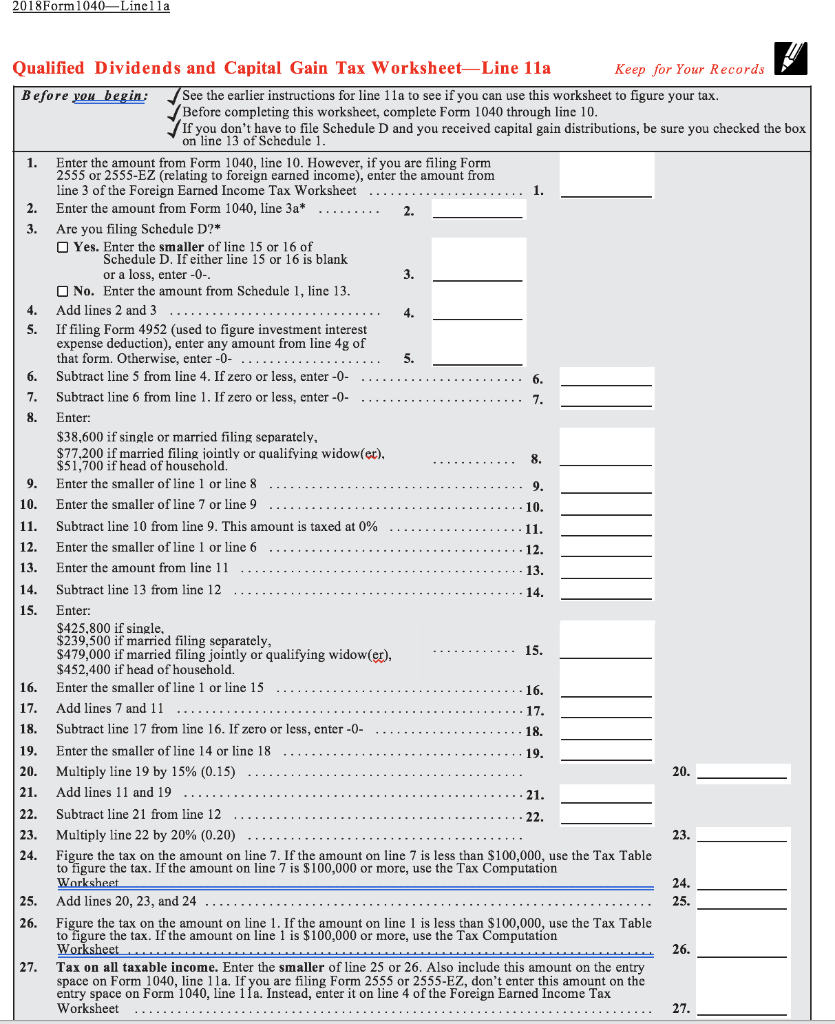

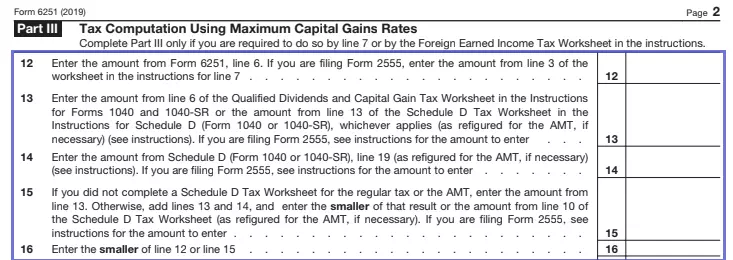

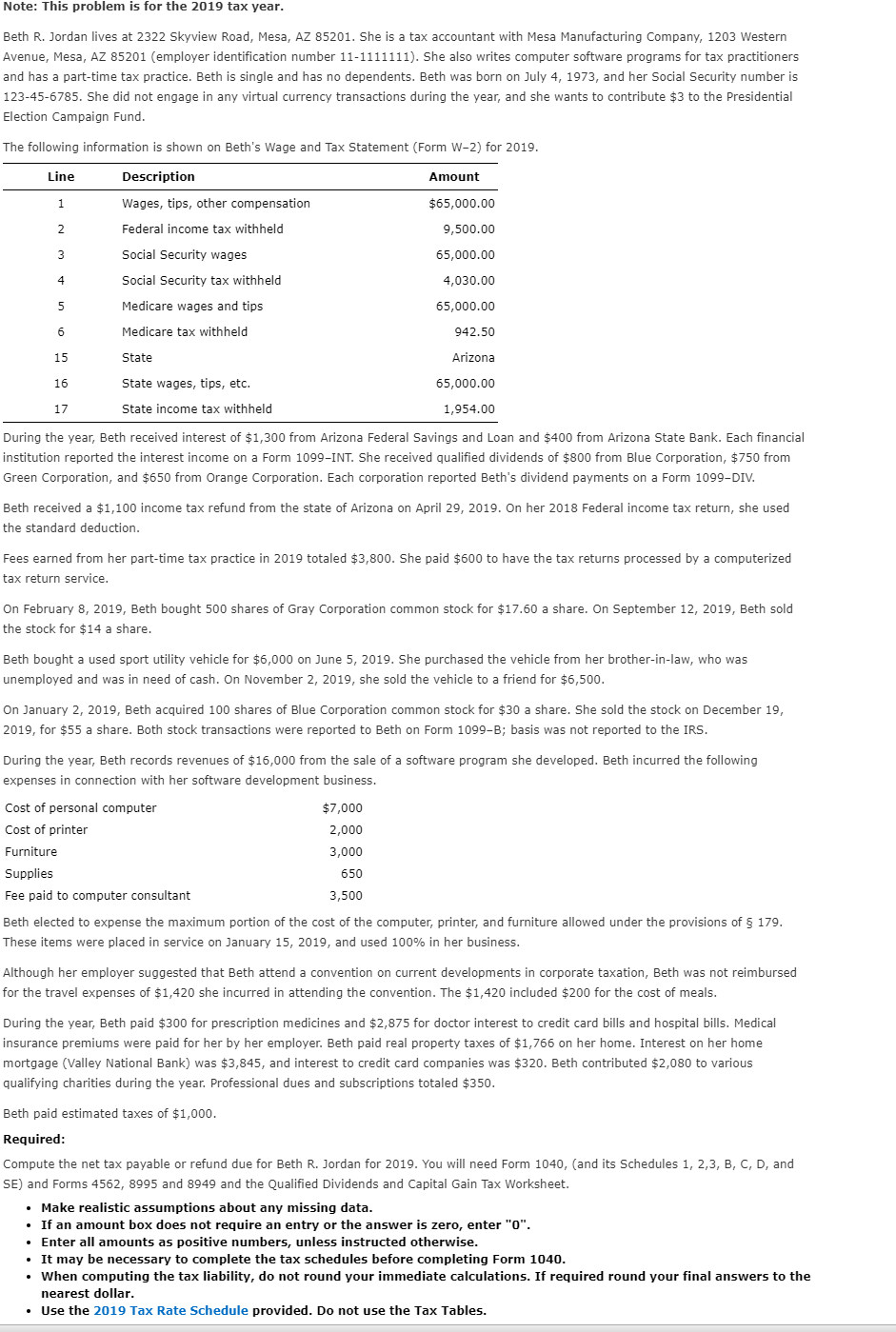

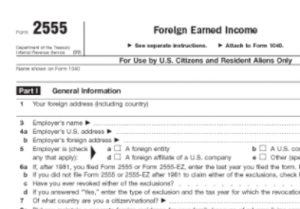

40 foreign earned income tax worksheet

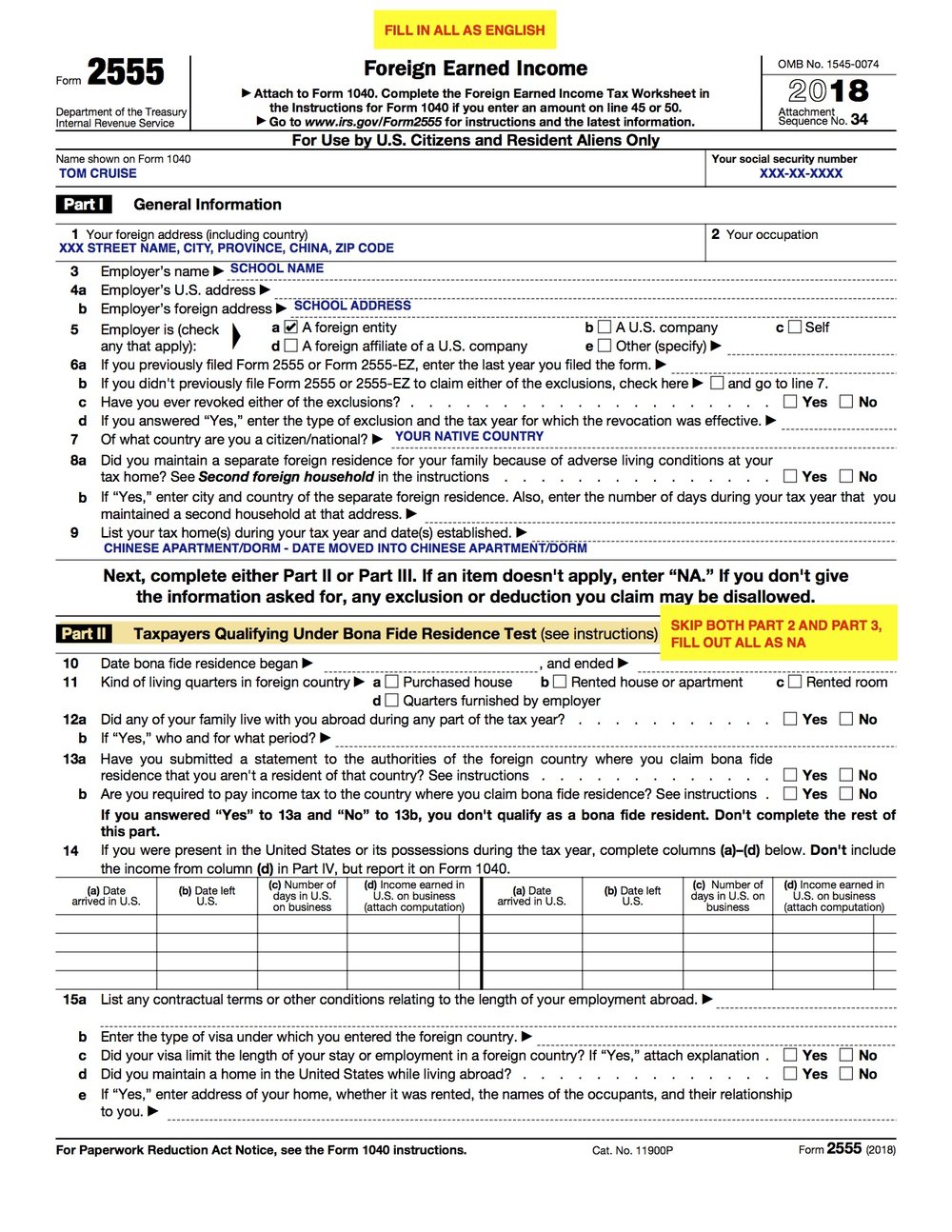

Frequently Asked Questions About International Individual Tax Matters ... The Internal Revenue Service (IRS) has received the following frequently asked questions regarding Expatriation Tax, Reporting of Foreign Financial Accounts, Foreign Earned Income Exclusion, Individual Taxpayer Identification Number (ITIN) Applications, and other general international federal tax matters impacting individual taxpayers.The answers to these … Publication 560 (2021), Retirement Plans for Small Business Common-law employees aren't self-employed and can't set up retirement plans for income from their work, even if that income is self-employment income for social security tax purposes. For example, common-law employees who are ministers, members of religious orders, full-time insurance salespeople, and U.S. citizens employed in the United States by foreign governments …

Publication 514 (2021), Foreign Tax Credit for Individuals If the foreign law taxes foreign earned income and some other income (for example, earned income from U.S. sources or a type of income not subject to U.S. tax), and the taxes on the other income cannot be segregated, the denominator of the fraction is the total amount of income subject to the foreign tax minus deductible expenses allocable to that income.

