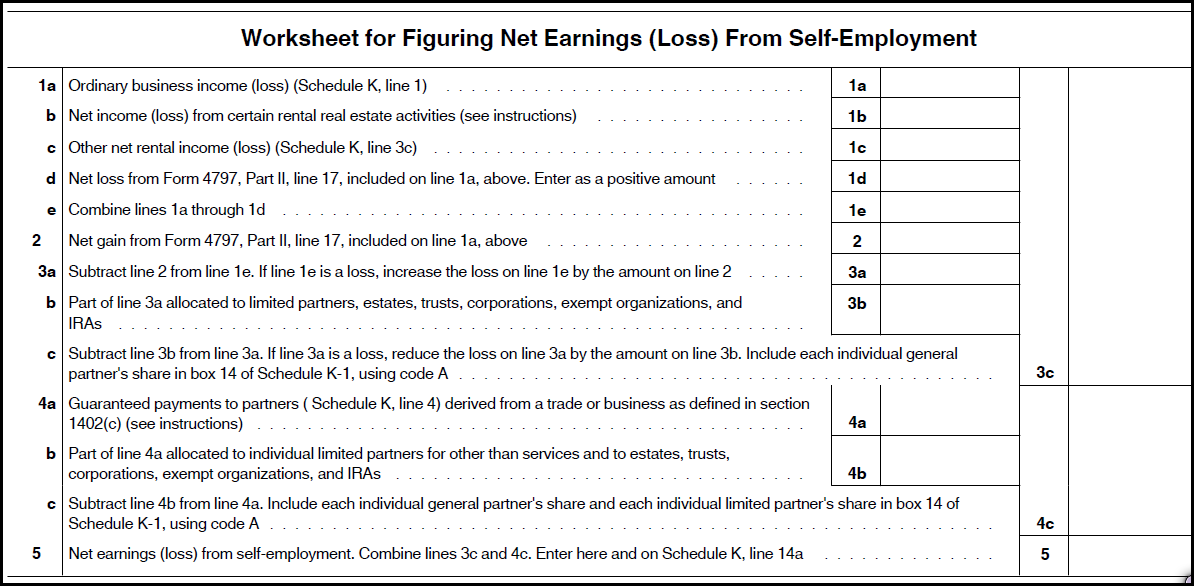

43 worksheet for figuring net earnings loss from self employment

Schedule K Line 14a (Form 1065) Calculating Self-Employment Earnings Line 14a of the Schedule K is the sum of Self-Employment earnings for all partners. General partners or LLC managers- self-employment earnings include their share of all income as well as manual self-employment income adjustments.; Limited partners- self-employment earnings consist only of guaranteed payments.; Lacerte computes line 14a using the Worksheet for Figuring Net Earnings (Loss) From ... Self-Employed Individuals - Calculating Your Own Retirement-Plan ... You can use the Table and Worksheets for the Self-Employed (Publication 560) to find the reduced plan contribution rate to calculate the plan contribution and deduction for yourself. Deducting retirement plan contributions Total limits on plan contributions depend in part on your plan type. See the contribution limits for your plan.

5 Look at the Worksheet for Figuring Net Earnings Loss from Self ... Look at the Worksheet for Figuring Net Earnings (Loss) from Self-Employment (p. 35 for 2014) of the Form 1065 instructions. What lines from Schedule K are, in general, involved in the calculation of Self-Employment income? What guaranteed payments are included in a partner's self-employment income?

Worksheet for figuring net earnings loss from self employment

Schedule K-1 (Form 1065) - Self-Employment Earnings (Loss) SELF-EMPLOYMENT EARNINGS (LOSS) Line 14A - Net Earnings (Loss) from Self-Employment - Amounts reported in Box 14, Code A represent the amount of net earnings from self-employment. For Limited Partners this amount generally includes any guaranteed payments received for services rendered to or on behalf of the partnership. Net Earnings from Self-Employment - SocialSecurityHop.com To calculate the net earnings from self-employment, follow the steps below: Add up your total gross income as calculated under the income tax law. Include income from all your trades and businesses. Subtract all the deductions, including the allowances for depreciation that you are allowed when you calculate your income tax from the result in (A). Reporting self-employment income to the Marketplace Filling out your Marketplace application. On your Marketplace application, you'll report your net income from your self-employment. (Net income is sometimes called "profit.") If your self-employment income is higher than your business expenses, you report this net income. If your business expenses are higher than your income, you report a net ...

Worksheet for figuring net earnings loss from self employment. Fannie Mae Self-employed Worksheet - myans.bhantedhammika.net Perceive the which means of Self Employed Study to make use of Fannie Maes Kind 1084 to calculate supportable earnings utilizing tax returns. A lender could use Fannie Mae Rental Earnings Worksheets Kind 1037 or Kind 1038 or a comparable kind to calculate particular person rental earnings loss reported on Schedule E. Seek advice from B3-32-01 ... PDF SEP IRA CONTRIBUTION WORKSHEET - Fidelity Investments Calculating Your Contribution if You Are Self-Employed Individuals with self-employed income must base their contributions on "earned income." For self-employed individu - als, earned income refers to net business profits derived from the business, reduced by a deduction of one-half of your self-employment tax, less your SEP IRA contribution. PDF Based on the calculations shown on his worksheet, Manuel's net profit ... Based on the calculations shown on his worksheet, Manuel's net profit on Line 27 of Part IV is $5,800 and his self-employment tax on Line 12 of Part V is $819. Here are the correct answers for each line: Version A, Cycle 6 INTERNAL USE ONLY DRAFT AS OF June 25, 2019 2021 Instructions for Schedule SE (2021) - Internal Revenue Service Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employment. The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program. This tax applies no matter how old you are and even if you are already getting social security or Medicare benefits.

Cash Flow Analysis (Form 1084) - Fannie Mae This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes. Solved: Sch K-1 Line 14c amount? - Intuit Line 14c is the gross nonfarm income for a general partner. It is needed for the partners to figure their net earnings from self-employment under the nonfarm optional method on their 1040 returns. How to calculate it: 1. Form 1065, page 1, line 8 Total Income (loss) multiplied by the ownership percentage rate (in decimal form) of the partner. Understanding Schedule K-1 self-employment income for partners ... - Intuit The program creates a worksheet to show the calculation of net earnings from self-employment. Follow these steps to view the Self-Employment Worksheet: Go to the Forms tab. Select Worksheets from the left-side Form window. Select Self-Emp. Worksheet from the left-side Page window. How do I enter adjustments or overrides for self-employment income? Reporting self-employment income to the Marketplace Filling out your Marketplace application. On your Marketplace application, you'll report your net income from your self-employment. (Net income is sometimes called "profit.") If your self-employment income is higher than your business expenses, you report this net income. If your business expenses are higher than your income, you report a net ...

Net Earnings from Self-Employment - SocialSecurityHop.com To calculate the net earnings from self-employment, follow the steps below: Add up your total gross income as calculated under the income tax law. Include income from all your trades and businesses. Subtract all the deductions, including the allowances for depreciation that you are allowed when you calculate your income tax from the result in (A). Schedule K-1 (Form 1065) - Self-Employment Earnings (Loss) SELF-EMPLOYMENT EARNINGS (LOSS) Line 14A - Net Earnings (Loss) from Self-Employment - Amounts reported in Box 14, Code A represent the amount of net earnings from self-employment. For Limited Partners this amount generally includes any guaranteed payments received for services rendered to or on behalf of the partnership.

0 Response to "43 worksheet for figuring net earnings loss from self employment"

Post a Comment