40 comparing credit card offers worksheet

Side by Side Credit Card Comparison - NerdWallet When comparing rewards credit cards, the rewards rate matters. Compare: Base rewards rate. Some cards earn a flat rewards rate on every purchase, often equivalent to 1.5% to 2% of the purchase... Your Credit Card - EconEdLink Find three credit card offers and compare the offers. Prepare a chart showing how the finance charge is calculated, the interest rate, annual fee, and minimum payment. Complete a worksheet that shows their understanding of how finance charges are calculated.

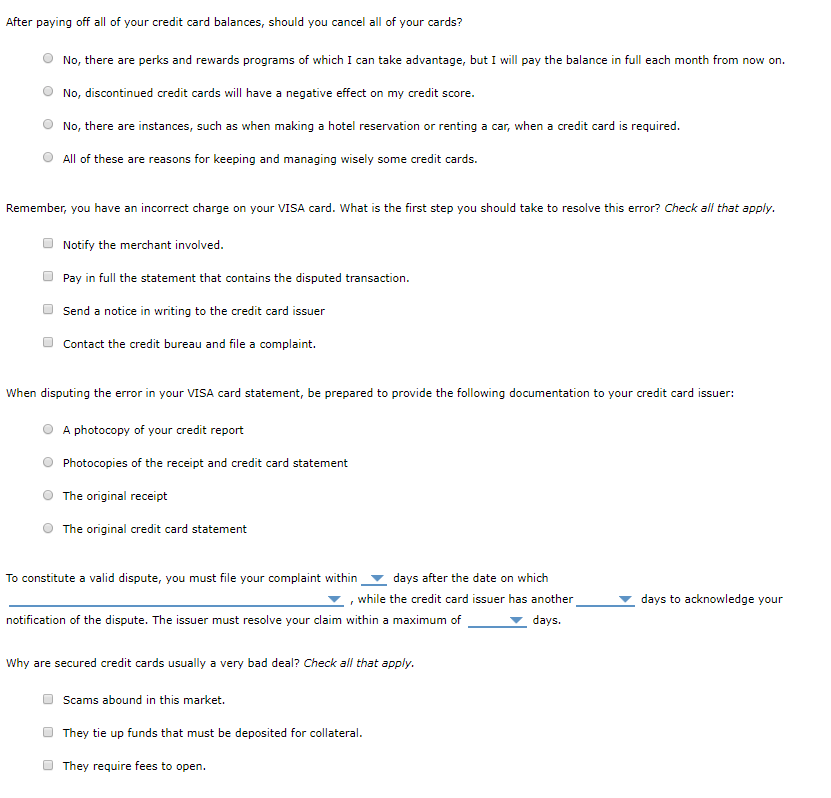

Compare Credit Cards: Compare & Apply Online Instantly Secured Credit Card → Min Deposit of $200 One-Time Fees → $0 Regular APR → 22.74% (V) Annual Fee $0 Monthly Fee $0 Minimum Credit Limited History Apply Now Show Details U.S. Bank Visa® Platinum Card 455 Reviews Rates & Fees Purchase Intro APR → 0% for 20 billing cycles Transfer Intro APR → 0% for 20 billing cycles | Transfer Fee: 3% (min $5)

Comparing credit card offers worksheet

PDF Evaluating Credit Card Offers Simulation - Intuit After looking at several offers, students will answer questions about the offers and complete a reflection question on the different types of credit card offers. Objectives 1. Evaluate credit card offers. 2. Identify the major steps involved with obtaining credit. 3. Recommend how to choose the best credit terms that best fit your needs. PDF Chapter 4 Comparing Credit Cards - Mr. Ibach's Website have the information needed to make an informed decision about which credit card is right for your needs and fi nancial situation. Comparing Two Credit Card Off ers Credit Card A Credit Card B 3.99% APR for the life of transferred balances; 13.25 % APR for all other purchases 0.00% APR for 6 months; 19.8% APR for remaining lifetime of card PDF Evaluating Credit Card Offers Simulation - Intuit Choose two of the credit card offers above by comparing answers you wrote above. Identify two ways these credit cards differ. 6. Which one credit card offer of the three you looked at do you feel is the best offer? Explain. 7. Scott's current credit card has an interest rate of 20%.

