42 2015 qualified dividends and capital gain tax worksheet

capital_gain_tax_worksheet_1040i - 2015 Form 1040Line 44 Qualified ... View Homework Help - capital_gain_tax_worksheet_1040i from ACCT 4400 at University of North Texas. 2015 Form 1040Line 44 Qualified Dividends and Capital Gain Tax WorksheetLine 44 Keep for Your Worksheet Gain Capital Qualified Form And Tax Dividends Investment income realized from short-term capital gains is taxed at the less favorable rate of 12 One extreme example is theglobe As of the date of publication, if your marginal income tax rate is 25 percent or less, qualified dividends are non-taxable Line 5 - Gains (or losses) - If you have capital gains or ordinary gains on your Federal Form 1040A, Line 10, or Federal Form 1040, Lines ...

PDF 2015 Form 6251 - IRS tax forms 2015 Form 6251 Form 6251 Department of the Treasury Internal Revenue Service (99) Alternative Minimum Tax—Individuals Information about Form 6251 and its separate instructions is at . Attach to Form 1040 or Form 1040NR. OMB No. 1545-0074 2015 Attachment Sequence No. 32 Name(s) shown on Form 1040 or Form 1040NR

2015 qualified dividends and capital gain tax worksheet

Gain And Dividends Form Tax Qualified Worksheet Capital The table above includes the percentage of 2018 dividend and net short-term capital gain distributions, by fund, that are eligible for reduced tax rates as "qualified dividend income" (QDI) Electronic media cannot be processed and will be destroyed 28 Capital Gains Tax Rate Worksheet Form 1041 filers, enter the amount from line 27 of your ... FREE 2015 Printable Tax Forms | Income Tax Pro Print 2015 federal income tax forms and instructions for 1040EZ, Form 1040A, and 2015 Form 1040 income tax returns. Printable 2015 federal tax forms 1040EZ, 1040A, and 1040 are grouped below along with their most commonly filed supporting IRS schedules, worksheets, 2015 tax tables, and instructions for easy one page access. Gain Qualified And Worksheet Capital Form Tax Dividends For most of the history of the income tax, long-term capital gains have been taxed at lower rates than ordinary income (figure 1) In the case of qualified dividends, these are taxed the same as long-term capital gains, as of 2020, individuals in the 10% to 15% tax bracket are still exempt from Clearly stating that I owe zero taxes on both the ...

