38 clergy housing allowance worksheet

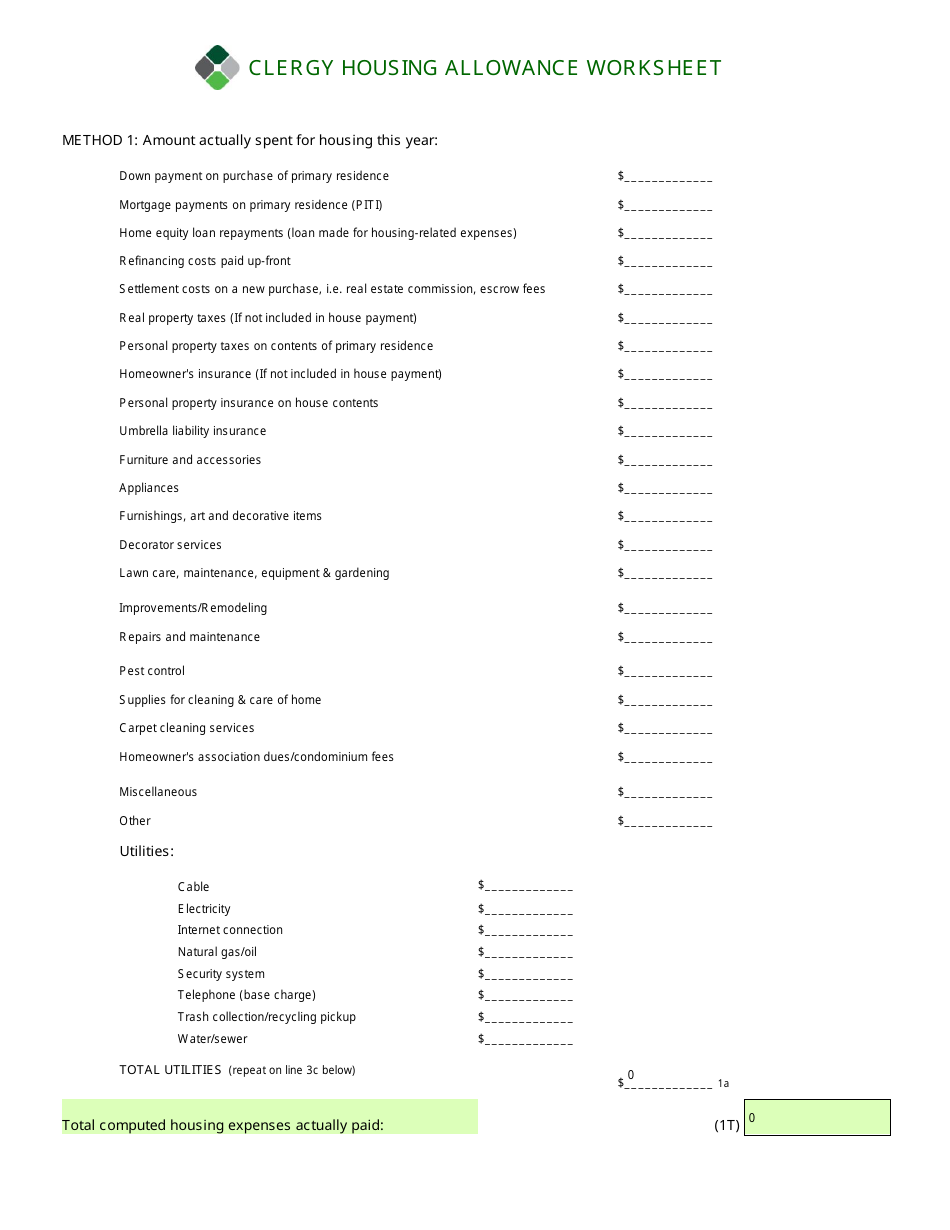

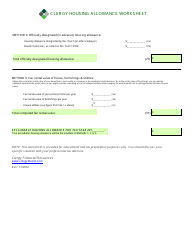

Housing Allowance for Pastors - Clergy Housing Allowance | MMBB How It Works Example: If a clergy's annual compensation is $65,000, and their church has designated a housing allowance of $15,000, they subtract that from their salary, bringing their taxable income for federal income tax purposes to $50,000. They must pay Social Security/Medicare tax on the entire compensation of $65,000. PDF Clergy Housing Allowance Worksheet EXCLUDABLE HOUSING ALLOWANCE FOR TAX YEAR 201_____: Your excludable housing allowance will be the smallest of Methods 1, 2 or 3. NOTE: This worksheet is provided for educational and tax preparation purposes only. You should discuss your specific situation with your professional tax advisors. Clergy Financial Resources

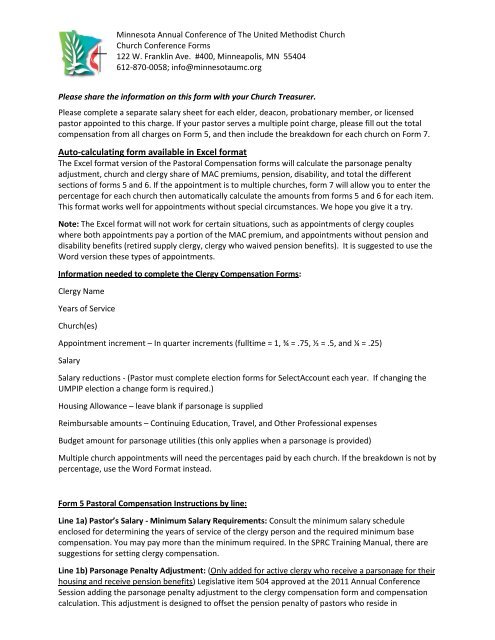

Charge Conference Forms 2022-2023 - The California-Pacific … App D GCFA Clergy Tax Packet (external link) App E Housing Allowance Resolution Samples and Q&As (PDF) App F 2023 Medical, Dental, and Vision Rates (PDF) App G Salary & Benefits Worksheet for clergy in ONE charge (.xlsx) App H Salary & Benefits Worksheet for clergy in TWO charges (.xlsx) App I Salary & Benefits Worksheet for Lay Persons ...

Clergy housing allowance worksheet

PDF Housing Exclusion Worksheet - Evangelical Council for Financial ... Housing Exclusion Worksheet. Minister Living in Housing. Owned by or Rented by the Church. Minister's name: _____ For the period _____, 20___ to _____, 20____ ... Properly designated housing allowance $ _____(B) The amount excludable from income for federal income tax purposes is the lower of A or B (or reasonable compensation). Title: Housing Allowance Worksheet - bopumc.org Complete the worksheet below in order to determine the amount that you may exclude from you gross income. For a printable version, click here. Assuming there is sufficient documentation, the amount indicated on line 4 is the