42 interest rate reduction refinancing loan worksheet

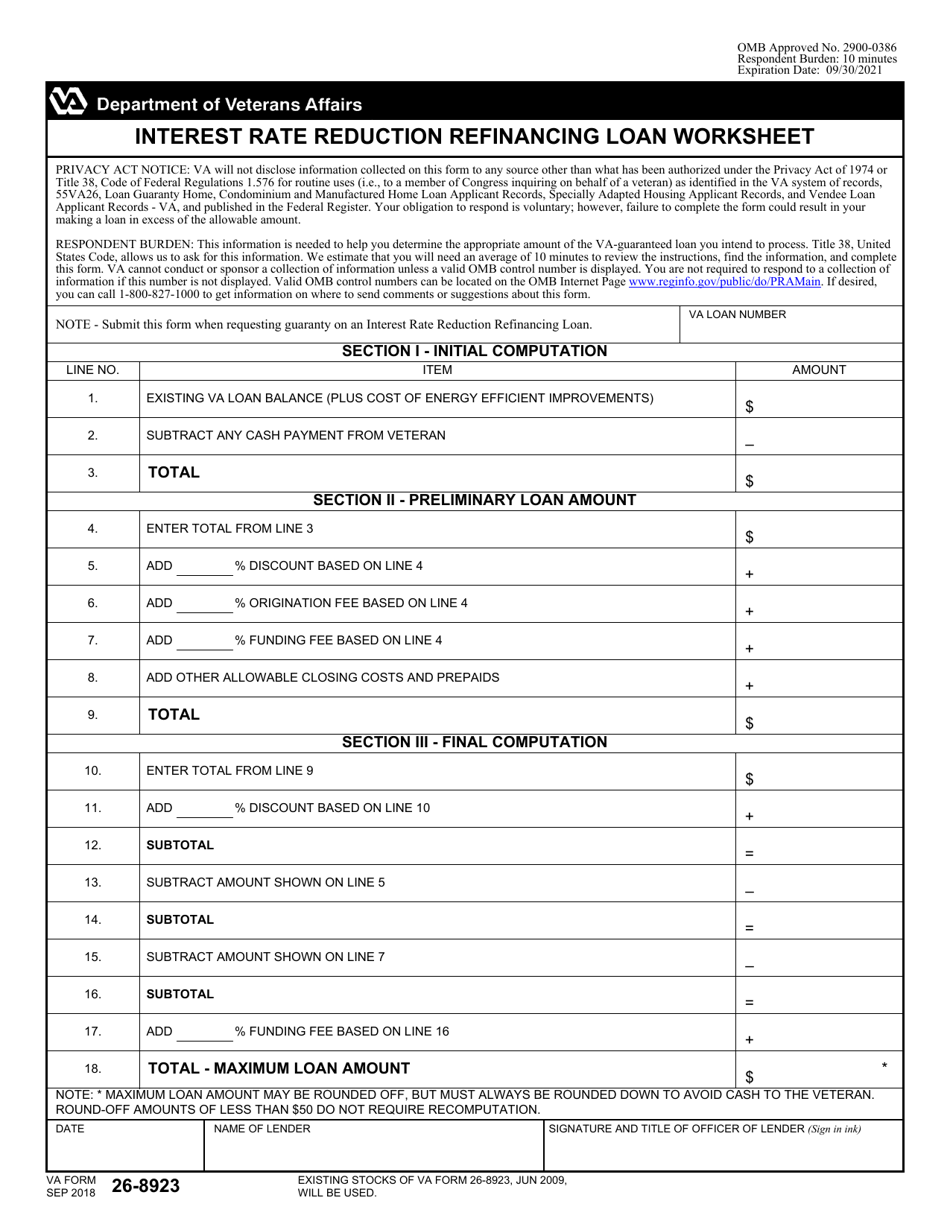

Publication 527 (2020), Residential Rental Property A loan or mortgage may end due to a refinancing, prepayment, foreclosure, or similar event. However, if the refinancing is with the same lender, the remaining points (OID) generally aren’t deductible in the year in which the refinancing occurs, but may be deductible over the term of the new mortgage or loan. About VA Form 26-8923 Jun 28, 2022 — Form name: Interest Rate Reduction Refinancing Loan Worksheet. Related to: Housing assistance. Form last updated: June 2022 ...

Publication 970 (2021), Tax Benefits for Education | Internal … Student loan interest deduction. For 2021, the amount of your student loan interest deduction is gradually reduced (phased out) if your MAGI is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return). ... You can use Worksheet 1-1 to figure the tax-free and taxable parts of your scholarship or fellowship grant ...

