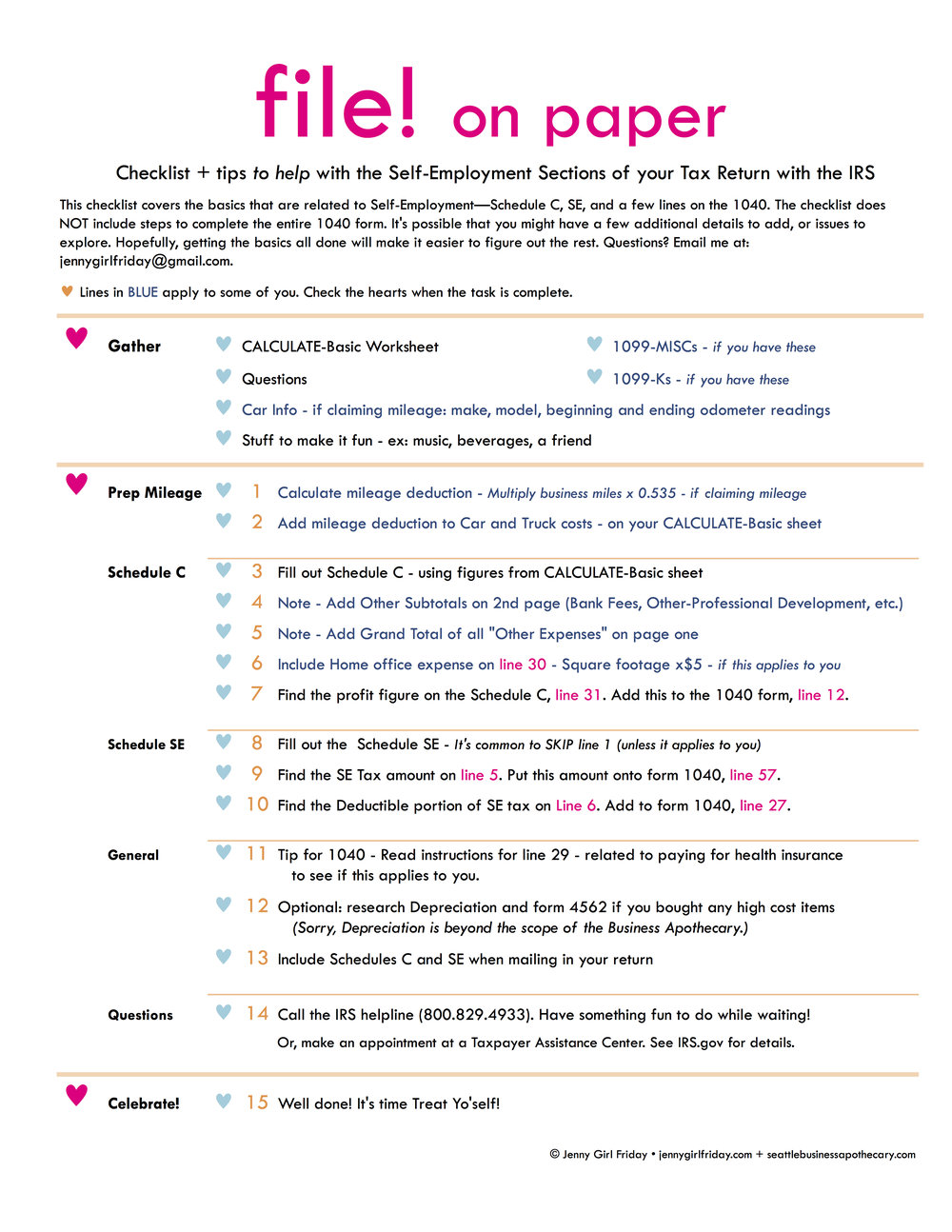

42 self employed expense worksheet

› articles › tax15 Tax Deductions and Benefits for the Self-Employed Jul 31, 2022 · IRS Publication 587: Business Use of Your Home (Including Use by Day-Care Providers): A document published by the Internal Revenue Service (IRS) that provides information on how taxpayers who use ... › obamacare › self-employedSelf-employed health insurance deduction | healthinsurance.org Mar 25, 2022 · Key takeaways. For the self-employed, health insurance premiums became 100% deductible in 2003. The deduction that allows self-employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year.

