44 truck driver expenses worksheet

2020 Truck Driver Tax Deductions Worksheet - Fill Online, Printable ... Truck driver tax deductions include on-the-job expenses ... Truck Driver Tax Deductions Knowledgebase - TaxSlayer.com Truck drivers can claim a variety of tax deductions while on the road. Mileage, daily meal allowances, truck repair (maintenance), ... Business Expenses. Rate free truck driver deductions spreadsheet form 4.0 Satisfied 20 Votes PDF TRUCKER'S INCOME & EXPENSE WORKSHEET - Cameron Tax Services 1099s: Amounts of $600.00 or more paid to individuals (notDue date of return is January 31. Nonfiling penalty can be $150 percorporations) for rent, interest, or services rendered to you in yourrecipient. If recipient does not furnish you with his/her Social Securitybusiness, require information returns to be filed by payer.Number, you are req...

19 Truck Driver Tax Deductions That Will Save You Money You can also claim related travel expenses, such as tolls and parking fees, as long as they are part of your work. And if you're away from home for work overnight, you can even claim hotel costs. Note that for truckers, there is no per diem for lodging. You'll have to keep receipts and claim your actual expenses. Office expenses

Truck driver expenses worksheet

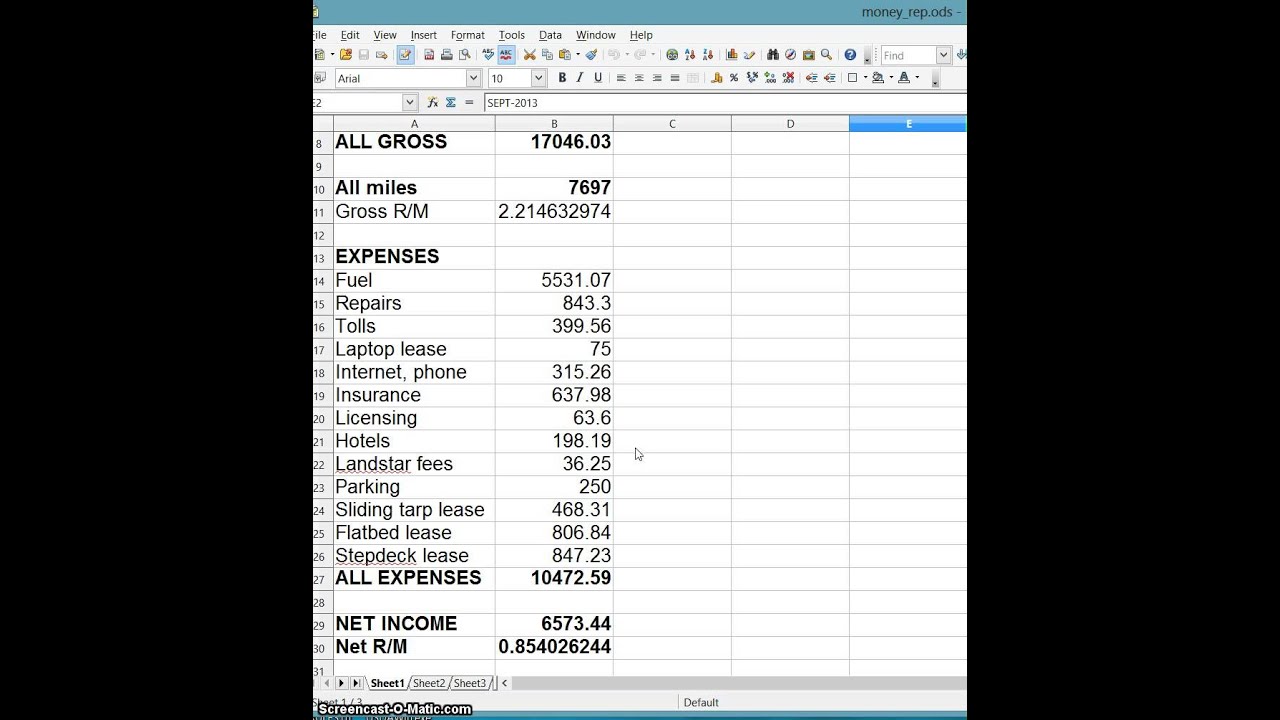

Free Trucking Expenses Spreadsheet | Know Your Operating Costs - SmartHop SmartHop's Expense Calculator is a free trucking expenses spreadsheet built to help you better understand how much it costs to run your business. Simply add in your expenses and the sheet will update to calculate your operating cost per mile, total monthly expenses, and average monthly profit after expenses. ... 5 tips to recruit new drivers ... Bookkeeping for Truckers | Free Profit & Loss Statement Template Expenses are the costs of operating a trucking company. For example; insurance, fuel, payroll & truck financing are expenses. Profit is the amount of money that is left after expenses are taken out. This can also be called net income. This is more simply put as: Revenue - Expenses = Profit or Net Income Applying Budgets to your Business Truck driver accounting software spreadsheet program from ... - DieselBoss Truck driver accounting software spreadsheet program from Dieselboss, 2021 Truck driver pay and owner operator expenses spreadsheet program for Excel All Products Fuel Prices Toll-free: 866-851-2346 The DieselBoss driver accounting Excel spreadsheet program Toggle navigation Truck Mounts for Laptops for Tablets

