41 non cash charitable contributions donations worksheet

Donation Value Guide for 2021 Taxes - The Balance 28/12/2021 · How to Claim Charitable Donations When You File Your Tax Return . During most tax years, you are required to itemize your deductions to claim your charitable gifts and contributions. The Taxpayer Certainty and Disaster Relief Act of 2020 waived this requirement in 2020 and the waiver still applies for tax year 2021. It applies to cash donations ... XLSX atslsmo.com NON CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET. Insert Tax Year ===> Revised March 22, 2007 WHAT IS YOUR ORIGINAL COST ... Notes (optional Better than Good. Please fill out each column. YOU MUST COMPLETE A SEPARATE WORKSHEET FOR EVERY SINGLE DONATION SLIP. EXAMPLE: IF YOU HAVE A DONATION SLIP FROM GOODWILL ON FEBRUARY 2nd AND ANOTHER ...

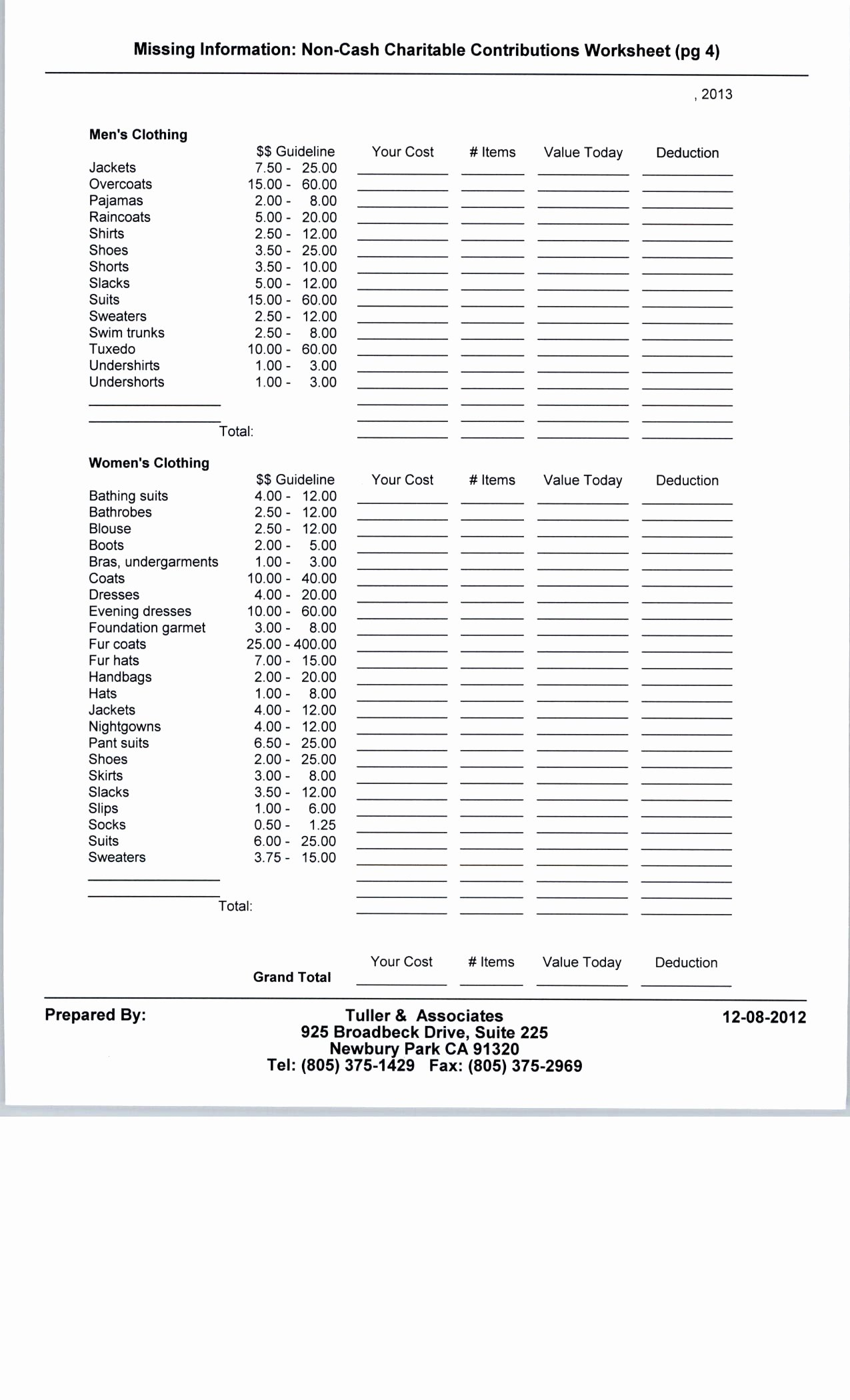

PDF Welcome | M. Greenwald Associates LLP EXPENSE WORKSHEET FOR NON-CASH CONTRIBUTIONS Drapes CLIENT NAME In order for us to maximize deductions please complete the work sheet TAX YEAR You can save tax dollars when you maximize your non-cash charitable deductions. The IRS allows you to deduct the Fair Market Value (FMV) — that is, the price the item would sell for in a thrift shop. The

Non cash charitable contributions donations worksheet

PDF TAX RETURN WORKSHEET NON-CASH CHARITABLE CONTRIBUTIONS - Freidag TAX RETURN WORKSHEET NON-CASH CHARITABLE CONTRIBUTIONS Name: Tax Year: The following is a guideline for valuation of non-cash charitable contributions. When valuing items, take into consideration the condition of the items. If the value of the donated items is $250 or more to one charity in How to Value Noncash Charitable Contributions | Nolo Property Donations Over $5,000 For any property donations worth $5,000 or more, you must obtain a formal appraisal from a qualified