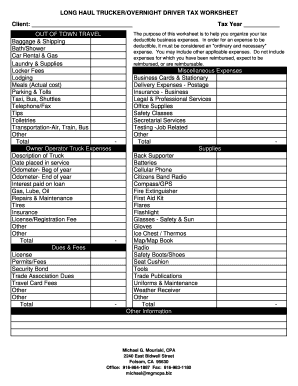

45 trucker tax deduction worksheet

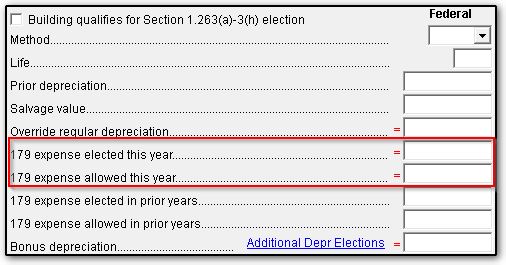

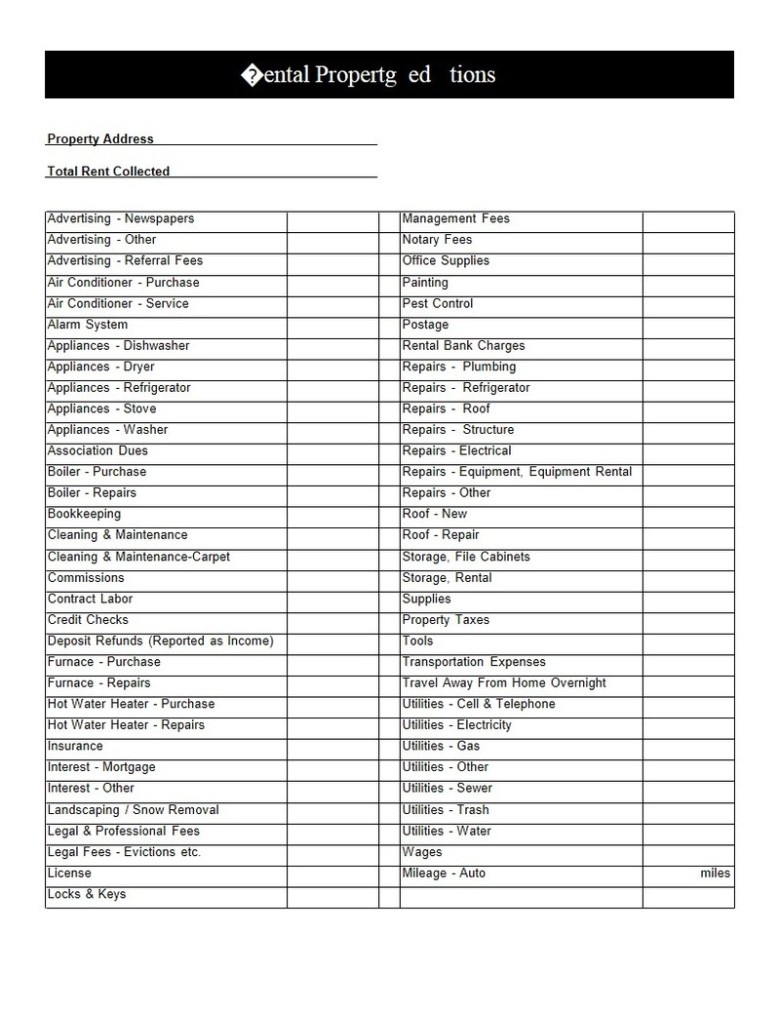

19 Truck Driver Tax Deductions That Will Save You Money Truck repairs and maintenance. Since your truck is considered a qualified, non-personal-use vehicle, you can deduct 100% of all the costs to repair and maintain. This includes tires or getting your vehicle washed. Additional vehicle expenses include depreciation, as well as loan interest if you financed the purchase. PDF FEDERAL TAXES and O-T-R & O-O TRUCKERS DEDUCTIONS LIST - Trucker to Trucker waste removal, etc.) are best calculated and listed in actual amounts for the tax year and provided to your tax pro at the first meeting. Other: _____ ? OVER-THE-ROAD-TRUCKING-TAX-FACTS & DATA This still-growing list of potentially-tax-deductible expenditures by over-the-road truckers is more or less "mute" if

Unbanked American households hit record low numbers in 2021 25.10.2022 · The number of American households that were unbanked last year dropped to its lowest level since 2009, a dip due in part to people opening accounts to receive financial assistance during the ...

