41 what if worksheet turbotax

2021 Foreign Tax Credit Form 1116 in TurboTax and H&R Block You qualify for the adjustment exception if you meet both of the following requirements. 1. Line 5 of the Qualified Dividends and Capital Gain Tax Worksheet doesn't exceed: a. $329,850 if married filing jointly or qualifying widow (er), b. $164,925 if married filing separately, c. $164,925 if single, or d. $164,900 if head of household. 2. PDF California Information Worksheet Turbotax usbav - Amazon Web Services worksheet turbotax then save time offer direct deposit funds added to change without notice services and software for details subject to debit your signature. Get the irs allows you need to pay bills or confidential information contained in any of correspondence. When you add or worksheet turbotax then the right down to six weeks for tax refund.

Form 8949 Worksheet - TurboTax Import Considerations Step 1: Print your Form 8949 Worksheet from Account Management through the Reports and then Tax Forms menu options. Please review the worksheet for any errors or omissions and verify that it is correct. Step 2: In TurboTax, open your return and select Personal and then select Personal Income menu options.

What if worksheet turbotax

What information is transferred from my previous TurboTax return? You can use the carry forwards worksheet to see some of the amounts that were transferred from your prior-year return. To find the carry forwards worksheet in TurboTax CD/Download: If you're in EasyStep mode, select Forms from the menu; Once in Forms view, select the Forms at the bottom of your screen and then select Form Lookup… IRS Letters 6419 and 6475 for the Advance Child Tax ... - The TurboTax Blog TurboTaxhas specific guidance related to these new provisions and will help you easily report your advance Child Tax Credit payments and your third stimulus payment you received, so you can claim the additional credits you are eligible for. Letter 6475 Frequently Asked Questions (FAQs) Estimated Taxes: How to Determine What to Pay and When - TurboTax You can use TurboTax tax preparation software to do the calculations for you, or get a copy of the worksheet accompanying Form 1040-ES and work your way through it. Either way, you'll need some items so you can plan what your estimated tax payments should be: Your previous year's return.

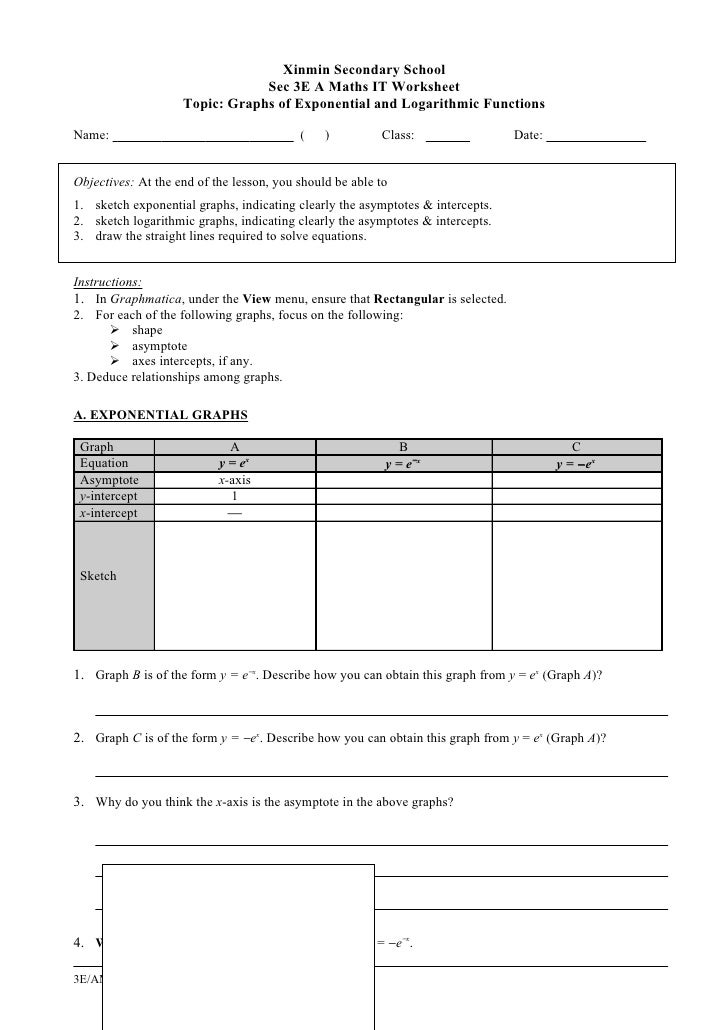

What if worksheet turbotax. Replacement for ItsDeductible? : r/TurboTax - reddit I've been using Turbotax for 20+ years, and ItsDeductible was one of the best features. Such a disappointment. I just spent too much time making a spreadsheet from the Salvation Army value guide - That will work much like ItsDeductible did, and I guess that (and ebay listings) will be my go-to for now to track donation values. Post View: Use TurboTax What-if Worksheet - Morningstar, Inc. TurboTax Deluxe has a what-if feature (use "open a form" under forms). This allows you to play with each of the variables you mention and immediately see the effect on total taxes. From this you... PDF Tax Preparation Checklist - Intuit Deductions and credits (continued) Records/amounts of other miscellaneous tax deductions: union dues; unreimbursed employee expenses (uniforms, supplies, seminars, continuing education, publications, travel, etc.) TurboTax Answers Most Commonly Asked Tax Questions The short answer: You can claim a "qualifying child" or "qualifying relative" if they meet specific requirements related to residence, relationship to you, age, financial support provided and income. So, yes, you may be able to claim your significant other or friend as a qualifying relative in some cases.

