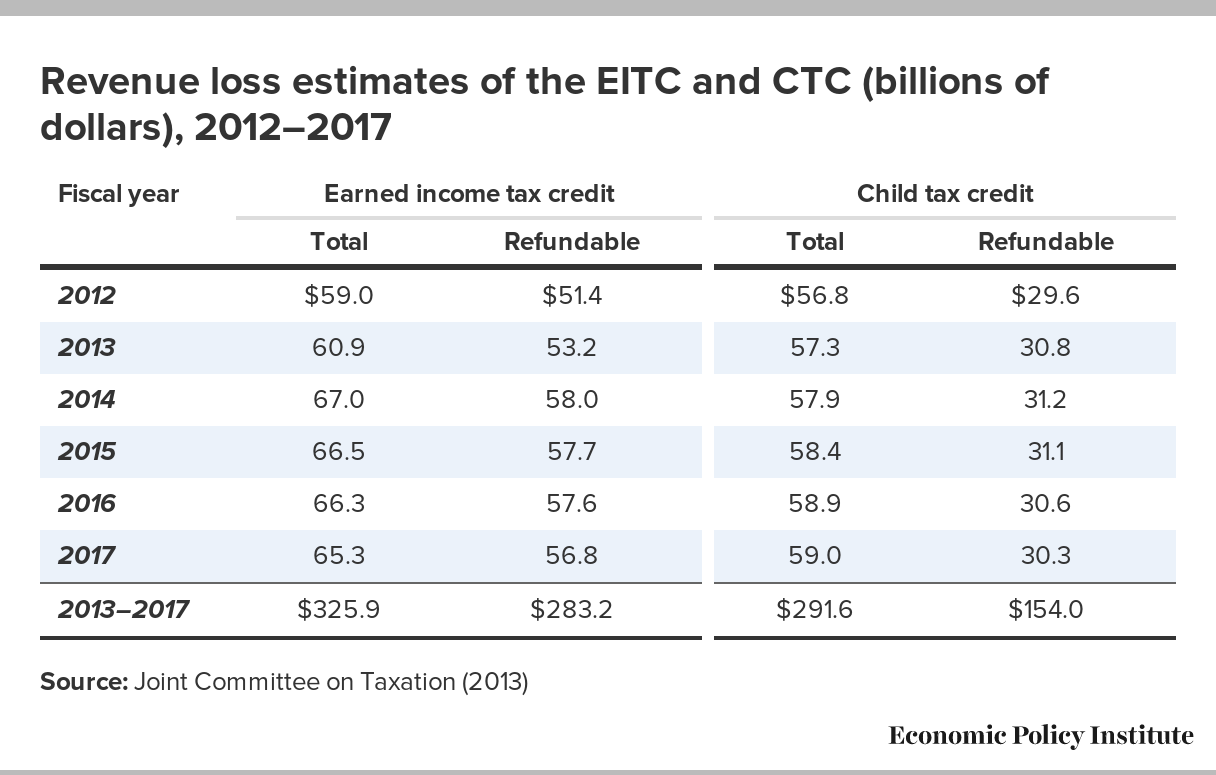

44 child tax credit worksheet 2016

Schedule 8812 (Form 1040A or 1040) 2016 If you file Form 2555 or 2555-EZ stop here, you cannot claim the additional child tax credit. If you are required to use the worksheet in Pub. 972, enter the ... Child Tax Credit - IRS Dec 20, 2016 ... Refunds for 2016 tax returns claiming EIC or ACTC cannot be issued before Feb. ... Child Tax Credit Worksheet later in this publication.

Individual Income Tax Forms - 2016 | Maine Revenue Services Schedule A (PDF), Adjustments to Tax / Child Care Credit Worksheet, See 1040ME Form Booklet. Tax Credit Worksheets, Worksheets for Tax Credits Claimed on ...

Child tax credit worksheet 2016

2016 Schedule 8812 (Form 1040A or 1040) - IRS If you file Form 2555 or 2555-EZ stop here; you cannot claim the additional child tax credit. If you are required to use the worksheet in Pub. 972, enter the ... How do I calculate the Child Tax Credit? - TaxSlayer Support Who can be considered a Qualifying Child? · You must have at least $2,500 in earned income on your return to claim the credit · Limited to tax liability (May ... 2016 I-151 Form 1NPR Instructions resident for 2016, you must file a 2016 Form 1NPR. Note Certain tax credits (for example, homestead credit and earned income credit) may not be claimed by ...

Child tax credit worksheet 2016. 2016 Instruction 1040A - Centro Latino de Capacitacion 2016 Child Tax Credit Worksheet—Line 35. • Single, head of household, or qualifying widow(er) — $75,000. Keep for Your Records. 1. To be a qualifying child ... Earned Income Credit EIC 2016 Notice to Employees of Federal. Earned Income Tax Credit (EIC). If you make $47,000* or less, your employer should notify you at the time of. California Earned Income Tax Credit and Young Child Tax Credit Apr 28, 2022 ... This credit gives you a refund or reduces your tax owed. If you qualify for CalEITC and have a child under the age of 6, you may also qualify ... 2016 Tax Changes Future Developments Forms D-400, D ... - NCDOR See Page 11, Instructions for Form D-400. Schedule S, for information about deductions from federal adjusted gross income. Line 11 - N.C. Standard Deduction or ...

