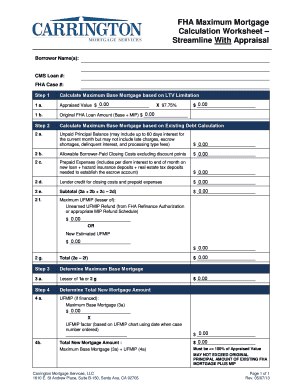

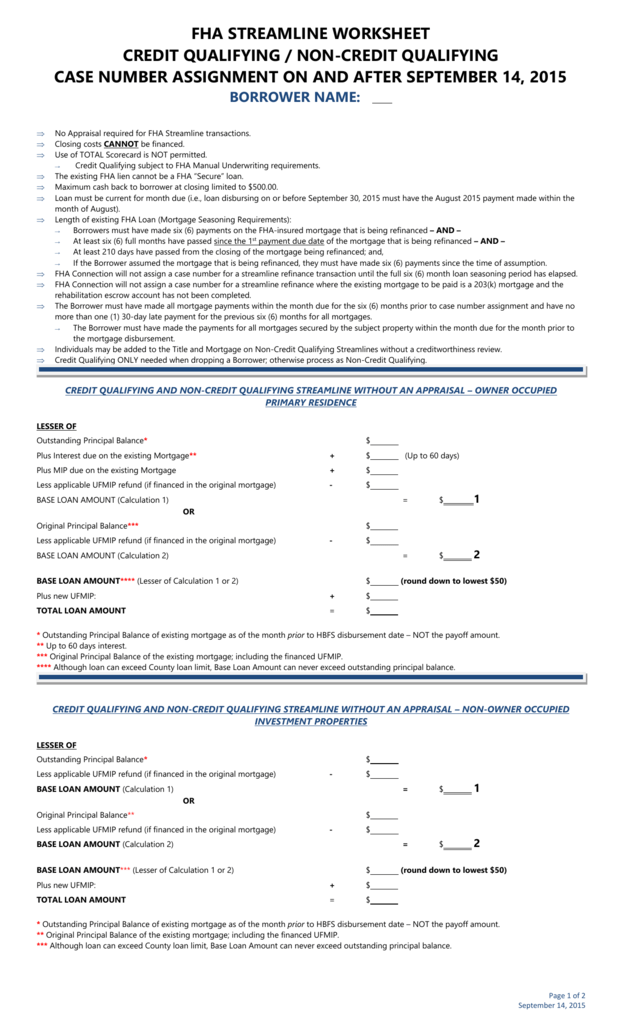

39 fha streamline with appraisal worksheet

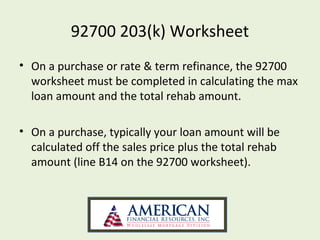

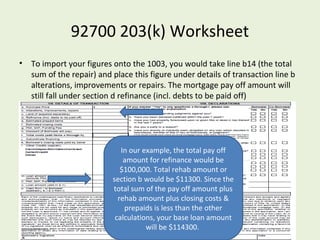

mymortgageinsider.com › fha-streamline-203k-rehab-loanFHA 203k Loans: How Does It Work? | Requirements 2022 If the appraisal states the home will only be worth $105,000 after all repairs are done, the maximum loan amount is based on 110% of the future appraised value: The HUD-92700 “203k Worksheet” As part of the 203k process, you will need to sign the FHA 203k Worksheet, also called the HUD-92700. This form is a breakdown of all loan costs, 203k ... Streamline Refinance Your Mortgage | HUD.gov / U.S. Streamline refinance refers to the refinance of an existing FHA-insured mortgage requiring limited borrower credit documentation and underwriting. Streamline refinances are available under credit qualifying and non-credit qualifying options. "Streamline refinance" refers only to the amount of documentation and underwriting that the lender must perform, and does not mean that there …

