45 understanding a credit card statement worksheet answers

16 Free Banking Worksheets PDF (Teach Kids how to Use Banks) Very important banking life skill! 2. TD's How to Balance a Checkbook. Suggested Age: 6-8 grades. Use this TD lesson plan and worksheet to teach students how to balance a checkbook. They'll then be given a case study of someone's spending, and need to balance that person's checkbook with the provided worksheet. 3. PDF Financial Literacy Credit Basics Worksheet Answer Key The Basics of Credit 1. It is doubtful today's consumer would give up the convenience of carrying a credit card they can use at virtually any location. 2. Some people do it for the convenience of not carrying cash, while others use credit to make purchases they can't actually afford. 3.

credit card statement worksheet answers 36 Credit Card Activity Worksheet - Combining Like Terms Worksheet chripchirp.blogspot.com. 31 Understanding A Credit Card Statement Worksheet Answers - Support martindxmguide.blogspot.com. solved. Bank Reconciliation Exercises And Answers Free Downloads . bank exercises reconciliation answers cashbook visa account ...

Understanding a credit card statement worksheet answers

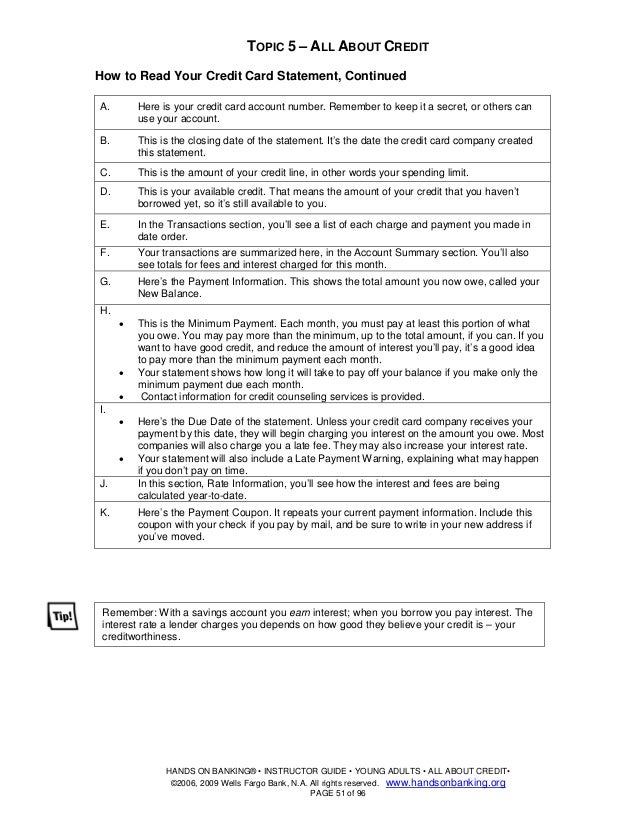

Credit Card Statement Lesson Plan Worksheet - Money Instructor This is a random worksheet that includes a person's credit card transactions for the month, and his or her monthly credit card statement. It is the student's task to answer the questions on identifying the parts of the credit card statement. Note: Transactions in this worksheet do not include "payments". ie. A payment is not a transaction. Credit Card Statement Worksheet | Mathematics - Quizizz If John pays only the minimum payment, how many months will it take him to pay off this credit card, assuming he makes no further purchases? answer choices. 12 ... Understanding Credit Cards: A Beginner's Guide (2022) Your monthly card statement is a summary of your card activity for one payment cycle. The most important information in your statement is: Your balance Your minimum payment Your payment due date Card statements aren't all alike, but most also show: Payments you made Purchases you made Credits you received (e.g., for purchases you returned)

Understanding a credit card statement worksheet answers. UNDERSTANDING A CREDIT CARD STATEMENT Quiz.docx Refer to the credit card statement to answer the following questions. What is the current APR for purchases, balance transfers, and cash advances? PDF Understanding Credit Card Statement Worksheet Understanding a Credit Card Statement Total Points Earned Name 15 Total Points Possible Date Percentage Class Directions: Refer to the provided credit card statement to answer the following questions. 1. What is the current APR for purchases, balance transfers, and cash advances? How to Read a Credit Card Statement | 101 Guide - finder CA 1. The statement period. Your statement period is usually listed in the top left-hand corner of your statement. If you wish to make use of your card's interest-free days, understanding your statement period is essential. One common mistake many credit card users make is assuming that interest-free days start applying from the date of the ... PDF Student Activities - Practical Money Skills understanding credit student activity 7-4b cont. the credit card statement name: date: SEND PAYMENT TO Box 1234 Anytown, USA CREDIT CARD STATEMENT ACCOUNT NUMBER NAME STATEMENT DUE PAYMENT DUE DATE 4125-239-412 John Doe 2/13/19 3/09/19

