45 1031 like kind exchange worksheet

How Do Taxes Affect Auto Trade-Ins? - KLR Starting in 2018, the like-kind exchange treatment was limited to the exchange of real property. Exchanges of vehicles after Dec. 31, 2017 may involve a taxable gain or a loss. Gain or loss is recognized on the vehicle traded-in depending upon the trade-in value and remaining basis in it. How Do I Avoid Capital Gains Tax When Selling a House? If you acquired the property through a 1031 ("like-kind") exchange or if you're subject to expatriate tax, then you aren't eligible to benefit for the maximum exclusion of gain under Section 121. ... Use Worksheet 1 in IRS Publication 523 to calculate your exclusion limit, and use Worksheet 2 in Publication 523 to calculate your gain or ...

bkpr.com › accounting-for-1031-like-kind-exchangeAccounting for 1031 Like-Kind Exchange - BKPR A Section 1031 or like-kind exchange is an income tax concept. It applies when you swap two real estate properties with the same nature or character. Even if the quality or grade of these properties differs, they may still qualify for like-kind exchange treatment. Personal Property Not Qualified for Like-Kind Exchange

1031 like kind exchange worksheet

› 1031-exchange-calculator1031 Like Kind Exchange Calculator - Excel Worksheet 1031 Like Kind Exchange Calculator - Excel Worksheet Smart 1031 Exchange Investments We don't think 1031 exchange investing should be so difficult That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. 1031 Exchange Update - Tax Relief for areas affected by Hurricane Ida ... The CA Notice also covers other time sensitive actions, including those in Rev. Proc. 2018-58, which covers the deadlines applicable to Section 1031 like-kind exchanges. Disaster Relief and 1031 Exchanges. It is important for taxpayers who are utilizing a 1031 exchange ("Exchangers") to understand the effects of Federally declared disasters ... Like-kind exchanges of real property - Journal of Accountancy The taxpayer pays $198,000 less in tax using a Sec. 1031 exchange versus an outright sale, a significant reduction from the $378,870 in tax savings that would accrue from using a like - kind exchange under the current rules; however, the like - kind exchange is still the better option.

1031 like kind exchange worksheet. Many changes in store for Form 1040 and related schedules Line 8 from the 2020 Schedule 2 is now divided into line 11, "Additional Medicare Tax," for the tax from Form 8959, Additional Medicare Tax, and line 12, "Net Investment Income Tax," for the tax from Form 8960, Net Investment Income Tax — Individuals, Estates, and Trusts. Line 8c, "Other Taxes," from 2020 has been divided up into lines 13 ... 1031 Exchange Rules 2022: How To Do A 1031 Exchange? The 1031 Exchange allows you (as an investor) to postpone paying capital gains taxes on the sale of investment property. Taxes on capital gains might be as high as 20-30% in a typical sale. Those taxes, however, can be avoided if the proceeds of the sale are reinvested according to the rules outlined in IRC 1031. › gainscalculation1031 Exchange Calculator | Calculate Your Capital Gains (As of 7/2019) Example and Explanation of the Like-Kind Exchange Analysis: A rental property has a selling price of $500,000 and will have selling costs of $40,000. The property cost $150,000 when purchased ten years ago. No depreciable improvements have been made. The estimated depreciation taken is $45,000. D. Exchange Reinvestment Requirements How Do You Calculate Basis for a 1031 Exchange? The $95,000 amount is the value added to the exchange. Add the relinquished property's depreciated amount to this value: + $272,460 = $367,460 The above figure is the new cost basis. Because this is a 1031 exchange, taxes on any gain will be deferred. You can continue to defer taxes on gains by doing 1031 exchanges for as long as you want.

