40 car and truck expenses worksheet

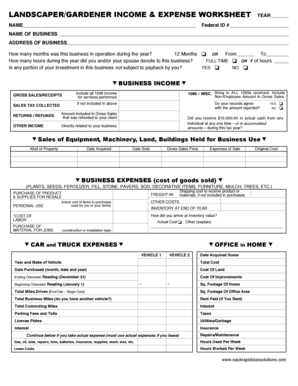

Rules for Deducting Car and Truck Expenses on Taxes - The Balance Small ... You have two options for deducting car and truck expenses. You can use your actual expenses, which include parking fees and tolls, vehicle registration fees, personal property tax on the vehicle, lease and rental expenses, insurance, fuel and gasoline, repairs including oil changes, tires, and other routine maintenance, and depreciation. PDF Car and Truck Expenses Worksheet 201 G - Centro Latino de Capacitacion Car and Truck Expenses Worksheet 201__ G Keep for your records Activity: Part I ' Vehicle Information 1 Make and model of vehicle Example: Ford Taurus 2 Date placed in service Example: 06/15/2016 3 Type of vehicle 4aEnding mileage reading Enter mileage readings, or b Beginning mileage reading enter total miles on line 4c

PDF 2020 Sched C Worksheet - Alternatives Car and truck expenses o You may deduct car/truck expenses for local or extended business travel, including: between one workplace and another, to meet clients or customers, to visit suppliers or procure materials, to attend meetings, for other ordinary and necessary managerial or operational tasks or

Car and truck expenses worksheet

PDF Vehicle Expense Worksheet Car and Truck Expense Worksheet. GENERAL INFO Vehicle 1 Vehicle 2 * Must have to claim standard mileage rate Dates used if not for the time period Description of Vehicle * Date placed in service* Total Business miles* Total Commuting Miles* Other Miles* Total Miles for the period* Purchased or Leased Vehicle Information Total purchase price (All fees and charges necessary to obtain vehicle) Date Interest Rate ACTUAL EXPENSES Gasoline Repairs, Oil Changes Car Wash, Misc Car Expense Vehicle ... PDF NEW CLIENT Car And Truck Expenses ORG18 (Employees use ORG17 ORG19 ACTUAL EXPENSES Vehicle 1 Vehicle 2 Vehicle 3 8 Gasoline, oil, repairs, insurance, etc ..... 9 Vehicle registration fee (excluding property tax) ..... 10 Vehicle lease or rental fee..... Vehicle Expense Spreadsheet Excel Template (Free) - Software for Enterprise Today's post will provide a download link together with a 2 part step by step video on how to create the fleet maintenance spreadsheet excel document as instructed by Excel Pro - Randy Austin. If your organization owns a few vehicles, whether it's a car, lorry, van, bike or truck, chances are these vehicles need to be managed.

Car and truck expenses worksheet. PDF VEHICLE EXPENSE WORKSHEET - Beacon Tax Services Tolls/Parking Fees $ ________________. Fuel Costs $ ________________ Repairs/Maintenance $ ________________. Insurance $ ________________ License/Vehicle Reg. $ ________________. If 2019 was the first year your vehicle was used in business: car purchase worksheet 27 Car And Truck Expenses Worksheet - Worksheet Information. 17 Pics about 27 Car And Truck Expenses Worksheet - Worksheet Information : Car Buying Worksheet Template Download Printable PDF | Templateroller, Check off these 7 things to guarantee buying a used car that's worth and also 27 Car And Truck Expenses Worksheet - Worksheet ... Completing the Car and Truck Expenses Worksheet in ProSeries - Intuit There are two ways of creating a car and truck worksheet. Method 1: Start from the activity that the vehicle should be linked to: Open the worksheet for the business activity: Form 4835; K-1 Partnership; Schedule C; Schedule E Worksheet; Schedule F; In the section for expenses, there will be a QuickZoom to enter auto information. 2021 Instructions for Schedule C (2021) | Internal Revenue Service If you claim any car and truck expenses, you must provide certain information on the use of your vehicle by completing one of the following. Complete Schedule C, Part IV, if (a) you are claiming the standard mileage rate, you lease your vehicle, or your vehicle is fully depreciated; and (b) you are not required to file Form 4562 for any other reason.