Trucker tax deduction worksheet

truck driver tax deductions worksheet 28 Trucker Tax Deduction Worksheet - Worksheet Resource Plans starless-suite.blogspot.com. tax worksheet deduction deductions trucker anchor service services beauty medical sales. Prowess Truck Driver Taxes Jrc Transportation, Popular Tax Deduction . 31 Best Tax Deductions for Truckers, Truck Drivers & Owner Operators Heavy Highway Use Tax (Form 2290) Most Truck Driver Pay about $550 Dollar for Heavy Highway Use Tax. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that they pay to IRS. Form 2290 is used by Truck Driver and owner operator truck drivers to calculate their Heavy Highway Use Tax. What You Need to Know About Truck Driver Tax Deductions Deducting the actual expense method requires that you keep track of what you spend on meals, including tips and tax. While the IRS allows most industries to deduct 50% of meals, drivers subject to the Department of Transportation's "hours of service" limits, can claim 80% of their actual meal expenses.

Trucker tax deduction worksheet. U.S. appeals court says CFPB funding is unconstitutional - Protocol 20.10.2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law … Instructions for Form 2290 (07/2022) | Internal Revenue Service 30.06.2011 · Trucker A must file one Form 2290 on or before August 31, 2022, ... Figure the additional tax using the following worksheet. ... The Sales Tax Deduction Calculator (IRS.gov/SalesTax) figures the amount you can claim if you itemize deductions on Schedule A ... PDF Truck Driver Worksheet - Emshwiller Truck Driver Worksheet - Emshwiller trucker tax deduction worksheet 37 Truck Driver Tax Deductions Worksheet - Worksheet Source 2021. 13 Pics about 37 Truck Driver Tax Deductions Worksheet - Worksheet Source 2021 : Long Haul Truck Driver Deductions - Best Image Truck Kusaboshi.Com, free templates trucking expenses spreadsheet - Spreadsheets and also Long Haul Truck Driver Deductions - Best Image Truck Kusaboshi.Com.

Overwatch 2 reaches 25 million players, tripling Overwatch 1 daily ... 14.10.2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc truck driver tax deductions worksheet - BB Metric This was my first truck driver tax deduction as a tax preparer. I used it as a template for my truck driver tax return to get a tax write-off. It's pretty funny to watch people take their tax deductions in the name of tax preparation or tax preparation is a phrase used to describe a tax item. PDF Over-the-road Trucker Expenses List - Pstap received as a taxicab driver, or bonuses received as a truck driver in cash, are taxable income. And the sale of any of your equipment or work-related purchases also constitute taxable income (i.e.: sales of tires, radios, etc.). If you are self-employed (unincorporated) and your net earnings after all legitimate deductions are taken are $400 or 2021 Instructions for Schedule C (2021) - IRS tax forms Form 8990 to determine whether your business interest deduction is limited. ... See the Instructions for Form 2290 to find out if you must pay this tax and visit IRS.gov/Trucker for the most recent developments. ... If you are required to file Schedule SE, remember to enter one-half of your self-employment tax in Part 1, line 1d, of Worksheet B..