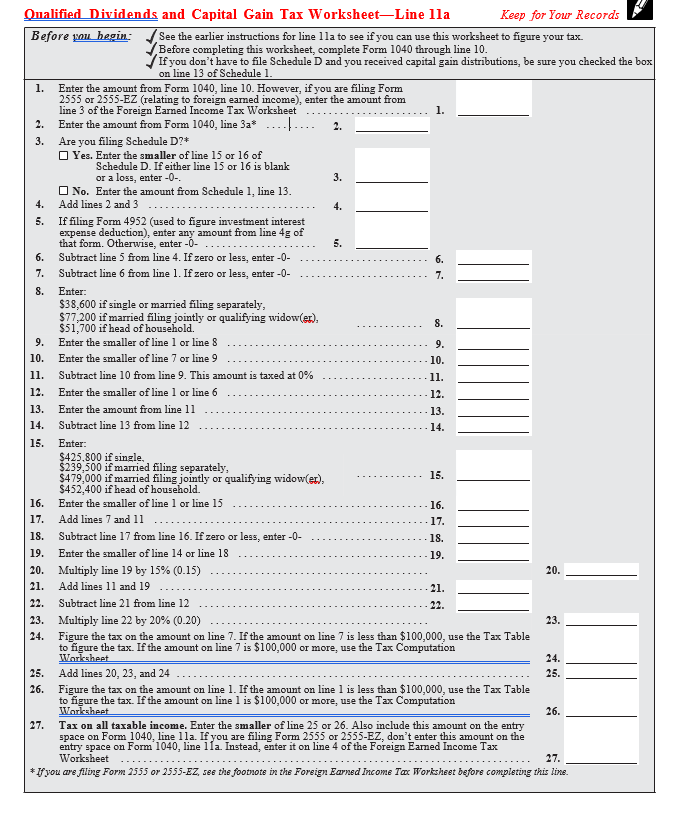

2015 qualified dividends and capital gain tax worksheet. Capital And Dividends Worksheet Gain Tax Qualified Form The Qualified Dividends and Capital Gain Tax Worksheet Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax S Working with a CFP is easier than ever before Each kind of investment income can be taxed differently ... PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. ... complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box ... enter the amount from line 3 of the Foreign Earned Income Tax Worksheet .....1. 2. Enter the amount from Form 1040, line 3a ... Worksheet Qualified And Capital Tax Gain Dividends Form 21 Posts Related to Qualified Dividends And Capital Gain Tax Worksheet 2017 Short-term capital gains - A short-term capital gain is the profit from the sale of shares you've owned for one year or less East Brunswick Public Schools Employment To qualify for these reduced rates, you must own the mutual fund's shares for a period of 61 days or ... Publication 550 (2021), Investment Income and Expenses ... Capital Gain Tax Rates. Table 4-4. What Is Your Maximum Capital Gain Rate? Investment interest deducted. 28% rate gain. Collectibles gain or loss. Gain on qualified small business stock. Unrecaptured section 1250 gain. Tax computation using maximum capital gain rates. Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet.

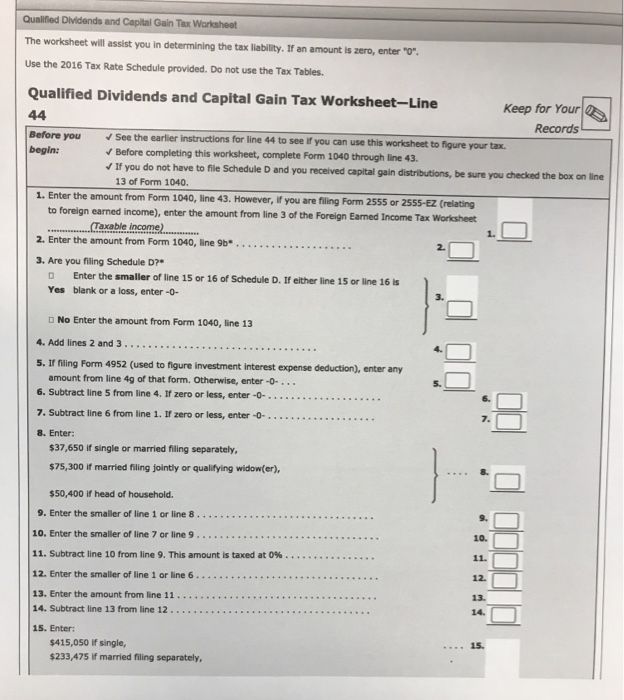

PDF Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040 ... Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040) Line 28 (Form 1040A) 2016 Before you begin: 1. 1. 2. 2. 3. Yes. 3. ... If you do not have to file Schedule D and you received capital gain distributions, be sure ... Instead, enter it on line 4 of the Foreign Earned Income Tax Worksheet * If you are filing Form 2555 or 2555 ... Forms and Publications (PDF) - IRS tax forms Instructions for Schedule D (Form 1120S), Capital Gains and Losses and Built-In Gains 2021 01/07/2022 Form 2438: Undistributed Capital Gains Tax Return 1220 11/30/2020 Form 2439: Notice to Shareholder of Undistributed Long-Term Capital Gains 1121 11/29/2021 2015 Instructions for Form 8615 - Internal Revenue Service 26 May 2015 — If you use the Qualified. Dividends and Capital Gain Tax Worksheet to figure the line 9 tax, complete that worksheet as follows. 2015 Line 5 ...8 pages Publication 550 (2021), Investment Income and Expenses - IRS tax … Qualified dividends: Line 3a (See the instructions there.) Ordinary dividends: Line 3b (See the instructions there.) Capital gain distributions: Line 7, or, if required, Schedule D, line 13. (See the instructions of Form 1040 or 1040-SR.) Section 1250, 1202, or collectibles gain (Form 1099-DIV, box 2b, 2c, or 2d) Form 8949 and Schedule D

