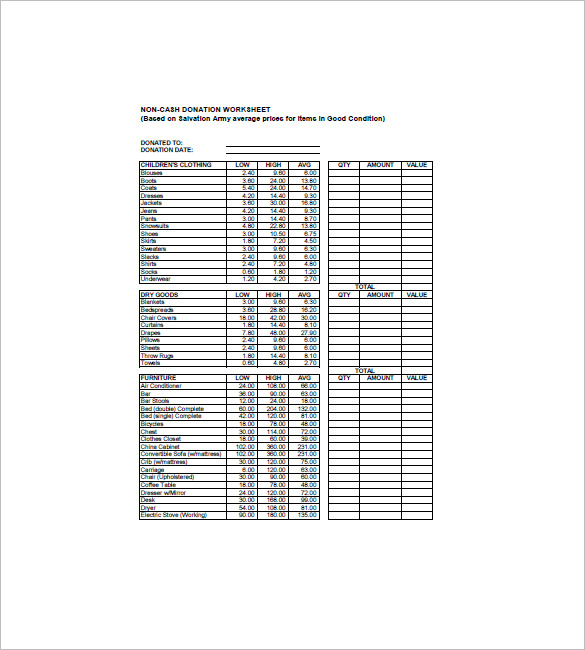

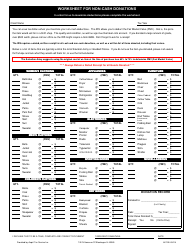

44 non cash charitable donations worksheet

› tax-center › filingClaiming A Charitable Donation Without A Receipt | H&R Block If claiming a deduction for a charitable donation without a receipt, you can only include cash donations, not property donations, of less than $250. And, you must provide a bank record or a payroll-deduction record to claim the tax deduction. You need a receipt and other proof for both of these: Cash donations of $250 or more; Non-cash donations goodwillnne.org › donate › donation-value-guideDonation value guide - Goodwill NNE Below is a donation value guide of what items generally sell for at Goodwill locations. To determine the fair market value of an item not on this list, use 30% of the item’s original price.

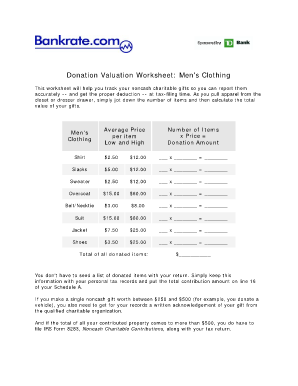

Free Clothing Donation Tax Receipt - PDF | Word - eForms Updated July 29, 2022. A clothing tax donation receipt serves as documentation of a charitable clothing donation which the donor can use to claim as a deduction against their State and/or Federal taxes. Since donated clothing is often secondhand, it is up to the donor to estimate the clothing's values. Standard guidelines, such as a fixed percentage of an item's original value, can help to ...