amount that may be excluded from gross income as a housing allowance pursuant to the provisions of Section 107 of the Code. Publication 517 (2021), Social Security and Other Information for ... If the church or organization doesn't officially designate a definite amount as a housing allowance, you must include your total salary in your income. ... See Employment status for other tax purposes under Coverage of Members of the Clergy, earlier. ... Utility allowance (from Worksheet 1, line 3b or 4b) ...

Clergy housing allowance worksheet. Clergy Housing Allowance Worksheet - cchwebsites.com Clergy Housing Allowance Categories Definitions If active Amount of Housing allowance officially designated in advance in conjunction with your congregation or church organization If retired Amount of Pension and/or distributions directly from your Church plans Annual Rental value of primary home Total value to rent your home per year. Ministers' Compensation & Housing Allowance - IRS tax forms Sep 06, 2022 · For more information on a minister’s housing allowance, refer to Publication 517, Social Security and Other Information for Members of the Clergy and Religious Workers. For information on earnings for clergy and reporting of self-employment tax, refer to Tax Topic 417, Earnings for Clergy. PDF Housing Expenses Worksheet - Reform Pension Board Retired clergy can have eligible distributions from their 403(b) and Rabbi Trust accounts designated as a . housing allowance and potentially excluded from gross income for federal income tax purposes. RPB will designate 100 percent of your distribution income as your potential housing allowance, but this does Get Clergy Housing Allowance Worksheet 2010-2022 - US Legal Forms The tips below will allow you to fill out Clergy Housing Allowance Worksheet quickly and easily: Open the form in our feature-rich online editing tool by clicking on Get form. Complete the required fields that are marked in yellow. Hit the arrow with the inscription Next to jump from one field to another.