Truck driver expenses worksheet. Cost Per Mile - OOIDA As a general rule of thumb, the driver should earn about 30% of the total gross revenue of the truck. Since the expenses should be the other 70%, you can take the "Total Vehicle Costs", divide by 70 and multiply the result by 30 to get the "Driver's Income." Understanding owner-operator expenses and costs - Rigbooks As you probably know, fuel is the biggest cost of owning and operating a truck. Your average owner-operator spends anywhere from $50,000 to $70,000 on fuel. Figuring out how much you'll be spending on fuel is just a matter of figuring out your truck's average cost per mile (fuel cost per gallon divided by average MPG) and then multiplying ... Trucking companies, Spreadsheet, Trucking business - Pinterest Trucking Spreadsheet - The transport and freight in United states is made mostly by the road. Whether with cars, trucks or buses, a good part of the operations of companies of all sizes depends on some level of the use of those vehicles. The automotive market is one of the largest in United states and …. a spreadsheet for truckdriver expense records. [SOLVED] Re: a spreadsheet for truckdriver expense records. check out the ones at there are a bunch of trucker excel based bookkeeping and ifta programs...very easy to use, work great. Register To Reply

Truck Driver Log Book Template - Excel TMP Posted on August 28, 2017 by exceltmp. Truck driver log book template is intended to be a trucker's new closest companion. This easy to use layout can make recording your everyday assignments and exercises the simplest thing you will do out and about. The trucker logbook is accessible as a moment download on this page cordiality on exceltmp.com. How To Build a Spreadsheet for Trucking - YouTube How To Build a Spreadsheet in Trucking. #taxes #business #trucking #cdl #money #excel #spreadsheet #charts #graph #businesses #revenue #budget #income PDF Truck Driver Worksheet - Emshwiller Created Date: 1/25/2017 2:53:15 PM PDF FEDERAL TAXES and O-T-R & O-O TRUCKERS DEDUCTIONS LIST - Trucker to Trucker You CANNOT legitimately deduct the income lost as a result of deadhead/unpaid mileage…Only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. You CANNOT legitimately deduct for downtime (with some minor exceptions…ask your tax pro). You CANNOT deduct charitable contributi...

Complete List Of Owner Operator Expenses For Trucking 100,000 operating expenses /75,000 miles = 1.33 cents a mile If you want to increase profitability you can lower your costs or raise your miles (although some costs will go up accordingly). Once you get on the road, you may find that your numbers were way off, but it gives you the ability to begin to plan. PDF Trucker'S Income & Expense Worksheet &$/,)251,$ 7$; %287,48( Year T CAR and TRUCK EXPENSES (personal vehicle) T VEIDCLEl Year and Make of Vehicle Date Purchased (month, date and year) Ending Odometer Reading (December 31) Beginning Odometer Reading (January 1) - Total Miles Driven (End Odo -Begin Odo) Total Business Miles (do you have another vehicle?) Tax Deduction List for Owner Operator Truck Drivers - CDLjobs.com Truck driver tax brackets depend largely on taxable income and filing statuses, including single, married filing jointly or qualifying widow (er), married filing separately, or head of household. Professional drivers can anticipate paying more to the IRS if they were fortunate enough to cash in on rising trucker salaries. Truck Driver Tax Deductions | H&R Block As a truck driver, you must claim your actual expenses for vehicles of this type. So, you can't use the standard mileage method. To deduct actual expenses for the truck, your expenses can include (but aren't limited to): Fuel Oil Repairs Tires Washing Insurance Any other legitimate business expense

How to Calculate Cost per Mile for Your Trucking Company Variable Costs. $0.3665. Driver Salaries. $0.375. Total Cost. $1.098. Knowing your trucking company's cost per mile benefits you in many ways. It helps identify spending patterns and areas where you can cut back if needed. Cost per mile also allows you to determine an appropriate per-mile rate to charge shippers.

PDF Over-the-road Trucker Expenses List - Pstap When determining passenger vehicle expenses, you cannot use, under current IRS rules and regulations, the standard mileage rate (which is 48.5 cents per mile for 2007 and 50.5 cents per mile for 2008) for vehicles used for hire such as taxicab, bus or tractor (over-the-road trucks).

31 Best Tax Deductions for Truckers, Truck Drivers & Owner Operators 2.29 Depreciation Expenses ( Any Equipment such as Truck, Tractor, Trailer purchase) 2.30 Per Diem Expenses (Need to know Days Out of of Town) 2.31 Self Employed Health Insurance 2.32 Retirement Plan (IRA, SEP IRA, Defined Benefit Plan) 3 Conclusion: Tax Deductions for Truckers, Truck Drivers & Owner Operators

truck driver expenses worksheet 27 Car And Truck Expenses Worksheet - Worksheet Information nuviab6ae4.blogspot.com expenses Truck Driver Accounting Spreadsheet With Regard To Truck Driver db-excel.com expenses indiansocial OWNER-OPERATOR'S PAY: January 2014 - YouTube operator owner spreadsheet excel pay pertaining db

Trucking Excel Spreadsheet | Spreadsheet template business, Excel ... Save right now, this kind of absolutely free editable Trucking Excel Spreadsheet absolutely free below. Plan, plan along with make in advance so that everything can happen regularly. Personalize along with cope with your own personal information. Tend not to waste material your time and effort!

Trucking Financial Projections Template & Expenses Spreadsheet Create investor and lender-ready projections in less than one hour with a trucking expenses spreadsheet prepared by CPAs in Excel. Download your trucking income and expense Excel spreadsheet online today at ProjectionHub. ... On average, an owner-operator truck driver could expect to make $200,000 in annual revenue per year, or just under ...

0 Response to "44 truck driver expenses worksheet"

Post a Comment