Non cash charitable donations worksheet

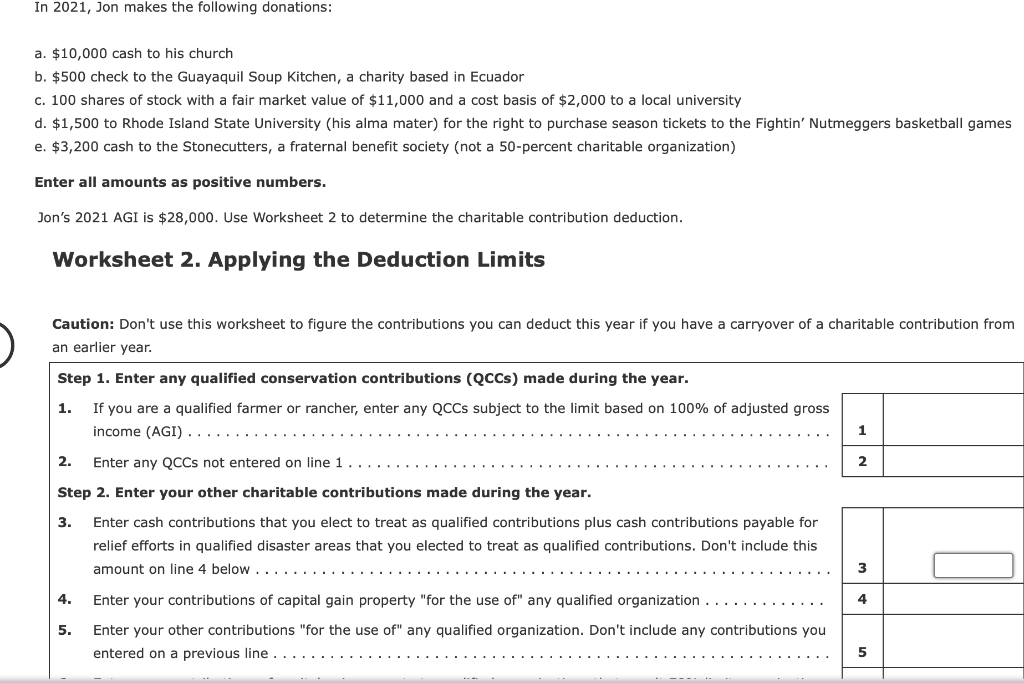

2021 Publication 526 - IRS tax forms Cash contributions if you don’t itemize de-ductions. If you don’t itemize your deductions on Schedule A (Form 1040), you may qualify to take a deduction for contributions of up to $600. See Cash contributions for individuals who do not itemize deductions, later. Deduction over $5,000. You must complete Section B of Form 8283 for each item or group of similar items for which … Entering charitable contributions for the 1040 in ProSeries - Intuit To generate this deduction: Open the Schedule A. Scroll down to the Cash Contributions Smart Worksheet above line 11 and enter the charitable contributions. Open the 1040/1040SR Wks. Scroll down to the section for Form 1040 or Form 1040-SR, Lines 8-11. Review the transferred amount on line 10a and adjust the amount as needed. The Complete 2022 Charitable Tax Deductions Guide - Daffy Non-cash contributions: For non-cash contributions, the limit to make a deduction without a receipt is $500. Additionally, non-cash contributions also require an appraisal to determine the fair market value of the item you donated. If the value is $5,000 or less, you just need to hang onto the appraisal with your tax documents in case of an audit.

