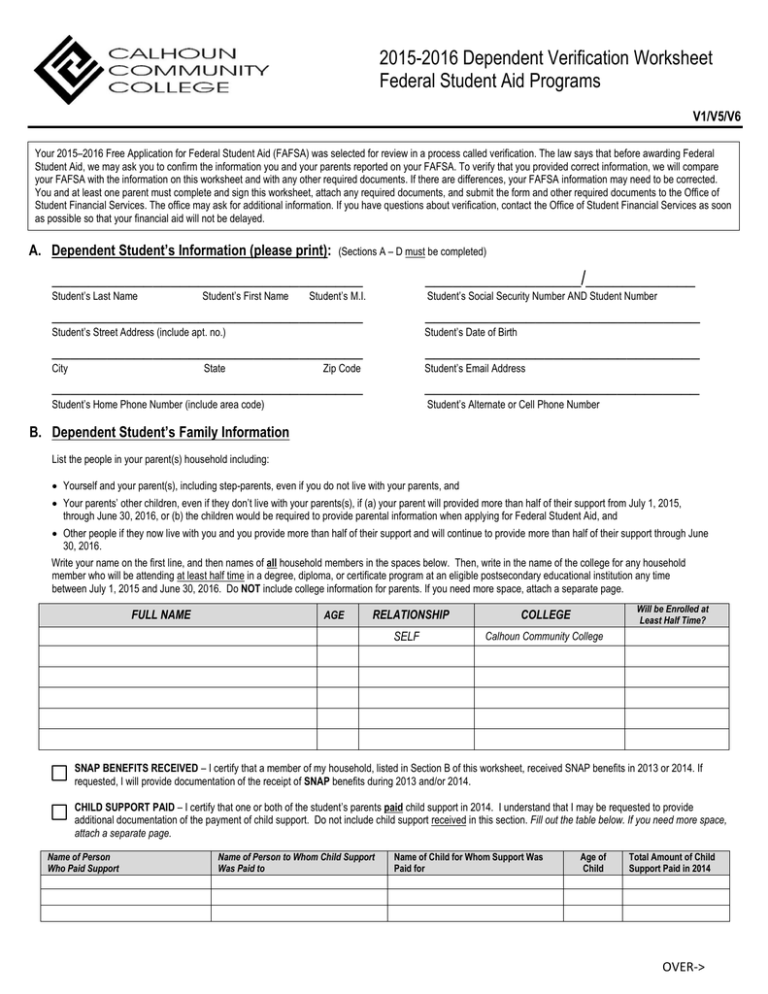

39 ira deduction worksheet 2014

personal finance: Advice, News, Features & Tips | Kiplinger The Inflation Reduction Act and Taxes: What You Should Know. President Biden signed the Inflation Reduction Act—a climate, energy, healthcare, and tax law that increases IRS funding, and changes ... turbotax.intuit.com › tax-tips › health-careAre Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos Jul 04, 2022 · For 2021, the standard deduction is $12,550 for single taxpayers and $25,100 for married taxpayers filing jointly. When you file your tax return, you typically have the choice between claiming the standard deduction or your itemized deductions. Usually you would select the one that gives you the largest deduction.

Filing Information for Individual Income Tax - Marylandtaxes.gov Calculate the standard deduction using the worksheet in Instruction 16 of the tax booklet. Prorate the standard deduction using the following formula: Standard deduction X Maryland income factor = Prorated standard deduction. Enter the prorated amount on line 17 of Form 502 and check the Standard Deduction Method box.

Ira deduction worksheet 2014

› tax-forms › maryland-form-502Maryland Tax Form 502 Instructions | eSmart Tax The STANDARD DEDUCTION METHOD gives you a standard deduction of 15% of Maryland adjusted gross income (line 16) with minimums of $1,500 and $3,000 and maximums of $2,000 and $4,000, depending on your filing status. Use STANDARD DEDUCTION WORKSHEET (16A) for your filing status to figure your standard deduction. How Does a SEP IRA Work? | The Motley Fool SEP IRA contribution limits The per-person annual contribution limit for a SEP IRA is the smaller of: 25% of the business owner or employee's compensation, or $58,000 in 2021 or $61,000 in 2022... Mortgage Rates: Compare Today's Rates | Bankrate For today, Tuesday, February 15, 2022, the average rate for a 30-year fixed mortgage is 4.20%, an increase of 27 basis points since the same time last week. If you're looking to refinance, the...