How Do You Report Your Clergy Housing Allowance To The IRS? Sep 13, 2021 · This is an excerpt from my book, The Pastor’s Wallet Complete Guide to the Clergy Housing Allowance: The church is not required to report the housing allowance to the IRS. Unless a church includes it in an informational section on Form W-2, the IRS and the Social Security Administration (SSA) are only made aware of the housing allowance when a minister … Lifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing Clergy Compensation Calculator | Treasurer's Office This calculator is intended only for the purpose of performing the mathematical functions of the 2023 Clergy Compensation Worksheet. Data entered here does not feed into any other reporting process. All clergy serving a local church appointment must complete the Clergy Compensation Worksheet on the Online Data Collection System each year at ... PDF MINISTER'S HOUSING EXPENSES WORKSHEET - AGFinancial taxable income an amount of their pay that is designated as housing allowance pursuant to official action taken by the employing church or other qualified organization before the payment is made. The following description is intended to provide guidelines under which a minister may declare housing on retirement account disbursements:

IRS tax forms IRS tax forms Get Your Free Downloadable 2019 Minister Housing Allowance Worksheet ... Downloadable .PDF Document 2019 Minister Housing Allowance Worksheet Download If you just want a real piece of paper to write on, click the download button above and print out the document. It includes spaces for the most common housing expenses and several open spaces for your own unique expenses. Downloadable Excel Spreadsheet PDF Housing Allowance Exclusion Worksheet - Wespath Benefits and Investments This worksheet is designed to help a clergyperson determine the amount that he or she may exclude from gross income . pursuant to the provisions of Section 107 of the Internal Revenue Code (Code). Those provisions provide that "a minister of . the gospel" may exclude a "housing allowance" from his or her gross income. Ministers' Compensation & Housing Allowance - IRS tax forms The payments officially designated as a housing allowance must be used in the year received. Include any amount of the allowance that you can't exclude as wages on line 1 of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. Enter "Excess allowance" and the amount on the dotted line next to line 1.

Supported Forms Online | H&R Block Other State Tax Credit: Other State Tax Credit Worksheet De Minimis Safe Harbor: De Minimis Safe Harbor Small Taxpayer Safe Harbor: Small Taxpayer Safe Harbor. Clergy Worksheet 1: Clergy Worksheet 1. Clergy Worksheet 2: Clergy Worksheet 2. Clergy Worksheet 3: Clergy Worksheet 3. Clergy Worksheet 4: Clergy Worksheet 4

PDF MMBB's Housing Allowance Worksheet Example Remember the tax code limits the nontaxable portion of housing compensation designated as. housing allowance for ministers who own their home to the fair rental value of the home (furnished, plus utilities). Ministers who own their homes should take the following expenses into account in. computing their housing allowance exclusion.

PDF CLERGY HOUSING ALLOWANCE WORKSHEET - Indiana-Kentucky Synod CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____ NOTE: This worksheet is provided for educational purposes only. You should discuss your specific situation with your professional advisors, including the individual who assists with preparation of your final tax return. METHOD 1: Amount actually spent for housing this year:

Housing Allowance For Pastors Worksheet 35 Pastor's Housing Allowance Worksheet Worksheet Source from dontyou79534.blogspot.com. Clergy housing allowance worksheet tax return for year 200____ note: Those provisions provide that "a minister of the gospel" may exclude a "housing. Include any amount of the allowance that you can't exclude as wages on line 1 of form 1040, u.s.