2016 I-151 Form 1NPR Instructions resident for 2016, you must file a 2016 Form 1NPR. Note Certain tax credits (for example, homestead credit and earned income credit) may not be claimed by ... How do I calculate the Child Tax Credit? - TaxSlayer Support Who can be considered a Qualifying Child? · You must have at least $2,500 in earned income on your return to claim the credit · Limited to tax liability (May ... 2016 Schedule 8812 (Form 1040A or 1040) - IRS If you file Form 2555 or 2555-EZ stop here; you cannot claim the additional child tax credit. If you are required to use the worksheet in Pub. 972, enter the ...

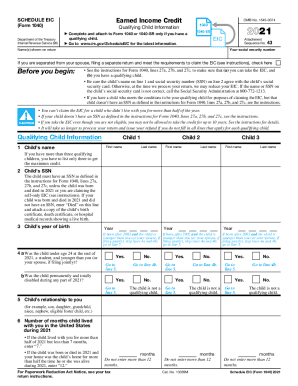

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-04.jpg)

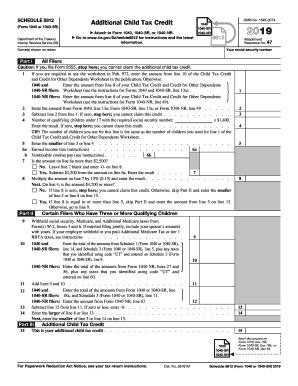

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-08.jpg)

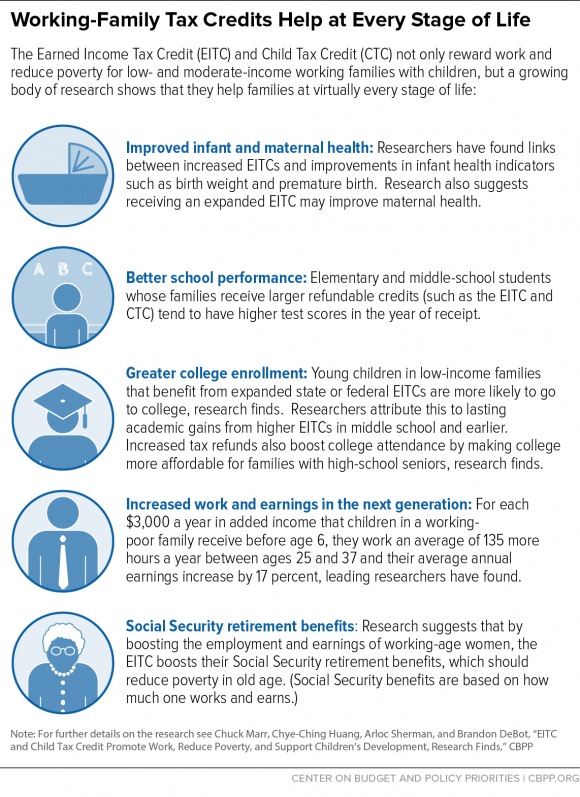

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-11.jpg)

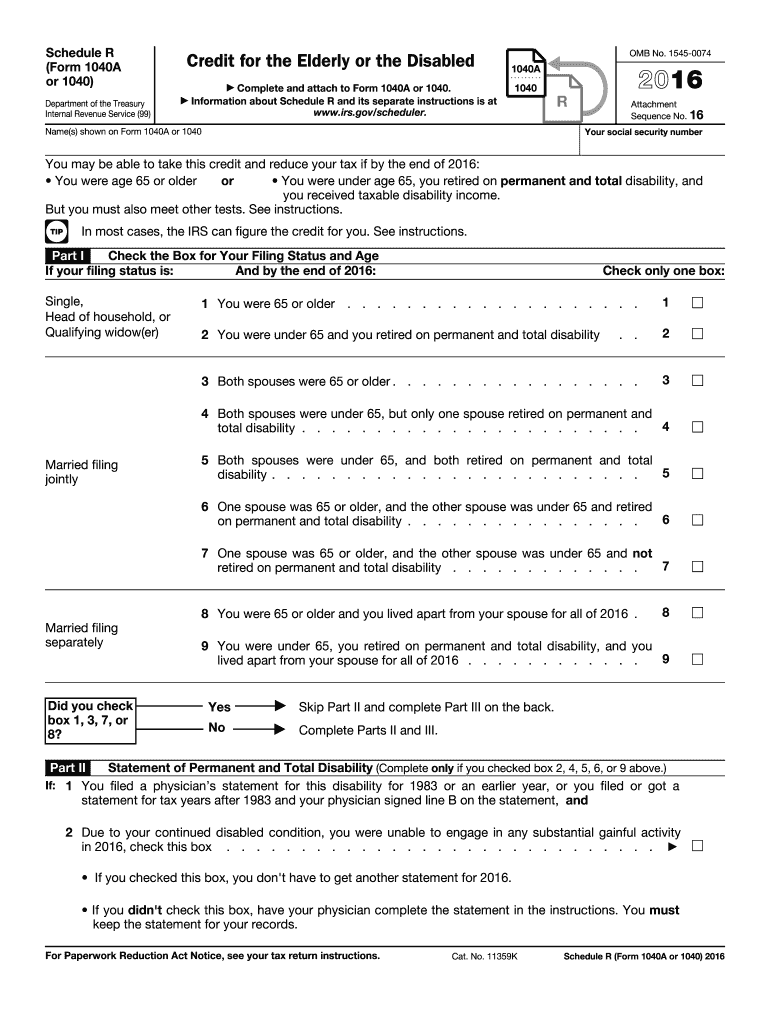

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-14.jpg)

0 Response to "44 child tax credit worksheet 2016"

Post a Comment