Solved: 1031 exchange - Intuit Accountants Community A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded. Realized vs Recognized Gain in 1031 Exchange - NetLease World When performing an exchange under the 1031 Section of the Revenue Code, there are some requirements for the real estate property types. The current property the investor is planning to sell should be similar to the real estate property for purchase. Moreover, the latter should be of the same or greater price than the currently owned property. 1031 Exchange Calculator with Answers to 16 FAQs! A 1031 exchange means that an investor has reinvested the sale proceeds in a new like-kind property to defer all capital gain taxes. This is a "popular term " for signifying the capital gains tax exemption law enshrined under 1031 of the Internal Revenue Code . IRC Section 1031 (a) (1) states as under : › 1031-exchange-examples1031 Exchange Examples | 2022 Like Kind Exchange Example (1) Federal Capital Gains equal to Realized Gain less depreciation taken multiplied by the applicable rate. (2) Based on amount of depreciation taken during ownership of the property. In this example,the amount is based on $400,000 of depreciation taken. (3) Rate varies by state. Example assumes California.

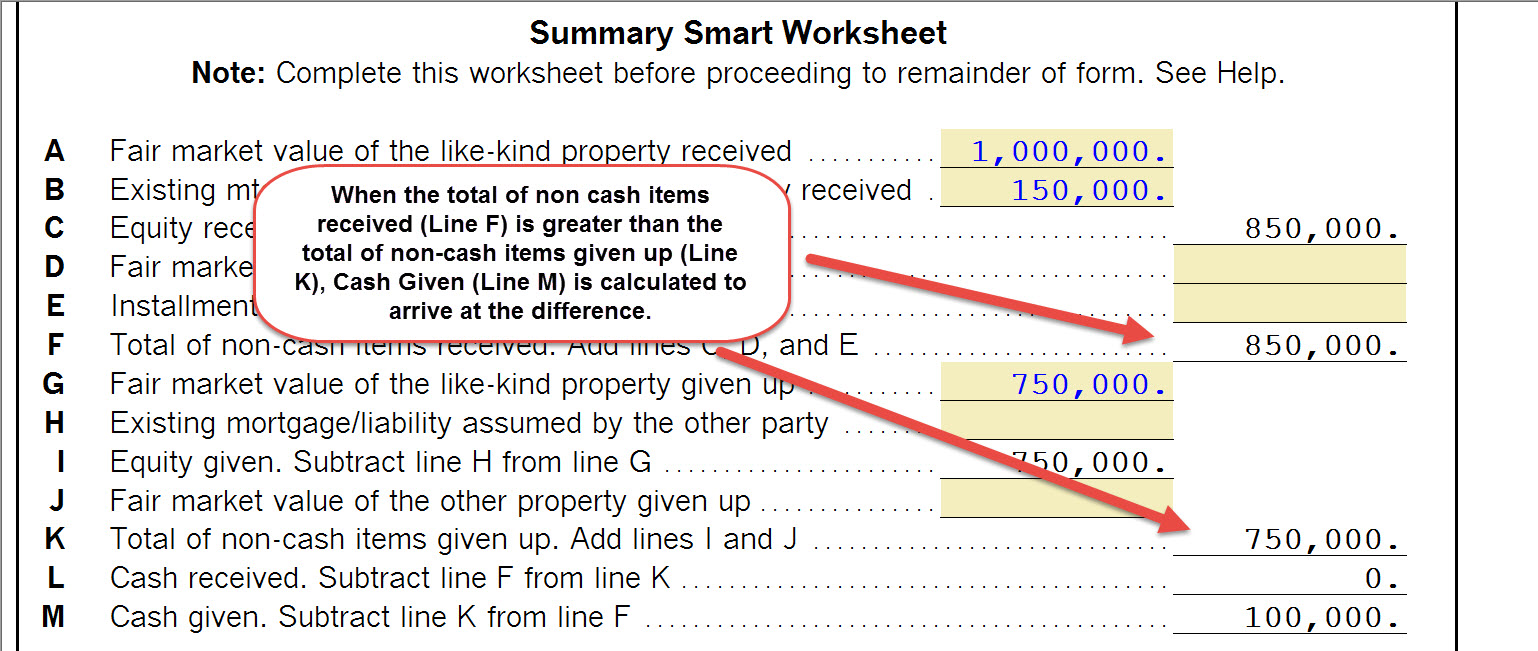

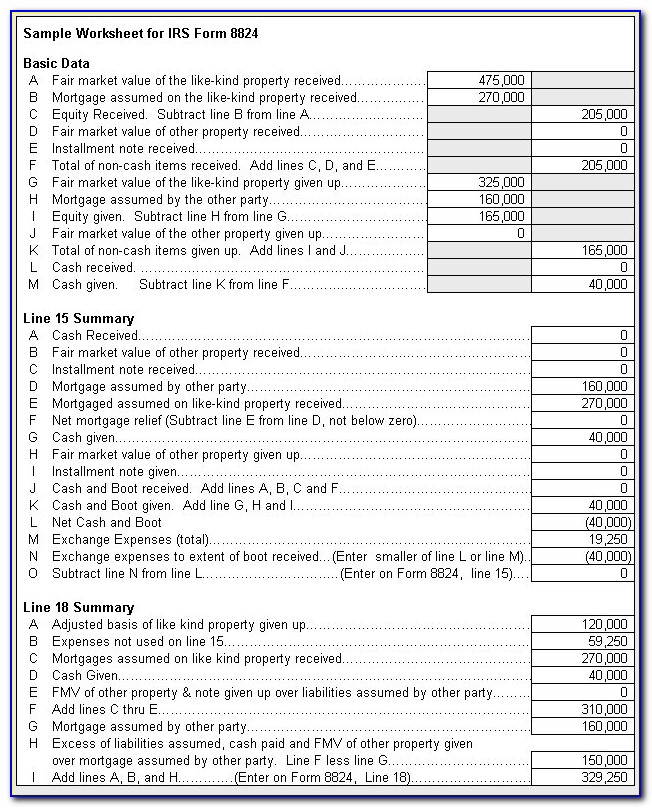

1031 Exchange Rules: All or Nothing? - 1031 Crowdfunding A partial 1031 exchange follows all the same rules as a standard 1031 exchange. These rules include: • Like-kind property: Your replacement property must be considered "like-kind," meaning it must be property of the same nature or character as your relinquished