45 2012 child tax credit worksheet

2012 Federal 1040 Tax Forms to download, print, and mail In order to file a 2012 IRS Tax Return, download, complete, print, and sign the 2012 IRS Tax Forms below and mail them to the address listed on the IRS and State Forms. Select your state (s) and download, complete, print, and sign your 2012 State Tax Return income forms. You can no longer claim a Tax Refund for Tax Year 2012. Forms and Publications (PDF) - IRS tax forms 04/22/2022. Notc 797. Possible Federal Tax Refund Due to the Earned Income Credit (EIC) 1221. 12/15/2021. Form 886-H-EIC. Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children. 1019. 07/31/2020.

Prior Year Products - IRS tax forms Prior Year Products. Enter a term in the Find Box. Select a category (column heading) in the drop down. Click Find. Click on the product number in each row to view/download. Click on column heading to sort the list. You may be able to enter information on forms before saving or printing.

2012 child tax credit worksheet

2021 Child Tax Credit (CTC) Qualification and Income Thresholds - $3000 ... 2020 and 2021 CTC (before ARPA stimulus bill increase) The Child Tax Credit (CTC) was set to $2,000 per child for 2021 (before Biden Stimulus bill, ARPA, update), the same level as it was in 2020, and is available to taxpayers who have children aged under 17 at the end of the tax year. Taxpayers can claim the CTC Child Tax Credit for every child who qualifies with no upper limit. 2021 Schedule 8812 Form and Instructions - Income Tax Pro The maximum amount of the Additional Child Tax Credit is still $1,400 per qualifying child, however, the included enhanced child tax credit calculation may increase the initial amount up to $3,600 per qualifying child. On page two of the IRS Form 1040, line 19 and line 28, the taxpayer is asked to add the amounts from Schedule 8812 . Forms and Publications (PDF) - IRS tax forms Child Tax Credit 2022 02/24/2022 Publ 972 (SP) Child Tax Credit (Spanish Version) 2022 02/25/2022 Form 1040-SS: U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico) 2021 01/21/2022 Inst 1040-SS: Instructions for Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional ...

2012 child tax credit worksheet. PDF Credit Page 1 of 12 8:57 - 17-Dec-2013 Child Tax Complete the Child Tax Credit Worksheet, later in this publication. If you were sent here from your Schedule 8812 in structions. Complete the 1040 and 1040NR Filers — Earned Income Worksheet, later in this publication. If you have not read your Form 1040, Form 1040A, or Form 1040NR instructions. 2012 Income Tax Forms - Nebraska Department of Revenue Form 4797N, 2012 Special Capital Gains Election and Computation. Form. Form CDN, 2012 Nebraska Community Development Assistance Act Credit Computation. Form. Form 3800N - Nebraska Employment and Investment Credit Computation for All Tax Years. View Forms. Form 1040XN, 2012 Amended Nebraska Individual Income Tax Return. Federal 1040 (Schedule 8812) (Child Tax Credit) - TaxFormFinder Download This Form Print This Form We last updated the Child Tax Credit in January 2022, so this is the latest version of 1040 (Schedule 8812), fully updated for tax year 2021. You can download or print current or past-year PDFs of 1040 (Schedule 8812) directly from TaxFormFinder. You can print other Federal tax forms here . 2021 Child Tax Credit Calculator | Kiplinger Our calculator will give you the answer. by: The Kiplinger Washington Editors. April 5, 2022. Big changes were made to the child tax credit for the 2021 tax year. The two most significant changes ...

PDF Quality Child-care Investment Tax Credit Worksheet for Tax Year 2012 36 ... that have made a qualifying investment in any tax year between 2003 and 2011, enter $1,000 on line 3. Sole proprietors who made a qualifi ed investment in 2003, enter $11,000 on this line. Line 4. Enter the amount from your 2011 Qualifi ed Child-Care Investment Tax Credit worksheet, line 8. PDF T1-2012 Federal Tax Schedule 1 - canada.ca T1-2012. Federal Tax Schedule 1. Complete this schedule, and attach a copy to your return. ... education, and textbook amounts transferred from a child. 324 + 27 Amounts transferred from your spouse or common-law partner (attach Schedule 2) 326 + 28. 330. ... Federal political contribution tax credit (use the federal worksheet) (maximum $650) ... PDF ARE YOU ELIGIBLE - IRS tax forms • $36,920 ($42,130 for married filing jointly) if you have one qualifying child, or • $13,980 ($19,190 for married filing jointly) if you do not have a qualifying child. 2. You must have a valid social security number. 3. Your filing status cannot be "Married filing separately." 4. You must be a U.S. citizen or resident alien all year. 5. PDF Worksheet—Line 12a Keep for Your Records Draft as of - IRS tax forms 2018 Child Tax Credit and Credit for Other Dependents Worksheet—Line 12a Keep for Your Records 1. To be a qualifying child for the child tax credit, the child must be your dependent, under age 17 at the end of 2018, and meet all the conditions in Steps 1 through 3 under Who Quali es as Your Dependent. Make sure you checked the box in