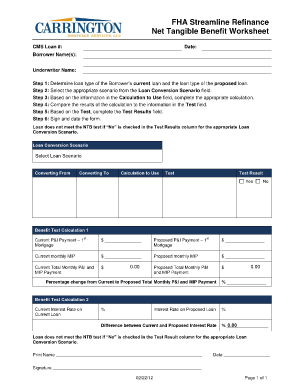

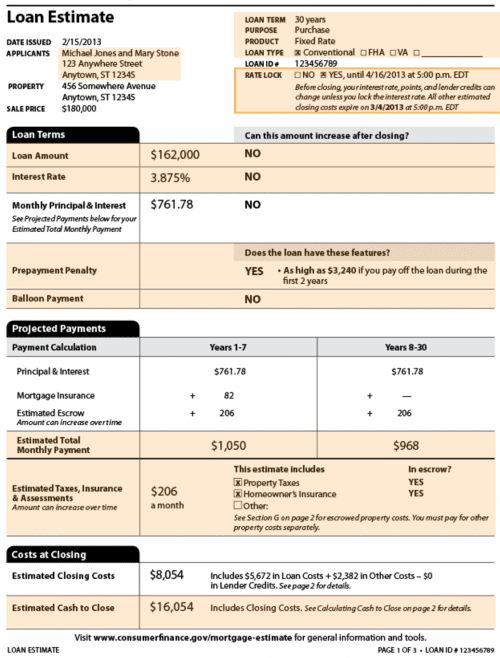

› learn › tangible-net-benefitsWhat Is A Tangible Net Benefit? | Rocket Mortgage Aug 22, 2022 · FHA Streamline refinances come with lower mortgage insurance rates. When you do an FHA streamline, your existing FHA loan is paid off and you move forward under a new mortgage with a different term. To have the term reduced on an FHA Streamline, three things have to occur: The term needs to be at least 3 years shorter than the previous one.

Fha streamline with appraisal worksheet

Access Denied - LiveJournal Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu. › housing › sfhStreamline Refinance Your Mortgage | HUD.gov / U.S ... U.S. Department of Housing and Urban Development. U.S. Department of Housing and Urban Development 451 7th Street, S.W., Washington, DC 20410 T: 202-708-1112 › correspondent › resourcesResource Center | CMG Financial 04-01-20 CMG Bulletin 2020-19 VVOE Clarifications- GSE Investor Designation Appraisal Flexibility-Fanne and Freddie UW guidelines COVID-19: 03-31-20 CMG Bulletin 2020-18 FHA Re-verification of Employment- FHA Exterior-Only and Desktop-Only COVID-19

Fha streamline with appraisal worksheet. › learn › loan-modificationLoan Modification Vs. Refinance | Rocket Mortgage Sep 16, 2022 · It might be beneficial to refinance to a new loan type if you have more than 20% equity in your home. For example, if you have an FHA loan, you’ll pay for mortgage insurance throughout the life of the loan if you put less than 10% down. However, you can cancel private mortgage insurance on a conventional loan as soon as you reach 20% equity. › fha_refinanceFHA Refinance With a Cash-out Option in 2022 To be eligible for an FHA cash-out refinance, borrowers will need at least 20 percent equity in the property based on a new appraisal. Equity is the difference between the current value of a property and the amount owed on the mortgage. In the following example, a borrower obtained an FHA loan of $275,000 to purchase a home. News and Insights | Nasdaq 07.10.2022 · Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more › mortgage-learningMortgage Learning Center - Zillow FHA Loan Limits. See all → Mortgage Learning Center. Featured. Earnest Money vs Down Payment: Is Earnest Money Part of the Down Payment?

› correspondent › resourcesResource Center | CMG Financial 04-01-20 CMG Bulletin 2020-19 VVOE Clarifications- GSE Investor Designation Appraisal Flexibility-Fanne and Freddie UW guidelines COVID-19: 03-31-20 CMG Bulletin 2020-18 FHA Re-verification of Employment- FHA Exterior-Only and Desktop-Only COVID-19 › housing › sfhStreamline Refinance Your Mortgage | HUD.gov / U.S ... U.S. Department of Housing and Urban Development. U.S. Department of Housing and Urban Development 451 7th Street, S.W., Washington, DC 20410 T: 202-708-1112 Access Denied - LiveJournal Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu.

0 Response to "39 fha streamline with appraisal worksheet"

Post a Comment