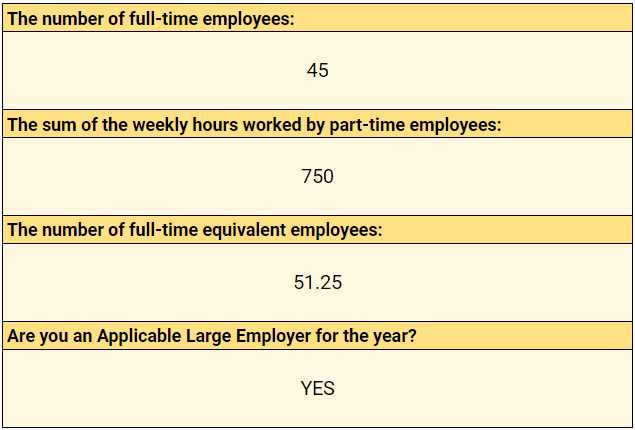

44 applicable large employer worksheet

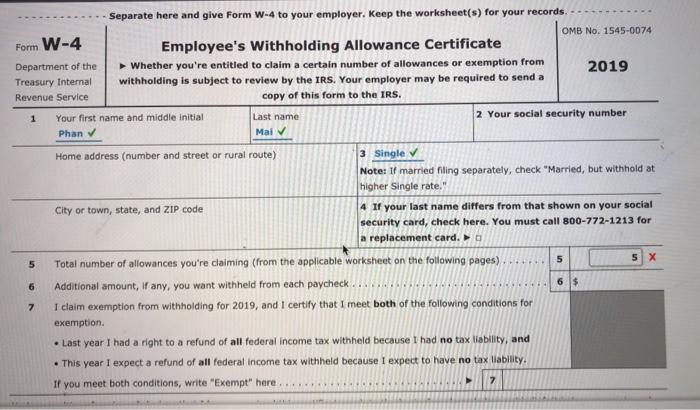

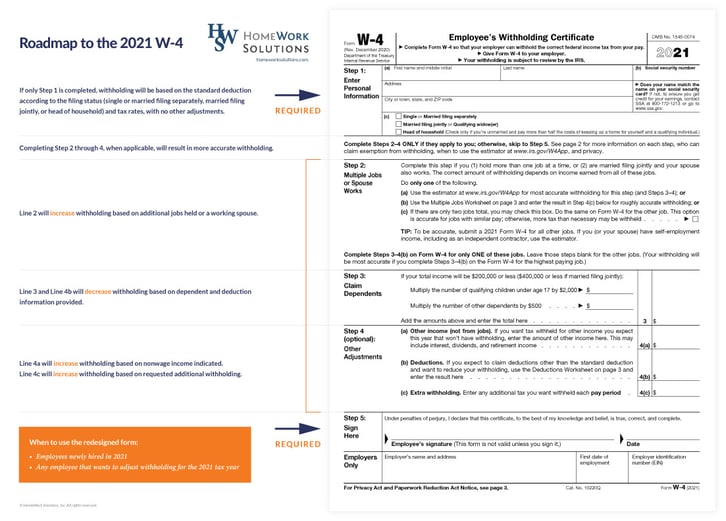

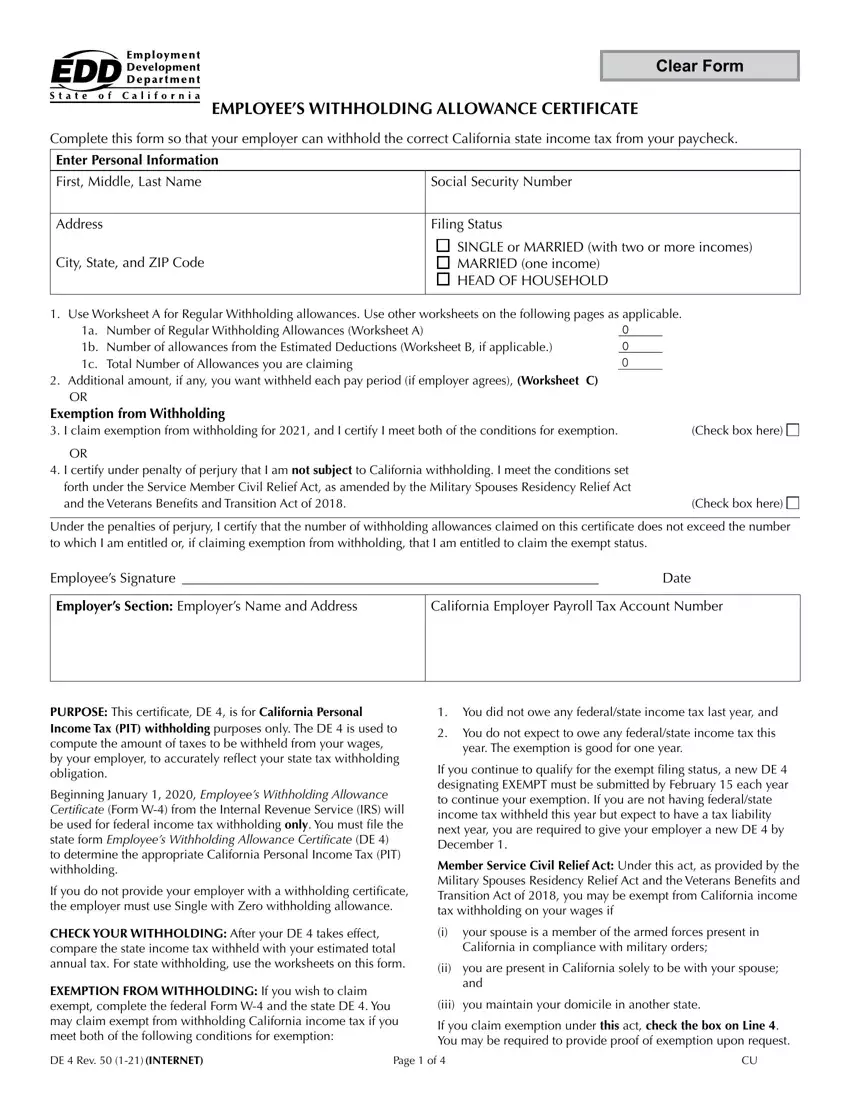

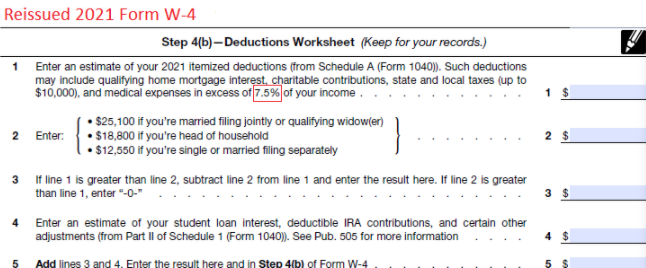

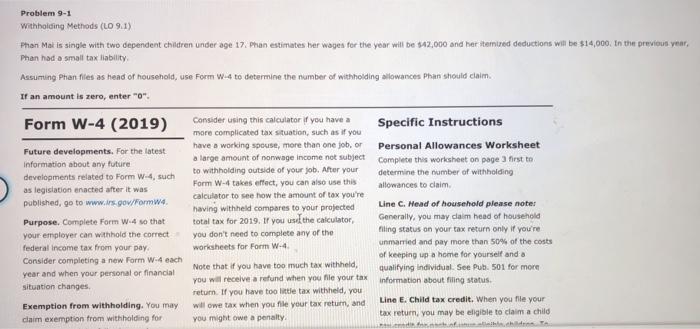

SAM.gov WebThe unique entity identifier used in SAM.gov has changed. On April 4, 2022, the unique entity identifier used across the federal government changed from the DUNS Number to the Unique Entity ID (generated by SAM.gov).. The Unique Entity ID is a 12-character alphanumeric ID assigned to an entity by SAM.gov. IT-2104 Employee’s Withholding Allowance Certificate Webworksheet or charts, you should complete a new 2022 Form IT-2104 and give it to your employer. Who should file this form This certificate, Form IT-2104, is completed by an employee and given to the employer to instruct the employer how much New York State (and New York City and Yonkers) tax to withhold from the employee’s pay. The

Publication 560 (2021), Retirement Plans for Small Business WebIncrease in credit limitation for small employer plan startup costs. The Further Consolidated Appropriations Act, 2020, P.L. 116-94, also amended section 45E. For tax years beginning after December 31, 2019, eligible employers can claim a tax credit for the first credit year and each of the 2 tax years immediately following. The credit equals 50% of qualified startup …

Applicable large employer worksheet

Publication 502 (2021), Medical and Dental Expenses Web13.01.2022 · Instructions: Use this worksheet to figure the amount of excess reimbursement you must include as income on your tax return when (a) you are reimbursed under two or more health insurance policies, (b) at least one of which is paid for by both you and your employer, and (c) your employer's contributions aren't included in your gross income. If … Per Diem Rates | GSA Web14.11.2022 · Per OMB Circular A-123, federal travelers "...must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes from their hotel bills." GSA's SmartPay team maintains the most current state tax information, including any applicable forms. Last Reviewed: 2022-11-14 . Home Resources for… Americans … Determining if an Employer is an Applicable Large Employer Web29.09.2022 · For employers that are an applicable large employer, an estimate of the maximum amount of the potential liability for the employer shared responsibility payment that could apply, based on the number of full-time employees reported if an employer fails to offer coverage to its full-time employees. Basic ALE Determination Examples Example …

