40 calculating sales tax worksheet pdf

Shopping With Sales Tax Word Problems - Teach-nology Using the price list, calculate the answer for each question. 1. If there is 5.2% sales tax on a pair of jeans? How much is the total tax? 2. 40% discount on a pair of shorts. What is the discount? 3. You want to buy a T-shirt and a Jacket. If the sales tax is 3.6%, what is your after-tax total cost? 4. What is 6% sales tax on a Scarf? 5. Calculating Sales Tax Worksheets & Teaching Resources | TpT PDF This is a real-world situation activity where students will work within a budget and calculate percents of a number, discounts, sales tax and totals. It can be used as an in-class assignment, homework or as a review. Students can also be placed in groups and complete cooperatively!SKILL-Finding perc Subjects:

Calculating Sales Tax Worksheet Calculating Sales Tax Worksheet March 1, 2022 admin Fabulous Calculating Sales Tax Worksheet - Therefore, an accounting worksheet is a straightforward representation within the type of a spreadsheet that helps track each step throughout the accounting cycle.

Calculating sales tax worksheet pdf

azdor.gov › files › FORMS_TPT_10649f-WorksheetCWorksheet C, Sale of Motor Vehicle to Nonresident Under A.R.S ... NOTE: The imposition of CITY PRIVILEGE (“SALES”) TAX is NOT affected by A.R.S. § 42-5061(U), and applies at the full rate. As this worksheet computes only STATE and COUNTY tax, city tax must be computed separately. This is a for fillable version used for a fillable, calculating pdf. Please do not overwrite this page; edit only. DOC Sales Tax and Discount Worksheet At best buy they have a 42" TV that sells for $1250 and is on sale for 15% and sales tax is 6.5%. What is the final cost. If your cell phone bill was $67.82 and there is a 7.5% late fee, how much will your bill be? If you go out to eat with 3 friends and your meal was $72.50, there is 6.75% sales tax and you should tip the waiter 15%. › revenue › tax-return-formsCorporate Income Tax Forms - 2021 | Maine Revenue Services Schedule NOL (PDF) For Calculating the Net Operating Loss (NOL) Recapture Subtraction Modification: Included: Worksheets for Tax Credits: Worksheets for Tax Credits Claimed on Form 1120ME, Schedule C: Included: 2220ME (PDF) Underpayment of Estimated Tax by Corporations or Financial Institutions: Included: 2220ME Annualized Worksheet (PDF)

Calculating sales tax worksheet pdf. DOC Sales Tax and Discount Worksheet - Chester Sales Tax and Discount Worksheet -Math 6. In a department store, a $50 dress is marked, "Save 25%." What is the discount? What is the sale price of the dress? In a grocery store, a $21 case of toilet paper is labeled, "Get a 20% discount." What is the discount? What is the sale price of the toilet paper? PDF How to calculate Discount and Sales Tax How much does that ... Sales Tax is an additional amount of money that will be added to the cost of the item. Sales Tax is given as a percentage and varies from state to state. In the year 2005, sales taxes range from 4% - 8%. For our lesson today we will assume Sales Tax = 5%. We will use the following formula to calculate the sales tax: Sales Tax = Sales Tax rate ... PDF Answer Keys - Central Bucks School District a) What is the sales tax? b) What is the total purchase price? 2) Martin bought an iPhone for $649.99 in California, where the sales tax rate is 7.5%. a) What is the sales tax? b) What is the total purchase price? 3) Mike purchased two blankets at $44.99 each, one mattress for $59.00 and two bed sheets for a total of $9.99.The sales tax rate is ... Calculating Sales Tax | Worksheet - education To figure it out, you'll have to practice calculating sales tax. Catered to fifth-grade students, this math worksheet shows kids the steps to find the amount something costs with tax. This process uses decimal numbers, rounding, and division. Students practice what they learn in both straightforward calculations and in word problems.

