40 capital gain worksheet 2015

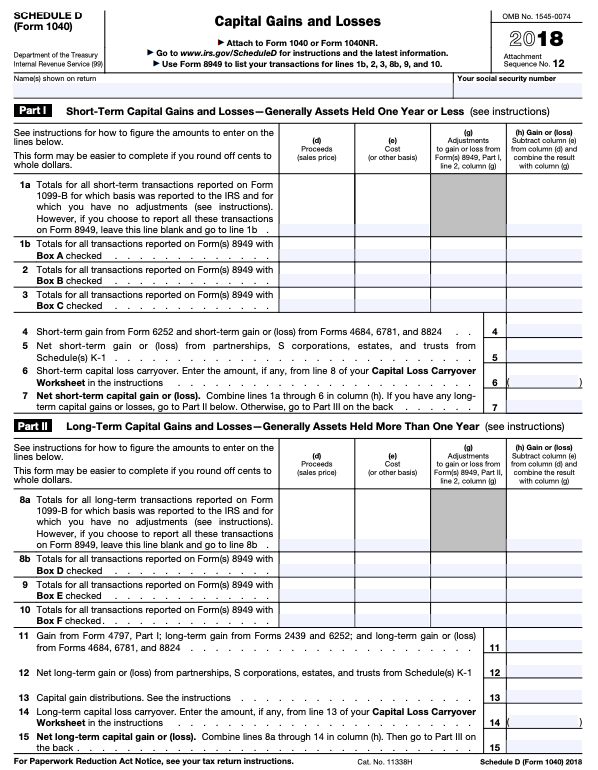

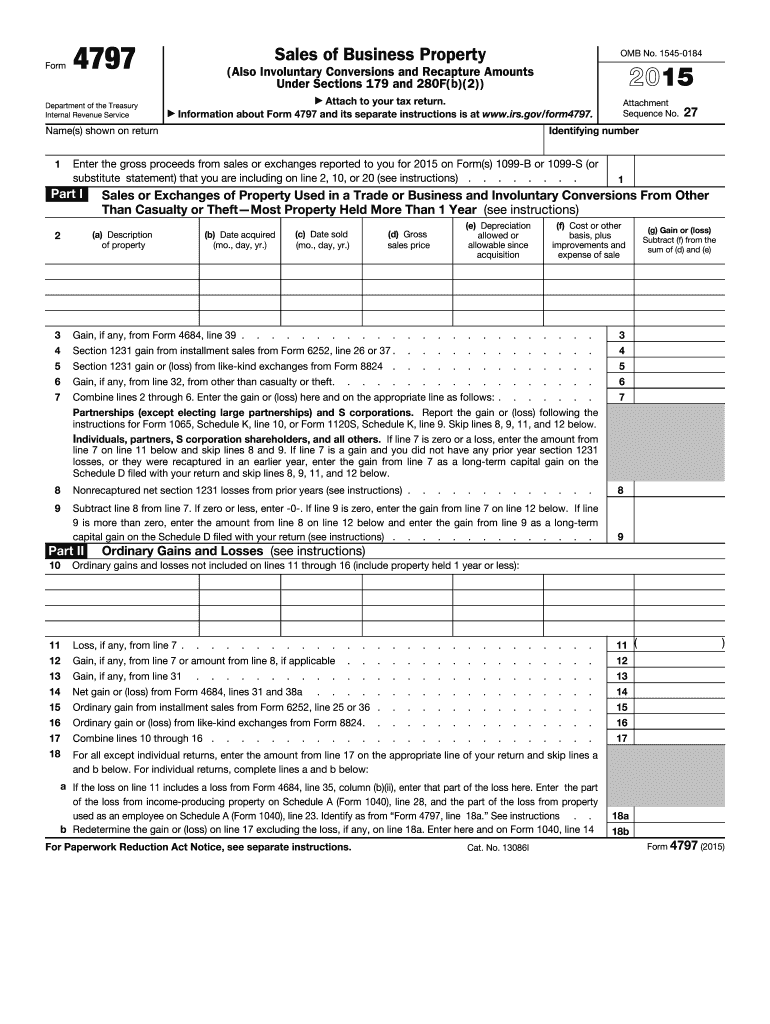

AR1000D 2015 Arkansas long-term capital gain or loss, add (or subtract) Line 1 and ... If Line 7a (Column B or C) is more than $10,000,000, you MUST use the WORKSHEET. 2015 Instructions for Schedule D - Capital Gains and Losses - IRS Dec 28, 2015 ... Rate Gain Worksheet in these instruc- tions if you complete line 18 of Sched- ule D. If you received capital gain distribu-.