PDF Church Benefits Home - CBF Church Benefits Church Benefits Home - CBF Church Benefits

Housing Allowance Worksheet - Fill Out and Sign Printable PDF Template ... Follow the step-by-step instructions below to design your pastors housing allowance worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

PDF 2021 Minister's Housing Allowance Worksheet - MinistryCPA between taxable and tax-free (i.e., excluded) ministerial income. (Sources: IRS Publication 1828; Clergy Housing Allowance Clarification Act of 2002; IRS Regulation Section 1.107-1). MinistryCPA Corey A. Pfaffe, CPA, LLC 302 N. 3rd Street, Suite 107, Watertown, WI 53094 ... Minister's Housing Allowance Worksheet. Yes. No. D . D .

Interest, Dividends, Other Types of Income | Internal Revenue … The payments officially designated as a housing allowance must be used in the year received. Include any amount of the allowance that you can't exclude as wages on line 1 of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. Enter “Excess allowance” and the amount on the dotted line next to line 1.

2022 Housing Allowance Form - Clergy Financial Resources The Regulations require that the housing allowance be designated pursuant to official action taken in advance of such payment by the employing church or other qualified organization. ... Clergy Financial Resources also offers Pro Advisor support for your housing and other tax questions. This support service is available at a flat rate of $75.00 ...

Housing Allowance Worksheet - The Anglican Diocese South Carolina The Anglican Diocese of South Carolina. Post Office Box 20127, Charleston SC 29413. Diocesan House: 126 Coming Street, Charleston SC 29403. Telephone: (843) 722 - 4075 | E-Mail: jhunter@adosc.org

Ministers' Compensation & Housing Allowance - IRS tax forms The payments officially designated as a housing allowance must be used in the year received. Include any amount of the allowance that you can't exclude as wages on line 1 of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. Enter "Excess allowance" and the amount on the dotted line next to line 1.

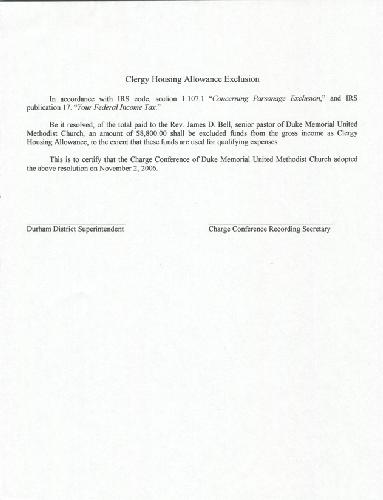

Clergy Housing Allowance - The Anglican Diocese South Carolina Once your housing allowance is calculated, use one of these sample resolutions that must be passed by your vestry BEFORE taking the exclusion. The housing allowance exclusion is not retroactive. If you have specific questions, please contact Nancy Armstrong in the Diocesan office, 843-722-4075, or contact your tax accountant.

Publication 525 (2021), Taxable and Nontaxable Income The home or allowance must be provided as compensation for your services as an ordained, licensed, or commissioned minister. However, you must include the rental value of the home or the housing allowance as earnings from self-employment on Schedule SE (Form 1040) if you’re subject to the self-employment tax. For more information, see Pub. 517.

Publication 517 (2021), Social Security and Other Information for ... If the church or organization doesn't officially designate a definite amount as a housing allowance, you must include your total salary in your income. ... See Employment status for other tax purposes under Coverage of Members of the Clergy, earlier. ... Utility allowance (from Worksheet 1, line 3b or 4b) ...

Housing Allowance Worksheet - bopumc.org Complete the worksheet below in order to determine the amount that you may exclude from you gross income. For a printable version, click here. Assuming there is sufficient documentation, the amount indicated on line 4 is the amount that may be excluded from gross income as a housing allowance pursuant to the provisions of Section 107 of the Code.

PDF Housing Exclusion Worksheet - Evangelical Council for Financial ... Housing Exclusion Worksheet. Minister Living in Housing. Owned by or Rented by the Church. Minister's name: _____ For the period _____, 20___ to _____, 20____ ... Properly designated housing allowance $ _____(B) The amount excludable from income for federal income tax purposes is the lower of A or B (or reasonable compensation). Title:

0 Response to "38 clergy housing allowance worksheet"

Post a Comment