40 qualified dividends and capital gain tax worksheet fillable

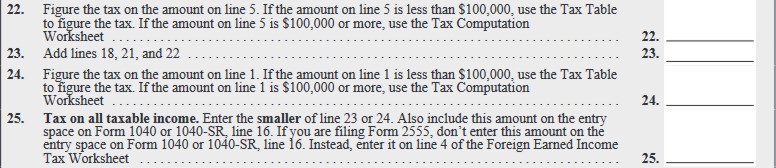

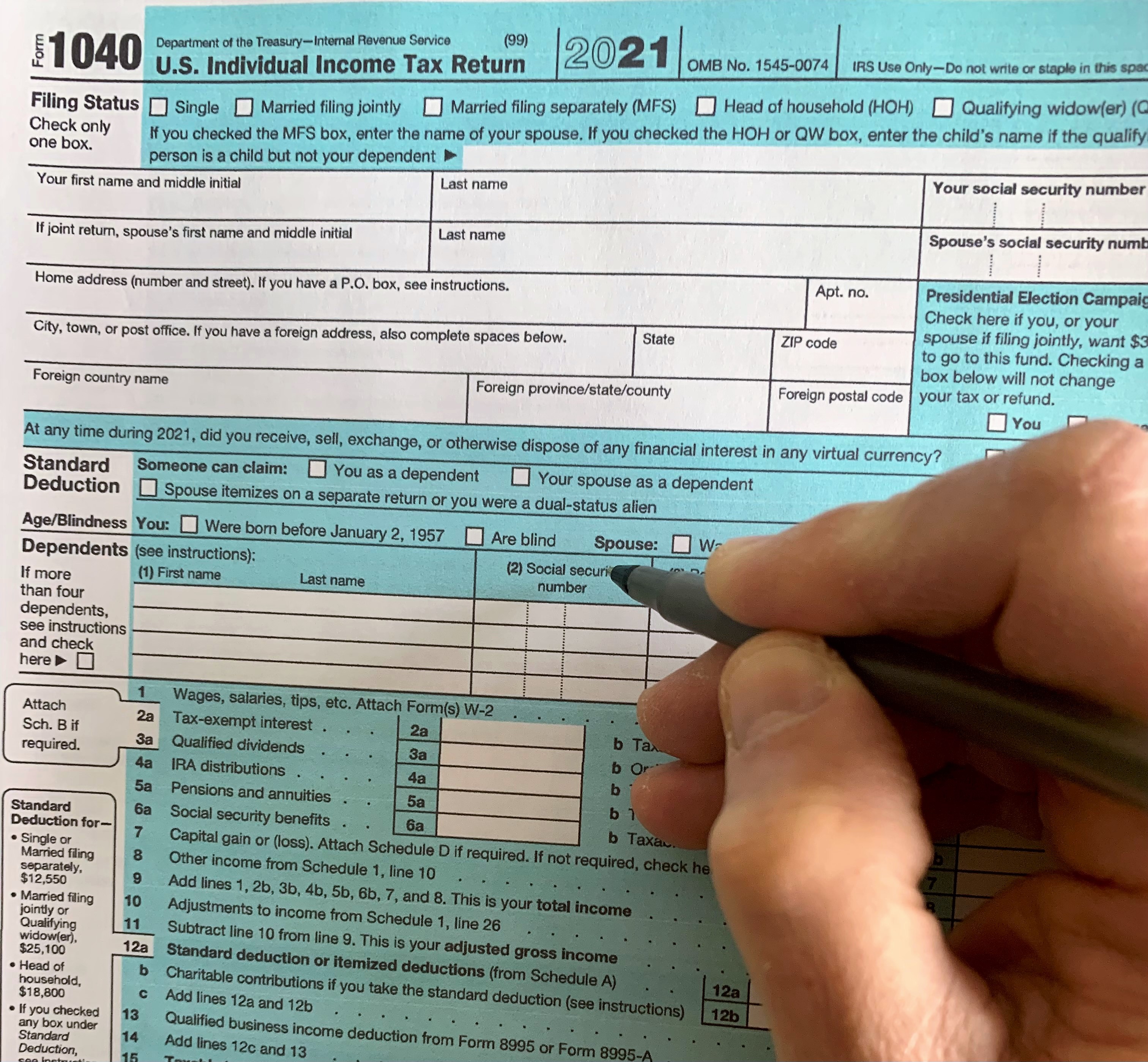

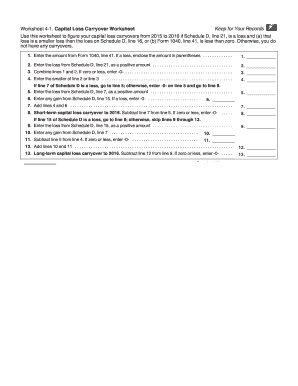

Page 40 of 117 - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don’t have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of … 2021 Form 6251 - IRS tax forms Enter the amount from line 5 of the Qualified Dividends and Capital Gain Tax Worksheet or the amount from line 14 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the amount from Form 1040 or 1040-SR, line 15; if zero or less, enter -0-. If ...

› pub › irs-pdf2021 Form 6251 - IRS tax forms Enter the amount from line 5 of the Qualified Dividends and Capital Gain Tax Worksheet or the amount from line 21 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the amount from Form 1040 or 1040-SR, line 15; if zero or less, enter -0-.