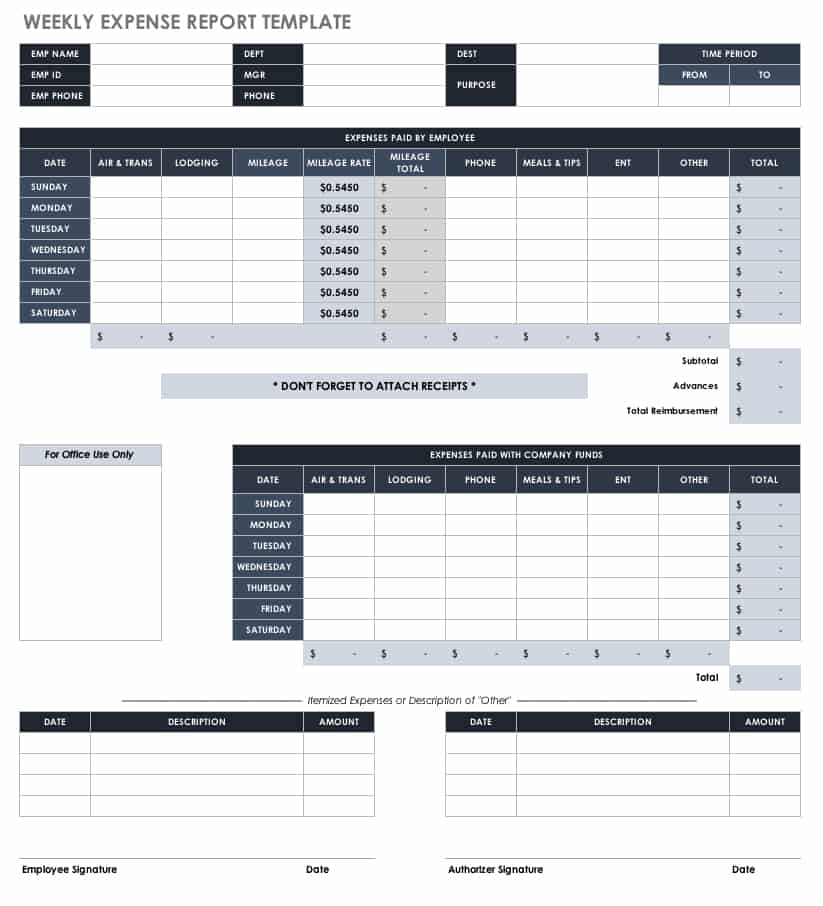

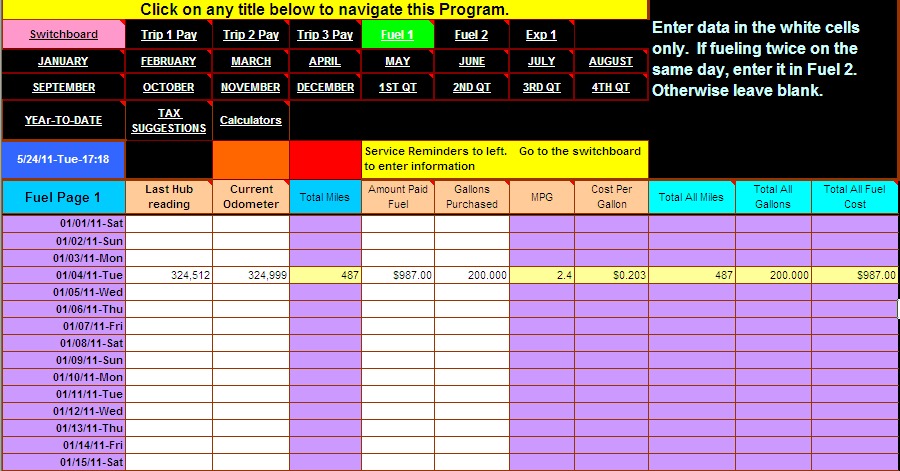

Truck Driver Deductions Spreadsheet: Fill & Download for Free - CocoDoc Click the Get Form or Get Form Now button to begin editing on Truck Driver Deductions Spreadsheet in CocoDoc PDF editor. Click on the Sign tool in the tools pane on the top; A window will pop up, click Add new signature button and you'll have three options—Type, Draw, and Upload. Once you're done, click the Save button. Truck Driver Expenses Worksheet PDF Form - FormsPal Truck Driver Expenses Worksheet PDF Details. If you are a truck driver, then you know that tracking your expenses is important. This Truck Driver Expenses Worksheet Form can help make the process a little easier. With this form, you can track your mileage, fuel costs, and other expenses. Printing out a copy of this form and keeping it with your receipts can help ensure that you get the most out of your tax return. Trucking Tax Center | Internal Revenue Service - IRS tax forms Use the Tax Computation table on page two of Form 2290 to calculate your tax based on each vehicle's taxable gross weight. File. E-file. E-filing is required if you are reporting 25 or more taxed vehicles on a Form 2290 and encouraged for all for faster processing. You can receive a watermarked Schedule 1 within minutes. Note. To avoid problems, ensure the watermark on your Schedule 1 is legible before submitting it to your state's department of motor vehicles. Could Call of Duty doom the Activision Blizzard deal? - Protocol 14.10.2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal.