Ira deduction worksheet 2014. Retirement Disability Calculator Nycers Search: Nycers Disability Retirement Calculator, ERS or TRS) - Calculate the cost of a Buyback and apply online We both presently reside in the state of Pennsylvania (in separate households) He/she files a retirement application and sits with NYCERS staff person to be briefed on the procedure Tier 3 Original members who elect to opt into Tier 3 Enhanced will use the 5-year average if they are ... Lacerte Tax Support - Intuit Oklahoma and a better product. SighTwo weeks ago, spent 7 hours online with Lacerte trying to do an Oklahoma Partnership return, as just 1% of our business but as our primary is SD (no state ... read more. olaf Level 1. Lacerte Tax. posted Sep 14, 2022. Last activity Sep 14, 2022 by abctax55. 3 2. › retirement › should-youShould You Contribute to a Non-Deductible IRA? - Investopedia Apr 26, 2022 · For a deductible IRA, filing as single or head of household eligibility phases out between $66,000 and $76,000 of modified adjusted gross income (MAGI) for 2021. In 2022 it goes up to $68,000 and ... 2022 2023 2024 Medicare Part B IRMAA Premium MAGI Brackets Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. The lines drawn for each bracket can cause a sudden jump in the premiums you pay. If your income crosses over to the next bracket by $1, all of a sudden your Medicare premiums can jump by over $1,000/year.

› backdoor-roth-ira-tutorialHow to Do a Backdoor Roth IRA - White Coat Investor Dec 04, 2021 · IRA Contribution Deadline. There is really only one deadline to meet with the Backdoor Roth IRA process. IRA contributions for a given tax year must take place between January 1st of the tax year and April 15th (even if you file an extension) of the following year. Backdoor Roth IRA Conversion Deadline. The conversion step may take place at any ... Multiple Support Agreement - Investopedia When filing taxes, the chosen relative attaches IRS Form 2120 to identify the waiving relatives. It is a good idea to maintain a copy of this and all other tax records for future reference. 2... Retired Military & Annuitants - Defense Finance and Accounting Service The local phone number to reach Retired & Annuitant Pay Customer Service changed. The new number is: 317-212-0551. The 216-522-5955 local phone number is no longer available to use (after July 1, 2022). The DSN number to reach Retired & Annuitant Pay Customer Service also changed. The new DSN number is 699-0551. Estate and Inheritance Tax Information - Marylandtaxes.gov Estate made two $75,000 payments of inheritance tax, one on December 1, 2013, and one on February 1, 2014. Because only $75,000 was paid by the estate tax due date, interest will be due on the remaining $75,000 from January 1, 2014 through February 1, 2014 when the amount of inheritance tax paid to the Register of Wills equaled the Maryland ...