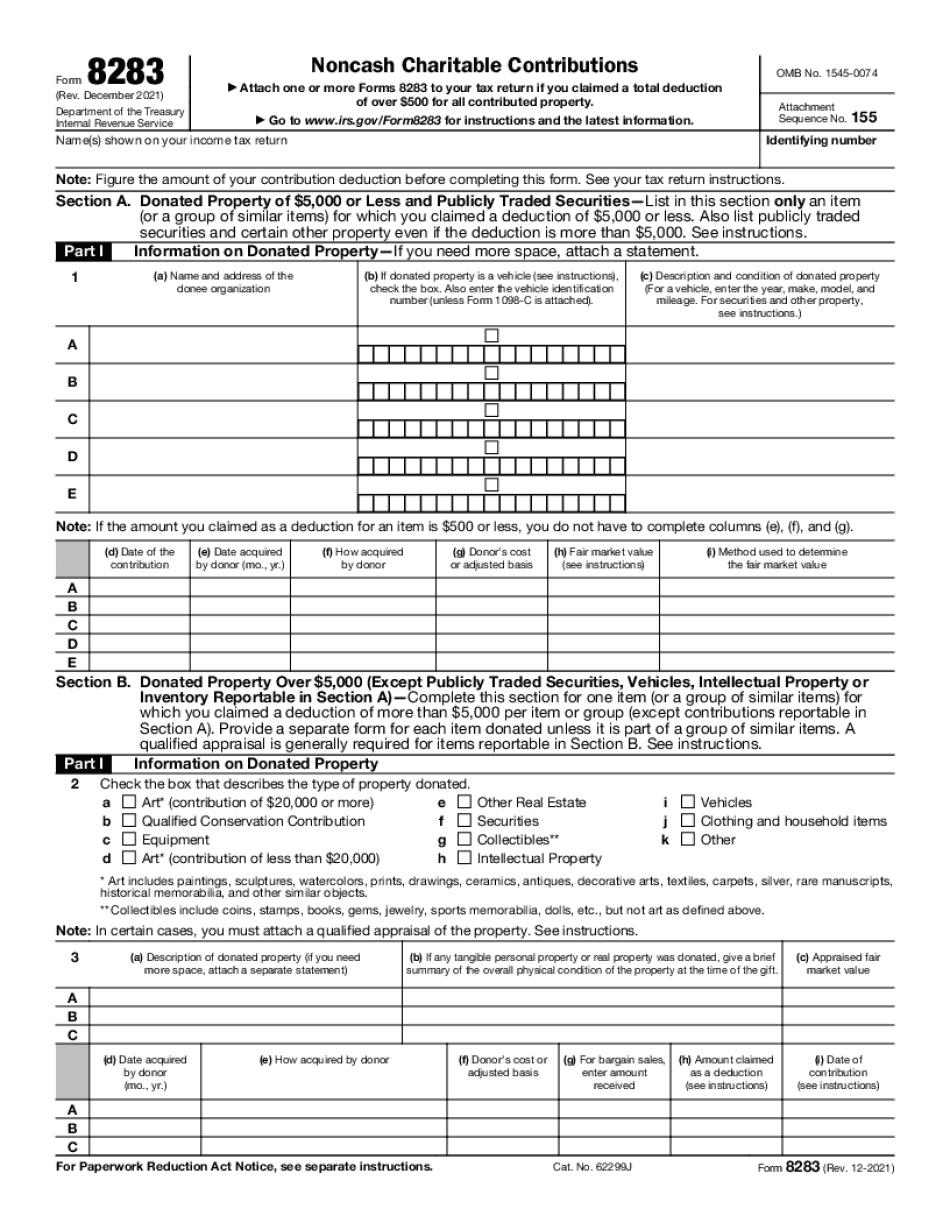

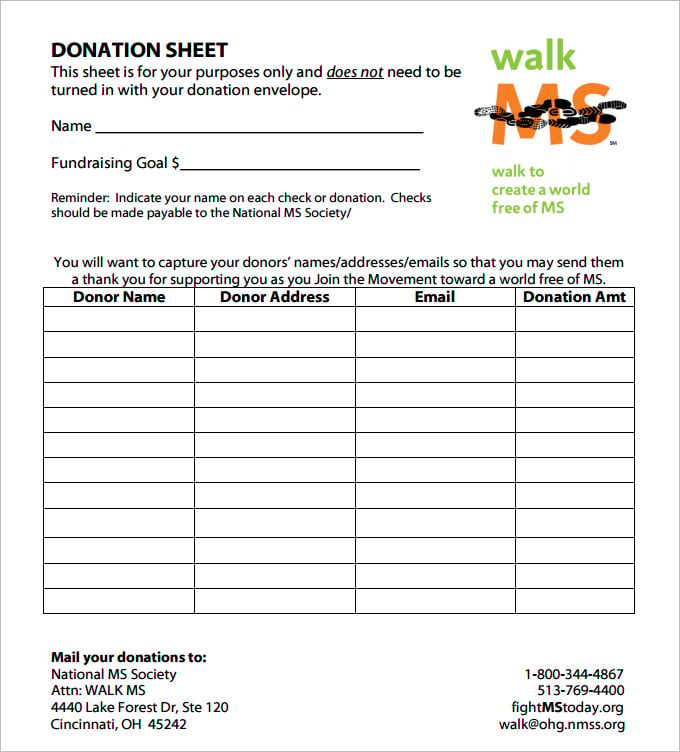

Non cash charitable donations worksheet. Tax Deductions - ItsDeductible Those old clothes are worth more than you think. Get the most of what you're giving. > Learn More Donation Sheet Template – 9+ Free Excel, PDF Documents … These templates can help you maintain and keep a track of donations made in a particular year, period, or specified time-frame. The readymade templates available for download are helpful in keeping the record of amount of donations made to any type of social and welfare organization. You can easily use these templates for filling in and submitting the donation form that you can … › donating › IRS-guidelinesIRS Guidelines and Information | Donating to Goodwill Stores Noncash Charitable Contributions — applies to deduction claims totaling more than $500 for all contributed items. If a donor is claiming over $5,000 in contribution value, there is a section labeled “Donee Acknowledgement” in Section B, Part IV of Internal Revenue Service (IRS) Form 8283 that must be completed. How do you write off charitable donations? - Pinestcars A Donors Guide to Vehicle Donation explains how your deduction is determined. If you received a gift or ticket to an event, you can only deduct the amount that exceeds the value of the gift or ticket. Note: Limits on cash and non-cash charitable donations have increased or been suspended. Learn more about charitable deductions in 2021.

Claiming A Charitable Donation Without A Receipt | H&R Block If claiming a deduction for a charitable donation without a receipt, you can only include cash donations, not property donations, of less than $250. And, you must provide a bank record or a payroll-deduction record to claim the tax deduction. You need a receipt and other proof for both of these: Cash donations of $250 or more; Non-cash donations Form 8283: Noncash Charitable Contributions Definition - Investopedia Non-cash contributions can include securities, property, vehicles, collectibles, and art. The form can be downloaded from the IRS website. 2 Key Takeaways Donated non-cash items may require an... How Anyone Can Get A 2021 Tax Deduction Charitable Donations - Forbes The other change to charitable donations in 2021 allows for a full tax deduction this year for donors making gifts up to 100% of their income. For tax year 2021, you can potentially donate 100% of ... Make A 2021 Donation Before It's Too Late - Forbes Assuming your 2021 RMD is $50,000 and your tax bill is $10,000, doing a QCD gets $50,000 to the charity and saves you $10,000 that you would have had to pay at tax time. You can find more details ...