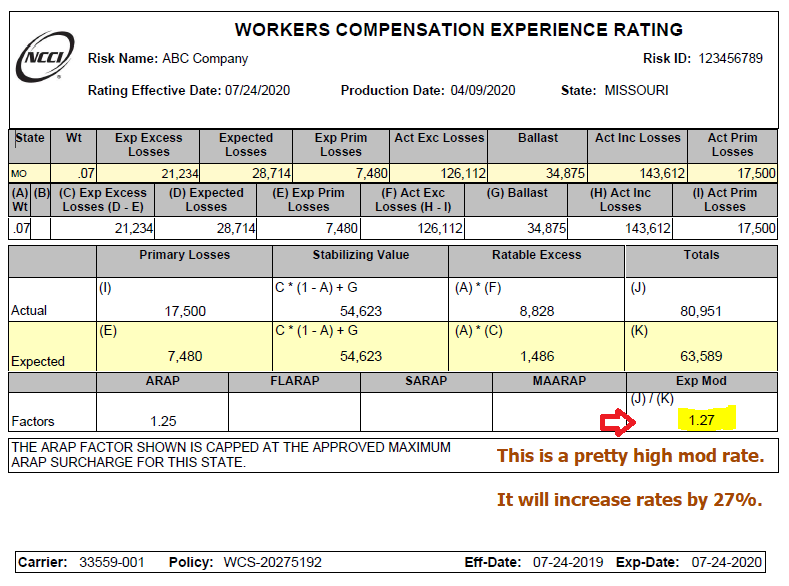

Applicable large employer worksheet. Experience Modification Rate - Emod, X-Mod, EMR Rating WebExperience rating compares an employer's actual claims experience to the expected or average experience of all similar business types within a state. An experience modification is developed and applied to risks with premium large enough for the insured's past experience to be an indicator of how much benefit, or claims, costs will be paid on behalf … Families First Coronavirus Response Act: Questions and ... -DOL I used 6 weeks of FFCRA leave between April 1, 2020, and December 31, 2020, because my childcare provider was unavailable due to COVID-19. My employer allowed me to take time off, but did not pay me for my last two weeks of FFCRA leave. Is my employer required to pay me for my last two weeks if the FFCRA has expired? (added 12/31/2020) Yes. Publication 537 (2021), Installment Sales | Internal Revenue Service WebApplicable federal rate (AFR). The AFR depends on the month the binding contract for the sale or exchange of property is made or the month of the sale or exchange and the term of the instrument. For an installment obligation, the term of the instrument is its weighted average maturity, as defined in Regulations section 1.1273-1(e)(3). Privacy Impact Assessments - PIA | Internal Revenue Service Jan 24, 2022 · Employer's Quarterly Federal Tax Return Form W-2; Employers engaged in a trade or business who pay compensation Form 9465; Installment Agreement Request ...

PAPPG Chapter II - NSF Web01.06.2020 · NSF 20-1 June 1, 2020 Chapter II - Proposal Preparation Instructions. Each proposing organization that is new to NSF or has not had an active NSF assistance award within the previous five years should be prepared to submit basic organization and management information and certifications, when requested, to the applicable award … PlayStation userbase "significantly larger" than Xbox even if ... Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ... Retirement Topics — Required Minimum Distributions (RMDs) Web01.01.2020 · Employer's Quarterly Federal Tax Return Form W-2; Employers engaged in a trade or business who pay compensation Form 9465 ... If you do not take any distributions, or if the distributions are not large enough, you may have to pay a 50% excise tax on the amount not distributed as required. To report the excise tax, you may have to file Form … Determining if an Employer is an Applicable Large Employer Web29.09.2022 · For employers that are an applicable large employer, an estimate of the maximum amount of the potential liability for the employer shared responsibility payment that could apply, based on the number of full-time employees reported if an employer fails to offer coverage to its full-time employees. Basic ALE Determination Examples Example …

Per Diem Rates | GSA Web14.11.2022 · Per OMB Circular A-123, federal travelers "...must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes from their hotel bills." GSA's SmartPay team maintains the most current state tax information, including any applicable forms. Last Reviewed: 2022-11-14 . Home Resources for… Americans … Publication 502 (2021), Medical and Dental Expenses Web13.01.2022 · Instructions: Use this worksheet to figure the amount of excess reimbursement you must include as income on your tax return when (a) you are reimbursed under two or more health insurance policies, (b) at least one of which is paid for by both you and your employer, and (c) your employer's contributions aren't included in your gross income. If …

0 Response to "44 applicable large employer worksheet"

Post a Comment