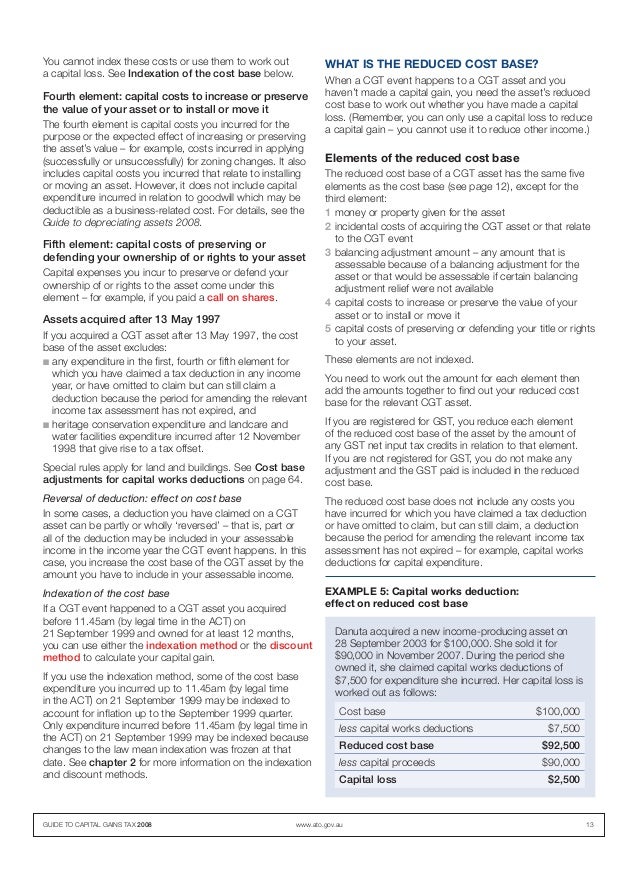

41 1040 qualified dividends worksheet

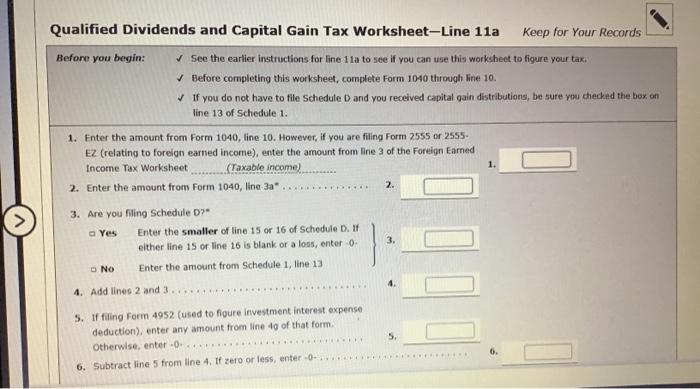

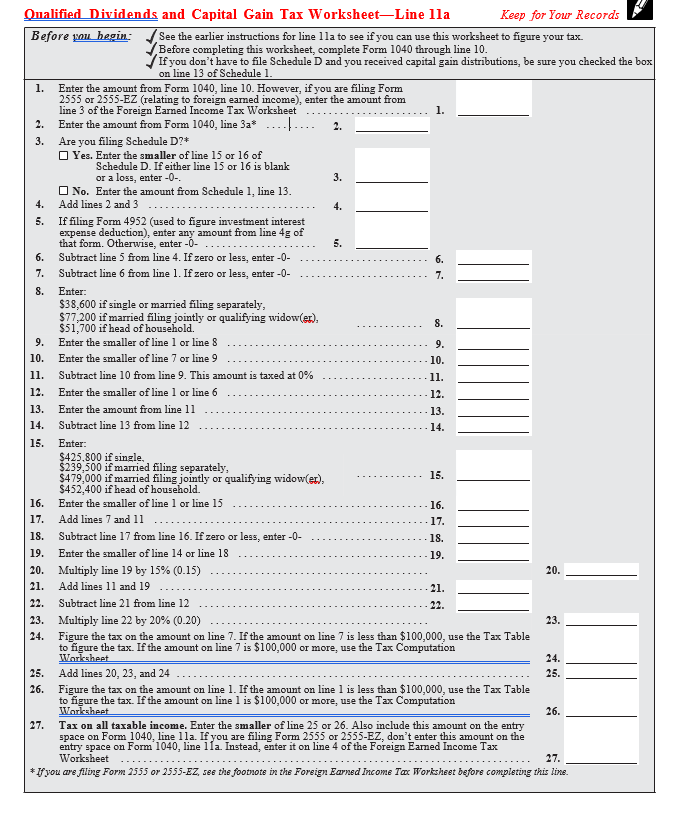

Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. Qualified dividends, on 1040 Schedule D, worksheet, does not… This worksheet directly compute Qualified Dividends, into lower Tax rate. In 2018, they eliminated the Worksheet below. 2018 Schedule D Tax Worksheet, asks for data, but eliminated link to lower Tax rate for Qualified Divdidends.I have suspicion, how they are handling this issue of Qualified Dividends built into 2018 Schedule D worksheet.

PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15.

1040 qualified dividends worksheet

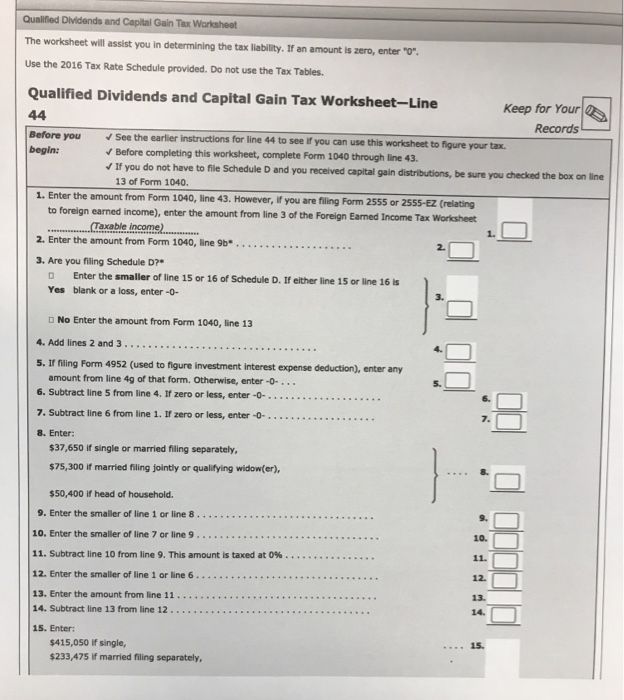

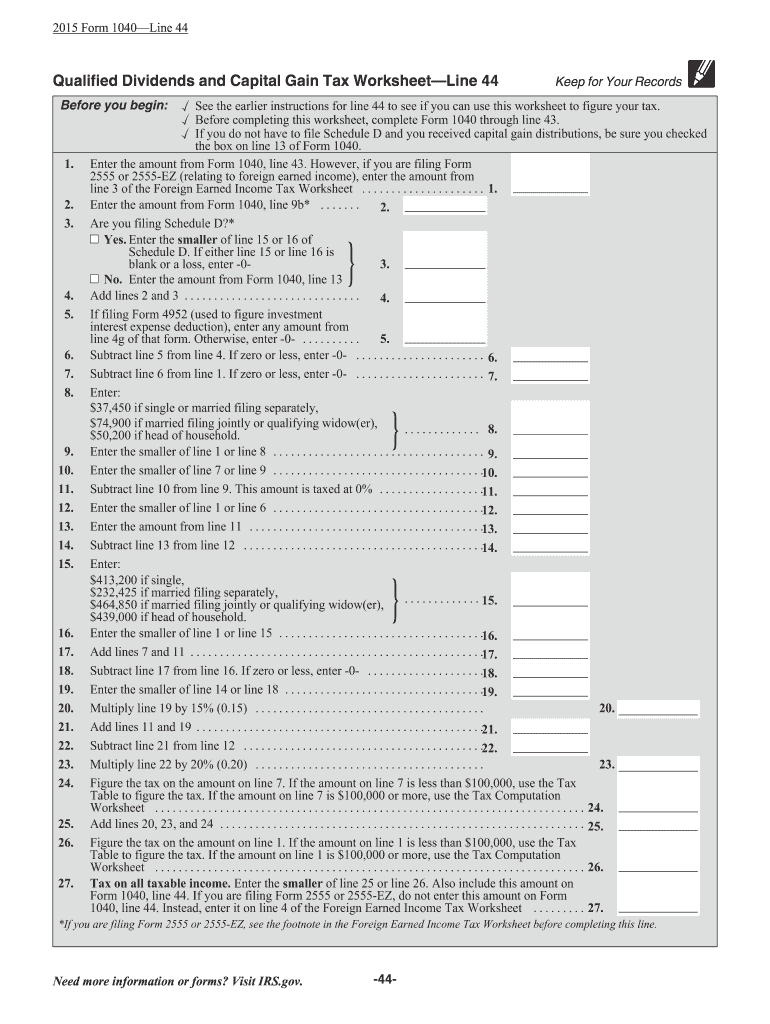

PDF Qualified Dividends and Capital Gain Tax Worksheet: An Alternative to ... for several years, the irs has provided a tax computation worksheet in the form 1040 and 1040a instructions for certain investors to get the benefit of the lower capital gains rates without the need to complete schedule d. taxpayers who had gains or losses from the sale, exchange, or conversion of investments or certain other items must use … Where do Qualified dividends go on 1040? - FindAnyAnswer.com Qualified dividends, as defined by the United States Internal Revenue Code, are ordinary dividends that meet specific criteria to be taxed at the lower long-term capital gains tax rate rather than at higher tax rate for an individual's ordinary income. The rates on qualified dividends range from 0 to 23.8%.

1040 qualified dividends worksheet. PDF SCHEDULE D Capital Gains and Losses - IRS tax forms Do you have qualified dividends on Form 1040, 1040-SR, or 1040-NR, line 3a? Yes. Complete the : Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. No. Complete the rest of