Monthly Credit Card Statement Walkthrough - The Balance Khadija Khartit. Credit card issuers have a legal requirement to send your monthly credit card statement at least 21 days before your minimum payment due date. 1 Billing statements usually consist of one or two pages containing a good deal of information about what you've charged, how much you paid last month, what payment you need to make ... PDF Understanding a Credit Card Statement - LPS Directions: Refer to the provided credit card statement to answer the following questions. 1. What is the current APR for purchases, balance transfers, and cash advances? (3 points) 2. What was the total amount of interest charged for this billing cycle? How much of this interest was charged to purchases? Understanding credit cards unit Flashcards - Quizlet 13% because that is what the credit card company charges to use the card What are the three main steps in obtaining a credit card? 1. Shop around- find the card that fits your needs 2. Complet a credit application- this will be at a bank or online. It's easy 3. Approval- you can be pre-approved or you can be deterred because of your credit history understandingCreditCardStatementWorksheet.1589931568.pdf - Course Hero Page | 27 1.4.1.A4 By educators… for educators Understanding a Credit Card. Study Resources. Main Menu; by School; by Literature Title; by Subject; by Study Guides ... for educators Understanding a Credit Card Statement Total Points Earned Name 15 Total Points Possible Date Percentage Class Directions: Refer to the provided credit card ...

Credit and Credit Card Lesson Plans, Consumer Credit ... - Money Instructor CREDIT AND Credit Cards. This section includes lessons on consumer credit cards, credit, and paying interest. Learn about credit with an introduction to credit cards, reading a credit card statement, and advanced lessons regarding incorrect credit card transactions. Also, see our spending money category for more consumer related material. Understanding Credit Cards Flashcards - Quizlet Understanding a credit card for personal finance: key terms. Terms in this set (17) Annual Fee A yearly fee that may be charged for having a credit card. Annual Percentage Rate (APR) The cost of credit expressed as a yearly interest rate. Balance Transfers The act of transferring debt from one credit card account to another. Credit Limit PDF Analyzing credit card statements - Consumer Financial Protection Bureau Analyzing credit card statements Understanding what's on a credit card statement can help you to remain financially responsible while paying your bills on time, paying the appropriate amount, and using a credit card as a tool to manage your money. Instructions Visit MyCreditUnion.gov's interactive credit card statement to answer the ... Understanding a Credit Card - SlideShare 29. Credit Card Interest Rates and Interest Charges Annual Percentage Rate (APR) for Purchases 12.99%, 13.99% or 14.99%, introductory APR for one year, based on your creditworthiness. After that, your APR will be 14.99%. This is a variable-rate APR that will vary with the market based on the Prime Rate.

Understanding a Credit Card Information Sheet 1.4.1 - Quia Applying for only credit cards that are needed Keeping track of all charges by keeping receipts Checking the monthly credit card statement for errors N Making late credit card payments (this may trigger penalty fees, a higher penalty interest rate, and will hurt the credit

PDF Understanding A Credit Card - wa-appliedmath.org Explain the credit card application and approval process. Analyze a credit card statement. Understand the protections and rights available to credit card holders. Review safety tips when using credit cards. Introduction Twenty-one year old Jenny felt rich when she received her first credit card during her junior year of college. She charged

4.3.a Understanding a Credit Card Statement_Sierra Slade Once you answer the questions submit a screenshot in the submit area. 1. What is the current APR for purchases, balance transfers, and cash advances? (3 points) 16.99% 16. 99 % 2. What was the total amount of interest charged for this billing cycle? How much of this interest was charged to purchases?

Understand Your Credit Card Statement | MyCreditUnion.gov A credit card statement is a summary of how you've used your credit card for a billing period. If you've ever looked at credit card statements, you know how difficult they can be to read. Credit card statements are filled with terms, numbers and percentages that play a role in the calculation of your total credit card balance.

0 Response to "45 understanding a credit card statement worksheet answers"

Post a Comment