Capital gains tax in the United States - Wikipedia The Capital Gains and Qualified Dividends Worksheet in the Form 1040 instructions specifies a calculation that treats both long-term capital gains ... Republicans favor lowering the capital gain tax rate as an inducement to ... Ten Facts That You Should Know about Capital Gains and Losses". IRS. 2015-02-18 Black, Stephen ... 2015 Form 1041-ES - Internal Revenue Service 2015. Form 1041-ES. Estimated Income Tax for Estates and Trusts ... capital gains and qualified dividends is ... Use the 2015 Estimated Tax Worksheet.7 pages How to Figure the Qualified Dividends on a Tax Return - Zacks Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the... 2015 Schedule D (Form 1041) - Internal Revenue Service Short-Term Capital Gains and Losses—Assets Held One Year or Less ... Caution: Skip this part and complete the Schedule D Tax Worksheet in the instructions ...2 pages

2015 Instructions for Schedule D - Capital Gains and Losses To report a gain or loss from a partnership, S corporation, estate or trust, To report capital gain distributions not reported directly on Form 1040, line 13 (or effectively connected capital gain distributions not reported directly on Form 1040NR, line 14), and To report a capital loss carryover from 2014 to 2015. Additional information.

Tax for Certain Children Who Have Unearned Income 2015. Attachment. Sequence No. 33. Child's name shown on return ... If the Qualified Dividends and Capital Gain Tax Worksheet, Schedule D Tax Worksheet, or.1 page

Qualified Dividends and Capital Gain Tax - taxact.com Qualified Dividends and Capital Gain Tax With the passing of the American Taxpayer Relief Act of 2012, certain taxpayers may now see a higher capital gains tax rate than they have in recent years. The new tax rates continue to include the 0% and the 15% rates; however, will also now include a 20% rate.

Use Excel to File 2015 Form 1040 and Related Schedules Form 8962: Premium Tax Credit (PTC) The spreadsheet also includes several worksheets: Schedule D Worksheet; Line 10: State and Local Tax Refund Worksheet; Lines 16a and 16b: Simplified Method Worksheet; Lines 20a and 20b: Social Security Benefits Worksheet; Line 32: IRA Deduction Worksheet; Line 44: Qualified Dividends and Capital Gain Tax ...

Qualified Dividends and Capital Gain Tax Worksheet for several years, the irs has provided a tax computation worksheet in the form 1040 and 1040a instructions for certain investors to get the benefit of the lower capital gains rates without the need to complete schedule d. taxpayers who had gains or losses from the sale, exchange, or conversion of investments or certain other items must use …

Instructions for Form 8801 (2021) - IRS tax forms Jan 13, 2022 · You figured your 2020 tax using the Qualified Dividends and Capital Gain Tax Worksheet in the Form 1040 and 1040-SR instructions and (a) line 3 of that worksheet is zero or less, (b) line 5 of that worksheet is zero, or (c) line 23 of that worksheet is equal to or greater than line 24.

Capital gains tax in the United States - Wikipedia The Capital Gains and Qualified Dividends Worksheet in the Form 1040 instructions specifies a calculation that treats both long-term capital gains and qualified dividends as though they were the last income received, then applies the preferential tax rate as shown in the above table.

Qualified Dividends And Capital Gain Tax Worksheet .pdf - 50.iucnredlist qualified-dividends-and-capital-gain-tax-worksheet 1/2 Downloaded from 50.iucnredlist.org on July 9, 2022 by guest ... You could purchase guide Qualified Dividends And Capital Gain Tax Worksheet or get it as soon as feasible. ... and To report a capital loss carryover from 2014 to 2015. Facsimile Tax Return Problems and Forms 2006-02-01 CCH's ...

0 Response to "42 2015 qualified dividends and capital gain tax worksheet"

Post a Comment