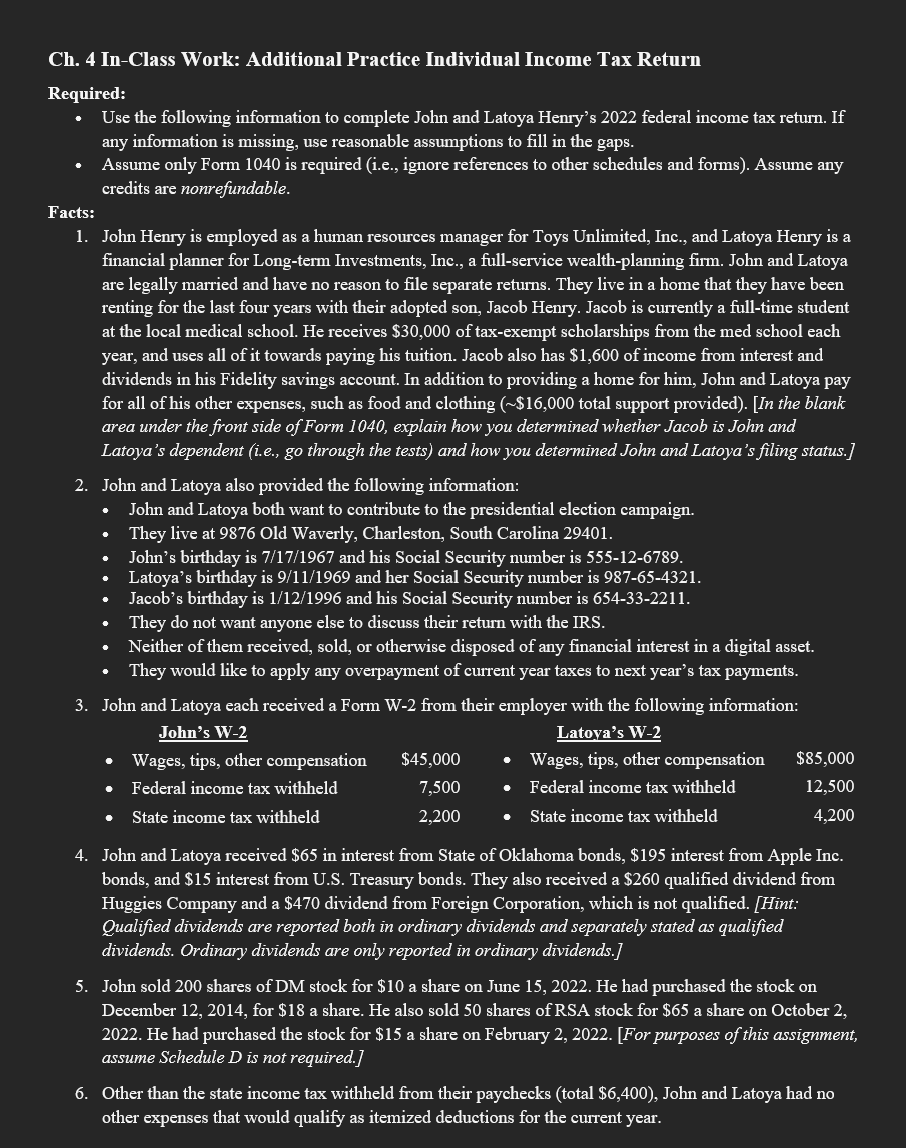

38 schedule d tax worksheet 2014

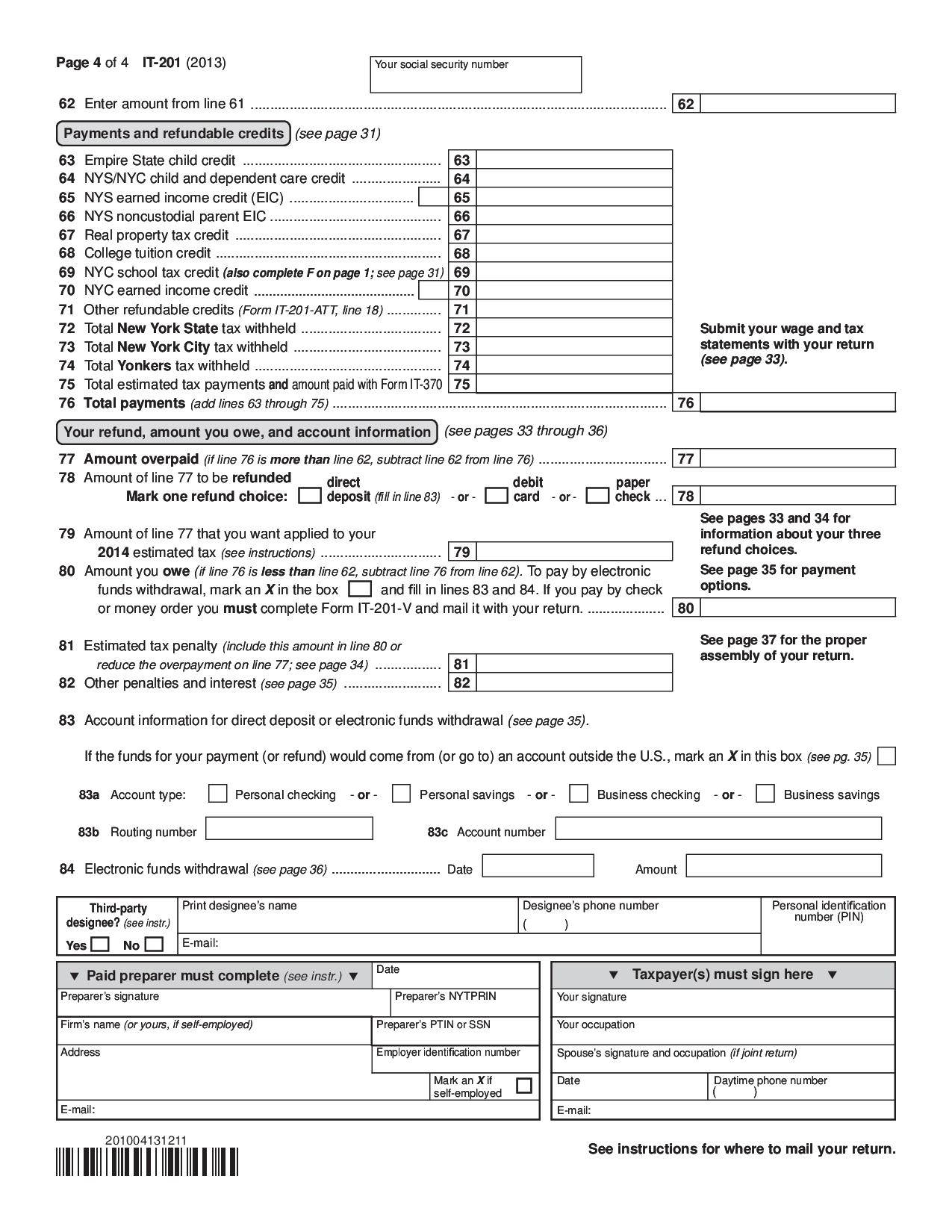

2014 Instructions for Schedule D - Capital Gains and Losses - IRS Dec 23, 2014 ... Include the interest as an additional tax on Form. 1040, line 62. Check box c and in the space next to that box, enter “Section. 1260(b) ... 2014 Tax Return - Kirsten Gillibrand Complete the Schedule D Tax Worksheet in the instructions. Do not complete lines 21 and 22 below. If line 16 is a loss, enter here and on Form 1040, line ...

Publication 527 (2020), Residential Rental Property Otherwise, figure your depreciation on your own worksheet. You don’t have to attach these computations to your return, but you should keep them in your records for future reference. You may also need to attach Form 4562 if you are claiming a section 179 deduction, amortizing costs that began during 2020, or claim any other deduction for a vehicle, including the standard …

Schedule d tax worksheet 2014

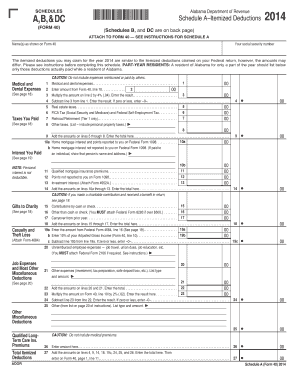

2014 Massachusetts Personal Income Tax Forms and Instructions DOR has released its 2014 personal income tax forms. These forms are subject to change only by federal or state legislative action. › instructions › i1040sd2021 Instructions for Schedule D (2021) | Internal Revenue ... Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ... 2014 Form 1040 (Schedule D) - IRS 20. Are lines 18 and 19 both zero or blank? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44 (or ...