Trucker Tax Deduction Worksheet » Veche.info 29 For single taxpayers and married individuals filing separately, the standard deduction rises to $12,550 for 2021, up $150, and for heads of households, the standard deduction will be $18,800 for tax year 2021, up $150. Source: starless-suite.blogspot.com. Owner operator expense spreadsheet pdf download, federal taxes and truckers deductions list.

tax deductions worksheet tax spreadsheet excel expenses template business expense templates. Worksheet tax expense deduction self employed business expenses deductions daycare annual questions inside child credit report driver truck excel accounting. Tax income worksheet deductions forms ny york fill excel db return deduction 2009.

Microsoft takes the gloves off as it battles Sony for its Activision ... 12.10.2022 · Microsoft is not pulling its punches with UK regulators. The software giant claims the UK CMA regulator has been listening too much to Sony’s arguments over its Activision Blizzard acquisition.

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

Microsoft is building an Xbox mobile gaming store to take on … 19.10.2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games.

truck driver expenses worksheet Tax Deduction Worksheet For Truck Drivers - Spreadsheets perfect-cleaning.info. truck tax deduction drivers worksheet driver spreadsheet expense. Truck Driver Expense Blank Forms Fill Online Printable — Db-excel.com db-excel.com. expense deductions deduction itemized haul pdffiller islamopedia.

Tax Deduction List for Owner Operator Truck Drivers - CDLjobs.com Professional drivers can anticipate paying more to the IRS if they were fortunate enough to cash in on rising trucker salaries. There are seven brackets for 2021 earnings: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. According to the IRS, items that rank among the greatest interest include the following: For tax year 2021, the monthly limitation for the qualified transportation fringe benefit remains $270, as is the monthly limitation for qualified ...

2020 Truck Driver Tax Deductions Worksheet - Fill Online, Printable ... Edit truck driver tax deductions worksheet form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

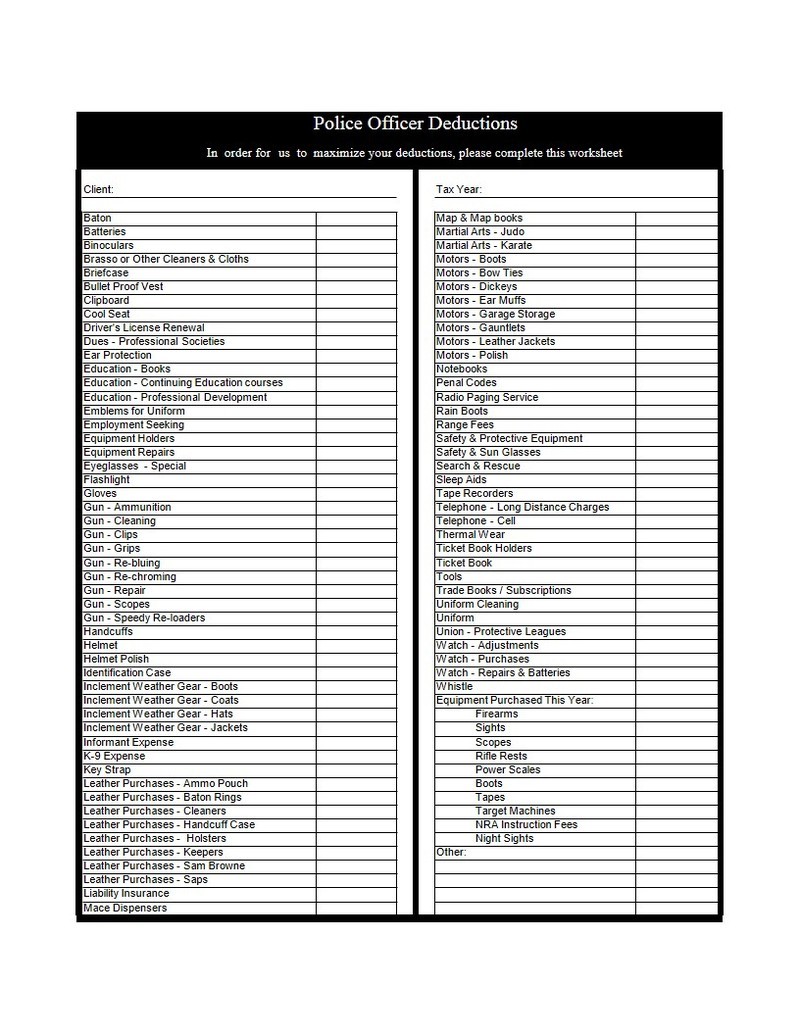

Truck Driver Tax Deductions: How to File in 2021 | TFX Truck drivers' standard tax deductions. When you claim work-related tax deductions, you also reduce your AGI (adjusted gross income). Which, in its turn, means that you will pay less in taxes. Truck driver write off list. Let's see the list of trucker tax deductions for both owner-operators and company drivers. Medical examinations. In this business the state of your health is crucial, so you can deduct all visits to the doctor that you had to make due to work-related problems.