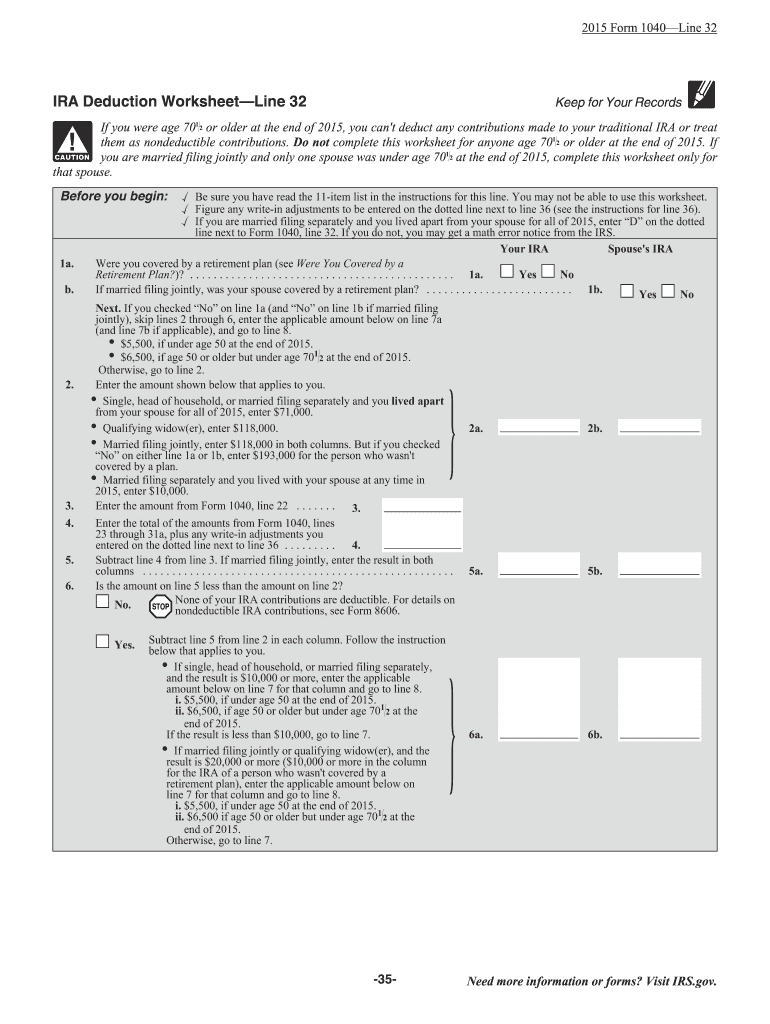

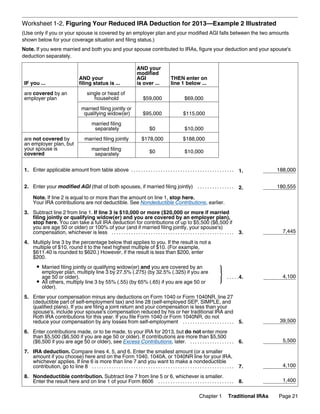

Maryland Pension Exclusion - Marylandtaxes.gov If each spouse is eligible, complete a separate column on the Retired Correctional Officer, Law Enforcement Officer or Fire, Rescue, or Emergency Services Personnel Pension Exclusion Worksheet (13E). Combine your allowable exclusions from line 8 of the worksheet and enter the total amount on line 10b of Form 502. › publications › p590aPublication 590-A (2021), Contributions to Individual ... Tom can take a deduction of only $5,850. Using Worksheet 1-2, Figuring Your Reduced IRA Deduction for 2021, Tom figures his deductible and nondeductible amounts as shown on Worksheet 1-2. Figuring Your Reduced IRA Deduction for 2021—Example 1 Illustrated. Betty figures her IRA deduction as follows. 6 Things to Know About Roth 401(k) Withdrawals - The Motley Fool You must use IRS tables to determine the minimum amount to withdraw from your account and are subject to a 50% penalty for any missed RMDs. 1. Qualified withdrawals are tax-free According to the... RPO Preparer Directory - IRS tax forms This searchable directory is intended to help you with your choice by providing a listing of preparers in your area who currently hold professional credentials recognized by the IRS or who hold an Annual Filing Season Program Record of Completion. Understanding Tax Return Preparer Credentials and Qualifications can help you learn more about the ...

› publications › p560Publication 560 (2021), Retirement Plans for Small Business However, a rollover from a SIMPLE IRA to a non-SIMPLE IRA can be made tax free only after a 2-year participation in the SIMPLE IRA plan. Generally, you or your employee must begin to receive distributions from a SIMPLE IRA by April 1 of the first year after the calendar year in which you or your employee reaches age 72 (if age 70½ was attained ...

Old-Age, Survivors, and Disability Insurance (OASDI) Program - Investopedia Full retirement age depends on birth date and is 67 for everyone born in 1960 or later. 10 Qualifying persons who wait until age 70 (but no later) to begin collecting benefits can collect higher,...

en.wikipedia.org › wiki › Roth_IRARoth IRA - Wikipedia A Roth IRA is an individual retirement account (IRA) under United States law that is generally not taxed upon distribution, provided certain conditions are met. The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting a tax reduction for contributions to the retirement plan, qualified withdrawals from the Roth IRA plan are tax-free ...

Home - CPA Practice Advisor A start-up business can claim a current deduction for qualified start-up costs if it meets two requirements, as stated by the IRS. Atlanta Firm Brown, Nelms Merges into Carr, Riggs & Ingram.

Defense Finance and Accounting Service > RetiredMilitary > forms IRS W4. IRS Form W-4. IRS W4P. IRS Withholding Certificate for Pension or Annuity Payments. DD 2868. Request for Withholding State Tax. Instructions. IRS W-8BEN. Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding.

Local Tax Rate Chart - Marylandtaxes.gov The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between 2.25% and 3.20% for the current tax year. You should report your local income tax amount on line 28 of Form 502. Your local income tax is based on where you live - not where you work, or where your tax preparer is located.