appraiser. The only exception is for marketable securities because they have a clear market value. Clothing and Household Items The most commonly donated property items are clothing and household items. PDF Non-Cash Charitable Contributions Worksheet - LB Tax Services missing information: non-cash charitable contributions worksheet (pg 2) furniture bed (twin) bed (king, queen, full) carriage chair (upholstered) chest china cabinet clothes closet coffee table convertible sofa crib (w/mattress) desk dining room set dresser w/ mirror end tables floor lamps folding beds hi riser high chair kitchen cabinet kitchen …

Non cash charitable contributions donations worksheet. PDF NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for ... NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for items in Good Condition) DONATED TO: DONATION DATE: MISCELLANEOUS LOW HIGH AVG QTY AMOUNT VALUE Adding Machines 24.00 90.00 57.00 Christmas Trees 18.00 60.00 39.00 Broiler Ovens 18.00 30.00 24.00 Copier 120.00 240.00 180.00 Donation Calculator Therefore, the ideal way to use this spreadsheet is by laptop or desktop computer. Entering Data Enter the number of items you donate in the Qty columns. Also, your totals will reset when you do. However, if when you enter a quantity field, you get an error. Simply change the quantity to 0 (zero). Exporting Goodwill Donation Sheet Worksheets - Learny Kids You can & download or print using the browser document reader options. 1. VALUATION GUIDE FOR GOODWILL DONORS 2. Goodwill Donated Goods Value Guide 3. NON-CASH DONATION WORKSHEET (Based on Salvation Army ... 4. NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET 5. The Salvation Army Valuation Guide for Donated Items ... 6. PDF Non-cash Charitable Contributions / Donations Worksheet Insert Date Given ===> Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation.