PDF Trucking Business Tax Worksheet - tnttaxserviceaz.com Trucking Business Tax Worksheet Name of Business: Taxpayer Name: Tax Payer SS#: Gross Income (provide any 1099's) *A $ Number of Miles Logged Bank Service Charges $ Telephone, Pager $ Computer Expense $ Tractor Rental $ Fuel Expense $ Tolls $

ATBS | Free Owner-Operator Trucker Tools 2022 Per Diem Tracker. Our per diem calendar will help you keep track of your days on the road for the truck driver per diem tax deduction. Write a slash (/) through partial days and an X through full days on the road. Download 2021 Per Diem Tracker. Download 2020 Per Diem Tracker.

Truck Driver Tax Deductions | H&R Block Other unreimbursed expenses you can deduct include: Log books. Lumper fees. Cell phone that's 100% for business use. License and fees for truck and trailer. Interest paid on loan for truck and trailer. Depreciate your truck and trailer: Over three years for a semi-truck for regular tax — or over four years for the Alternative Minimum Tax ...

PDF TRUCKER'S INCOME & EXPENSE WORKSHEET!!!!!!!!!!!!!! - Webflow TRUCKER'S EXPENSES (continued) EQUIPMENT PURCHASED Radio, pager, cellular phone, answering machine, other… Item Purchased Date Purchased Cost (including sales tax) Item Traded Additional Cash Paid Traded with Related Property Other Information! 1099s: Amounts of $600.00 or more paid to individuals (not

Truck Driver Tax Deductions Worksheet Form - signNow Rate Truck Driver Tax Deductions Worksheet as 5 stars Rate Truck Driver Tax Deductions Worksheet as 4 stars Rate Truck Driver Tax Deductions Worksheet as 3 stars Rate Truck Driver Tax Deductions Worksheet as 2 stars Rate Truck Driver Tax Deductions Worksheet as 1 stars

PDF TRUCKER TAX DEDUCTION WORKSHEET - IA Rugby.com TRUCKER TAX DEDUCTION WORKSHEET This is a quick list to help identify business expenses that are used in the trucking business on a daily basis and can all be deducted yearly on our taxes. Expenses Amount Accounting Services (Quickbooks, Prior Year Taxes) Administrative Services (ME!) Broker Fees (Factoring Fees) Comdata, Comchek Fees Co-Driver Lumper

From Business Profit or Loss - IRS tax forms your business interest deduction is limited. • Form 8995 or 8995-A to claim a deduction for qualified business income. Single-member limited liability com-pany (LLC). Generally, a single-mem-ber domestic LLC is not treated as a sep-arate entity for federal income tax purposes. If you are the sole member of a domestic LLC, file Schedule C (or

What You Need to Know About Truck Driver Tax Deductions Deducting the actual expense method requires that you keep track of what you spend on meals, including tips and tax. While the IRS allows most industries to deduct 50% of meals, drivers subject to the Department of Transportation's "hours of service" limits, can claim 80% of their actual meal expenses.

31 Best Tax Deductions for Truckers, Truck Drivers & Owner Operators Heavy Highway Use Tax (Form 2290) Most Truck Driver Pay about $550 Dollar for Heavy Highway Use Tax. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that they pay to IRS. Form 2290 is used by Truck Driver and owner operator truck drivers to calculate their Heavy Highway Use Tax.

truck driver tax deductions worksheet 28 Trucker Tax Deduction Worksheet - Worksheet Resource Plans starless-suite.blogspot.com. tax worksheet deduction deductions trucker anchor service services beauty medical sales. Prowess Truck Driver Taxes Jrc Transportation, Popular Tax Deduction .

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fcf2e45bd9fa5a86e28d_schedule-c-categories.png)

.jpg)

0 Response to "45 trucker tax deduction worksheet"

Post a Comment