43 like kind exchange worksheet

Knowledge Base Solution - How do I complete a Like Kind Exchange using ... When a like-kind exchange is entered on Like-Kind Exchanges worksheet and the "Automatic Sale" feature is used, up to five assets can be sold and new continuation assets are created for all five. To prevent the creating of the new assets click on the D-9 box 46. 1031 Like Kind Exchange Calculator - Excel Worksheet That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. Calculate the taxes you can defer when selling a property. Includes state taxes and depreciation recapture.

PDF NATP offers series of worksheets, charts for tax pros to use during tax ... NATP offers series of worksheets, charts for tax pros to use during tax season . Worksheets include AMT NOL loss computation, like-kind exchange and due diligence questionnaire . APPLETON, Wis. (Feb. 11, 2021) - Individuals preparing tax returns for 2021 are encouraged to take advantage of the abundance of resources NATP offers, including

Like kind exchange worksheet

Like Kind Exchange Calculator - cchwebsites.com Like Kind Exchange Calculator If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property. Like Kind Exchange * indicates required. IA 8824 Like Kind Exchange Worksheet 45-017 - Iowa Stay informed, subscribe to receive updates. Subscribe to Updates. Footer menu. About; Contact Us; Taxpayer Rights; Website Policies Asset Worksheet for Like-Kind Exchange - ttlc.intuit.com Asset Worksheet for Like-Kind Exchange I have exchanged a rental property, which had Asset Worksheets (for example) for House, Renovation, Roof, and Land. The new property has Building (27.5 yrs), Site Improvements (15 yrs), and Land. I've got the entries in Schedule E for both the relinquished and replacement properties, as well as the 8824 ...