Tax, Tip, and Discount Word Problems Find the discount and the sales price if a customer buys an item that normally sells for $365. 7. Jean Junction is selling jeans at 15% off the regular price. The regular price is $25.00 per pair. What is the discount amount? 8. If the sales tax for the city of Los Angeles is 9.75%, how much tax would you pay for an item that costs $200.00? 9. Mrs. PDF Calculating Sales Tax - raymondgeddes.com Calculating Sales Tax Sales Receipt Worksheet Complete each sales receipt by calculating total prices for each item of the receipt, the subtotal amount, the sales tax amount, and the total purchase amount. Sales Tax Rate: ____ Sales Tax Rate Converted to Decimal: ___ Receipt #5 Customer Name: Marcus hgms.psd202.org › documents › llouckSales Tax and Discount Worksheet - psd202.org 2.To find the tax, multiply the rate (as a decimal) by the original price. 3.To find the total cost, add the tax to the original price. 5) If the sales tax rate is 7.25% in California, then how much would you pay in Los Angeles for a pair of shoes that cost $39.00? 6) The price of a new car is $29,990. If the sales tax rate is 6.5%, then how ... Calculating Total Cost after Sales Tax - Liveworksheets Close. Live worksheets > English > Math > Percentage > Calculating Total Cost after Sales Tax. Calculating Total Cost after Sales Tax. Finding Sales Tax and Total Cost after it is applied. ID: 839531. Language: English. School subject: Math. Grade/level: Grade 5. Age: 7-15.

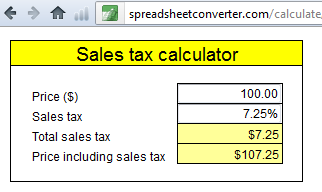

Calculating Sales Tax - Lesson Title • Identify the sales tax rate in your state. Ohio's State tax is 5.5 % which is .055 • Multiply this percentage by the retail price of the item(s). This amount is the sales tax. .055 x cost of Twister Eraser .35 = .02 • Add the sales tax to the retail price of the item(s) to determine the total price of the purchase. .02 = .35 = .37 PDF Name: Date: Practice: Tax, Tip and Commission 1. Percentsare used to calculate sales tax. 2. Sales tax: A tax put on a good that goes to the government to pay for programs 3. To calculate sales tax, find the tax rateof the price. 4. Then, add the sales tax to the original price. 5. A shirt costs $25.50. If the sales tax rate is 8.5%, what is the total cost to purchase the shirt? PDF Percent discount Worksheet - Math Goodies Percent discount Worksheet. Search form. Search . To print this worksheet: click the "printer" icon in toolbar below. To save, click the "download" icon. Sign Up For Our FREE Newsletter! * By signing up, you agree to receive useful information and to our privacy policy ... PDF Calculating Sales Tax - Denton ISD The sales tax is 5%. What is the total cost of the meal? Steps: 1) Find the tip. **You can either multiply $12 by .20 or divide $12 by 5 2) Find the sales tax. 3) Add the bill, tip, and tax. 20% ∙ 12= $2.40 5% ∙ 12= $0.60 The total cost is $15 = $15 $12 + $2.40 + $0.60 **You multiply $12 by .05 Finding Sales Tax and Tip

PDF Tip and Tax Homework Worksheet - Kyrene School District Name:&_____H our:&_____& & Tip&and&Tax&Worksheet& Find&the&price&of&the&meal&with&the&given&information.& & 1) Food&bill&before&tax:&$30& & & 2)&&Food&bill&before&tax ...

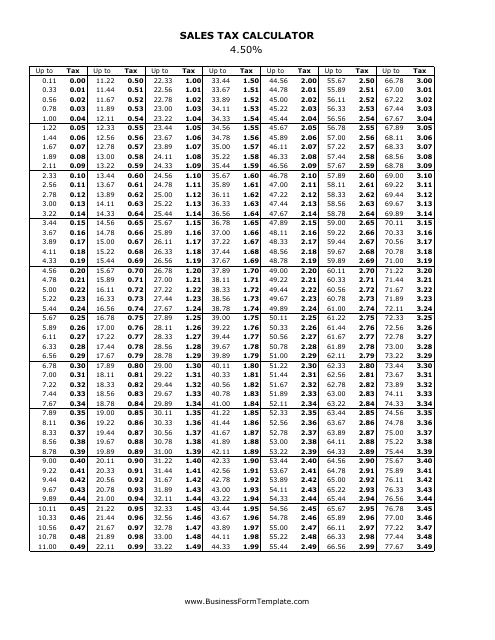

Sales Tax and Discount Worksheet - The Wesley School 5) If the sales tax rate is 7.25% in California, then how much would you pay in Los ... Calculate the sales tax & final price for the following:.5 pages