7 tax tips for maximizing charitable giving | USAA Count noncash donations. To maximize benefit, make sure you're properly valuing noncash donations such as clothing, furniture, toys and electronics. The most important step is putting a fair price tag on each item so you get an accurate deduction. Bunching charitable contributions. Accounting for In-Kind Donations to Nonprofits | The Charity CFO Step #2: Record Your In-Kind Donations. Now that you've established the fair market value, let's take a look at accounting for the value of these donations on your books. You'll want to track all of your in-kind donations along with donor information in a spreadsheet or CRM, too. Tax planning and charitable giving: What to consider now That means the deduction for cash contributions to public charities is no longer up to 100% of adjusted gross income (AGI) for those who itemize. Be sure to consult with your tax advisor to learn the latest on allowable deductions for charitable donations of cash and property as well as potential carryover opportunities. When tax planning for 2023 Charitable Contributions - TurboTax Tax Tips & Videos The basic rule is that your contributions to qualified public charities, colleges and religious groups generally can't exceed 60 percent of your Adjusted Gross Income (AGI) (100% of AGI in 2020 for qualified charities). The caps are a bit lower for gifts to other types of nonprofits.

Charitable Contributions: Tax Breaks and Limits - Investopedia 30/07/2022 · Non-cash donations to non-qualifying entities continue to be capped at 30% of the individual donor’s AGI. Also, contributions of appreciated capital gain property are generally capped at 30% of ...

› articles › personal-financeCharitable Contributions: Tax Breaks and Limits - Investopedia Non-cash donations to non-qualifying entities continue to be capped at 30% of the individual donor's AGI. Also, contributions of appreciated capital gain property are generally capped at 30% of the...

How to List Charitable Donations for Tax Deductions Listing your donations on Form 8283 is required if your donations are worth more than $500 . Provided you don't take a deduction in excess of $5,000 for any single donated item, or group of similar items, you'll only have to list the charity's name and address, and a short description of the item, explains the IRS.