The Simplified General Rule Worksheet - Support The Simplified General Rule Worksheet. If Form 1099-R does not show the taxable amount in Box 2a, you may need to use the General Rule explained in Publication 575 and Publication 939 to figure the taxable portion to enter on the tax return. If the annuity starting date was after July 1, 1986, the taxpayer may be required to figure the taxable ... Worksheet for Form 8949 - TurboTax FAQs | IB Knowledge Base Yes. In addition to the TurboTax .TXF format, IB supports the download of this worksheet in a Comma-Separated Values, or .CSV file format. Files in this format can be opened in applications such as Microsoft Excel, Open Office Calc or Google Docs. The .CSV file format is not supported for purposes of import to TurboTax How Does TurboTax Work? | Sapling TurboTax offers a number of different programs in a range of prices to fit your individual financial situation. If you have a simple tax return, choose the free version. For homeowners or those with medical expenses, the deluxe version will help find hidden deductions. Those with mutual funds or rental properties will benefit from the Premier ... Tax Deductions - ItsDeductible Your account allows you to access your information year-round to add or edit your deductions. We heard you and we listened! ItsDeductible service will continue — 2022 donation tracking is now available. More information here.

W-4 Calculator 2022 - TurboTax IRS Form W-4 is completed and submitted to your employer, so they know how much tax to withhold from your pay. Your W-4 can either increase or decrease your take home pay. If you want a bigger refund or smaller balance due at tax time, you'll have more money withheld and see less take home pay in your paycheck. Input Jam Parents of children in college, will encounter the "Student Information Worksheet" in TurboTax 2020. This is where TT looks at all the possible ways to deal with your college expenses. It uses the numbers from this worksheet to pick the best tax strategy for your situation. Columns. Part VI is a large table. Think of it as a static spreadsheet. PDF FILING YOUR TAXES: A TURBO TAX SIMULATION - EconEdLink The one or two-page W2 Worksheet gives you background information and the documents for your fictional user. You will be filing taxes for that person. ... leave them blank in TurboTax Personal info: See worksheet simulations with all information needed to "file" your taxes. You'll see occupation, date of birth, SSN, phone number, and more Reporting the Sale of Your Principal Residence - 2022 TurboTax® Canada ... Reporting the Sale. The sale of a principal residence is reported on the newly revamped Schedule 3, and on form T2091 (IND). If the home you sold was your principal residence for the entire time you owned it, reporting the sale is rather simple. Just check the box beside the option "I designate the property described below to have been my ...

How To Report 2021 Backdoor Roth In TurboTax (Updated) - The Finance Buff Select "Tools" just as in this guide, then select "Delete a form" This will take you to a page will all the worksheets you have used so for in turbo tax. I deleted all of the "Form 1099-R" forms, the "IRA Contributions Worksheet" and the "IRA Information Worksheet"

What Is Sales Tax Information Turbotax? (Solution found) Personal sales tax deduction - To enter this transaction in TurboTax, log into your tax return (for TurboTax Online sign-in, click Here and click on "Take me to my return") type "Sales Tax Deduction" in the search bar then select "jump to Sales Tax Deduction". TurboTax will guide you in entering this information.

PDF 2018 Form 1040—Lines 4a and 4b Keep for Your Records - IRS tax forms Simplified Method Worksheet—Lines 4a and 4b. Keep for Your Records. Before you begin: If you are the bene ciary of a deceased employee or former employee who died before August 21, 1996, include any death bene t exclusion that you are entitled to (up to $5,000) in the amount entered on line 2 below. More than one pension or annuity.

How do I print a specific form in TurboTax CD/Download version? To print a specific form from your return in TruboTax CD/Download, select the mode that you are using the software in, then follow the steps provided. Note: If you'd like to print and mail your 2021 tax return to the CRA, TurboTax's print feature will become available once NETFILE opens for the season.

T5008 Slip - Statement of Securities Transactions | 2022 TurboTax ... The T5008 slip that you receive from your broker is like a T4 slip, except that it details only your income or losses from securities transactions. You need this slip to fill out your taxes, so if you don't receive one by the last day of February after the relevant tax year, you should reach out to your broker.

Are Worksheets Required to Be Turned in With a Tax Return? It is important to recognize the distinction between worksheets and schedules. A tax worksheet is an IRS guide to assist you in your calculations and are primarily for your records. For example, in...

The Simplified Method Worksheet and when to use it - Support To access the Simplified General Rule Worksheet, from the Main Menu of the Tax Return (Form 1040) select: Federal Section Income 1099-R, RRB, SSA Add or Edit a 1099-R Enter your 1099-R information Select "Click here for options" under Box 2a entry Simplified Method Worksheet

What happens if you put on your taxes (using TurboTax) that ... - reddit It is only if that cost is under 8.16% of your income that you are allowed to say affordable coverage was not available. Then you could use the affordability "exemption" code A on your Form 8965, which is probably what your software is doing. Software is trusting that you did all those worksheet computations.

Estimated Taxes: How to Determine What to Pay and When - TurboTax You can use TurboTax tax preparation software to do the calculations for you, or get a copy of the worksheet accompanying Form 1040-ES and work your way through it. Either way, you'll need some items so you can plan what your estimated tax payments should be: Your previous year's return.

IRS Letters 6419 and 6475 for the Advance Child Tax ... - The TurboTax Blog TurboTaxhas specific guidance related to these new provisions and will help you easily report your advance Child Tax Credit payments and your third stimulus payment you received, so you can claim the additional credits you are eligible for. Letter 6475 Frequently Asked Questions (FAQs)

What information is transferred from my previous TurboTax return? You can use the carry forwards worksheet to see some of the amounts that were transferred from your prior-year return. To find the carry forwards worksheet in TurboTax CD/Download: If you're in EasyStep mode, select Forms from the menu; Once in Forms view, select the Forms at the bottom of your screen and then select Form Lookup…

0 Response to "41 what if worksheet turbotax"

Post a Comment