39 form 1023 ez eligibility worksheet

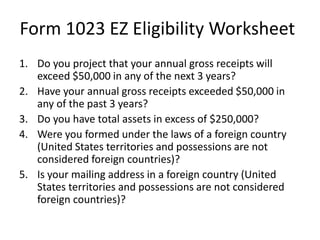

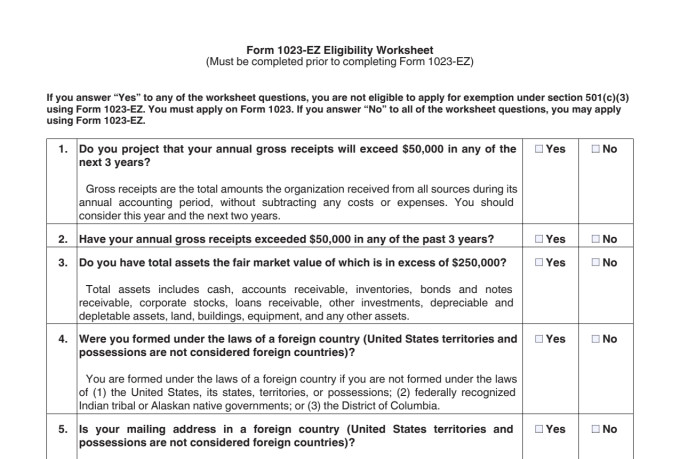

Form 1023-EZ (1023EZ) Application for 501c3 Pros & Cons Where can I find the form 1023 EZ eligibility worksheet? You can find the Form 1023 EZ eligibility worksheet from here. Conclusion. I could go on and on, but the honest verdict on the form 1023 EZ is that the only honest organizations that could possibly benefit from this short exemption application form are the very, very, very, small animal ... Instructions for Form 1023-EZ (01/2018) | Internal Revenue ... Dec 20, 2019 · To determine if you are eligible to file Form 1023-EZ, you must complete the Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ.