Foreign earned income tax worksheet

Publication 525 (2021), Taxable and Nontaxable Income If you're a U.S. citizen or resident alien, you must report income from sources outside the United States (foreign income) on your tax return unless it’s exempt by U.S. law. This is true whether you reside inside or outside the United States and whether or not you receive a Form W-2, Wage and Tax Statement, or Form 1099 from the foreign payer. This applies to earned income (such as … Foreign Earned Income Exclusion | Internal Revenue Service - IRS tax … 12/10/2022 · Figuring the tax: If you qualify for and claim the foreign earned income exclusion, the foreign housing exclusion, or both, must figure the tax on your remaining non-excluded income using the tax rates that would have applied had you not claimed the exclusion(s). Use the Foreign Earned Income Tax Worksheet in the Form 1040 Instructions. Publication 501 (2021), Dependents, Standard Deduction ... - IRS tax … Earned income. Earned income includes salaries, wages, professional fees, and other amounts received as pay for work you actually perform. Earned income (only for purposes of filing requirements and the standard deduction) also includes any part of a taxable scholarship. See chapter 1 of Pub. 970 for more information on taxable and nontaxable ...

Foreign earned income tax worksheet. 20 Foreign source income and foreign assets or property 2022 Example 1. Lachlan was employed overseas from 15 October 2021 until 23 April 2022. He did not receive a PAYG payment summary – foreign employment, neither did he receive an income statement showing foreign employment. The income was not exempt income. Lachlan received A$11,250 for his foreign employment after he paid A$3,750 in foreign tax. 1040 (2021) | Internal Revenue Service - IRS tax forms Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments. Line 25 Federal Income Tax Withheld. Line 25a—Form(s) W-2; Line 25b—Form(s) 1099 ; Line 25c—Other Forms; Line 26. 2021 Estimated Tax Payments. … Publication 596 (2021), Earned Income Credit (EIC) - IRS tax forms You can’t file Form 2555 (relating to foreign earned income). 6. Your investment income must be $10,000 or less. 7. You must have earned income. 8. Your child must meet the relationship, age, residency, and joint return tests. 9. Your qualifying child can’t be used by more than one person to claim the EIC. 10. You can’t be a qualifying child of another person. 11. You must meet the age ... Do I Have to Report Income From Foreign Sources? - Investopedia 25/12/2021 · If you are a U.S. citizen or resident alien, your income–unless exempt–is subject to U.S. income tax, including income that is earned outside the U.S.

Publication 501 (2021), Dependents, Standard Deduction ... - IRS tax … Earned income. Earned income includes salaries, wages, professional fees, and other amounts received as pay for work you actually perform. Earned income (only for purposes of filing requirements and the standard deduction) also includes any part of a taxable scholarship. See chapter 1 of Pub. 970 for more information on taxable and nontaxable ... Foreign Earned Income Exclusion | Internal Revenue Service - IRS tax … 12/10/2022 · Figuring the tax: If you qualify for and claim the foreign earned income exclusion, the foreign housing exclusion, or both, must figure the tax on your remaining non-excluded income using the tax rates that would have applied had you not claimed the exclusion(s). Use the Foreign Earned Income Tax Worksheet in the Form 1040 Instructions. Publication 525 (2021), Taxable and Nontaxable Income If you're a U.S. citizen or resident alien, you must report income from sources outside the United States (foreign income) on your tax return unless it’s exempt by U.S. law. This is true whether you reside inside or outside the United States and whether or not you receive a Form W-2, Wage and Tax Statement, or Form 1099 from the foreign payer. This applies to earned income (such as …

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

![[ Offshore Tax ] Today's Thought - What Is Foreign Earned Income Exclusion?](https://i.ytimg.com/vi/gtRwnEyLUrg/maxresdefault.jpg)

0 Response to "40 foreign earned income tax worksheet"

Post a Comment