Comparing credit card offers worksheet. Compare Credit Cards - Credit Card Comparison Calculator Terms & Definitions For Comparing Credit Cards Balance - The amount of money owed on a credit card. Fixed Monthly Payment Amount - The amount of money applied to the balance on a monthly, consistent basis. Credit Limit - The maximum amount of money that can be borrowed at any one time using a credit card. fcs340_document_l07ComparingCreditCardOffers (1).docx ... Comparing Credit Card Offers Instructions Compare credit card offers from 2 banks, 2 retail stores, and a travel/entertainment card. Look for the features each card offers. Compare these offers with other cards that you already hold (if applicable). Complete the table below to summarize your findings. PDF Lesson Five Credit Cards - Practical Money Skills Develop skills to compare and evaluate the terms and conditions of various credit cards, the differences between credit cards, and the legal and financial responsibilities involved. lesson objectives List three types of credit card accounts, and explain the uses and payment methods of each Understand how to shop for a credit card Personal Finance Final Note cards Flashcards - Quizlet Comparing credit card offers include comparing introductory APR's, benefits, minimums, etc. How much of your net income should you save each month? 10% and more. Why is diversification important? it reduces risk by spreasing it over a variety of investments.

ACTIVITY GOAL Comparing Two Credit Card Offers 3.99% APR ... Comparing Two Credit Card Offers 3.99% APR for the life of transferred balances; 13.25 % APR for all other purchases Minimum monthly payment of $ 15 or of balance Rewards program: $ I O shopping card with each $1 in spending 0.00% APR for 6 months; 19.8% APR for remaining lifetime of card Monthly balance must be paid in full each month PDF EVALUATING CREDIT CARD OFFERS - EconEdLink Choose two of the credit card offers above by comparing answers you wrote above. Identify two ways these credit cards differ. 6. Which one credit card offer of the three you looked at do you feel is the best offer? Explain. 7. Scott's current credit card has an interest rate of 20%. EOF Why A Credit Card Comparison Worksheet Is So Important ... A credit card comparison worksheet is a very useful tool for ranking credit cards in the order of their value to you. A credit card is only useful if it can meet your needs. So using this worksheet will eventually save you loads of time as well as money in the long-run. Many credit cards come with great rewards but may attract huge fees.

