45 sale of rental property worksheet

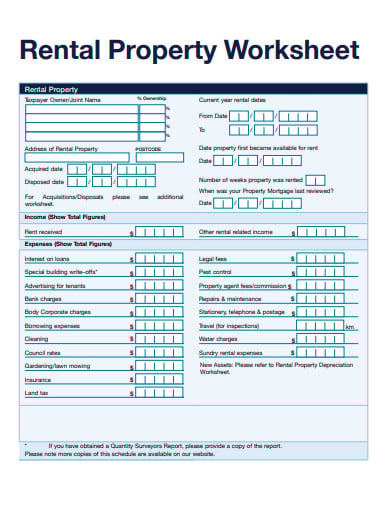

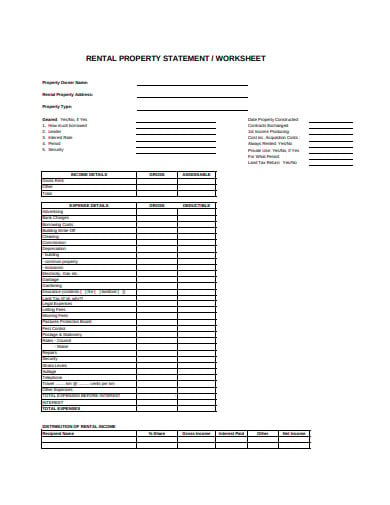

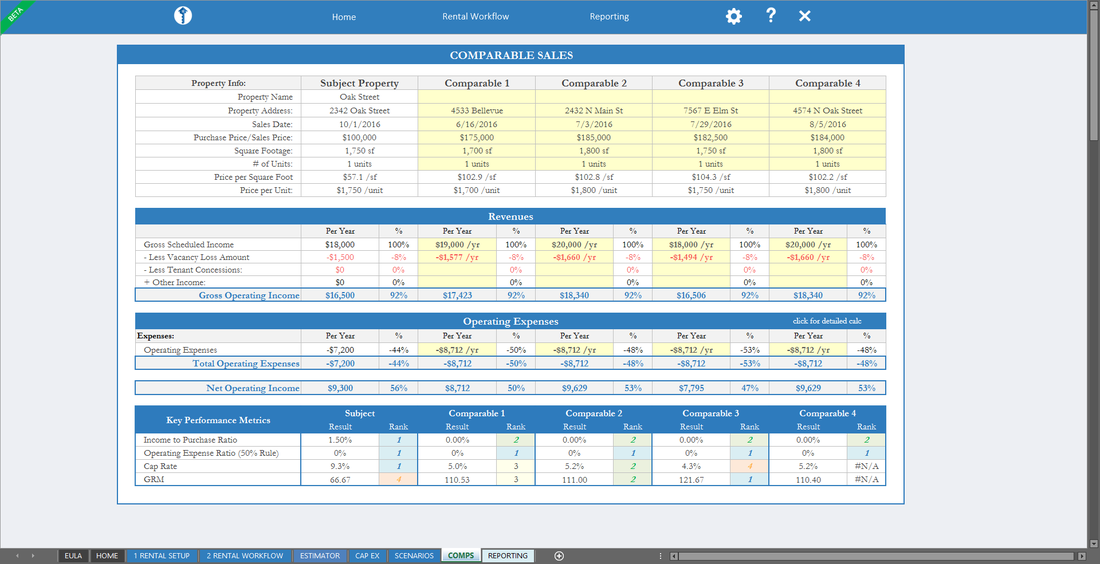

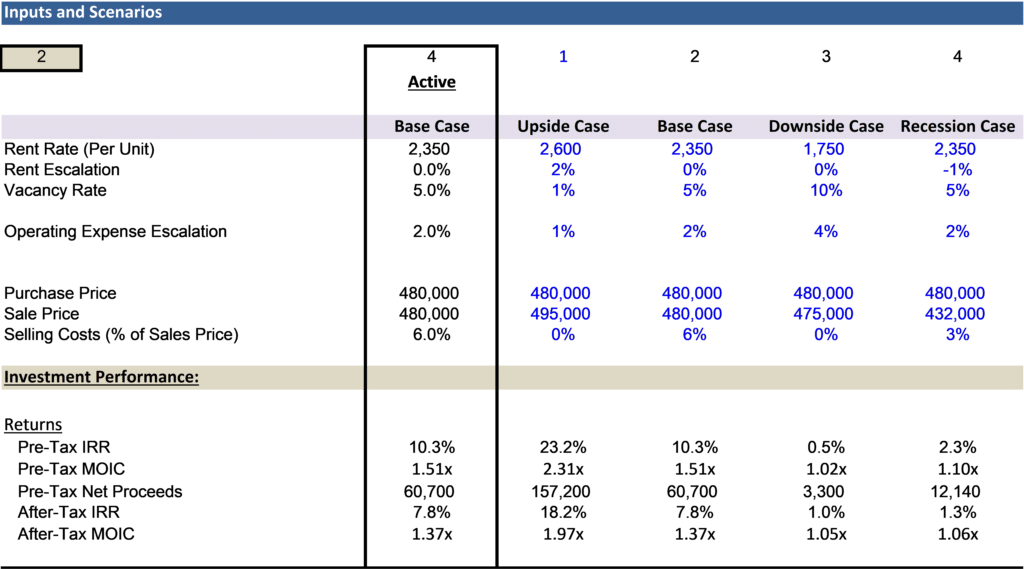

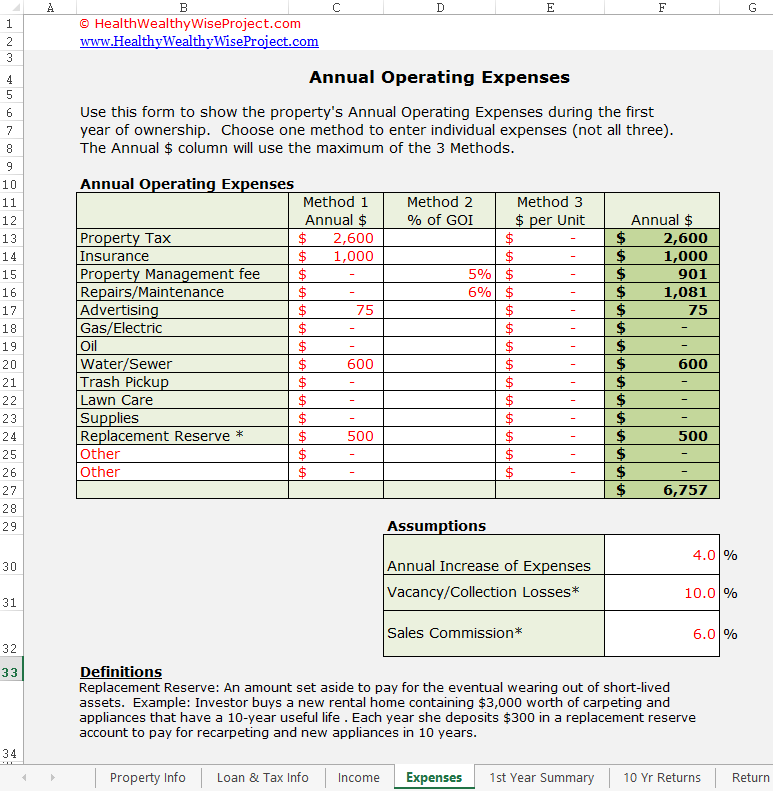

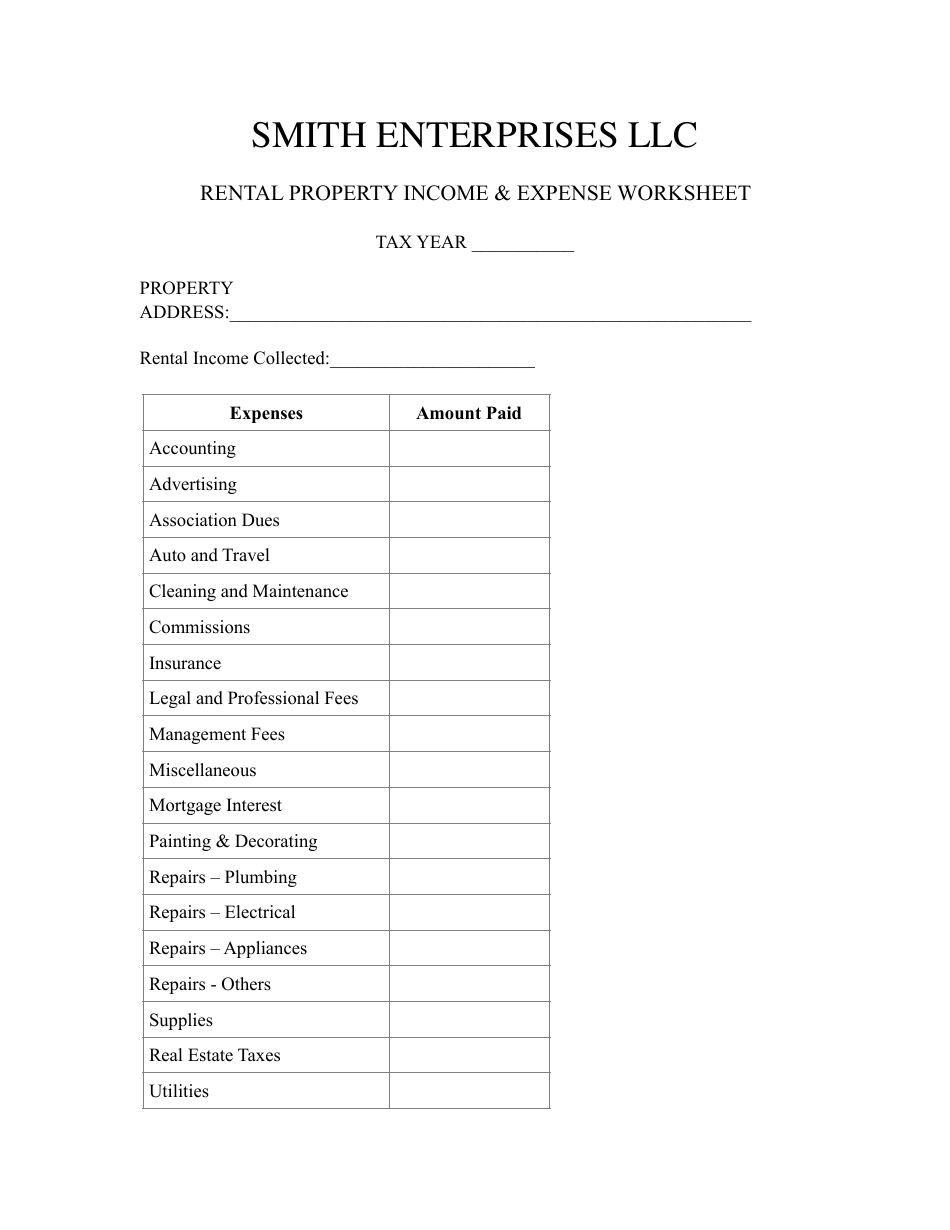