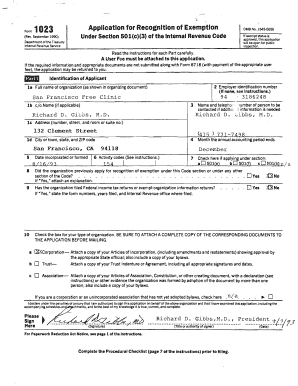

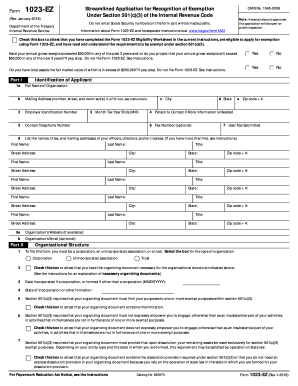

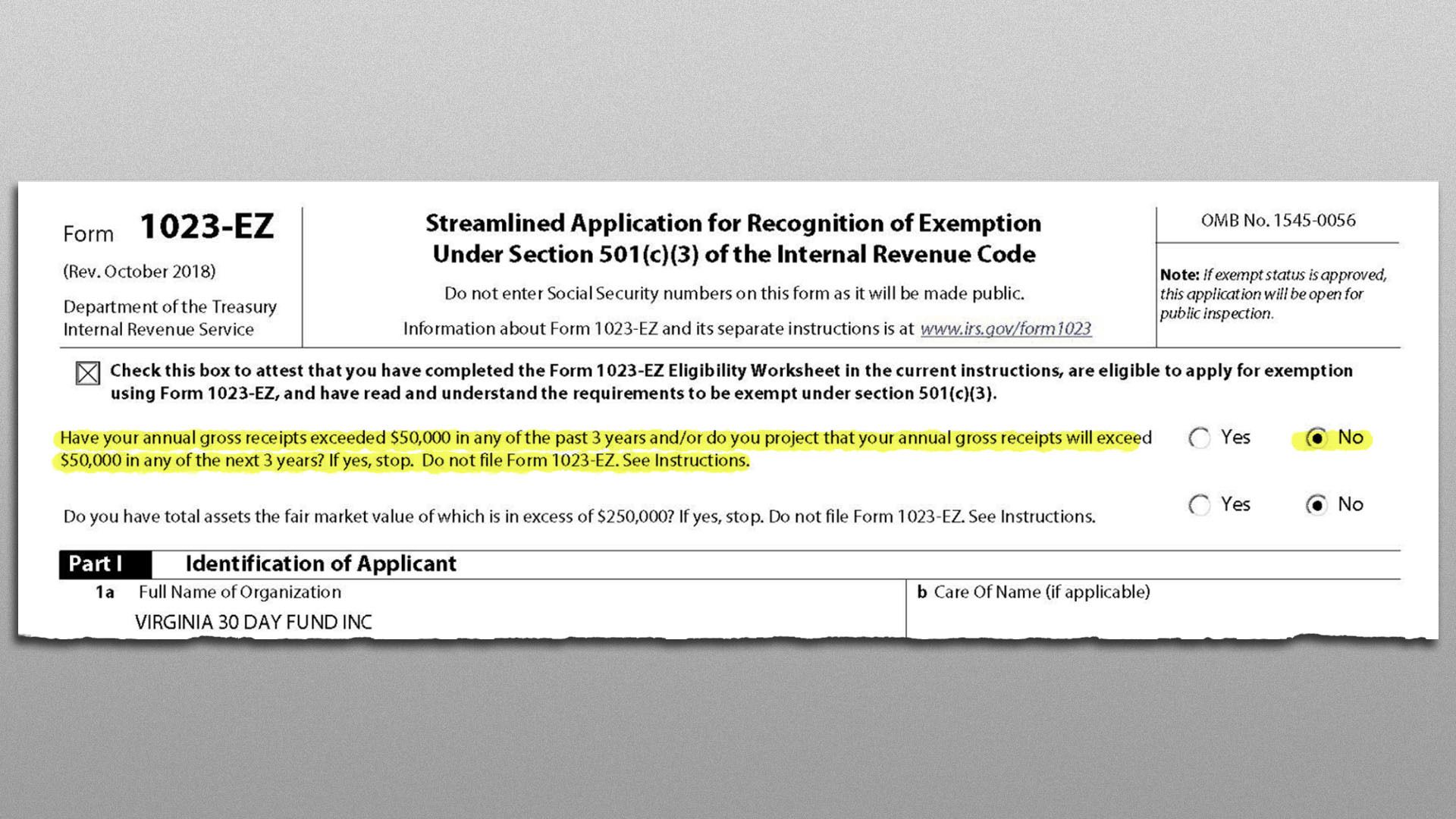

Form OMB No. 1545-0056 Under Section 501(c)(3) of the ... Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3). Part I Identification of Applicant 1a Full Name of Organization

Form 1023 ez eligibility worksheet

Instructions for Form 1023-EZ (Rev. January 2018) - IRS tax forms Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ. About Form 1023-EZ, Streamlined Application for Recognition ... To submit Form 1023-EZ, you must: Read the Instructions for Form 1023-EZ and complete its Eligibility Worksheet found at the end of the instructions. (If you are not eligible to file Form 1023-EZ, you can still file Form 1023.) If eligible to file Form 1023-EZ, register for an account on Pay.gov. Enter "1023-EZ" in the search box. Complete the ... Form 1023 Ez - Fill Out and Sign Printable PDF Template | signNow Have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3). Part I 1a Identification of Applicant Full Name of Organization b Mailing Address (number, street, and room/suite).

Form 1023 ez eligibility worksheet. Instructions for Form 1023 (01/2020) | Internal Revenue Service Unless an exception applies, an organization must file Form 1023 or Form 1023-EZ (if eligible) to obtain recognition of exemption from federal income tax under section 501(c)(3). You can find information about eligibility to file Form 1023-EZ at IRS.gov/Charities. Form 1023 Ez - Fill Out and Sign Printable PDF Template | signNow Have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3). Part I 1a Identification of Applicant Full Name of Organization b Mailing Address (number, street, and room/suite). About Form 1023-EZ, Streamlined Application for Recognition ... To submit Form 1023-EZ, you must: Read the Instructions for Form 1023-EZ and complete its Eligibility Worksheet found at the end of the instructions. (If you are not eligible to file Form 1023-EZ, you can still file Form 1023.) If eligible to file Form 1023-EZ, register for an account on Pay.gov. Enter "1023-EZ" in the search box. Complete the ... Instructions for Form 1023-EZ (Rev. January 2018) - IRS tax forms Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ.

0 Response to "39 form 1023 ez eligibility worksheet"

Post a Comment