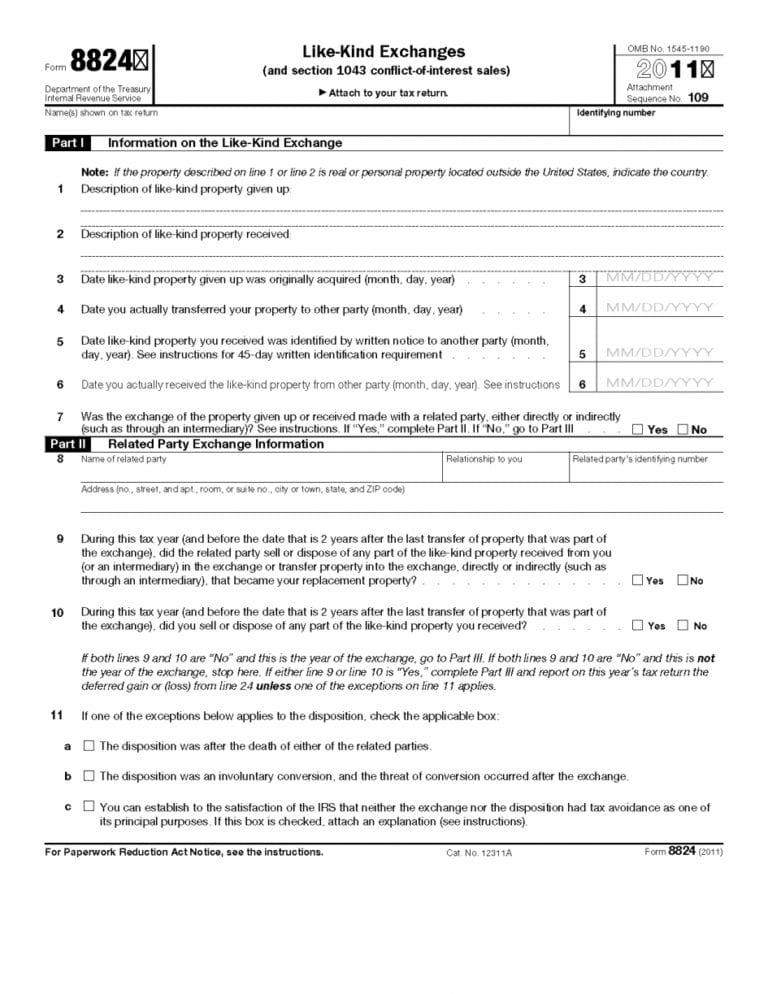

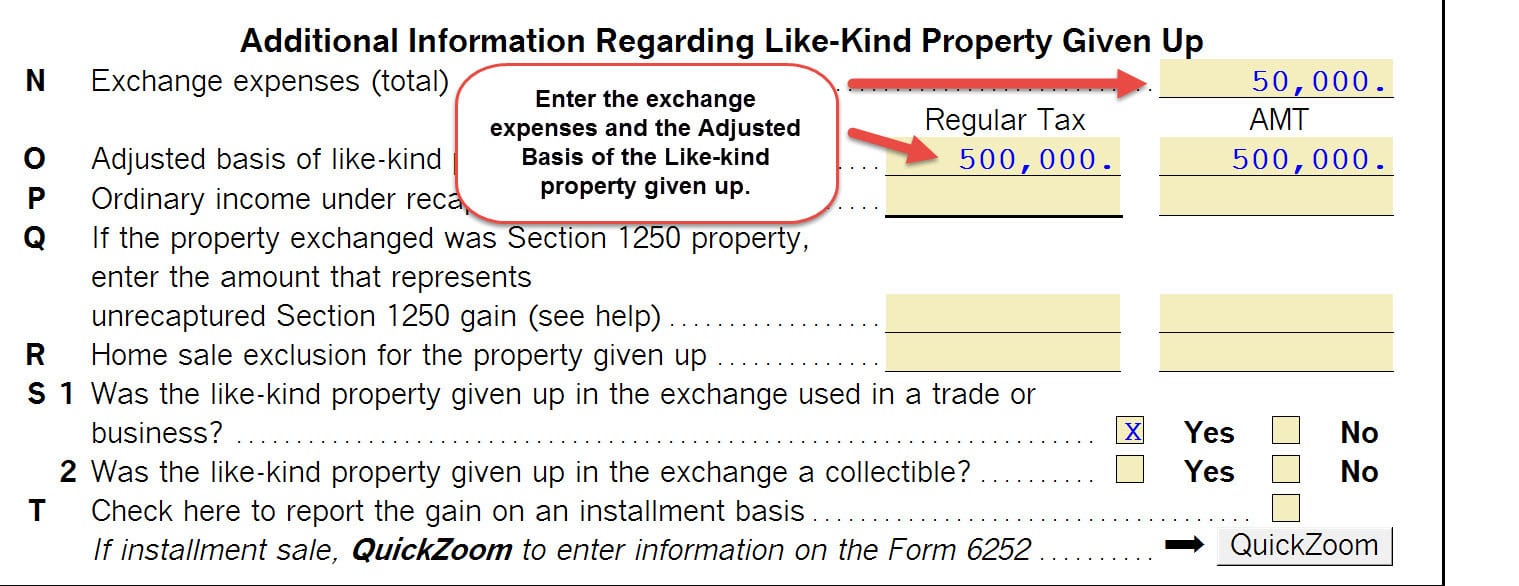

Like kind exchange worksheet. Knowledge Base Solution - How do I complete a like-kind exchange in a ... How do I complete a like-kind exchange in a 1040 return using worksheet view in CCH Axcess™ Tax and CCH® ProSystem fx® Tax? Go to the Income/Deductions > Rent and Royalty worksheet. Select section 7 - Depreciation and Amortization and select Detail . Select section 1 - General . Line 23 - Sale ... Completing a like-kind exchange in the 1040 return - Intuit Completing a like-kind exchange in the 1040 return Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded. Scroll down to the... Step 2: Completing the 8824 Open the 8824. In the Form 8824 General Information Smart Worksheet complete lines A-C. In... Step ... How to Calculate Basis on Like Kind Exchange | Pocketsense Finding the New Cost Basis. Subtract the amount realized from the cost basis of the new property and add the depreciated basis back in. In this example, you'd subtract $149,080 from $197,150 to find out that you put $48,070 of new value in, then add back the old property's depreciated value of $71,625 to find a new basis of $119,695. About Form 8824, Like-Kind Exchanges | Internal Revenue Service About Form 8824, Like-Kind Exchanges. Use Parts I, II, and III of Form 8824 to report each exchange of business or investment property for property of a like kind. Certain members of the executive branch of the Federal Government and judicial officers of the Federal Government use Part IV to elect to defer gain on conflict-of-interest sales.

Solved: Like-Kind Exchange - Intuit The property I relinquished in the like-kind exchange is being reported in form 4797, "Sale of Business Property". There are two entries for the same property that was relinquished: I see that the two entries amount to the improvements and the current list of depreciating assets. The second entry is the land amount, when I purchased the property. PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 - 1031 The Exchange is reported on IRS Form 8824, Like-Kind Exchanges. The Form 8824 is divided into four parts: Part I. Information on the Like-Kind Exchange Part II. Related Party Exchange Information Part III. Realized Gain or (Loss), Recognized Gain, and Basis of Like-Kind Property Received Part IV. PDF WorkSheets & Forms - 1031 Exchange Experts Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 A. Depreciation taken in prior years from WorkSheet #1 (Line D)$ _____ B. Taxable gain from ... PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Date Closed Taxpayer Exchange Property Replacement Property Form 8824 Line 15 Cash and Other Property Received and Net Debt Relief Net cash received (line 21) $ 1 Net debt relief (line 30) 2 Less net cash paid (line 22) ( ) 3 Total to Form 8824 Line 15 (not less than zero) $ 4