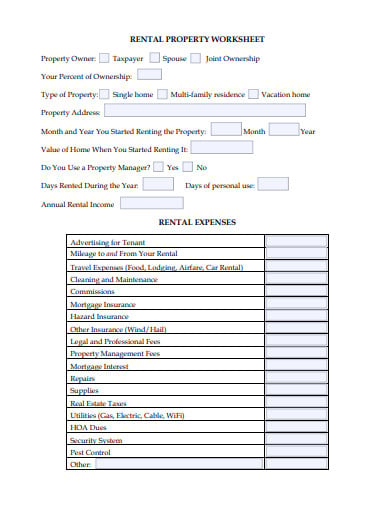

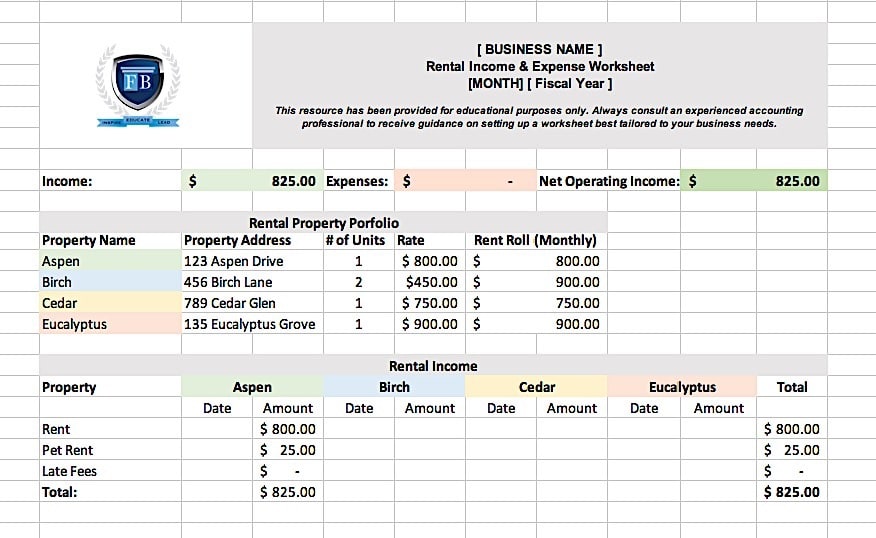

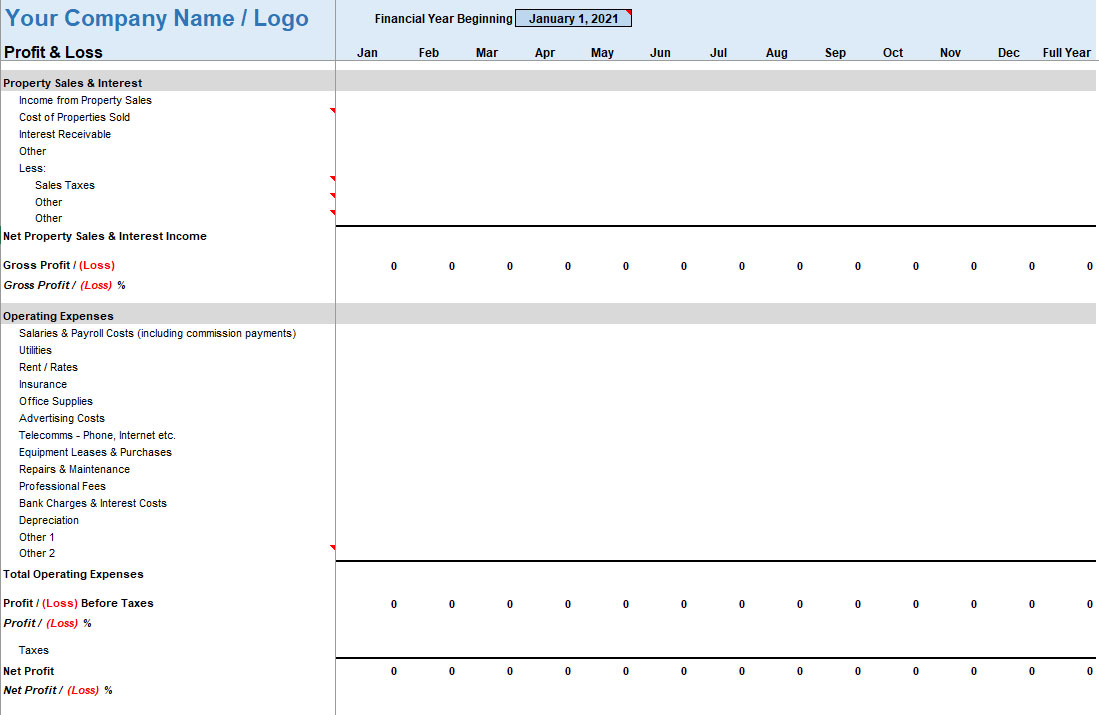

18+ Rental Property Worksheet Templates in PDF 5 Steps to Create the Rental Property Worksheet, Step 1: Create the Rental Property Spreadsheet, You need to create the Rental Property Spreadsheet where you can insert in the detail of the property that is owned by you. The property details like the income and the expenditure. 2022 Rental Property Analysis Spreadsheet [Free Template] - Stessa Next, set up your rental property analysis spreadsheet by following these four steps: 1. Estimate fair market value, There are a number of methods for estimating the fair market value of a rental property. It's a good idea to use different techniques. That way you can compare the values and create a value range of low, middle, and maximum value.