SELF-EMPLOYED WORKSHEET | NI Direct SELF-EMPLOYED WORKSHEET FOR RATES HOUSING BENEFIT/RATE RELIEF APPLICATION (4.0). Page 1 of 4 ... details of your income and expenses? From. DD/MM/YYYY.

Self employed expense worksheet

Self-Employed Tax Deductions Worksheet (Download FREE) Looking to lower your tax liability for the year? Well, you are in the right place. User our free self-employed tax deductions worksheet to record/track all ... › publications › p502Publication 502 (2021), Medical and Dental Expenses Jan 13, 2022 · Health Insurance Costs for Self-Employed Persons. If you were self-employed and had a net profit for the year, you may be able to deduct, as an adjustment to income, amounts paid for medical and qualified long-term care insurance on behalf of yourself, your spouse, your dependents, and your children who were under age 27 at the end of 2021. › oes › currentMay 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site.

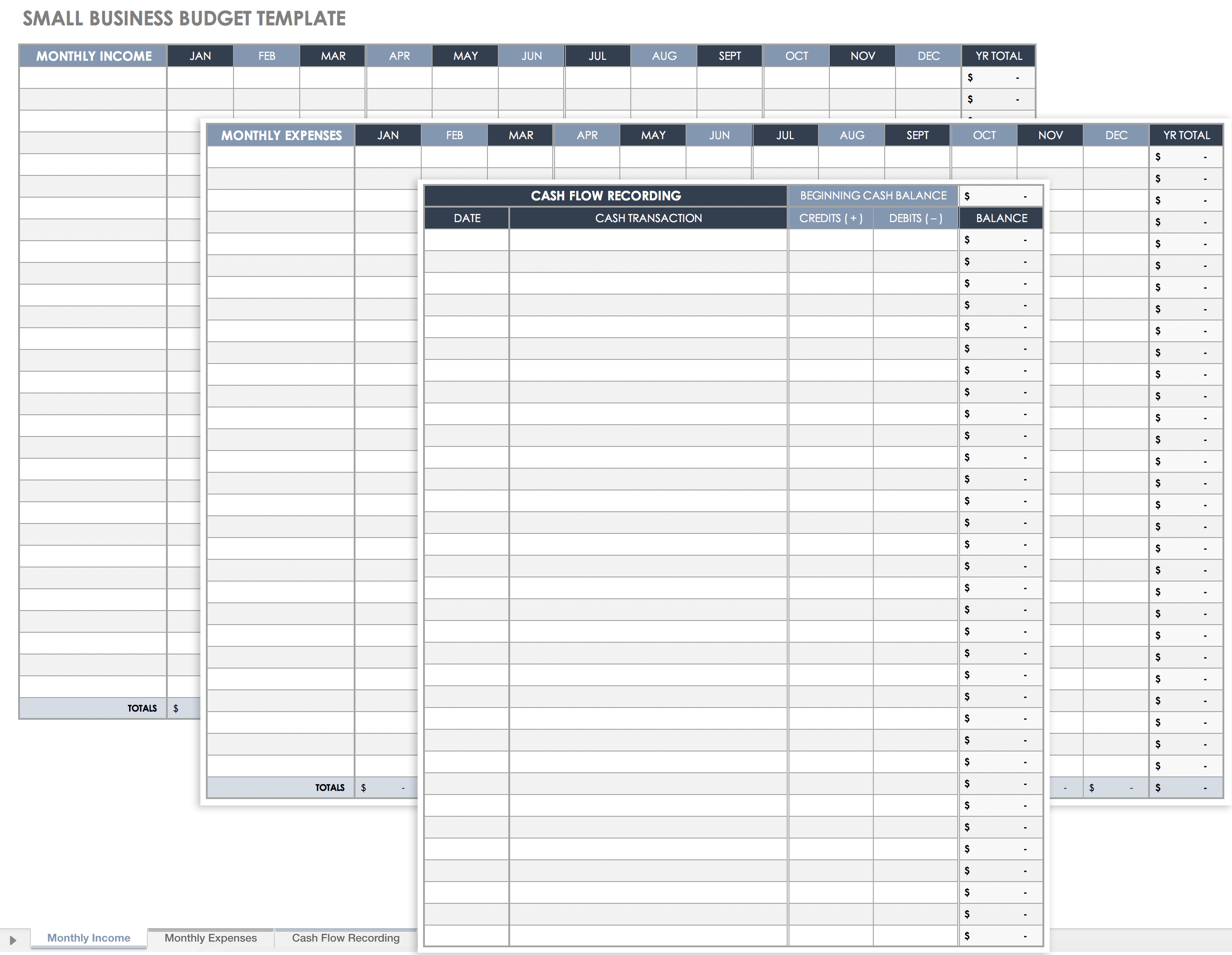

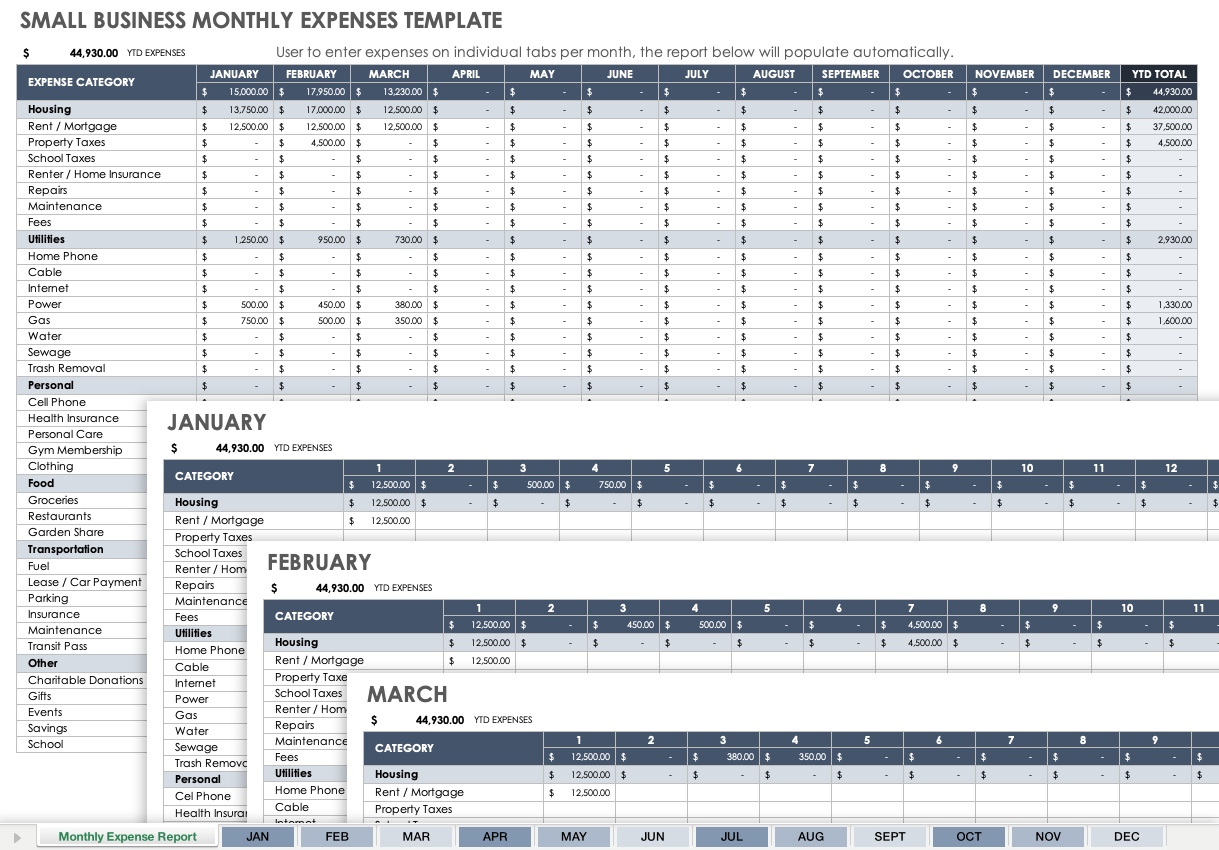

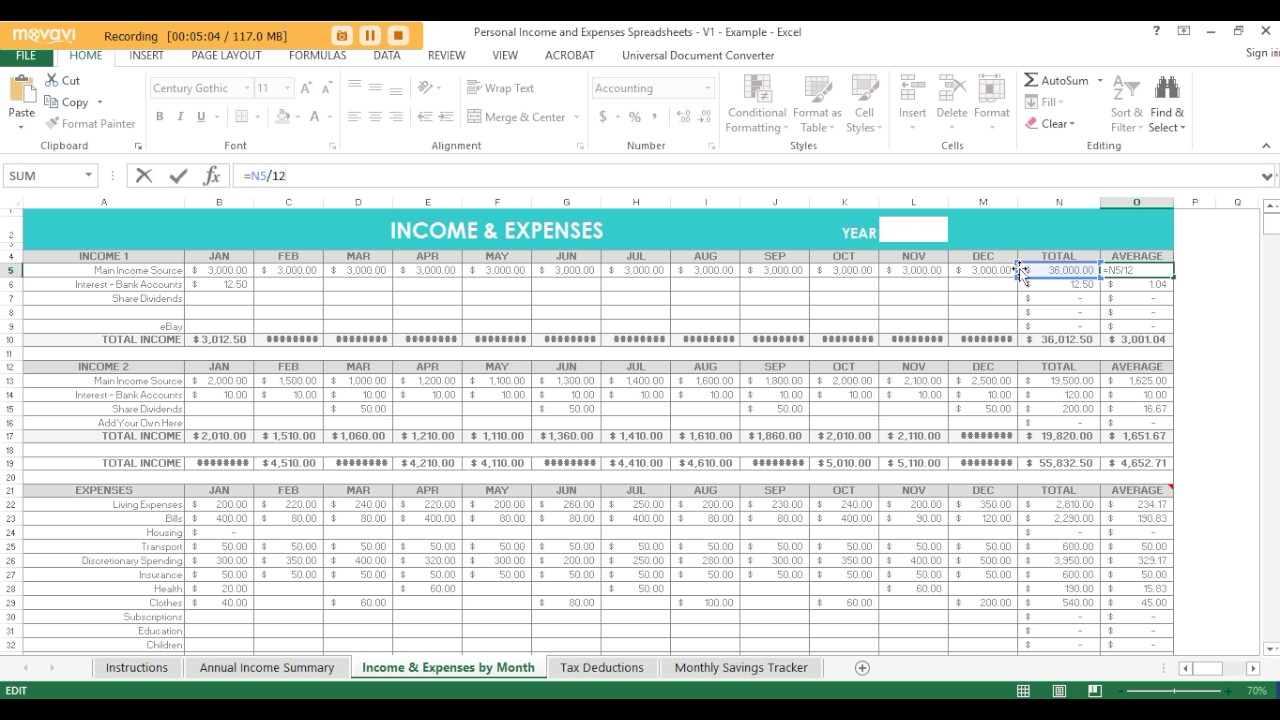

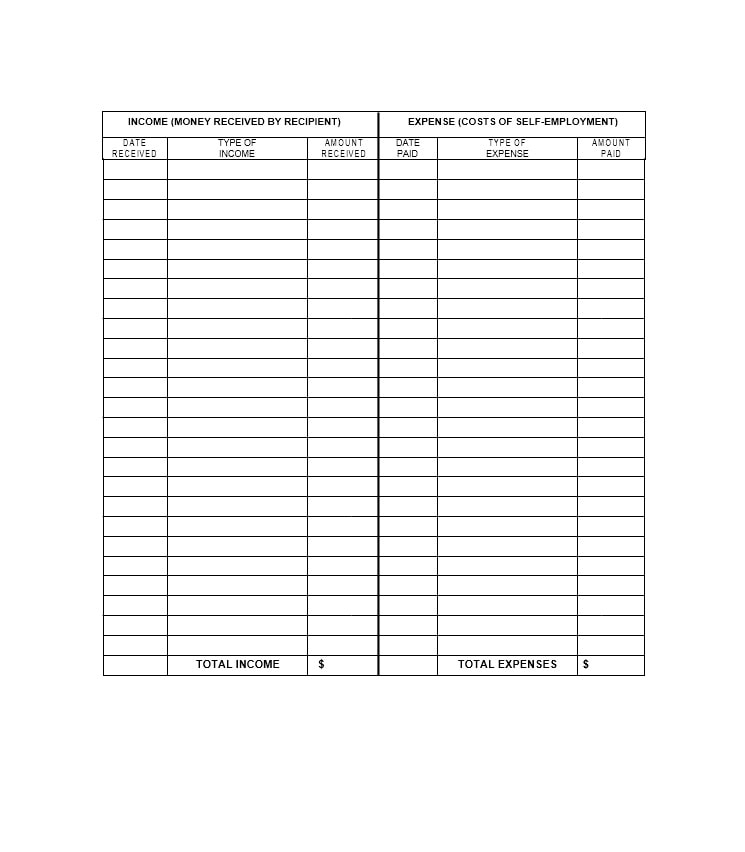

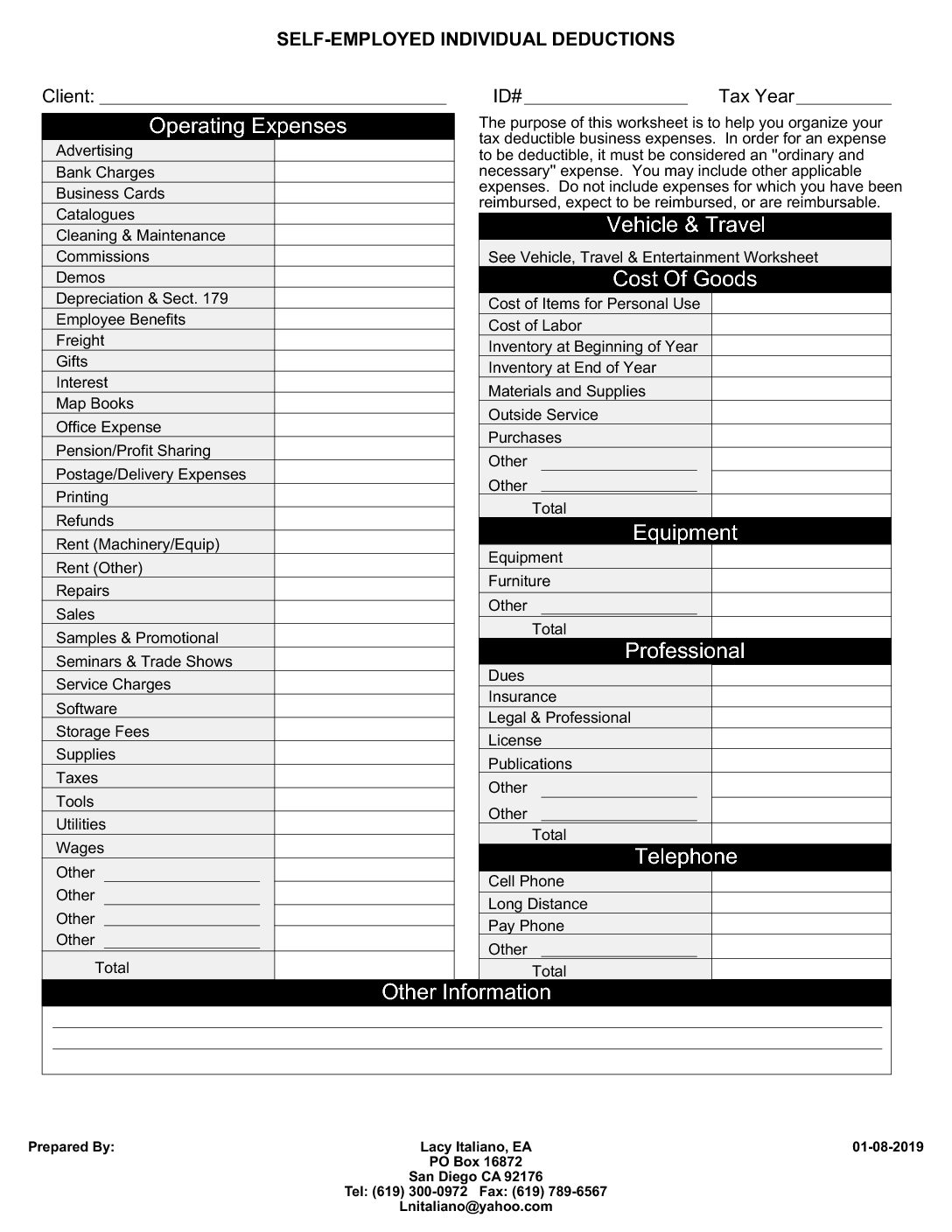

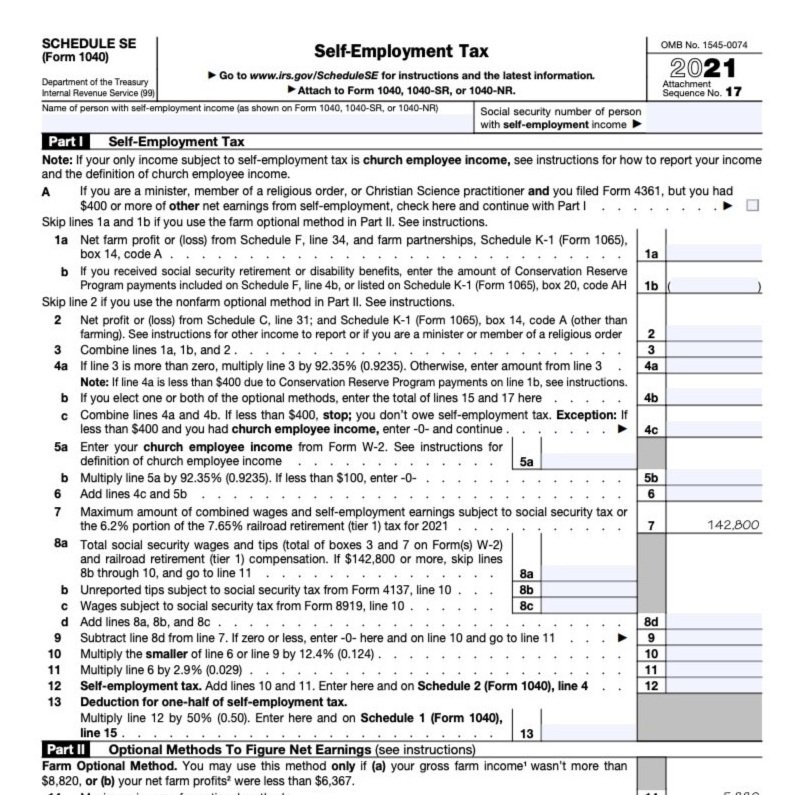

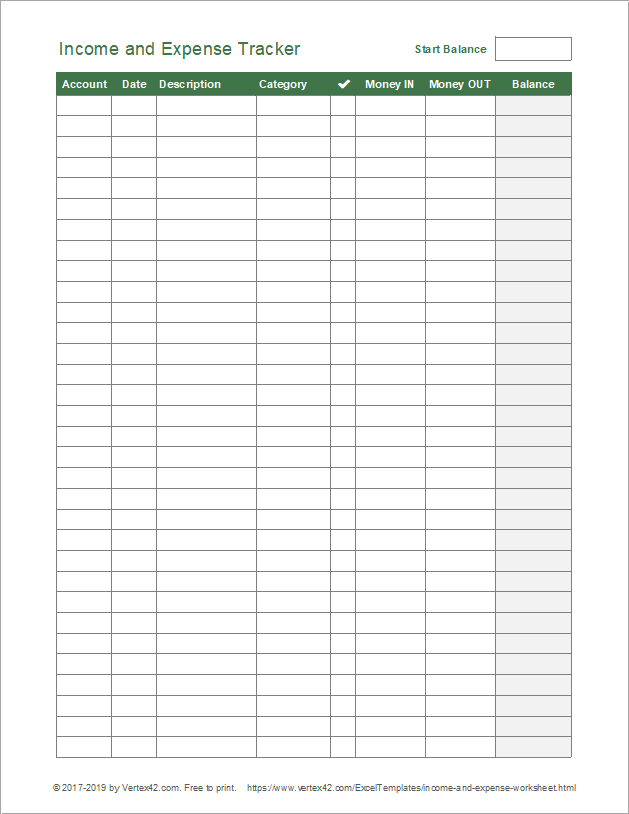

Self employed expense worksheet. › publications › p535Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. SELF-EMPLOYMENT WORKSHEET Deductible Expense: Advertising. Car/Truck Expenses. Commissions/Fees. Contract Labor. Depletion. Depreciation. Employee Benefit Programs. Insurance. Free expenses spreadsheet for self-employed - Hello Bonsai Get a free self-employed expenses spreadsheet or use Bonsai to track your expenses for free. Simplify your accounting and billing and get on with your work. SELF-EMPLOYMENT INCOME AND EXPENSE WORKSHEET SELF-EMPLOYMENT INCOME AND EXPENSE WORKSHEET. Your name: ... Km for business/employment or %. Purchases for the year. Total Km driven. Subcontracts.

