Monthly Sales and Expense Worksheet - Washington Monthly Total Self Employment Income $ Deducting Business Expenses If you want to claim business expenses, you must list the expenses on the following page and give us documentation of the expense. (WAC 388-450-0085, 182-512-0840) For cash and food only: I choose to take the 50% standard deduction instead of listing my expenses on the next page.

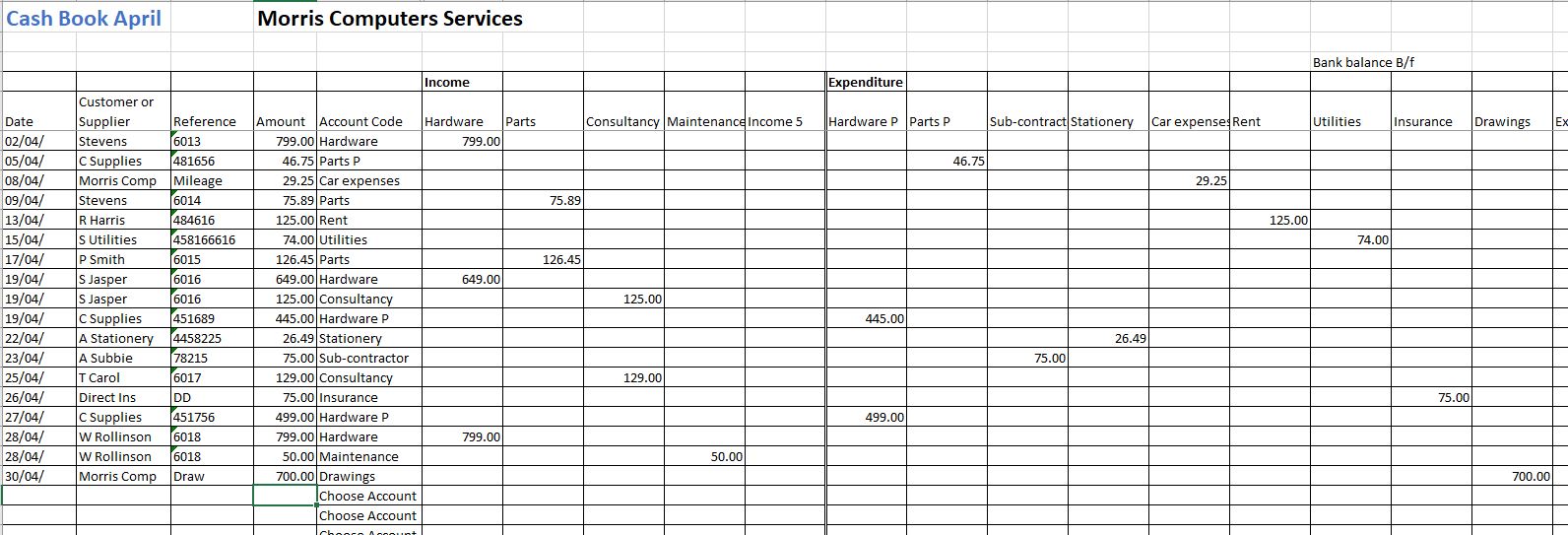

Self employed expenses worksheet. Independent Contractor Expenses Spreadsheet [Free Template] - Keeper Tax Luckily, Keeper's free template will make doing your taxes a little less painful — for your soul and for your wallet. It's been updated with all the latest info for you: Grab it for free! Just click on the link above and "Make a copy" in Google Sheets. From there, you can also download it to use as a 1099 Excel template. PDF (Schedule C) Self-Employed Business Expenses Worksheet for Single (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse Income: Total ... Publications and Forms for the Self-Employed Publication 15-A, Employer's Supplemental Tax Guide PDF. Publication 225, Farmer's Tax Guide. Publication 334, Tax Guide for Small Business (For Individuals Who Use Schedule C) Publication 463, Travel, Gift, and Car Expenses. Publication 505, Tax Withholding and Estimated Tax. Publication 535, Business Expenses. PDF Self Employed Income/Expense Sheet SELF EMPLOYED INCOME/EXPENSE SHEET NAME OF PROPRIETOR BUSINESS ADDRESS BUSINESS NAME FEDERAL I.D. NUMBER Automobile Mileage (Adequate records required) COST OF GOODS SOLD (If Applicable) Beginning of the Year Inventory End of Year Inventory Purchases Other: Title: Self Employed Income & Expense Sheet.xlsx ...

2022 Instructions for Schedule C (2022) | Internal Revenue Service Self-employed tax payments deferred in 2020. If you elected to defer self-employed tax payments from 2020, ... Use this worksheet to figure the amount of expenses you may deduct for a qualified business use of a home if you are electing to use the simplified method for that home. If you are not electing to use the simplified method, use Form 8829. Publication 535 (2021), Business Expenses - IRS tax forms Worksheet 6-A. Self-Employed Health Insurance Deduction Worksheet; Chronically ill individual. Benefits received. ... If you are self-employed, you can also deduct the business part of interest on your car loan, state and local personal property tax on the car, parking fees, and tolls, whether or not you claim the standard mileage rate ... Self Employed Expense Sheet Template - Excel, Word, Apple Numbers ... Self Employed Expense Sheet Template This document allows the self employed worker to keep track of their expenses. This Self Employed Expense Sheet Template is compatible on all versions of MS Excel, MS Word, Mac Numbers, and Mac Pages. Free to download now, just edit the content and texts available before printing. Daily Expense Sheet Template SEB cash flow worksheets - MGIC Updated for the 2021 tax year, our editable and auto-calculating cash flow analysis worksheets are fitted specifically for loan officers and mortgage pros. MGIC's self-employed borrower worksheets are uniquely suited for analyzing: Cash flow and YTD profit and loss (P&L) Comparative income Liquidity ratios Rental income Get the worksheets