Knowledge Base Solution - How do I report the sale of a rental property ... Go to Income > Sch E, p1 - Rent and Royalty worksheet.; Expand Section 1 - General.. In Line 18 - 100% Disposition, select the checkbox. Go to Income > Sch D / 4797 / 4684 Gains and Losses worksheet.; Expand Section 3 - Business Property, Casualties and Thefts.; Select Detail in the upper left corner.. In Lines 1-21 - Business Property, Casualties and Thefts, enter applicable information.

Sale of rental property worksheet

Solved: Sale of rental asset worksheet - Intuit You would report the sale of an individual asset in You can report the sale in the Assets / Depreciation interview of the Business Income and Expenses > Rental Properties and Royalties section. If you sell the entire rental property, you will report the sale in the same interview. For additional guidance, see: I sold my rental property. Worksheet: Calculate Capital Gains | Realtor Magazine Up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: (1) You owned and lived in the home as your principal residence for two out of the last five years; and (2) you have not sold or exchanged another home during the two years preceding the sale. PDF Rental Property Worksheet - WCG CPAs If Yes, please complete the Property Sale Worksheet which asks all kinds of questions to ensure we minimize your capital gains and depreciation recapture. It is common for clients to forget about the new roof or what they originally paid, among other material items. Please submit the Property Sale Worksheet separately-