About Form 8283, Noncash Charitable Contributions Aug 28, 2020 · Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500. Current Revision Form 8283 PDF Instructions for Form 8283 (Print Version) PDF Recent Developments 6+ Popular Non Cash Donation Worksheet - Mate Template Design Non Cash Charitable Contributions Donations Worksheet 2017. Goodwill Donation Excel Spreadsheet Template. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. The Donation Form Templates can help you procure the details about the amount and property youve donated in charity hospitals and foundations. NON-CASH DONATION WORKSHEET - US Legal Forms Complete each fillable area. Ensure the details you fill in NON-CASH DONATION WORKSHEET is updated and accurate. Add the date to the record with the Date feature. Click on the Sign tool and create a digital signature. There are 3 available choices; typing, drawing, or uploading one. Be sure that every area has been filled in correctly. XLS Noncash charitable deductions worksheet. - LSTAX.com Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the

Publication 526 (2021), Charitable Contributions - IRS tax forms Noncash Contributions Out-of-Pocket Expenses How To Report Reporting expenses for student living with you. Noncash contributions. Total deduction over $500. Deduction over $5,000. Vehicle donations. Clothing and household items not in good used condition. Qualified appraisal. Qualified appraiser. Easement on building in historic district. Noncash charitable deductions worksheet. - Template IMPORTANT! One should prepare a list for EACH separate entity and date donations are made. For example: If one made a donation Boitnott & Schaben LLC Phone 540-966-0114 For more information about Charitable Contributions & Non-Cash Donations see IRS Publication 526: $2.00 $7.00 2.00 $12.00 $0.00 $5.00 $10.00 2.00 $15.00 $0 ... Charitable Contributions: Tax Breaks and Limits - Investopedia 13/01/2022 · Corporations also have an increased ceiling for cash charitable contributions in 2021. For cash donations, the ceiling increases from 10% to 25% of taxable income (with some adjustments) for “C ... Tax Tip: Deducting Non-Cash Charitable Donations for 2021 A clothing or household item for which a taxpayer claims a deduction of over $500 does not have to meet this standard if the taxpayer includes a qualified appraisal of the item with their tax return. Donations of property totaling over $5,000 annually always require an appraisal. However, appraisals have to meet strict paperwork requirements ...

pdfFiller - Fill Online, Printable, Fillable, Blank A Non Cash Charitable Contributions/Donations Worksheet is necessary for individuals who make non-cash charitable donations to the Salvation Army that do not exceed $5,000. People in the USA are encouraged to become contributors not only due to the moral virtues inherent to this act, but they will also be to claim corresponding deductions from the tax return. What is …

Online Donation Value Guide Spreadsheet - Printable and Editable PDF Form While other platforms allow you only to download the Donation Value Guide Spreadsheet for further printing, filling, and scanning, we give you a complete and simple service for preparing it online. First of all, when you select Get Form, you get numerous features for efficient document preparing and eSigning. Next, it is possible to select your ...