Prior Year Products - Internal Revenue Service Results 1 - 38 of 38 — Inst 1040 (Schedule 8812), Instructions for Child Tax Credit, 2012. Form 1040 (Schedule 8812) (sp), Credits for Qualifying Children and ... PDF Introduction Objectives Topics - IRS tax forms Form 1040 Instructions, Child Tax Credit Worksheet Schedule 8812, Credits for Qualifying Children and Other Dependents Pub 17, Chapter 14, Child Tax Credit . TaxSlayer Demo: Entering Basic Credits, Verify the amount of the credit in TaxSlayer by viewing the return summary Determining Eligibility and Schedule 8812 and the Additional Child Tax Credit - Credit Karma Line 4 — Enter the number of qualifying children you have multiplied by $1,400 (the portion of the child tax credit that's refundable). This should be the same number of children used for Line 1 of the Child Tax Credit and Credit for Other Dependents Worksheet. Line 5 — Enter the smaller amount of Line 3 or Line 4. PDF Child Support Worksheet - Nashville 1a Federal benefit for child + + 1b Self-employment tax paid - - 1c Subtotal $ $ Use Credit Worksheet 1d Credit for In-Home Children - - to calculate line items 1e Credit for Not In Home Children - - 1d and 1e. 2 Adjusted Gross Income (AGI) $ $ 2a Combined Adjusted Gross Income $ 3 Percentage Share of Income (PI) % % Part III.

W-4 Form: How to Fill It Out in 2022 - Investopedia Step 5: Sign and Date Form W-4. The form isn't valid until you sign it. 4. Remember, you only have to fill out the new Form W-4 if you either start a new job or want to make changes to the ...

PDF 2012 Louisiana Nonrefundable Child Care Credit Worksheet (For use with ... This amount is your unused Child Care Credit Carryforward from 2008 through 2011 that can be carried forward to 2013. Also, your entire Child Care Credit for 2012 (Line 2 or 2A above) will be carried forward to 2013. Stop here; you are finished with the worksheet. .00 Use Lines 11 through 15 to determine the amount of Child Care Credit Carryforward

Child Tax Credit Deduction Calculator 2012, 2013 - YouTube 2012, 2013 Child Tax Credit Deductionhttp://

2012 Ind Inc Tax Forms - Connecticut Child Tax Rebate - A new child tax rebate was recently authorized by the Connecticut ... 2012 Connecticut Earned Income Tax Credit: 12/2012: CT-1040NR/PY: Form & Instr. 2012 Nonresident/Part-Year Resident Tax Booklet: 12/2012 ... Part-Year Resident Income Allocation Worksheet: 12/2012: CT-1040BA: Form: Nonresident Business Apportionment ...

PDF Instructions for Preparing your 2012 Nonresident and Part-Year Resident ... XDO NOT ATTACH THIS WORKSHEET TO YOUR RETURN. 2012 Louisiana Nonrefundable Child Care Credit Worksheet (For use with Form IT-540B) 23 1Enter Federal Child Care Credit from Federal Form 1040, Line 48 or Federal Form 1040A, Line 29.1 .00 1A Enter the applicable percentage from the chart shown below. Federal Adjusted Gross Income Percentage

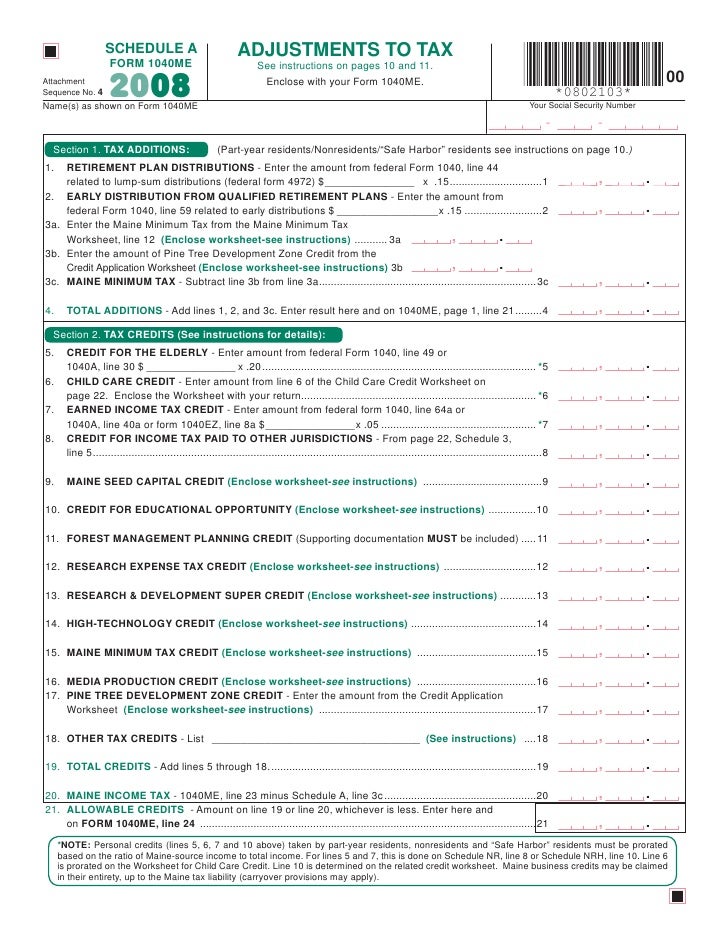

PDF Child Tax Credit 2012 or 1040) Attach to Form 1040, Form 1040A, or Form ... 2012. 47. Name(s) shown on return . Your social security number . Part I Filers Who Have Certain Child Dependent(s) with an ITIN (Individual Taxpayer Identification Number) ... Enter the amount from line 6 of your Child Tax Credit Worksheet (see the Instructions for Form 1040, line 51). 1040A filers:

Child Tax Credit Amount 2012 In 2012, the Child Tax Credit can be worth a maximum of $1,000 for each qualifying child below 17 years old. Depending on your income level, the Child Tax Credit may be used to lower your federal income tax by a specific amount. To qualify for Child Tax Credit, the child must meet the qualifying requirements as outlined by six tests: Age Test

PDF Credit Page 1 of 11 8:27 - 14-Jan-2013 Child Tax household in 2012, that child meets condition (7) above to be a qualifying child for the child tax credit. Exceptions to time lived with you. A child is consid- ered to have lived with you for more than half of 2012 if the child was born or died in 2012 and your home was this child's home for more than half the time he or she was alive.

Claiming the Child Tax Credit - Everything You Need to Know in 2022 Date January 10, 2022. Raising a child isn't cheap. According to a 2019 analysis by EverQuote, it costs about $2,319,162 to raise a family in the United States, including providing common family expenses like housing, food, transportation, insurance, child care, and vacations. For parents, tax season is a chance to recoup some of those costs.

Child Tax Credit Amount 2012: Child Tax Credit Worksheet 1.The child is your son, daughter, stepchild, foster child, sister, brother, stepsister, stepbrother, or a descendant of any of them 2.The child must be UNDER the age of 17 by the end of the year 3.The child did not provide half of his or her own support for the year 4.The child must be claimed as a dependent on your income tax return

PDF 2012 Instruction 1040 Schedule - IRS tax forms All the days your child was present in 2012, and b. 1/3 of the days your child was present in 2011, and c. 1/6 of the days your child was present in 2010. Not all days that your dependent is physically present in the United States count as days of presence for the sub stantial presence test. See Days of Presence in the United States in Pub. 519.

Form 1040 Child Tax Credit for 2012, 2013 - YouTube Form 1040 Child Tax Credit for 2012, 2013http://

Forms and Publications (PDF) - IRS tax forms Child Tax Credit 2022 02/24/2022 Publ 972 (SP) Child Tax Credit (Spanish Version) 2022 02/25/2022 Form 1040-SS: U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico) 2021 01/21/2022 Inst 1040-SS: Instructions for Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional ...

2021 Schedule 8812 Form and Instructions - Income Tax Pro The maximum amount of the Additional Child Tax Credit is still $1,400 per qualifying child, however, the included enhanced child tax credit calculation may increase the initial amount up to $3,600 per qualifying child. On page two of the IRS Form 1040, line 19 and line 28, the taxpayer is asked to add the amounts from Schedule 8812 .

2021 Child Tax Credit (CTC) Qualification and Income Thresholds - $3000 ... 2020 and 2021 CTC (before ARPA stimulus bill increase) The Child Tax Credit (CTC) was set to $2,000 per child for 2021 (before Biden Stimulus bill, ARPA, update), the same level as it was in 2020, and is available to taxpayers who have children aged under 17 at the end of the tax year. Taxpayers can claim the CTC Child Tax Credit for every child who qualifies with no upper limit.

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-18.jpg)

0 Response to "45 2012 child tax credit worksheet"

Post a Comment