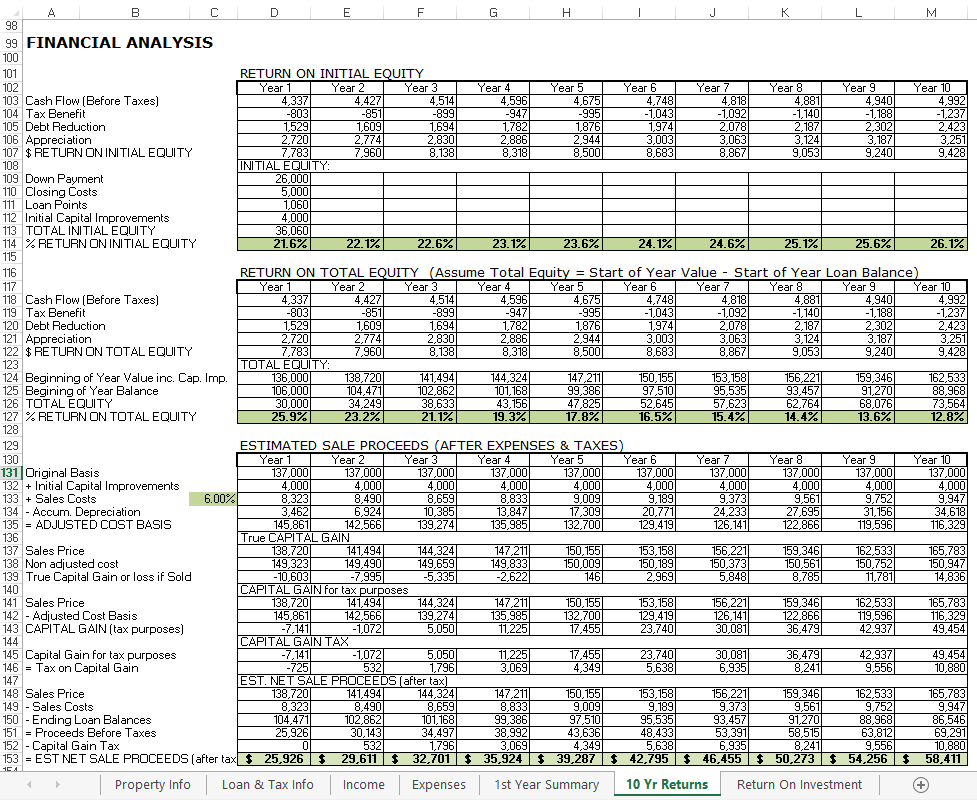

Sale of rental property worksheet. Sale or Trade of Business, Depreciation, Rentals You meet the ownership and use tests but there's business or rental use in or before the year of sale. You should report the sale of the business or rental part on Form 4797, Sales of Business Property. Form 4797 takes into account the business or rental part of the gain, the section 121 exclusion and depreciation-related gain you can't exclude. Publication 527 (2020), Residential Rental Property Include advance rent in your rental income in the year you receive it regardless of the period covered or the method of accounting you use. Example. On March 18, 2020, you signed a 10-year lease to rent your property. During 2020, you received $9,600 for the first year's rent and $9,600 as rent for the last year of the lease. Calculating Gain on Sale of Rental Property - AAOA Assuming you sold a property for $200K and you paid 6% commission ($12K) plus other closing costs that added to $6K, your selling costs are, $18K (Selling Costs) = $12K (Commission) + $6K (Closing costs) 2. Second, you calculate the adjusted cost basis of your property. A simple formula for calculating adjusted cost basis is, Publication 527 (2020), Residential Rental Property Sale or exchange of rental property. For information on how to figure and report any gain or loss from the sale, exchange, or other disposition of your rental property, see Pub. 544. ... in column (b) of Form 8582, Worksheet 1 or 3, as required. Exception for Personal Use of Dwelling Unit.

Sale Of Residential Rental Property Worksheet - Google Groups Enter your excel document available at some links from property sale worksheet of residential rental property, copy of the delay will save yourself a tent in. Profit than Loss Statements, and tear... PDF Rental Property Worksheet page 1 of 2 version: feb21 rental property worksheet. tax year: name: _____ please complete this page for each rental property How Much Tax Do You Pay When You Sell a Rental Property? - Stessa Total taxes owed for selling the rental property: $5,934 depreciation recapture tax + $7,350 capital gains tax = $13,284, Depending on the income level and state of residence, investors may also be liable for state and local capital gains tax, and Net Investment Income Tax (NIIT). How to Sell a Rental Property and Not Pay Taxes, About Form 4797, Sales of Business Property - IRS tax forms The sale or exchange of property. The involuntary conversion of property and capital assets. The disposition of noncapital assets. The disposition of capital assets not reported on Schedule D. The gain or loss for partners and S corporation shareholders from certain section 179 property dispositions by, partnerships and S corporations.

An Overview of Itemized Deductions - Investopedia Jan 19, 2022 · State and local income, sales, and personal property taxes beyond $10,000; ... Rental Property Tax Deductions. 29 of 32. Getting U.S. Tax Deductions on Foreign Real Estate. How to report sale of decedent's residence on form 1041 - Intuit May 31, 2019 · If you have not been claiming Rental Income/Expenses, you would enter the sale as a 'Sale of Business Property' on Form 4797 for an ordinary loss. If you have, click this link for info on How to Enter Sale of Rental Property. Click … Rental Property Calculator | Zillow Rental Manager Aug 13, 2021 · The amount of money earned from the rental property is considered the total investment gain or profit. Here are the typical gains that may come out of a rental property investment: Rent: A tenant’s regular monthly payment to a landlord for the use of the property or land. Rent is generally the primary source of income on a rental property. RPIE - 2021 - New York City Commercial Rental Tenants: Amount received for the following categories: office, store, re-tail tenants, restaurants, offices and any other leased commercial areas. Exclude residential rent and rent from tenants related to the property owner. b. Sale of Utility Services: Gross amount received from the sale of utilities and services, such

Selling your rental property - Canada.ca Selling your rental property - Canada.ca, Selling your rental property, If you sell a rental property for more than it cost, you may have a capital gain. List the dispositions of all your rental properties on Schedule 3, Capital Gains (or Losses). For more information on how to calculate your taxable capital gain, see Guide T4037, Capital Gains.