Qualified dividends and capital gain tax worksheet fillable

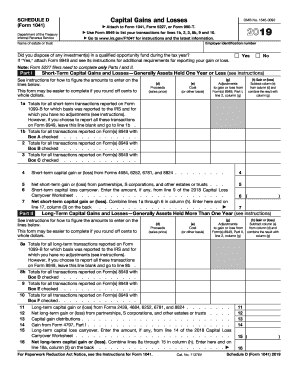

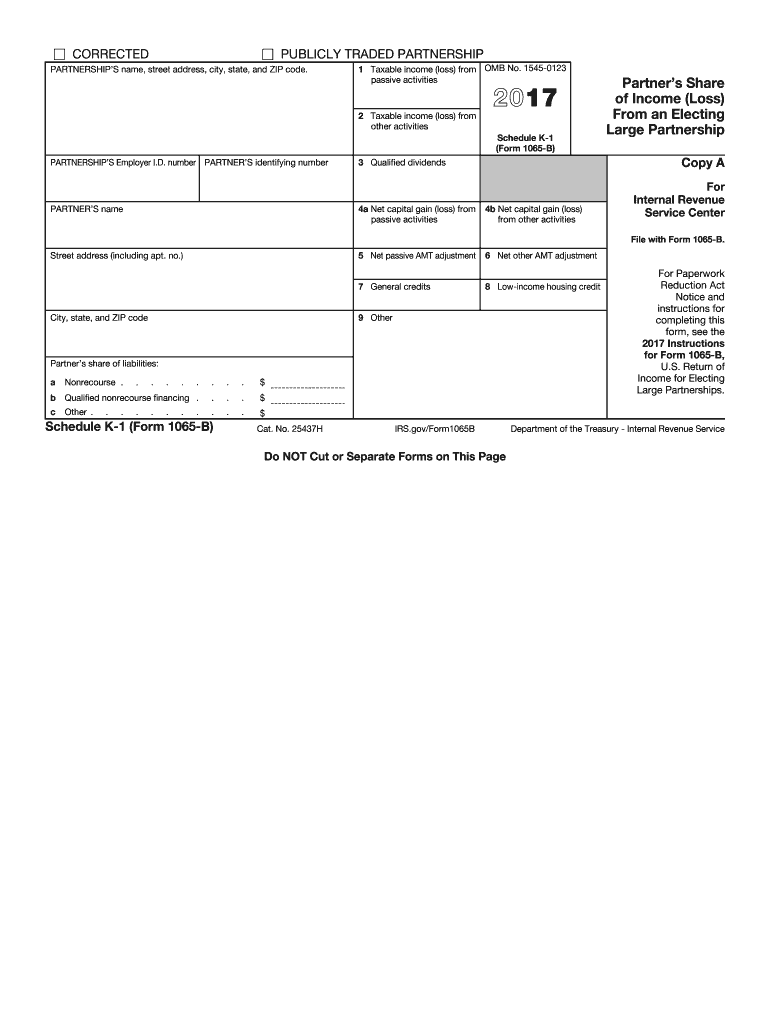

apps.irs.gov › app › vitaPage 40 of 117 - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. 2019 Schedule K-1 (Form 1120-S) - IRS tax forms Qualified dividends . 6 . Royalties . 7 . Net short-term capital gain (loss) 8a . Net long-term capital gain (loss) 8b . Collectibles (28%) gain (loss) 8c . Unrecaptured section 1250 gain . 9 . Net section 1231 gain (loss) 10 . Other income (loss) 11 . Section 179 deduction . 12 . Other deductions . 13 . Credits . 14 . Foreign transactions . 15 . Alternative minimum tax (AMT) items. … › pub › irs-prior2019 Schedule K-1 (Form 1120-S) - IRS tax forms Ordinary dividends . 5b . Qualified dividends . 6 . Royalties . 7 . Net short-term capital gain (loss) 8a . Net long-term capital gain (loss) 8b . Collectibles (28%) gain (loss) 8c . Unrecaptured section 1250 gain . 9 . Net section 1231 gain (loss) 10 . Other income (loss) 11 . Section 179 deduction . 12 . Other deductions . 13 . Credits . 14 ...

Qualified dividends and capital gain tax worksheet fillable. › pub › irs-prior2019 Schedule K-1 (Form 1120-S) - IRS tax forms Ordinary dividends . 5b . Qualified dividends . 6 . Royalties . 7 . Net short-term capital gain (loss) 8a . Net long-term capital gain (loss) 8b . Collectibles (28%) gain (loss) 8c . Unrecaptured section 1250 gain . 9 . Net section 1231 gain (loss) 10 . Other income (loss) 11 . Section 179 deduction . 12 . Other deductions . 13 . Credits . 14 ... 2019 Schedule K-1 (Form 1120-S) - IRS tax forms Qualified dividends . 6 . Royalties . 7 . Net short-term capital gain (loss) 8a . Net long-term capital gain (loss) 8b . Collectibles (28%) gain (loss) 8c . Unrecaptured section 1250 gain . 9 . Net section 1231 gain (loss) 10 . Other income (loss) 11 . Section 179 deduction . 12 . Other deductions . 13 . Credits . 14 . Foreign transactions . 15 . Alternative minimum tax (AMT) items. … apps.irs.gov › app › vitaPage 40 of 117 - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

0 Response to "40 qualified dividends and capital gain tax worksheet fillable"

Post a Comment