Interest rate reduction refinancing loan worksheet

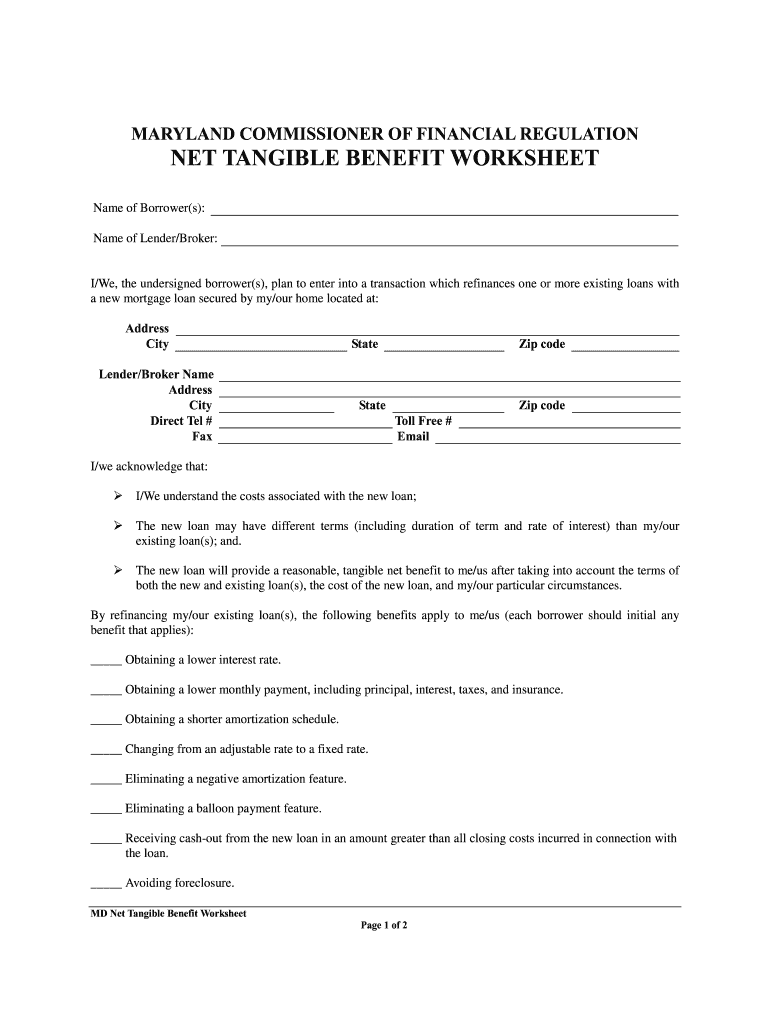

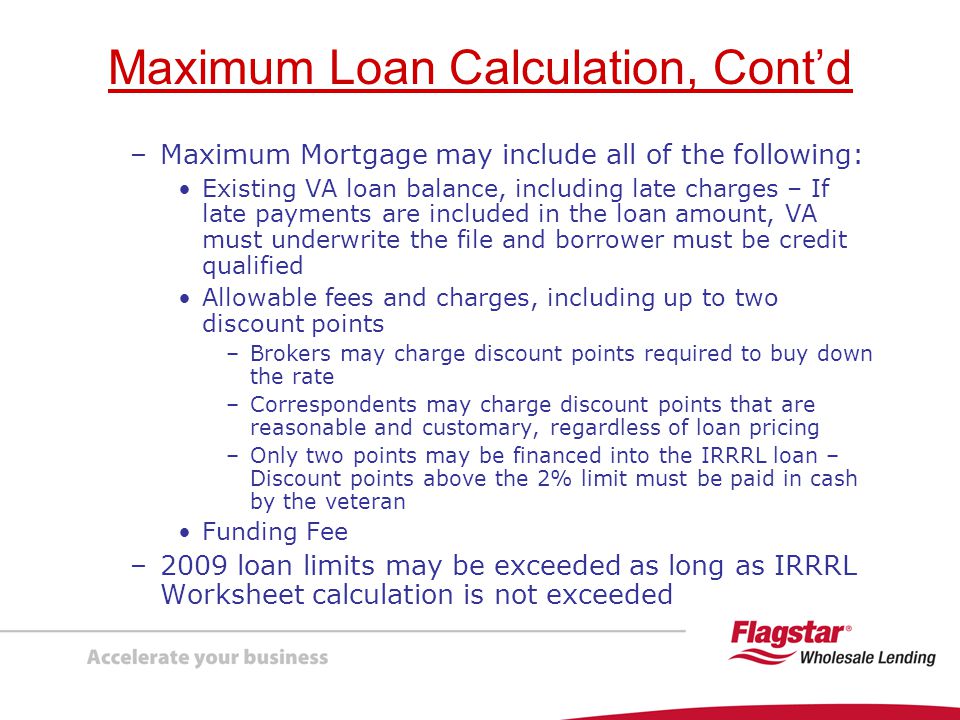

Interest Rate Reduction Refinance Loan Rate Reduction Refinance Loan (IRRRL) generally lowers the interest rate by refinancing an existing VA home loan. By obtaining a lower interest rate, the. 2021 Instructions for Schedule A (2021) | Internal Revenue Service However, you can deduct qualified home mortgage interest (on your Schedule A) and interest on certain student loans (on Schedule 1 (Form 1040), line 21), as explained in Pub. 936 and Pub. 970. If you use the proceeds of a loan for more than one purpose (for example, personal and business), you must allocate the interest on the loan to each use. Overwatch 2 reaches 25 million players, tripling Overwatch 1 daily ... Oct 14, 2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc

Interest rate reduction refinancing loan worksheet. Instructions for Form 706 (09/2022) | Internal Revenue Service Interest on the portion of the tax in excess of the 2% portion is figured at 45% of the annual rate of interest on underpayments. This rate is based on the federal short-term rate and is announced quarterly by the IRS in the Internal Revenue Bulletin. Tables Created by BLS - Bureau of Labor Statistics Jul 19, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site. Loan Guaranty: Revisions to VA-Guaranteed or Insured Interest Rate ... Nov 01, 2022 · Specifically, as proposed, lenders would be required to utilize a new standardized form, Interest Rate Reduction Refinancing Loan Comparison Disclosure (hereinafter, Comparison Disclosure), to notify veterans of certain loan information, including the total closing costs and recoupment period, at various stages during the loan process (initial ... INTEREST RATE REDUCTION REFINANCING LOAN ... INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET. PRIVACY ACT NOTICE: VA will not disclose information collected on this form to any source other than ...