Form 1040, 1040-SR, or 1040-NR. Schedule D (Form 1040) 2021: 1040 (2021) | Internal Revenue Service - IRS tax forms ABC Mutual Fund paid a cash dividend of 10 cents a share. The ex-dividend date was July 16, 2021. The ABC Mutual Fund advises you that the part of the dividend eligible to be treated as qualified dividends equals 2 cents a share. Your Form 1099-DIV from ABC Mutual Fund shows total ordinary dividends of $1,000 and qualified dividends of $200. 2021 Instructions for Schedule D (2021) - Internal Revenue Service 28% Rate Gain Worksheet—Line 18 Line 19 Instructions for the Unrecaptured Section 1250 Gain Worksheet Lines 1 through 3. Line 4. Step 1. Step 2. Step 3. Unrecaptured Section 1250 Gain Worksheet—Line 19 Line 10. Line 12. Installment sales. Other sales or dispositions of section 1250 property. Line 21 Schedule D Tax Worksheet Solved: The Qualified Dividends and Capital Gains Tax worksheet ... last updated June 06, 2019 1:05 AM The Qualified Dividends and Capital Gains Tax worksheet correctly calculates the 15% tax on these amounts but I cannot see how it is ever reflected on my 1040 return. Please show how the results from the Qualified Dividends and Capital Gain Tax worksheet are applied to the 1040 Forms.