property. • Timing: After the relinquished property sale, you have 45 days to ... › wp-content › uploadsReporting the Like-Kind Exchange of Real Estate Using ... - 1031 Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 7400 Heritage Village Plaza, Suite 102 Gainesville, VA 20155 800-795-0769 703-754-9411 Fax 703-754-0754 Compliments of Realty Exchange Corporation Your Nationwide Qualified Intermediary for the Tax Deferred Exchange of Real Estate What Is a 1031 Exchange? Rules, Requirements, Process - Insider The different types of like-kind exchanges A 1031 exchange is a like-kind exchange — a transaction that allows you to essentially swap one asset for another one of a similar type and value.... › 1031-exchange-worksheet1031 Like Kind Exchange Worksheet And Form 8824 Worksheet ... Apr 17, 2018 · We constantly effort to reveal a picture with high resolution or with perfect images. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template can be beneficial inspiration for people who seek an image according specific topic, you will find it in this site. Finally all pictures we've been displayed in this site will inspire you all.

Completing a like-kind exchange in the 1040 return - Intuit A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded.

The boot in a 1031 exchange & how to avoid paying taxes on it Boot is a portion of the sales proceeds you receive from a 1031 exchange that isn't re-invested in a replacement property. For example, if you sell a property for $200,000 but only re-invest $180,000, the $20K difference is known as boot. The main reason for conducting a 1031 exchange is to defer the payment of capital gains tax.