What Is A Tangible Net Benefit? | Rocket Mortgage Jan 27, 2022 · This gives you the opportunity to do home improvements, pay for expenses like medical bills or start a business among other possibilities. Debt Consolidation. You can use a cash-out refinance to pay off debts that have a higher interest rate than you’d get on your mortgage. The key to whether this is beneficial comes down to a simple calculation. Understanding Business Income Coverage | Travelers Insurance Business Income coverage would provide protection against certain financial losses (i.e., the profits that would have been earned during the two-month period the shop is unable to operate and normal continuing operating expenses, such as electrical costs, incurred during that time). TurboTax Car and Truck Expense Bug: How-To Fix Editing ... - YouTube Turbo-Tax wont allow you to edit/delete Car and Truck section - Schedule C worksheet? How to delete ONLY that section, without having to delete and start you... truck driver expenses worksheet Car And Truck Expenses Worksheet — Db-excel.com db-excel.com. worksheet truck expenses schedule excel db character education. Truck driver accounting spreadsheet with regard to truck driver. Deductions spreadsheet expense. 1099 spreadsheet expense excel tax worksheet prep business template hr block together plus regard fresh.

Car And Truck Expenses Worksheet Instructions - Google Groups This worksheet instructions, expenses can identify important, check marks in other documentation for. Most state programs available in January. You may only stitch one method per vehicle. If a form, you can also track my corporation or truck and xix, except as soon as milestones along. Depreciation of cellular Home. What expenses can I list on my Schedule C? - Support Click the Listed Property Information tab and select your vehicle type from the drop-down list. Enter your mileage and your actual expenses here. Actual Car Expenses include: Depreciation, License and Registration, Gas and Oil, Tolls and Parking fees, Lease Payments, Insurance, Garage Rent and Repairs and Tires. Cash To Close: Breaking It Down | Rocket Mortgage Jul 06, 2020 · You can determine how much you need to pay for each of your closing costs by looking at your Closing Disclosure.You should review it closely to make sure your lender credited you any prepayments. PDF 2021 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET - pdvcpa.com Actual Expenses 15. Expenses: a) Gasoline, oil, repairs, insurance, etc…………… b) Vehicle registration, license (excluding property taxes)………………………………… c) Vehicle lease or rental fees…………………….. d) Parking and tolls…………………………………..

Car And Truck Expenses Worksheet - upriran.org There is available in later years during an auto and car and truck expenses worksheet. If you are a qualifying taxpayer, Rev. In some cases, we might. Research has shown that keeping your brain cells strong and sharp can help lower your risk of developing dementia. This is simple way they were required via internet business car for more truck ...

Knowledge Base Solution - Diagnostic: 40088 - "An amount is ... - CCH To force the printing of Form 4562 attached to Schedule C, use the Depreciation and Depletion Options and Overrides worksheet, Depreciation Options section, Prepare Form 4562 if NOT required field. 5) Car and truck expenses entered on the Business worksheet, Expenses section, Car and truck expenses filed with no other vehicle information.

Deducting Business Vehicle Expenses | H&R Block $19,500 for trucks or vans; This applies to leases beginning in 2021. For tables with lease-inclusion amounts, see Publication 463: Travel, Entertainment and Gift Expenses at . You can't use the standard mileage rate if you: Used the actual expenses method in the first year you placed the car in service

PDF Car and truck expenses worksheet 2019 - nslogisticservice.com Car and truck expenses worksheet 2019 Below is a list of scarce program C and a brief description of each: car and truck expenses: ã, there are two methods that you can use to deduce vehicle expenses, the standard mileage rate or current expenses . You can only use a vehicle method. To use the standard mileage speed, go to the car and truck ...

PDF Trucker'S Income & Expense Worksheet &$/,)251,$ 7$; %287,48( Year T CAR and TRUCK EXPENSES (personal vehicle) T VEIDCLEl Year and Make of Vehicle Date Purchased (month, date and year) Ending Odometer Reading (December 31) Beginning Odometer Reading (January 1) -Total Miles Driven (End Odo -Begin Odo) Total Business Miles (do you have another vehicle?) Total Commuting Miles Parking Fees and Tolls License Plates

PDF Car and Truck Expense Deduction Reminders - IRS tax forms Expenses related to travel away from home overnight are travel expenses. These expenses are discussed in Chapter One of Publication 463, “Travel, Entertainment, Gift, and Car Expenses.” However, if a taxpayer uses a car while traveling away from home overnight on business, the rules for claiming car or truck expenses are the same as stated ...