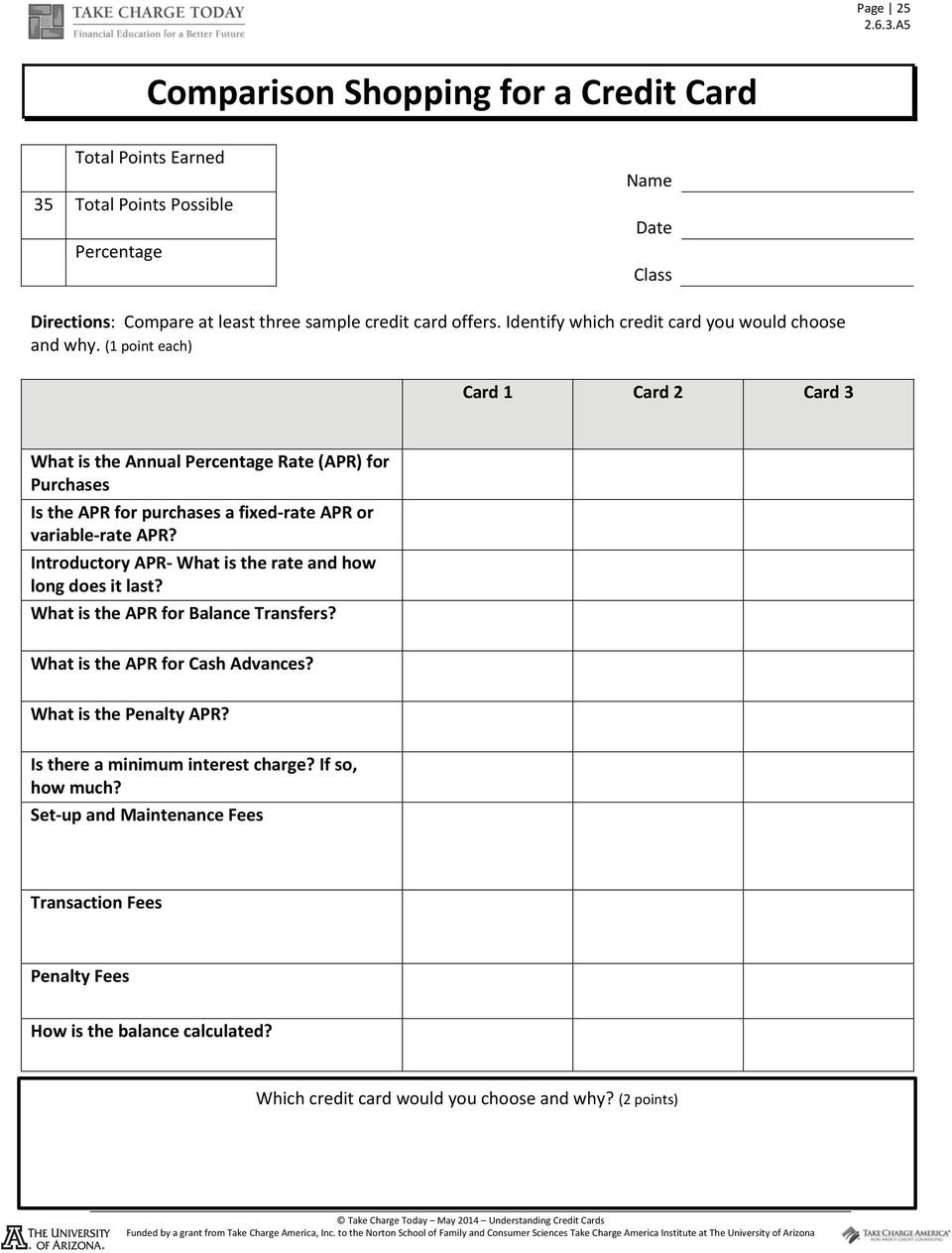

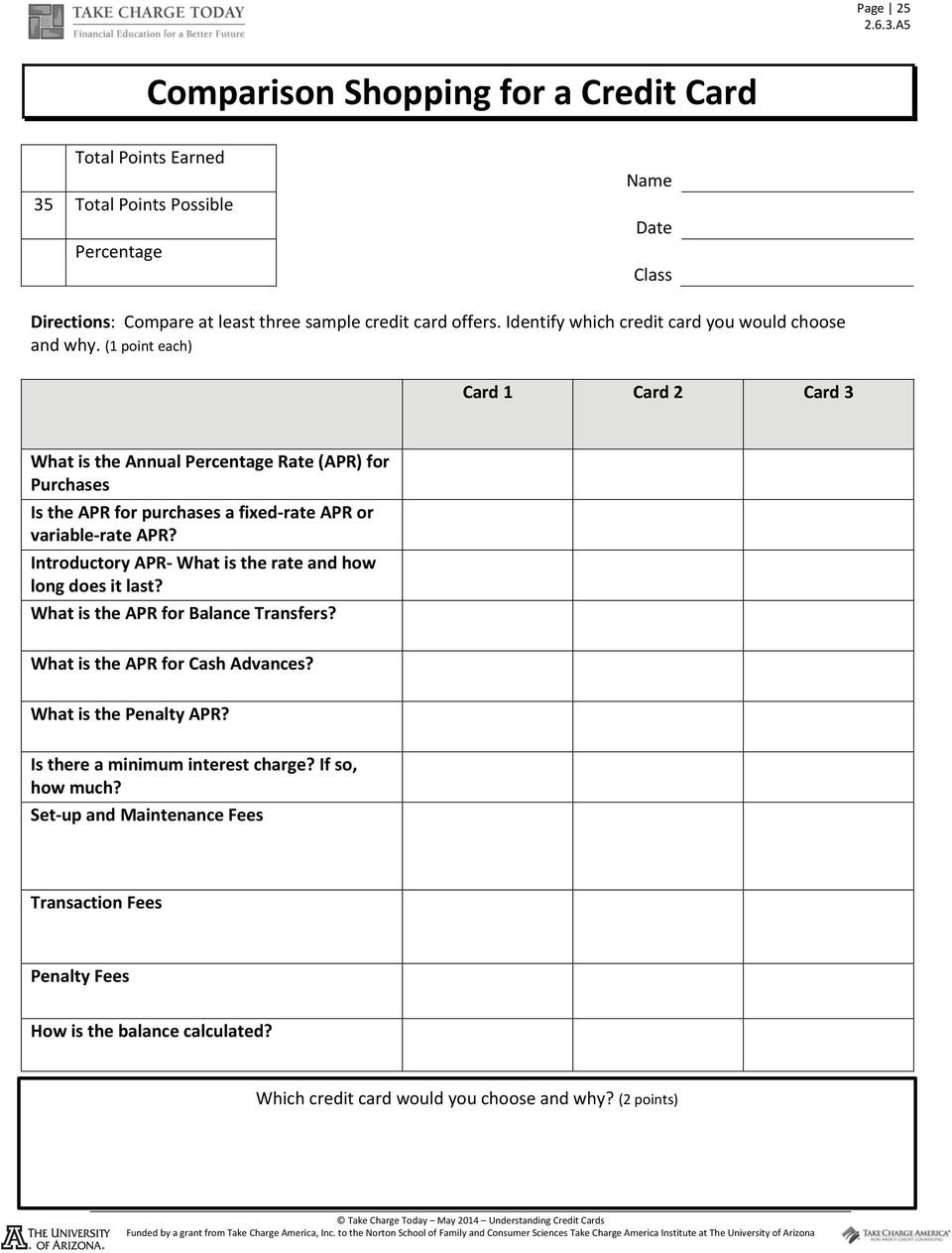

Credit Card Comparison Flashcards | Quizlet Credit Card Comparison Flashcards | Quizlet Credit Card Comparison STUDY Flashcards Learn Write Spell TestNew stuff! PLAY Match Gravity Interest Rate Click card to see definition 👆 The fee, expressed as a percentage, a borrower owes for the use of a creditor's money. At an interest rate of 10%, a borrower would pay $110 for $100 borrowed. PDF Comparison Shopping for a Credit Card - Weebly Directions : Compare at least three sample credit card offers. Identify which credit card you would choose and why. Card 1 Capital One® VentureOne® Rewards Credit Card Card 2 Quicksilver From Capital One Card 3 Discover It What is the Annual Percentage Rate (APR) for Purchases 0% 0% 0% 4 Credit Card Comparison Charts (Rewards, Fees, Rates ... Capital One VentureOne Rewards Credit Card AIR MILES RATING ★★★★★ 4.9 OVERALL RATING 4.8/5.0 $0 annual fee and no foreign transaction fees Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel Earn unlimited 1.25X miles on every purchase, every day PDF Credit Card Comparison Shopping Worksheet Publisher Credit Card Comparison Shopping Worksheet Things to consider when choosing a credit card: • If you're going to pay the bill in fullevery month, then the interest rate doesn't really matter to you. Look for a card with no annual fee and a longer grace period so you don't get hit with a finance charge.

Financial Literacy Activity Comparing Credit Card Offers Answers : Authorized Users: Adding Them ...

PDF Evaluating Credit Card Offers Simulation - Intuit Choose two of the credit card offers above by comparing answers you wrote above. Identify two ways these credit cards differ. 6. Which one credit card offer of the three you looked at do you feel is the best offer? Explain. 7. Scott's current credit card has an interest rate of 20%.

PDF Chapter 4 Comparing Credit Cards - Mr. Ibach's Website have the information needed to make an informed decision about which credit card is right for your needs and fi nancial situation. Comparing Two Credit Card Off ers Credit Card A Credit Card B 3.99% APR for the life of transferred balances; 13.25 % APR for all other purchases 0.00% APR for 6 months; 19.8% APR for remaining lifetime of card

PDF Evaluating Credit Card Offers Simulation - Intuit After looking at several offers, students will answer questions about the offers and complete a reflection question on the different types of credit card offers. Objectives 1. Evaluate credit card offers. 2. Identify the major steps involved with obtaining credit. 3. Recommend how to choose the best credit terms that best fit your needs.

0 Response to "40 comparing credit card offers worksheet"

Post a Comment