Arizona Form 165 Schedule K-1 For the □ calendar year 2015 or □ fiscal year beginning M M D D 2 0 1 5 and ending ... Net Long-Term Capital Gain Subtraction – Information Schedule.

Capital gain worksheet 2015

2020 Instructions for California Schedule D (540NR) | FTB.ca.gov California Capital Gain or Loss Adjustment. ... California Capital Loss Carryover Worksheet For Full-Year Residents; Schedule D (540NR) Worksheet for ... Self Assessment: Capital gains summary (SA108) - GOV.UK Use supplementary pages SA108 to record capital gains and losses on your SA100 Tax Return. CGT SUMMARY WORKSHEET FOR 2015 TAX RETURNS current year capital gains from collectables you need to complete table 9 of this worksheet. PART 1 TOTAL CURRENT YEAR CAPITAL GAINS AND LOSSES.

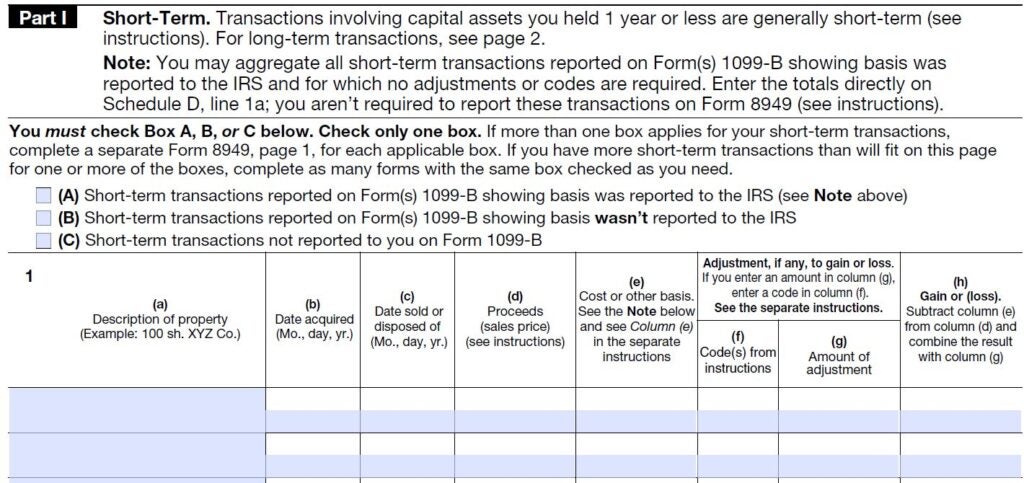

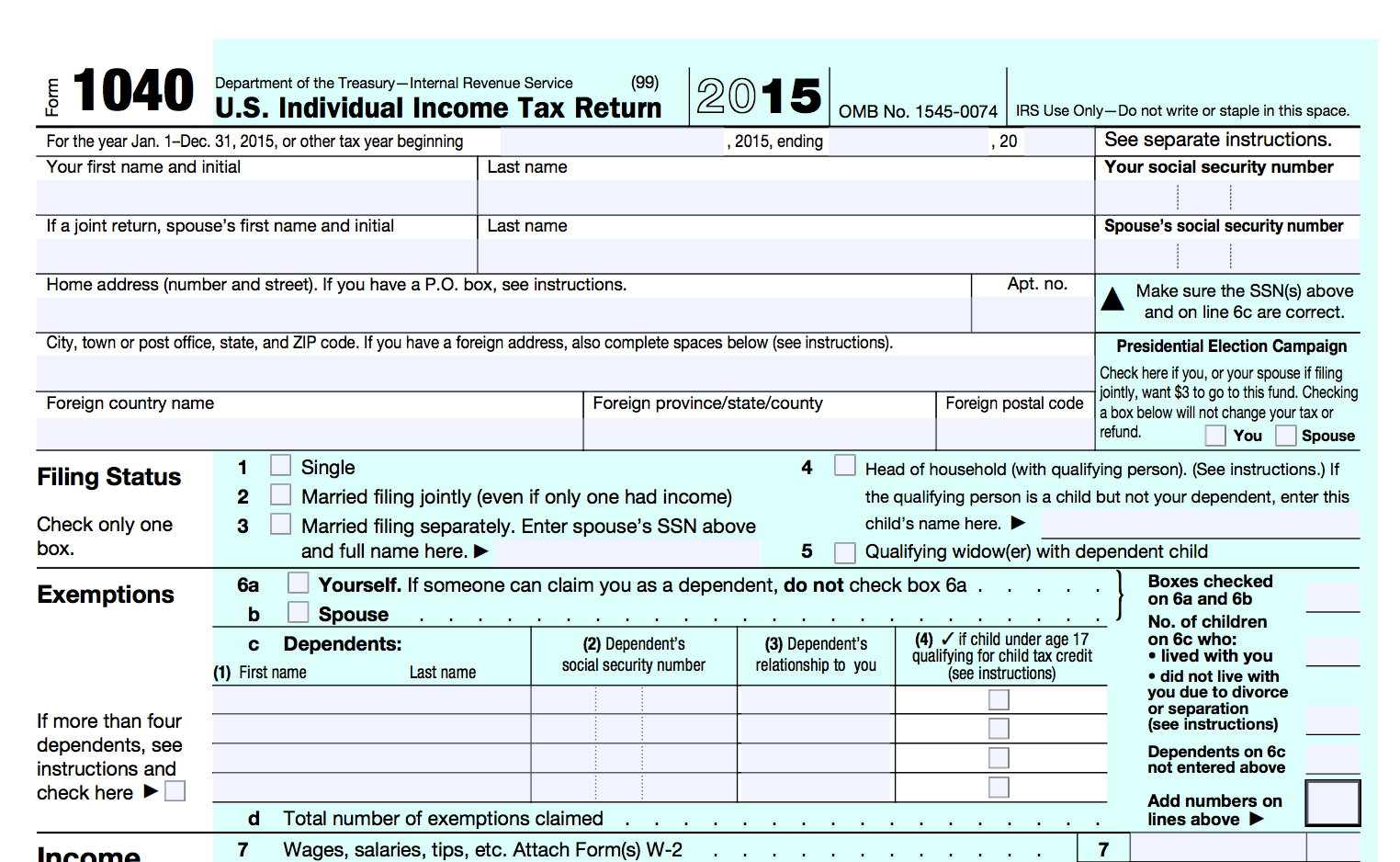

Capital gain worksheet 2015. CAPITAL GAIN OR CAPITAL LOSS WORKSHEET to capital gains tax 2015. 