Publication 936 (2021), Home Mortgage Interest Deduction Enter the annual interest rate on the mortgage. If the interest rate varied in 2021, use the lowest rate for the year: 0.09: 3. Divide the amount on line 1 by the amount on line 2. Enter the result: $27,778 VA Form 26-8923 INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET. VA will not disclose information collected on this form to any source other than what has been ... About Our Coalition - Clean Air California About Our Coalition. Prop 30 is supported by a coalition including CalFire Firefighters, the American Lung Association, environmental organizations, electrical workers and businesses that want to improve California’s air quality by fighting and preventing wildfires and reducing air pollution from vehicles. INTEREST RATE REDUCTION REFINANCING LOAN ... NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT.

Circular 26-17-12 - Veterans Benefits Administration Apr 12, 2017 — Instructions for Completion of VA Form 26-8923, Interest Rate Reduction Refinance Loan. Worksheet. 1. Purpose. This Circular clarifies the ... FAFSA for 2022: Income Limits, Types of Aid and More - Student Loan … Jan 13, 2022 · Rates shown are for the College Ave Undergraduate Loan product and include autopay discount. The 0.25% auto-pay interest rate reduction applies as long as a valid bank account is designated for required monthly payments. Variable rates may increase after consummation. Information advertised valid as of 11/15/2022. Interest Rate Reduction Refinancing Loan Worksheet (VA ... VA Form 22-8923 is used by lenders for completing the funding fee and maximum permissible loan amounts for interest rate reduction refinancing loans to ... Overwatch 2 reaches 25 million players, tripling Overwatch 1 daily ... Oct 14, 2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc

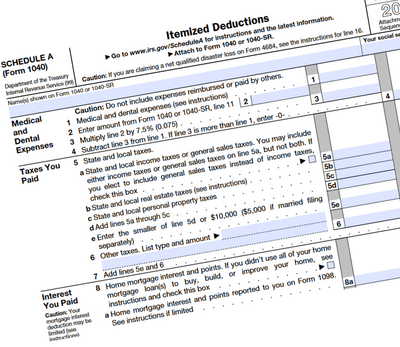

2021 Instructions for Schedule A (2021) | Internal Revenue Service However, you can deduct qualified home mortgage interest (on your Schedule A) and interest on certain student loans (on Schedule 1 (Form 1040), line 21), as explained in Pub. 936 and Pub. 970. If you use the proceeds of a loan for more than one purpose (for example, personal and business), you must allocate the interest on the loan to each use.

Interest Rate Reduction Refinance Loan Rate Reduction Refinance Loan (IRRRL) generally lowers the interest rate by refinancing an existing VA home loan. By obtaining a lower interest rate, the.

0 Response to "42 interest rate reduction refinancing loan worksheet"

Post a Comment