You Can Do a 1031 Exchange on a Primary Residence—Here's How Download The Guide To 1031 Exchange Download eBook The 1031 Investor's Guidebook Tackle the art and science of completing your 1031 exchange. Yes No 400 W. 15th Street Suite 700 Austin, TX 78701 (877) 797-1031

The 3 Property Rule (and Other Rules) of 1031 Exchanges The 1031 exchange is a powerful tool to level up your portfolio, but investors need to be careful of the 3 property rule, the 200% rule, and the 95% rule. ... To qualify as a like-kind property under a 1031 exchange, the replacement property must be of the same general type as the initial property that's being sold.

Tax-Free Like-Kind Exchanges Of Property (§1031 Exchanges) 2021-10-29 Like-kind property used in a trade or business or for investment purposes can be exchanged for similar property used for the same purpose without incurring taxes in the year of the exchange. Instead, the replaced property receives the carryover basis of the exchanged property. Like kind property is defined in IRC §1031, which is why ...

Defer tax with a like-kind exchange - Sensiba San Filippo An example of the tax deferring process Let's say you exchange land (business property) with a basis of $100,000 for a building (business property) valued at $120,000 plus $15,000 in cash. Your realized gain on the exchange is $35,000: You received $135,000 in value for an asset with a basis of $100,000.

What Happens When You Sell a 1031 Exchange Property? also referred to as a like-kind exchange or starker exchange, a 1031 exchange allows you to defer capital gains taxes on the sale of an investment property by using its proceeds to purchase another "like-kind" investment property. 2 for example, if your investment in a condo is depreciating in value, you can use the net proceeds of the sale of …

How Eliminating 1031 Exchanges Could Affect Property Owners ... - Forbes The proposed cuts to 1031 like-kind exchanges would place a $500,000 limit to gains (and $1 million for married taxpayers with a joint return). The issue is that most commercial real estate sales ...

1031 Exchange: Like-Kind Rules & Basics to Know - NerdWallet A 1031 exchange, named after section 1031 of the U.S. Internal Revenue Code, is a way to postpone capital gains tax on the sale of a business or investment property by using the proceeds to buy a...

Like Kind Exchange Worksheet - The Math Worksheets Like kind exchange worksheet 1031 exchange calculator excel. Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement like-kind asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset.

Like-Kind Exchange Definition - Investopedia A like-kind exchange allows the seller to defer their depreciation recapture. How a Like-Kind Exchange Works When a commercial property or investment property is sold for a gain, the investor is...

What Is a 1031 Exchange? Know the Rules - Investopedia Broadly stated, a 1031 exchange (also called a " like-kind exchange " or a "Starker") is a swap of one investment property for another. Most swaps are taxable as sales, although if yours meets the...

What Is a 1031 Exchange? And How Does It Work? Since 1031 exchanges can get really complicated really quickly, working with a qualified tax advisor who can help you get all the details right can take a lot of the stress out of the process. Choosing a Replacement Property for a 1031 Exchange. When you do a 1031 exchange, the swap has to be between what the IRS calls "like-kind ...

Real Estate: 1031 Exchange Examples - SmartAsset What Is a 1031 Exchange? A 1031 exchange is a tax-deferment strategy often used by real estate investors. In this process, the owner of an investment property (or multiple) sells their original property and buys a like-kind property as a replacement. By following the IRS's rules during this procedure, they defer capital gains tax.

› calcs › 1031-exchangeIRC 1031 Like-Kind Exchange Calculator IRC 1031 Like-Kind Exchange Calculator Figure Your Tax Deferred Benefits 1031 Exchange Calculator This calculator will help you to determine how much tax deferment you can realize by performing a 1031 tax exchange instead of a taxable sale. We also offer a 1031 deadline calculator.

Asset Worksheet for Like-Kind Exchange - Intuit You depreciate property you received in a like kind exchange (Section 1031), as though you never gave up the original property. You use the same adjusted basis as the property given up.

0 Response to "45 1031 like kind exchange worksheet"

Post a Comment