2 Indexation method*. For CGT assets acquired before 11.45am (by legal time in the ACT) on 21 September 1999,. qualified dividends and capital gain tax worksheet 2020 - pdfFiller Easily complete a printable IRS Instruction 1040 Line 44 Form 2015 online. Get ready for this year's Tax Season quickly and safely with pdfFiller! Income and Tax Calculator Capital Gains Show Details ... Short Term Capital Gains (Covered u/s 111A) 15% ... Long Term Capital Gains (Charged to tax @ 20%) 20%. 2015 Form 1040 (Schedule D) - IRS 20. Are lines 18 and 19 both zero or blank? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44 (or ...

CGT SUMMARY WORKSHEET FOR 2015 TAX RETURNS current year capital gains from collectables you need to complete table 9 of this worksheet. PART 1 TOTAL CURRENT YEAR CAPITAL GAINS AND LOSSES. Self Assessment: Capital gains summary (SA108) - GOV.UK Use supplementary pages SA108 to record capital gains and losses on your SA100 Tax Return. 2020 Instructions for California Schedule D (540NR) | FTB.ca.gov California Capital Gain or Loss Adjustment. ... California Capital Loss Carryover Worksheet For Full-Year Residents; Schedule D (540NR) Worksheet for ...

0 Response to "40 capital gain worksheet 2015"

Post a Comment