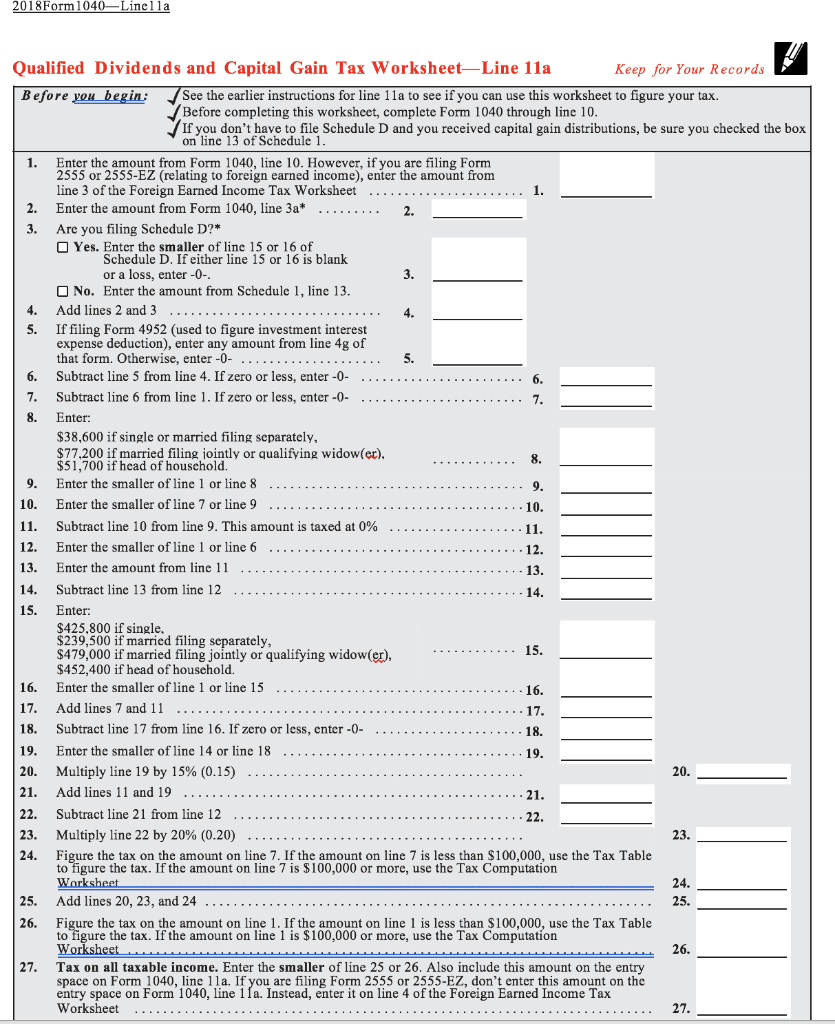

PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. PDF SCHEDULE D Capital Gains and Losses - IRS tax forms Do you have qualified dividends on Form 1040 or 1040-SR, line 3a; or Form 1040-NR, line 10b? ... Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 12a (or in the instructions for Form 1040-NR, line 42). No. Complete the rest of Form 1040, 1040-SR, or 1040-NR. Schedule D (Form 1040 or 1040 ... PDF Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040 ... 1040, line 44 (Form 1040A, line 28). If you are filing Form 2555 or 2555-EZ, do not enter this amount on Form 1040, line 44 (or Form 1040A, line 28). Instead, enter it on line 4 of the Foreign Earned Income Tax Worksheet * If you are filing Form 2555 or 2555-EZ, see the footnote in the Foreign Earned Income Tax Worksheet before completing this ... Calculation of tax on Form 1040, line 16 - Thomson Reuters You can find them in the Form 1040 Instructions. Qualified Dividend and Capital Gain Tax Worksheet. To see this select Forms View, then the DTaxWrk folder, then the Qualified Div & Cap Gain Wrk tab. Per the IRS Form 1040 Instructions, this worksheet must be used if: The taxpayer reported qualified dividends on Form 1040, Line 3a.

I have qualified dividends (1040 line 3a) and ordi... Yes -- qualified dividends are used in a special tax calculation. When you enter qualified dividends and/or capital gains on your return, taxes will not be calculated using the tax tables, but using either the Schedule D Tax Worksheet provided in the Instructions for Schedule D, or the Qualified Dividends and Capital Gains Tax Worksheet in the ... Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. 2018 Qualified Dividends Worksheets - K12 Workbook 2018 Qualified Dividends. Displaying all worksheets related to - 2018 Qualified Dividends. Worksheets are 2018 form 1041 es, 2018 form 1040 es, 2018 estimated tax work keep for your records 1 2a, 44 of 107, Pacific grace tax accounting, Qualified dividends and capital gain tax work an, 2017 qualified dividends and capital gain tax work ... How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018. On average this form takes 7 minutes to complete. The Form 1040 Qualified Dividends and Capital Gain Tax ...

Qualified Dividends and Capital Gains Worksheet.pdf qualified dividends and capital gain tax worksheet—line 12a keep for your records see the earlier instructions for line 12a to see if you can use this worksheet to figure your tax.before completing this worksheet, complete form 1040 or 1040-sr through line 11b.if you don't have to file schedule d and you received capital gain distributions, be …

Form 1040 line 10 different from line 10 qualified dividend ... - Intuit June 4, 2019 10:47 PM. Line 10 on the qualified dividend and capital worksheet is not necessarily the same as line 10 from your 1040. Your taxable income from your 1040 goes to line #1 of the QD/CG worksheet. June 4, 2019 10:47 PM. So the 1040 for this year is poorly designed!

Where do Qualified dividends go on 1040? - FindAnyAnswer.com Qualified dividends, as defined by the United States Internal Revenue Code, are ordinary dividends that meet specific criteria to be taxed at the lower long-term capital gains tax rate rather than at higher tax rate for an individual's ordinary income. The rates on qualified dividends range from 0 to 23.8%.

PDF Qualified Dividends and Capital Gain Tax Worksheet: An Alternative to ... for several years, the irs has provided a tax computation worksheet in the form 1040 and 1040a instructions for certain investors to get the benefit of the lower capital gains rates without the need to complete schedule d. taxpayers who had gains or losses from the sale, exchange, or conversion of investments or certain other items must use …

0 Response to "41 1040 qualified dividends worksheet"

Post a Comment