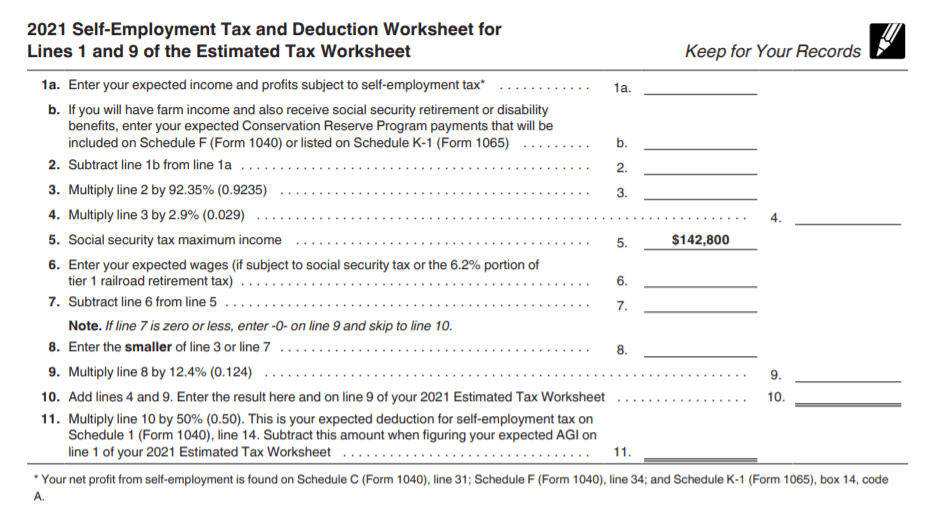

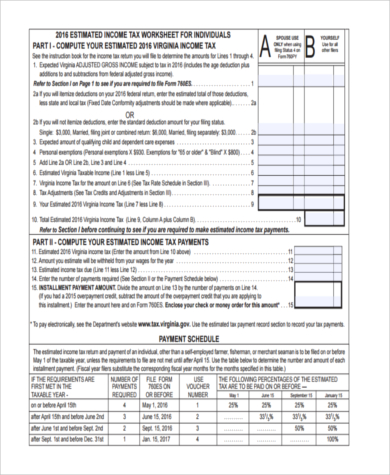

Self Employment Monthly Sales and Expense Worksheet - WA.gov Monthly Sales and Expense Worksheet, NAME. MONTH, CLIENT ID NUMBER. Self Employment Income. You must tell us about your monthly self employment income. › publications › p505Publication 505 (2022), Tax Withholding and Estimated Tax If self-employed, first complete Worksheet 2-3 to figure your expected deduction for self-employment tax. Subtract the amount from Worksheet 2-3, line 11, to figure the line 1 entry: 1. 2. If you: • Don’t plan to itemize deductions on Schedule A (Form 1040), use Worksheet 2-4 to figure your expected standard deduction. • › publications › p969Publication 969 (2021), Health Savings Accounts and Other Tax ... Costs for home testing and personal protective equipment (PPE) for COVID-19. The cost of home testing for COVID-19 and PPE is an eligible medical expense that can be paid or reimbursed under health flexible spending arrangements (health FSAs), health savings accounts (HSAs), 1099 Taxes Calculator | Estimate Your Self-Employment Taxes As a self-employed individual, you are generally responsible for estimated quarterly tax payments and an annual return. You are responsible for federal and state (if applicable) taxes on your adjusted gross income.So the more tax deductions you can find, the more money you’ll keep in your pocket. Filing an annual return: To file yearly taxes, you’ll need a Schedule Cform.

(Schedule C) Self-Employed Business Expenses Worksheet for Single (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Tax Worksheet for Self-employed, Independent contractors, Sole ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC. LLCs & 1099-MISC with box 7 income listed. SELF EMPLOYMENT INCOME WORKSHEET Allowable expenses that can be deducted from income are listed below within the worksheet (#4-17). - Income Taxes (federal, state, and local ). EXPENSES:. Use this worksheet to record your monthly income and expenses ... Track gas and vehicle expenses for your budget, but business mileage will be needed for your taxes. Use our SETO (Self-Employed Tax. Organizer) to calculate the ...

› oes › currentMay 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site.

› publications › p502Publication 502 (2021), Medical and Dental Expenses Jan 13, 2022 · Health Insurance Costs for Self-Employed Persons. If you were self-employed and had a net profit for the year, you may be able to deduct, as an adjustment to income, amounts paid for medical and qualified long-term care insurance on behalf of yourself, your spouse, your dependents, and your children who were under age 27 at the end of 2021.

Self-Employed Tax Deductions Worksheet (Download FREE) Looking to lower your tax liability for the year? Well, you are in the right place. User our free self-employed tax deductions worksheet to record/track all ...

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fcf2e45bd9fa5a86e28d_schedule-c-categories.png)

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-feature.jpg?strip=all&lossy=1&ssl=1)

0 Response to "42 self employed expense worksheet"

Post a Comment