Donating to Charity | USAGov "A Donor's Guide to Vehicle Donation" explains how your deduction is determined. If you received a gift or ticket to an event, you can only deduct the amount that exceeds the value of the gift or ticket. Note: Limits on cash and non-cash charitable donations have increased or been suspended. Learn more about charitable deductions in 2021.

Deduction for individuals who don't itemize; cash donations up to $600 ... The law now permits C corporations to apply an increased limit (Increased Corporate Limit) of 25% of taxable income for charitable contributions of cash they make to eligible charities during calendar-year 2021. Normally, the maximum allowable deduction is limited to 10% of a corporation's taxable income.

Printable Act Of Donation Form - RoutedReviews Donation Value Guide 2020 Excel Spreadsheet - PdfFiller. By submitting this donation form, ... People in the USA are encouraged to become contributors not only due to the moral virtues inherent to this act, but they will also be to claim corresponding deductions from the tax return. What is Non Cash Charitable Contributions/Donations Worksheet for?

itsdeductibleonline.intuit.comTax Deductions - ItsDeductible Existing Customers. Sign In. New Customers. Create New Account. Your account allows you to access your information year-round to add or edit your deductions.

Important Items to Know about Charitable Contributions First - if you make noncash contributions to a 50% organization, your deduction may be limited to 50% of AGI. Also, less commonly, qualified conservation contributions are limited to 50% of AGI. It is important to note, this is calculated as 50% of your AGI minus cash contributions subject to a 60% limit.

Donation Value Guide For 2021 | Bankrate 29/09/2021 · If you make a single non-cash gift worth between $250 and $500 (if, for example, you donate a vehicle), you’re required to have a receipt or a written acknowledgment of your gift from a ...

IRS Guidelines and Information | Donating to Goodwill Stores Noncash Charitable Contributions — applies to deduction claims totaling more than $500 for all contributed items. If a donor is claiming over $5,000 in contribution value, there is a section labeled “Donee Acknowledgement” in Section B, Part IV of Internal Revenue Service (IRS) Form 8283 that must be completed. The form and instructions are available on the IRS site and can …

› taxes › donation-value-guideDonation Value Guide For 2021 | Bankrate If you make a single non-cash gift worth between $250 and $500 (if, for example, you donate a vehicle), you're required to have a receipt or a written acknowledgment of your gift from a qualified...

Tax Preparation Worksheets - Lake Stevens Tax Service We have created several worksheets to aid you in the collection and categorization of receipts. Individual Income Tax Worksheet Self-Employed Income & Expense Worksheet Daycare Provider Worksheets Non-Cash Charitable Donations Rental Property Worksheet

The IRS Donation Limit: What is the Maximum you can Deduct? 07/01/2022 · According to IRS publication 526 (the gospel for qualified charitable contributions):. The amount you can deduct for charitable contributions generally is limited to no more than 60% of your adjusted gross income. Your deduction may be further limited to 50%, 30%, or 20% of your adjusted gross income, depending on the type of property you give and the type of …

Free Goodwill Donation Receipt Template - PDF - eForms 1 - Save The Goodwill Receipt Template. The receipt used to document a Goodwill donation can be accessed with the "Adobe PDF" link above. Select it then download this file. If you have compatible software, you may enter information onscreen however, many would consider it wise to have such paperwork in a readily accessible location in ...

How do I enter a charitable carryover? - Intuit Answer Yes and enter the info for your charitable carryovers on the following screens. Tip:Most qualified charitable organizations are 60% limit organizations, which means you'll enter the carryover on the Enter Your Charitable Carryoversscreen. 20% and 30% limit organizations are entered on the following screen, Other Carryovers.

Strict Compliance Required for Gift Acknowledgment Letters To be considered "contemporaneous," donors must receive the acknowledgment by the earlier of either (i) the date on which the donor actually files his or her individual federal income tax return for the year of the contribution; or (ii) the due date (including extensions) of the individual income tax return.