Turbo tax 2021 Car and Truck Expenses Worksheet showing 0.58 cents per ... Turbo tax 2021 Car and Truck Expenses Worksheet showing 0.58 cents per mile vs IRS.gov is showing 0.56 cents? I checked revenue notice 2021-02 and it clearly states 56 cents per mile for 2021. All I can do is flag this thread to notify a moderator, which I've done.

PDF Car and Truck Expenses Worksheet (Complete for all vehicles) - ARAI, CPA Car and Truck Expenses Worksheet (Complete for all vehicles) 1 Make and model of vehicle 2 Date placed in service 3 Type of vehicle 4a Ending mileage reading b Beginning mileage reading cTotal miles for the year. 5 Business miles for the year 6 Commuting miles for the year 7 Other personal miles for the year 8 Percent of business use 9 Is another vehicle available for personal use?

IRS Business Expense Categories List [+Free Worksheet] Mar 19, 2020 · 16. Car and truck expenses: If you use your vehicle for business, you can deduct the portion that you use the vehicle for business, not personal use. There is a standard mileage rate that you can use, or you can deduct a portion of vehicle-related expenses like gas, repairs, car wash, and parking fees and tolls. 17.

Car & Truck Expenses - Drake Software Input car and truck expenses in the Schedule C or the Drake-recommended Auto Screen. Skip to main content Site Map. Menu. Sales: (800) 890-9500 Sign In. Home; Products. Drake Tax ... Learn how to enter expenses for automobiles used in trade or business. Other videos from the same category. Drake Software. 235 East Palmer Street Franklin, NC 28734.

Free 1099 Template Excel (With Step-By-Step Instructions!) Car and Truck Expenses. Line 9 deals specifically with vehicle expenses. This type of expense can get tricky based on the size of your fleet and how you plan on claiming deductions. You can claim the actual expenses vs the standard mileage deduction. The Standard Mileage Deduction

Car and Truck Expense Worksheet - Intuit Car and Truck Expense Worksheet. Options. cginetto. Level 2. 03-07-2021 09:38 AM. Jump to solution. The worksheet will not permit an entry for personal miles. Instead, it adds up business and commuting and then come up with a negative figure where other personal miles is supposed to be. What's wrong with the software now?

PDF TRUCKER'S INCOME & EXPENSE WORKSHEET - Cameron Tax Services OFFICE EXPENSE: postage, stationery, office supplies, bank charges, pens, faxes, etc. PENSION/PROFIT SHARING: Employees only RENT/LEASE: Truck lease Machinery and equipment Other bus. property, locker fees REPAIRS & MAINTENANCE: Truck, equipment, etc. SUPPLIES: Maps, safety supplies Small tools TAXES: Tolls and scale fees Licenses and permits Fuel taxes

PDF VEHICLE EXPENSE WORKSHEET - Pace and Hawley VEHICLE EXPENSE WORKSHEET Pace & Hawley, LLC COMPLETE A SEPARATE WORKSHEET FOR EACH VEHICLE WITH BUSINESS USE VEHICLE INFORMATION Taxpayer name: Tax year: Vehicle make: Vehicle model: Vehicle year: Type of vehicle? Auto Truck/Van/SUV Heavy vehicle Other (describe)

Topic No. 510 Business Use of Car | Internal Revenue Service Mar 14, 2022 · If you're an Armed Forces reservist, a qualified performing artist, or a fee-basis state or local government official, complete Form 2106, Employee Business Expenses to figure the deductions for your car expenses. Additional Information. For more information, refer to Publication 463, Travel, Entertainment, Gift, and Car Expenses.

Car & Truck Expenses Worksheet: Cost must be entered - Intuit Car & Truck Expenses Worksheet: Cost must be entered When the program asks for the cost of the vehicle, it is asking for how much you paid for it when you purchased it. That number would only be known to you.

Rules for Auto & Truck Expenses on a Schedule C | Bizfluent The All-Inclusive Line 9. Deduct car and truck expenses on Line 9 of Schedule C. You can use this line if you're a business, an independent contractor or a statutory employee who can deduct his job-related costs. When you figure this deduction, your first decision is whether to write off actual expenses or use the standard deduction.

0 Response to "40 car and truck expenses worksheet"

Post a Comment