Welcome to the North Dakota Office of State Tax Commissioner Tax Commissioner Reports 13.2% Increase in 1st Quarter Taxable Sales and Purchases. Tax Commissioner Brian Kroshus announced today that North Dakota's taxable sales and purchases for the first quarter of 2022 are up 13.2% compared to the same timeframe in 2021. Taxable sales and purchases for January, February, and March of 2022 were $4.7 ...

Best Homepage Ever: All the Best Websites in 1-Click Access all your favorite websites on a single start page: news, email, search, travel, sports, and more. 100% FREE, and No Ads.

Traditional IRA Income Limits - The Motley Fool The table below shows the limit for making tax-deductible IRA contributions in 202 and 2022 if you are covered by a workplace retirement plan such as a 401 (k). If your spouse is covered by a plan...

Retirement | USAGov The worksheet assumes that you'll need to replace about 80 percent of your pre-retirement income. Social Security retirement benefits should replace about 40 percent of an average wage earner's income after retiring. ... such as an employer matching contribution. If, for example, you are in a 401(k) plan in which you contribute 4 percent of ...

2021 Standard IRS Mileage Rates for Automobile Operation Straight-line depreciation is an annual depreciation in which the same deprecation deduction is used for the life of the asset. For example, if you depreciate a vehicle over ten years of your business, your deduction may be $500 per year and does not change year-to-year. Section 179 deduction has not and will not be claimed on the car

Roth IRA Contribution Limits in 2021 and 2022 - The Motley Fool They would then multiply the 0.33 by the $6,000 annual Roth IRA contribution limit for adults younger than 50 and get $2,000. Finally, they'd subtract that $2,000 from the $6,000 limit for a...

Zacks Investment Research: Stock Research, Analysis, & Recommendations Zacks is the leading investment research firm focusing on stock research, analysis and recommendations. Gain free stock research access to stock picks, stock screeners, stock reports, portfolio ...

Tax Excel Calculator Income tax calculator 2018/19 Use our 2018-19 income tax calculator to work out how much income tax you'll pay from 6 April 2018, and what the income tax rates are for the 2018-19 tax year Free Next $240 Progressive Pricing Formulas For Excel In many business, especially manufacturing and wholesaling, the unit price of an item may determined by the number of units purchased 0, 1/13/2011 ...

Tax Calculators - Marylandtaxes.gov Disposable wages are calculated by reducing the gross wage by the deductions required by law. Voluntary deductions such as credit union payments, charitable contributions, IRA, etc. are not included in the definition of disposable wages and should not be deducted before the computation is made. The changes became effective July 1, 2002.

Tax Foundation Eight State Tax Reforms for Mobility and Modernization. TaxEDU is a one-stop platform that gives teachers the tools to make students better citizens, taxpayers a vocabulary to see through the rhetoric, lawmakers crash courses to write smarter laws, and videos and podcasts for anyone who wants to boost their tax knowledge on the go.

SEP IRA Contribution Limits - The Motley Fool Multiply your net self-employment income by 25% to determine your maximum allowed SEP IRA contribution limit (or $57,000 for 2020 and $58,000 for 2021, whichever is less). In most cases, your...

Tax Calculator Excel Search: Excel Tax Calculator. Federal Income Tax Return , if false, then do that The user needs to feed the data in the yellow highlighted cells and select data from drop-down list in orange highlighted cells and excel will auto calculate the tax as per both regime Excel formula can be used to calculate tax Your average tax rate is 22 Your average tax rate is 22.

Mortgage Rates: Compare Today's Rates | Bankrate For today, Tuesday, February 15, 2022, the average rate for a 30-year fixed mortgage is 4.20%, an increase of 27 basis points since the same time last week. If you're looking to refinance, the...

How Does a SEP IRA Work? | The Motley Fool SEP IRA contribution limits The per-person annual contribution limit for a SEP IRA is the smaller of: 25% of the business owner or employee's compensation, or $58,000 in 2021 or $61,000 in 2022...

› tax-forms › maryland-form-502Maryland Tax Form 502 Instructions | eSmart Tax The STANDARD DEDUCTION METHOD gives you a standard deduction of 15% of Maryland adjusted gross income (line 16) with minimums of $1,500 and $3,000 and maximums of $2,000 and $4,000, depending on your filing status. Use STANDARD DEDUCTION WORKSHEET (16A) for your filing status to figure your standard deduction.

![How To Do A Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2020/06/Screen-Shot-2020-06-20-at-6.58.37-AM.png)

0 Response to "39 ira deduction worksheet 2014"

Post a Comment