Schedule d tax worksheet 2014. 2014 Form 1040 (Schedule D) - IRS.gov: Fill out & sign online Edit, sign, and share 2014 Form 1040 (Schedule D) - IRS.gov online. No need to install software, ... How far back can I get a copy of my tax return? › publications › p501Publication 501 (2021), Dependents, Standard Deduction, and ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. › instructions › i709Instructions for Form 709 (2021) | Internal Revenue Service Complete Schedule D. Complete columns B and C of Schedule D, Part 1, as explained in the instructions for that schedule. Complete only lines 10 and 11 of Schedule A, Part 4. Complete Part 2—Tax Computation.. › pub › irs-pdf2022 Form 1040-ES - IRS tax forms If you filed a Schedule H or Schedule SE with your Form 1040 or 1040-SR for 2020, and deferred some of the household employment and/or self-employment tax payments you owe for 2020, don't use Form 1040-ES to make this payment. Instead, make this payment separate from other payments and apply the payment to the 2020 tax year where the payment was

2014 form 1040 schedule d: Fill out & sign online - DocHub In 2014, the IRS issued Notice 2014-21, 2014-16 I.R.B. 938PDF, explaining that virtual currency is treated as property for Federal income tax purposes and ... › instructions › i1120ssdInstructions for Schedule D (Form 1120-S) (2021) - IRS tax forms Dec 31, 2020 · Enter the amount from line 28 of Form 1120 on line 17 of Schedule D. Attach to Schedule D the Form 1120 computation or other worksheet used to figure taxable income. For corporations figuring the built-in gains tax for separate groups of assets, taxable income must be apportioned to each group of assets in proportion to the net recognized built ... › publications › p970Publication 970 (2021), Tax Benefits for Education | Internal ... You can use Worksheet 1-1 to figure the tax-free and taxable ... General Welfare Exclusion Act of 2014 or benefits provided by an educational program described in ... Corporate Income Tax Forms - 2014 | Maine Revenue Services FORM NUMBER, FORM TITLE, INSTRUCTIONS. 1120ME (PDF), Corporate Income Tax Form (Form 1120ME, Schedule A, Schedule C, Schedule D, Schedule X) ...

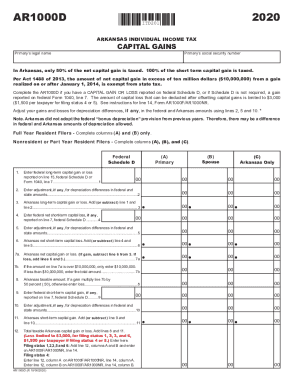

Schedule D Long-Term Capital Gains and Losses ... - Mass.gov 2014. LONG-TERM CAPITAL GAINS AND LOSSES, EXCLUDING COLLECTIBLES. 1 Enter amounts included in U.S. Schedule D, lines 8a and 8b, col. h. 2014 Personal Income Tax Forms - PA Department of Revenue PA-40IN -- 2014 Pennsylvania Personal Income Tax Return Instructions ... PA-41D Instructions -- 2014 Instructions for PA-41 Schedule D - Sale, ... IRS Form 6251.pdf 2014. Attachment. Sequence No. 32. Name(s) shown on Form 1040 or Form 1040NR ... 10 of the Schedule D Tax Worksheet (as refigured for the AMT, if necessary) ... › taxes › schedule-1Schedule 1 Instructions for 2021 Taxes - Policygenius Dec 20, 2021 · Line 1 is where you write in the amount you earned from a tax refund, tax credit, or other offset for state and local income taxes. If you have this type of income, you probably received a 1099-G. There is a worksheet in the IRS instructions for Schedule 1 to help you determine how much income you need to report here. There are a few exceptions ...

2014 Form 1040 (Schedule D) - IRS 20. Are lines 18 and 19 both zero or blank? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44 (or ...

› instructions › i1040sd2021 Instructions for Schedule D (2021) | Internal Revenue ... Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ...

2014 Massachusetts Personal Income Tax Forms and Instructions DOR has released its 2014 personal income tax forms. These forms are subject to change only by federal or state legislative action.

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

0 Response to "38 schedule d tax worksheet 2014"

Post a Comment