› revenue › tax-return-formsIndividual Income Tax Forms - 2022 | Maine Revenue Services Schedule PTFC/STFC (PDF) Property Tax Fairness Credit and Sales Tax Fairness Credit: Included: Schedule A (PDF) Adjustments to Tax / Child Care Credit Worksheet: See 1040ME General Instructions: Worksheet for "Other" Tax Credits (PDF) Other Tax Credits Worksheet Worksheet for Form 1040ME, Schedule A, lines 6 and 20: Included: Tax Credit Worksheets

Period: ______ Sales Tax Worksheet Directions Sales Tax Worksheet. Directions: Using percents and proportions solve the following problems. Show all work. 1. If the sales tax rate in 7.25% in California ...2 pages

› pdf › current_formsForm ST-101-ATT New York State and Local Annual Sales and Use ... Annual Sales and Use Tax Credit Worksheet ST-101-ATT (2/22) Page 1 of 1 Credit summary – Enter the total amount of taxable receipts (for all jurisdictions). These are the amounts you used to reduce your taxable sales or purchases subject to tax when calculating the tax due for each jurisdiction.

calculating tax worksheet - Teachers Pay Teachers Calculating Sales Tax Printable Worksheet Bundle by Life Skills Made Easier 1 $12.00 $9.60 Bundle This bundle consists of receive 4 printable pdf files. There are 4 themes.

dor.mo.gov › formsForms and Manuals - Missouri Worksheet for Calculating Business Facility Credit, Enterprise Zone Modifications and Enterprise Zone Credit: 12/5/2014: 4357: Other Tobacco Products Tax Exemption Certificate: 5/30/2014: 4374: Application for Registration as a Fleet Vehicle Owner: 2/13/2014: 4379: Request For Information or Audit of Local Sales and Use Tax Records: 4/9/2021: 4379A

PDF Grade Level: 7 You Can't Hide from Taxes Lesson: 1 tax and Medicare tax using the standard percentage; and calculate other deductions to find the net income. Finally, the students will play a game to practice calculating sales tax and payroll tax. Texas Essential Knowledge and Skills (Target standards) PFL Math 7.13A: Calculate the sales tax for a given purchase and calculate

support.cch.com › kb › solutionQualified Dividends and Capital Gain Tax Worksheet. - CCH Schedule D Tax Worksheet If you have to file Schedule D, and line 18 or 19 of Schedule D is more than zero, use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040, line 44. Qualified Dividends and Capital Gain Tax Worksheet.

PDF Sales Tax Practice Worksheet - MATH IN DEMAND Sales Tax = $65 x 0.06 Sales Tax = $3.90 Sales Tax = $1.80 If a shirt costs $20 and the sales tax is 9%, how much money do you need to Sales Tax = $20 x 0.09 Total Cost = $20 + $1.80 Total Cost = $21.80 socks that cost $4. If there is an 8% sales tax, how Sales Tax = $4 x 0.08 Sales Tax = $0.32 Total Cost = $4 + $0.32 Total Cost = $4.32

PDF Sales Tax and Discount Worksheet - Loudoun County Public ... Sales Tax and Discount Worksheet 1) In a department store, a $40 dress is marked, "Save 25%." What is the discount? What is the sale price of the dress? 2) In a grocery store, a $12 case of soda is labeled, "Get a 20% discount." What is the discount? What is the sale price of the case of soda?

Discount and Sales Tax Worksheet The following items at ... Discount and Sales Tax Worksheet The following items at Sam's Sports Palace are on sale. Find the amount of discount, sale price, sales tax, and total cost for each item. Use a sales tax rate of 5%. Tennis Racquet: $100 at 30% off Can of Tennis Balls: $4.00 at 25% off Basketball: $10.95 at 20% off Baseball Glove: $44.50 at 10% off

› revenue › tax-return-formsCorporate Income Tax Forms - 2021 | Maine Revenue Services Schedule NOL (PDF) For Calculating the Net Operating Loss (NOL) