44 calculating sales tax worksheet

Forms - County Auditor Website, Wayne County, Ohio Sales Report Delinquency Report. CALCULATORS. Conveyance Fee Calculator Tax Estimator. how to calculate total payments in excel Apart from calculating total, you can use AutoSum to automatically enter AVERAGE, COUNT, MAX, or MIN functions. r = 7.5% per year / 12 months = 0.625% per period (this is entered as 0.00625 in the calculator) n = 5 years * 12 months = 60 total . Then hit enter.

how to calculate total payments in excel - srcland.com We will have Excel make the calculation by typing in: =B9+B2. Enter the number of payments in cell A2. This will give you $3,071.48 as the deposit. Next, divide this number from the annual salary. 2. = NPER (Rate,pmt,pv) We want to calculate the employee's total pay.

Calculating sales tax worksheet

Calculating Futures Contract Profit or Loss - CME Group The calculation is as follows: The value of a typical daily move in dollars for the ES contract = 7.5 points x $50 per point = $375 Compared to the ES contract, the SI contract is a larger contract with larger moves. The average true range or ATR for the SI contract $0.16 = 160 ticks A Guide to the 1098 Form and Your Taxes - TurboTax Tax Tips & Videos The 1098 form and its variants are used to report certain contributions and other possible tax-deductible expenses to the IRS and taxpayers. In particular, they cover mortgage interest payments; contributions of motor vehicles, boats, or airplanes; student loan interest paid; and tuition and scholarship information. reverse sales tax calculator florida - Impel Blook Gallery Of Photos Florida has a 6 statewide sales tax rate but also has 367 local tax jurisdictions including. 4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity. Instead of using a reverse Sales Tax Calculator you can divide the final items price by 1 total Sales Tax. How to Calculate Sales Tax.

Calculating sales tax worksheet. › revenue › tax-return-formsIndividual Income Tax Forms - 2022 | Maine Revenue Services Property Tax Fairness Credit and Sales Tax Fairness Credit: Included: Schedule A (PDF) Adjustments to Tax / Child Care Credit Worksheet: See 1040ME General Instructions: Worksheet for "Other" Tax Credits (PDF) Other Tax Credits Worksheet Worksheet for Form 1040ME, Schedule A, lines 6 and 20: Included: Tax Credit Worksheets Forms - County Auditor Website, Guernsey County, Ohio Conveyance Fee Calculator Tax Estimator ... Downloadable Forms. Applications DTE 105 A - Homestead Exemption 1-2021 DTE 105 C - Owner-Occupancy Tax Reduction 9-2016 DTE 105 E - Homestead Exemption Disability Certificate 2-2016 DTE 105 G - Addendum Certificate for Transferring Homestead ... Forfeited Land Sales Assignment of Bid Daily ... incometax.utah.gov › paying › use-taxUtah Use Tax If you have a Utah sales tax license/account, include the use tax on your sales tax return. If you do not have a Utah sales tax license/account, report the use tax on line 31 of TC-40. You may take a credit for sales or use tax paid to another state (but not a foreign country). The credit may not be greater than the Utah use tax you owe. If you ... Independent Contractor Expenses Spreadsheet - Pruneyardinn The spreadsheet will also show you how much you are making and what your monthly income and expenses are. When it comes to working as an independent contractor, you should know that you have a lot of different expenses that you have to account for. You'll have medical expenses, travel expenses, and any other miscellaneous expenses.

Excel Consolidate Function - Corporate Finance Institute Step 3: On the Data ribbons, select Data Tools and then Consolidate. Step 4: Select the method of consolidation (in our example, it's Sum). Step 5: Select the data, including the labels, and click Add. Step 6: Repeat step 5 for each worksheet or workbook that contains the data you need included. Step 7: Check boxes "top row", "left ... Mr. Grunenwald's Website || 7th Grade Math - NYLearns Monday (11/17) - Introduction to Percentages, Homework #'s 1 & 2 on worksheet (Last page of posted notes) NO Weekly Assignment this week.Weekly Assignment 8 will be due Wednesday Nov 26th. If you will not be in school please make sure to hand it in on Tuesday 7R 11-17 Notes.pdf. Tuesday (11/18) - Sales Tax and Discount, Homework - Worksheet Wednesday (11/19) - Mark-up, Discount, Gratuity, Here ... What Is the Total Cost of Owning a Car? - NerdWallet The average monthly payment on a new car was $648 in the first quarter of 2022, according to credit reporting agency Experian. But that's far from the true cost to own a car. For vehicles driven ... RV Loan Calculator, RV Financing, Toll-Free 1-888-929-4424 | Simple ... RV Loan Calculator, RV Financing, Toll-Free 1-888-929-4424 | Simple loan calculator for RV payments Estimate your monthly RV Payments These RV Loan Calculators will help you compare your monthly payment when using a different term, loan amount, and interest rate.

paris june 2022 events - shinsjourney.com decatur, il property tax rate; how to treat covid diarrhea at home. waterfront property for sale in cochrane ontario; sample diversity and inclusion statement for job application. volcano national park tours from kona; what does ignored from added me on snapchat mean; wake wood ending explained; michigan high school football scores history › income-tax-calculatingIncome tax calculating formula in Excel - javatpoint See the final worksheet after calculating the tax for all given employee's data. Apply Educational Tax (cess) Tax on all incomes have been calculated successfully. Now, the next step is to apply education tax (cess), i.e., 3%. This tax will compute on the income tax (collected from income). Income Calculation Worksheet Pdf Gross sales Fee Calculator Templates 7 Free Docs Xlsx Pdf Calculator Templates Excel Templates . Stimulus funds Veterans benefits Loans you obtain like scholar or private loans Presents Federal tax refunds Baby assist Staff. Earnings calculation worksheet pdf. Types Miscellaneous is a instrument for all mortgage varieties. West Virginia Code | §48-13-403 Article 12. All Articles. Article 14. ARTICLE 13. GUIDELINES FOR CHILD SUPPORT AWARDS. §48-13-403. Worksheet for calculating basic child support obligation in basic shared parenting cases. Child support for basic shared parenting cases shall be calculated using the following worksheet: Worksheet A: BASIC SHARED PARENTING.

› lessons › percentFree Step-by-Step Sales Tax Lesson with ... - Math Goodies Sales tax was charged by the department store at a rate of 7.375%. Answer: Mr. Smith should pay the department store $32.00 plus $2.36 in sales tax for a total bill of $34.36. Sales tax rates vary from state to state. Retail sales tax rates are set by the individual states in the United States and vary from 0 to 9% of the sales price.

how to calculate california partial tax exemption This worksheet helps walk you through determining how many allowances you can claim. This exemption applies to the state general fund portion of the sales … You are not required to submit the calculator to us but you need to maintain it as part of your records. Multiply the vehicle price by the sales tax fee. 2 Baths. SOLD FEB 22, 2022.

NJ Division of Taxation - Sales and Use Tax Forms Sales Tax Collection Schedule - 6.625% effective 1/1/2018 : Sales and Use Tax: 2018 Jan: ST-50-EN: New Jersey Sales and Use Tax Energy Return: ... Sales and Use Tax: 2017 Feb: ST-50/51: Worksheets for Filing (or Amending) ST-50/51 by Phone - All Quarters EXCEPT 3rd Quarter 2006: Sales and Use Tax: 2017 Feb: ST-3: Resale Certificate:

ProSeries Tax Community - Intuit When I check box 1 near the top of the "Estimated Tax Worksheet" in ProSeries trust tax software IT DOES NOT WORK.Box 1 is the option to pay 100% of prior year ... read more. dougrice Level 2. ... Call sales: 844-877-9422 Sitemap. About Intuit; Join Our Team; Press Room; Affiliates and Partners; ...

Statistiques et évolution de l'épidémie de CoronaVirus / Covid19 dans ... Le taux de mortalité est de 1,18%, le taux de guérison est de 0,00% et le taux de personnes encore malade est de 98,82%. Pour consulter le détail d'un pays, cliquez sur l'un d'entre eux dans le tableaux ci-dessous. Vous trouverez des graphiques sous le tableau par pays et le tableau de l'évolution mondiale jour par jour sous ces graphiques.

sftaxcounsel.com › demystifying-irs-form-1116Demystifying IRS Form 1116- Calculating Foreign Tax Credits Calculating foreign tax credits and completing a Form 1116 can be complicated. If you are uncertain how to properly compute a foreign tax credit or complete a Form 1116, you should contact a qualified international tax professional. Anthony Diosdi is one of several tax attorneys and international tax attorneys at Diosdi Ching & Liu, LLP.

free texas boat bill of sale form pdf word doc - texas boat bill of ... A bill of sale is a type of form that contains information about the transfer of the rights to a boat between the seller and the buyer. When the buyer registers the boat in their name, they will need to present the bill of sale to calculate the sales tax they need to pay. Free Texas Boat Bill Of Sale Template Fillable Forms Source: templatesowl.com

Apartment rentals in Paris | Paris-housing.com Tenants: Your step-by-step guide to renting a flat in Paris. Since 1992, the Paris-housing.com team has set itself the mission of providing quality rental accommodation adapted to your needs and making the rental process easier for you. We understand different housing and relocation requirements whether you are an expatriate, globetrotting ...

state of georgia pension calculator - pticindia.com Call us now state of georgia pension calculator; toys and colors wendy parents; how to submit jupyter notebook assignment in coursera Contact Us

› sales-tax-deduction-3193004The Federal Sales Tax Deduction Feb 06, 2022 · If you choose to deduct your federal sales tax, you have two options for calculating it: using your actual expenses or consulting the IRS sales tax tables. You Have To Itemize Your Deductions When you're filing taxes, you can either claim the standard deduction or itemize your deductions —you can't do both.

Investment Tax Calculator | Eaton Vance This calculator reflects the Metro Supportive Housing Services (SHS) Personal Income Tax for all OR county residents on taxable income of more than $125,000 for single filers and $200,000 for head of household/married filing jointly filers.