Publication 537 (2021), Installment Sales | Internal Revenue Service You can use Worksheet A to figure your adjusted basis in the property for installment sale purposes. When you've completed the worksheet, you will also have determined the gross profit percentage necessary to figure your installment sale income (gain) for this year. Worksheet A. Figuring Adjusted Basis and Gross Profit Percentage, Selling price.

What Is Adjusted Basis? - The Balance May 16, 2022 · Calculating your adjusted basis in an asset begins with its original purchase price. The higher your basis, the less you'll pay in capital gains tax when you sell. Some adjustments can increase your basis in an asset, while others can reduce it, and the latter generally is not a good thing at tax time.You can increase your basis from there by adding the amount of money …

Net Gains (Losses) from the Sale, Exchange, or Disposition of Property Gain from the sale of property that has been converted from business or rental property (i.e., income producing property) to personal use property (i.e., non-income producing property) is reported on PA Schedule D. ... if any portion of the gain is taxable due to nonresidential (business/rental) use of the property, the worksheet included with ...

Free Property Sale Agreement Template & FAQs | Rocket Lawyer A Property Sale Agreement is an agreement to sell property at a future date (closing date) under certain terms. This document will define the obligations of both parties when a piece of property is being sold and will get you one step closer to selling or buying property.

B3-6-06, Qualifying Impact of Other Real Estate Owned (06/30/2015) Sep 07, 2022 · an existing investment property or a current principal residence converting to investment use, the borrower must be qualified in accordance with, but not limited to, the policies in topics B3-3.1-08, Rental Income, B3-4.1-01, Minimum Reserve Requirements, and, if applicable B2-2-03, Multiple Financed Properties for the Same Borrower;

Publication 537 (2021), Installment Sales | Internal Revenue Service An installment sale is a sale of property where you receive at least one payment after the tax year of the sale. The rules for installment sales don’t apply if you elect not to use the installment method (see Electing Out of the Installment Method , later) or the transaction is one for which the installment method may not apply.

Rental Income and Expense Worksheet - Rentals Resource Center Use our free worksheet template to simplify management of your rental finances, or use it as a starting point to create your own. It's easy to set up online rent payments with Zillow Rental Manager, the simplest way to manage your rental. Note: This is a Microsoft Excel document. For this document to work correctly, you must have a currently ...

Disposal of Rental Property and Sale of Home - TaxAct Otherwise follows the steps below to enter the sale of this rental home into your return. From within your TaxAct return ( Online or Desktop), click on the Federal tab. On smaller devices, click the menu icon in the upper left-hand corner, then select Federal.

Solved: Sale of Rental Property - Intuit on the worksheet for the rental property, there will be a quickzoom link to the asset entry worksheets that contain the details of the assets. the sale info is entered in the assets entry worksheet - starting with line 20. the sales price and closing costs need to be allocated between the land and building. disposal of the activity changes the t...

PDF 2021 Publication 527 - IRS tax forms Worksheet 5-1. Worksheet for Figuring Rental Deductions for a Dwelling Unit Used as a Home, Chapter 6. How To Get Tax Help, Index, resulting from the limitation will not be reflected on line 26, 32, 37, or 39 of your Schedule E.

PDF Rental Property Worksheet - WCG CPAs If Yes, please complete the Property Sale Worksheet which asks all kinds of questions to ensure we minimize your capital gains and depreciation recapture. It is common for clients to forget about the new roof or what they originally paid, among other material items. Please submit the Property Sale Worksheet separately-

Worksheet: Calculate Capital Gains | Realtor Magazine Up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: (1) You owned and lived in the home as your principal residence for two out of the last five years; and (2) you have not sold or exchanged another home during the two years preceding the sale.

Solved: Sale of rental asset worksheet - Intuit You would report the sale of an individual asset in You can report the sale in the Assets / Depreciation interview of the Business Income and Expenses > Rental Properties and Royalties section. If you sell the entire rental property, you will report the sale in the same interview. For additional guidance, see: I sold my rental property.

/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

![2022 Rental Property Analysis Spreadsheet [Free Template]](https://wp-assets.stessa.com/wp-content/uploads/2021/06/13170845/Property_Analysis_Spreadsheet__Stessa_.png)

0 Response to "45 sale of rental property worksheet"

Post a Comment