Like Kind Exchange Worksheet - The Math Worksheets Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement like-kind asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset. It was coming from reputable online resource which we like it. Like-Kind Exchange Definition - Investopedia A like-kind exchange is used when someone wants to sell an asset and acquire a similar one while avoiding the capital gains tax. Like-kind exchanges are heavily monitored by the IRS and require... 1031 Exchange Examples: Like-Kind Examples to Study & Learn From Example 3. You own a $4,000,000 investment property with a tax basis of $3,500,000 — meaning that you have a $500,000 capital gain. You would like to do a 1031 exchange into a $3,800,000 7-Eleven in Newport News, Virginia. If you exchange your $4,000,000 property for the $3,800,000 7-Eleven. Therefore, a taxable cash boot of $200,000 is realized. 1031 Exchange Examples | 2022 Like Kind Exchange Example 37.3%. $606,625. (1) Federal Capital Gains equal to Realized Gain less depreciation taken multiplied by the applicable rate. (2) Based on amount of depreciation taken during ownership of the property. In this example,the amount is based on $400,000 of depreciation taken. (3) Rate varies by state.

Like Kind Exchange Vehicle Worksheet And Like Kind ... - Pruneyardinn Worksheet April 17, 2018. We tried to get some amazing references about Like Kind Exchange Vehicle Worksheet And Like Kind Exchange Example With Boot for you. Here it is. It was coming from reputable online resource and that we enjoy it. We hope you can find what you need here.

Accounting for 1031 Like-Kind Exchange - BKPR Assume you own a piece of land in California (valued at $100,000) and you enter into a like-kind exchange to acquire another property in Colorado (also valued at $100,000). In a pure like-kind transaction like this, you can record the transaction as follows: Debit: Land (new) $100,000. Credit: Land (old) $100,000.

Like Kind Exchange Calculator - Considine & Considine Like Kind Exchange Calculator. If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property.

What is IRS Form 8824: Like-Kind Exchange - TurboTax Both can affect your taxes. But if you immediately buy a similar property to replace the one you sold, the tax code calls that a "like-kind exchange," and it lets you delay some or all of the tax effects. The Internal Revenue Service (IRS) uses Form 8824 for like-kind exchanges. TABLE OF CONTENTS.

IRC 1031 Like-Kind Exchange Calculator This calculator will help you to determine how much tax deferment you can realize by performing a 1031 tax exchange instead of a taxable sale. We also offer a 1031 deadline calculator. For your convenience we list current Redmond mortgage rates to help real estate investors estimate monthly loan payments & find local lenders.

PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form ... - 1031 Like-Kind Exchanges. The Form 8824 is divided into four parts: Part I. Information on the Like-Kind Exchange Part II. Related Party Exchange Information Part III. Realized Gain or (Loss), Recognized Gain, and Basis of Like-Kind Property Received Part IV. Not used for 1031 Exchange - Used only for Section 1043 Conflict of Interest Sales.

Like-Kind Exchange Worksheet - Thomson Reuters Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement "like-kind" asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset.

Completing a Like Kind Exchange for business returns in ProSeries - Intuit A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded.

Like-kind Exchanges of Personal Property | IDR - Iowa The Department has created the IA 8824 worksheet for use in tax years 2017, 2018, and 2019, to aid taxpayers in applying and documenting like-kind exchanges of personal property for Iowa tax purposes, and in calculating and reporting the required Iowa income tax adjustments resulting from such exchanges. Taxpayers who elect a tax-deferred like ...

Like-Kind Exchange (Meaning, Rules)| How Does 1031 Works? - WallStreetMojo Explanation. A like-kind exchange is a transaction to defer the capital gain tax arising in the transaction of sale of an asset when it can be shown that the proceeds are being used to acquire another asset in the place of the first-mentioned asset. It is called the 1031 exchange because Section 1031 of the Internal Revenue Code exempts the seller of an asset when the sale proceeds are reinvested in assets of value equal or higher.

PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms taxpayer exchanges for like-kind property of lesser value. This fact sheet, the 21. st in the Tax Gap series, provides additional guidance to taxpayers regarding the rules and regulations governing deferred like-kind exchanges. Who qualifies for the Section 1031 exchange? Owners of investment and business property may qualify for a Section 1031 deferral. Individuals,

Asset Worksheet for Like-Kind Exchange - ttlc.intuit.com Asset Worksheet for Like-Kind Exchange I have exchanged a rental property, which had Asset Worksheets (for example) for House, Renovation, Roof, and Land. The new property has Building (27.5 yrs), Site Improvements (15 yrs), and Land. I've got the entries in Schedule E for both the relinquished and replacement properties, as well as the 8824 ...

IA 8824 Like Kind Exchange Worksheet 45-017 - Iowa Stay informed, subscribe to receive updates. Subscribe to Updates. Footer menu. About; Contact Us; Taxpayer Rights; Website Policies

Like Kind Exchange Calculator - cchwebsites.com Like Kind Exchange Calculator If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property. Like Kind Exchange * indicates required.

0 Response to "43 like kind exchange worksheet"

Post a Comment