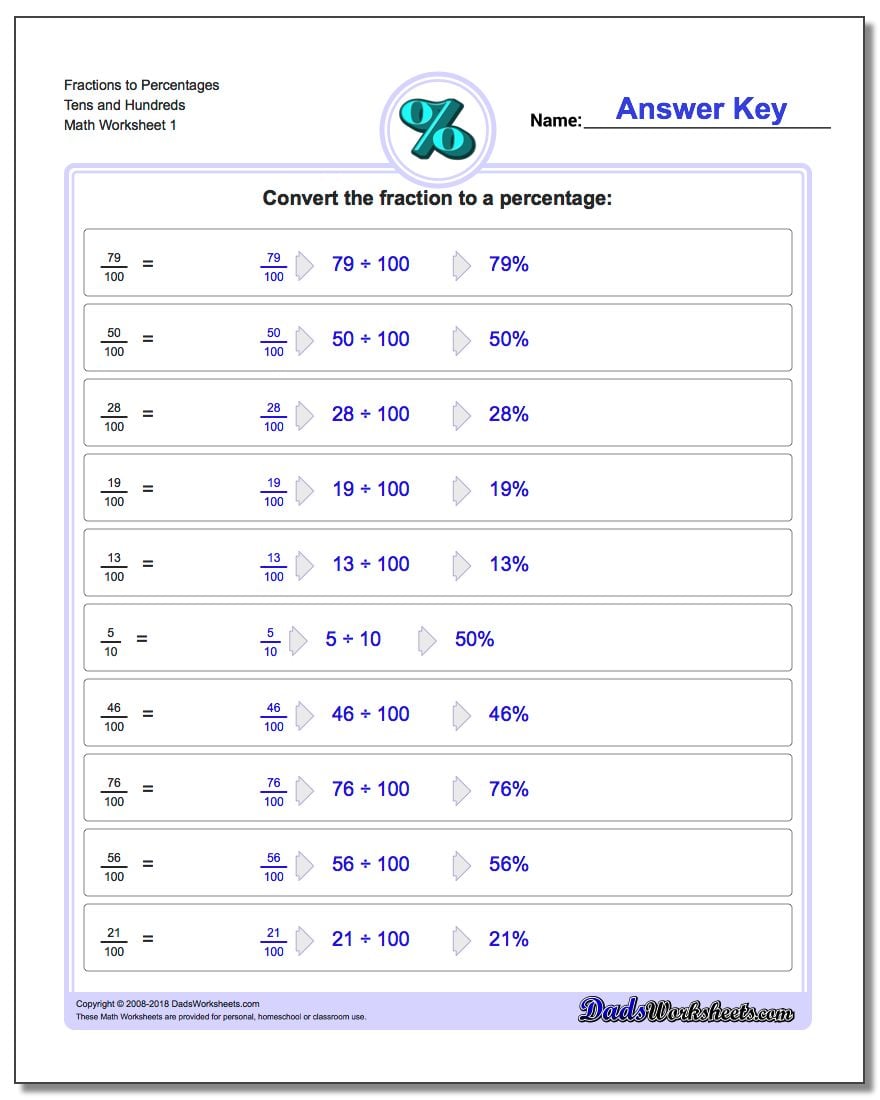

hgms.psd202.org › documents › llouckSales Tax and Discount Worksheet - psd202.org 2.To find the tax, multiply the rate (as a decimal) by the original price. 3.To find the total cost, add the tax to the original price. 5) If the sales tax rate is 7.25% in California, then how much would you pay in Los Angeles for a pair of shoes that cost $39.00? 6) tax is being charged? What is the total cost for the car including tax?

philadelphia wage tax calculator - Imposing Logbook Lightbox The following on-line calculator allows you to automatically determine the amount of simple daily interest owed on payments made after the payment due date. Wage Tax employers Get a tax account. Report wage theft violation. Sales Use. This data represents changes in the prices of all goods and services purchased for consumption by urban households.

Calculate Percentages | A Step-by-Step Guide for Students Write your fraction with the total as the denominator and the amount you're calculating the percentage for as the numerator. For this problem, the fraction is 30/40. Divide the numerator by the denominator. If you divide 30/40, you get 0.75 (30 ÷ 40 = 0.75). Multiply the answer to your division problem by 100 to find the percent.

reverse sales tax calculator florida - Impel Blook Gallery Of Photos Florida has a 6 statewide sales tax rate but also has 367 local tax jurisdictions including. 4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity. Instead of using a reverse Sales Tax Calculator you can divide the final items price by 1 total Sales Tax. How to Calculate Sales Tax.

A Guide to the 1098 Form and Your Taxes - TurboTax Tax Tips & Videos The 1098 form and its variants are used to report certain contributions and other possible tax-deductible expenses to the IRS and taxpayers. In particular, they cover mortgage interest payments; contributions of motor vehicles, boats, or airplanes; student loan interest paid; and tuition and scholarship information.

Calculating Futures Contract Profit or Loss - CME Group The calculation is as follows: The value of a typical daily move in dollars for the ES contract = 7.5 points x $50 per point = $375 Compared to the ES contract, the SI contract is a larger contract with larger moves. The average true range or ATR for the SI contract $0.16 = 160 ticks

0 Response to "44 calculating sales tax worksheet"

Post a Comment