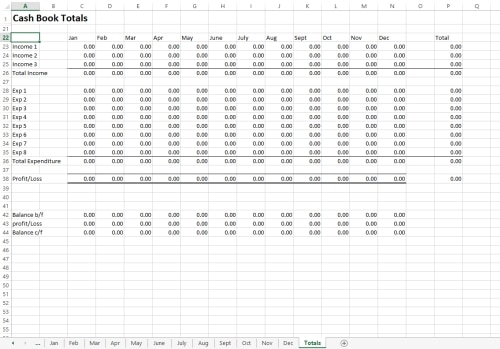

Self-Employed Tax Deductions Worksheet (Download FREE) - Bonsai Self-Employed Tax Deductions Worksheet (Download FREE) 5 Min Read Taxes Scope of Work Tools Contractor Copywriting Graphic Design Marketing SEO Translation Web Design Tom Smery At the end of the tax year, most self-employed individuals try to minimize their self-employment tax liability by saving their receipts for business-related activities. PDF Self Employment Monthly Sales and Expense Worksheet - Washington If you want to claim business expenses, you must list the expenses on the following page and give us documentation of the expense. (WAC 388-450-0085, 182-512-0840) For cash and food only: I choose to take the 50% standard deduction instead of listing my expenses on the next page. (Sign the back page.) PDF Tax Worksheet for Self-employed, Independent contractors, Sole ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate. PDF Self-Employed/Business Monthly Worksheet - mirtocpa.com Self-Employed/Business Name of Proprietor Social Security Number Monthly Worksheet Principal Business or Profession, Including Product or Service Income January February March April May June July August Sept October Nov Dec TOTALS Gross Sales Expenses January February March April May June July August Sept October Nov Dec TOTALS Accounting Advertising

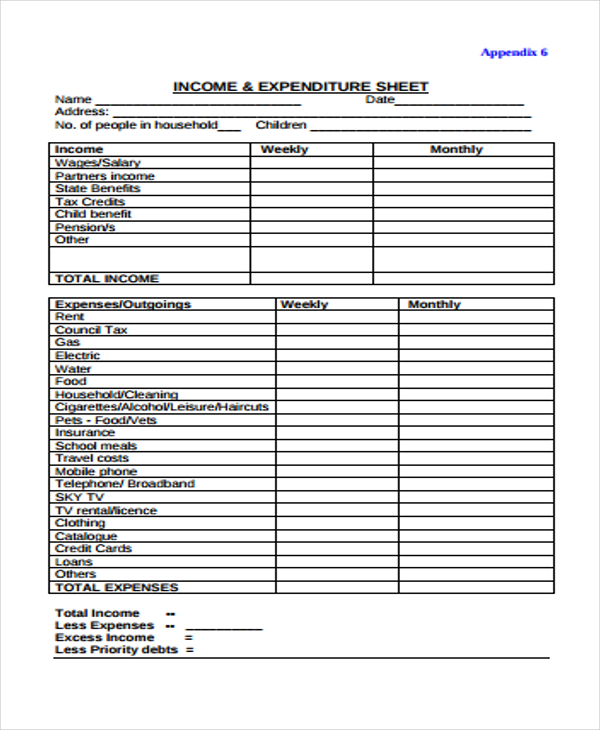

PDF Self-employed Income and Expense Worksheet self-employed income and expense worksheet taxpayer name ssn principal business or profession business name employer id number business address business entity (circle one) individual spouse joint business city, state, zip code income expenses $ gross receipts or sales $ advertising $ returns & allowances auto & travel $ $

Expenses if you're self-employed: Overview - GOV.UK If you're self-employed, your business will have various running costs. You can deduct some of these costs to work out your taxable profit as long as they're allowable expenses. Example Your...

DOC Self Employment Monthly Sales and Expense Worksheet - Washington Monthly Total Self Employment Income $ Deducting Business Expenses If you want to claim business expenses, you must list the expenses on the following page and give us documentation of the expense. (WAC 388-450-0085, 182-512-0840) For cash and food only: I choose to take the 50% standard deduction instead of listing my expenses on the next page.

Self-Employed Individuals Tax Center | Internal Revenue Service Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System (EFTPS).

Free expenses spreadsheet for self-employed - hellobonsai.com Expenses Spreadsheet for Self-Employed Whether it's for your own accounting or to manage your billable expenses, an expenses spreadsheet can help you stay organized and maximize your tax deductions in preparation for your self employment taxes. We've built it to help you get peace of mind and get on with your work.

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fcf2e45bd9fa5a86e28d_schedule-c-categories.png)

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-feature.jpg?strip=all&lossy=1&ssl=1)

0 Response to "40 self employed expenses worksheet"

Post a Comment