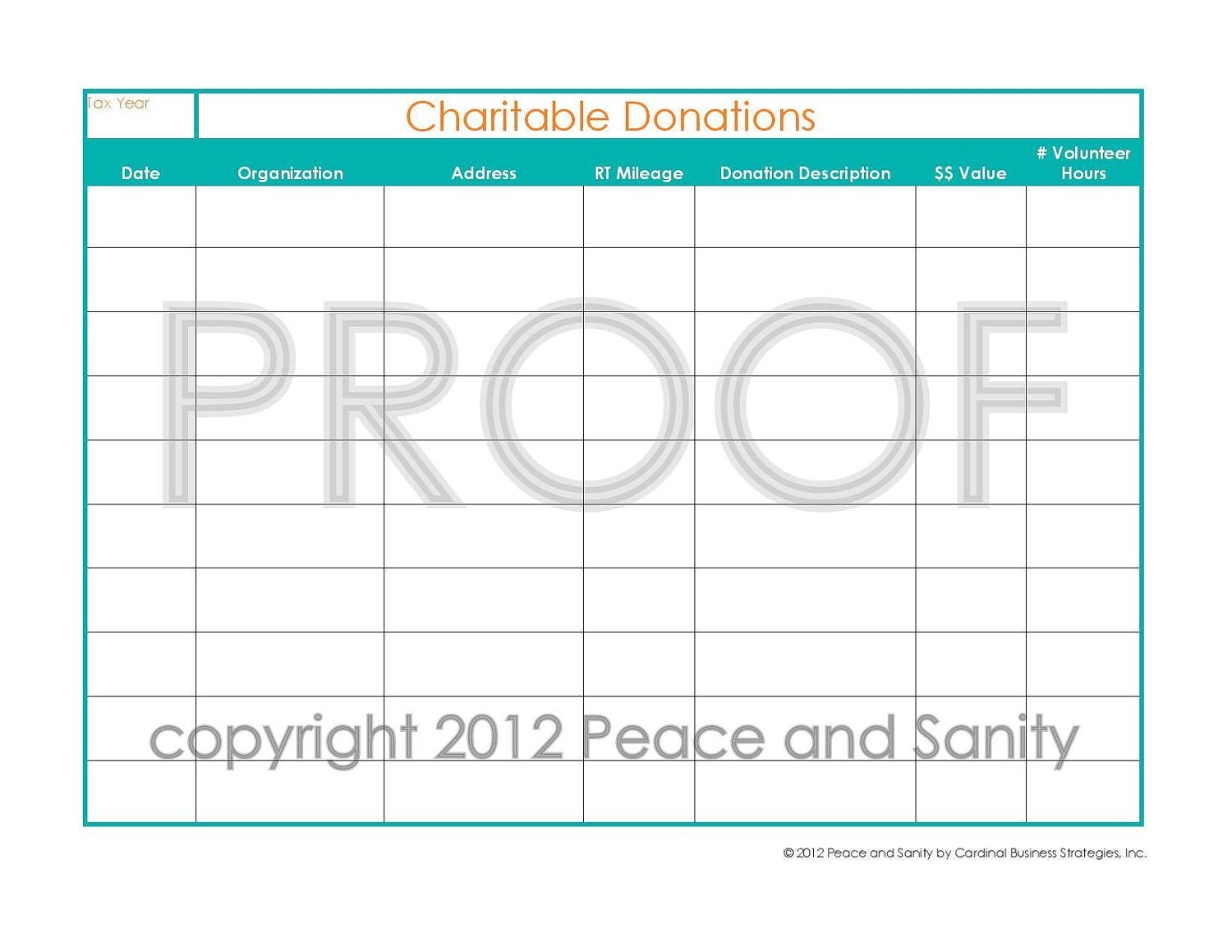

Charitable Contribution Worksheet | STAC Accounting December 20, 2017 Reporting Non Cash Charitable Donations can be extremely beneficial to your bottom line tax liability. Although, pulling it all together can also be painfully arduous. I am providing access to a worksheet built in excel. Download it and open in your 'sheets' app (excel, numbers, google sheets).

Donation Calculator Use this donation calculator to find, calculate, as well as document the value of non-cash donations. You can look up clothing, household goods furniture and appliances. Using The Spreadsheet. If you are using a tablet or mobile device, you cannot enter any data. However, you can browse the sheet to find values. Therefore, the ideal way to use this spreadsheet is by …

XLS Noncash charitable deductions worksheet. Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the Retain this worksheet with your receipts in your tax file.

Non-Cash Donation & Contribution Worksheet - Famiglio Non-Cash Donation & Contribution Worksheet Take this filled out worksheet to Goodwill or the charity of your choice, have them sign off on it, give us a copy, and then keep it in your tax records. It helps you keep track of what you may actually deduct and serves as support should the IRS request more information.

XLS Noncash charitable deductions worksheet. - imgix NON CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET. Insert Tax Year ===> Insert Date Given ===> ENTER ITEMS NOT PROVIDED FOR IN THE ABOVE CATEGORIES. SET YOUR OWN VALUE. WHAT IS YOUR ORIGINAL COST BASED ON RECIEPTS, OR YOUR BEST ESTIMATE, OF THE ITEMS DONATED? Charity's Address Blouse Coats Dresses Evening dresses Handbags WOMEN's CLOTHING

0 Response to "41 non cash charitable contributions donations worksheet"

Post a Comment