Tax 101: 2021 charitable contributions | Becker Charitable contribution tax savings. $1,880. $2,000. Net tax deduction. $1,280. ($1,880 savings - $600 tax) $2,000. Deduction options for benevolent taxpayers have expanded for the 2021 tax year. Now, taxpayers who do not itemize can receive a tax benefit for gifts to charitable organizations.

20somethingfinance.com › irs-maximum-charitableThe IRS Donation Limit: What is the Maximum you can Deduct? Jan 07, 2022 · By default, always at least get written confirmation for your donation. I won’t get in to the full details here, since I have previously gone in to depth about cash and non-cash scenarios where you need a charitable donation receipt, appraisal, or no written acknowledgement at all in order to deduct a donation. It’s important, so read up.

Clothing donation tax deduction worksheet - IgiEnglish.pl Donation valuation worksheet: men's clothingthis worksheet will help you track your noncash charitable gifts so you can report themaccurately -- and get the proper deduction -- at tax -filing time. as you pull apparel from thecloset or dresser drawer, FILL NOW. Clothes donation value worksheet How to ask for clothing donations.

Entering corporate charitable contributions in Lacerte - Intuit Go to Screen 20, Deductions. Scroll down to the Contributions (Use Screen 24 to enter contribution carryovers) subsection. Enter the contribution amount in Cash (Ctrl+E). Follow these steps to enter current noncash contributions: Go to Screen 25, Noncash Contributions (8283).

Tax deduction for charitable donations: Did you donate last ... - Yahoo! "If you donate noncash items, you need to be eligible to claim itemized deductions," Greene-Lewis said. ... property taxes and charitable contributions need to add up to more than your standard ...

Charitable contributions deduction problems/errors - Page 2 I believe the whole TT worksheet (Charitable Deduction Limits Worksheet for Carryover Contributions" which you displayed is incorrect, in that ... TurboTax 2020 overcalculated the amount of allowable noncash charitable contributions on my 2020 return. It gave me a much higher deduction than is allowed by IRS, so now I must file a 1040x to make ...

Donation value guide - Goodwill NNE Below is a donation value guide of what items generally sell for at Goodwill locations. To determine the fair market value of an item not on this list, use 30% of the item’s original price.

Financial Forms | Financial Services | Duke To request an Agency Fund, an Agency Fund Application form and a Cost Object Request form should be completed and signed by the person responsible for the agency fund, the sponsoring department designee and “The Approver.†Requests for Agency Fund accounts can originate only from a department or school of Duke University. Both forms should be emailed …

Charitable Contributions: How Much Can You Write Off? Cash donations are deductible up to a limit of 60% of your AGI. Non-cash donations. The deductible limit for non-cash donations falls between 20% and 50% of your AGI, depending on the type of non-cash donation that's being made. Non-cash donations include the following types of property: New or used clothing or other household items and food.

The Complete 2022 Charitable Tax Deductions Guide - Daffy Non-cash contributions: For non-cash contributions, the limit to make a deduction without a receipt is $500. Additionally, non-cash contributions also require an appraisal to determine the fair market value of the item you donated. If the value is $5,000 or less, you just need to hang onto the appraisal with your tax documents in case of an audit.

Entering charitable contributions for the 1040 in ProSeries - Intuit To generate this deduction: Open the Schedule A. Scroll down to the Cash Contributions Smart Worksheet above line 11 and enter the charitable contributions. Open the 1040/1040SR Wks. Scroll down to the section for Form 1040 or Form 1040-SR, Lines 8-11. Review the transferred amount on line 10a and adjust the amount as needed.

2021 Publication 526 - IRS tax forms Cash contributions if you don’t itemize de-ductions. If you don’t itemize your deductions on Schedule A (Form 1040), you may qualify to take a deduction for contributions of up to $600. See Cash contributions for individuals who do not itemize deductions, later. Deduction over $5,000. You must complete Section B of Form 8283 for each item or group of similar items for which …

0 Response to "44 non cash charitable donations worksheet"

Post a Comment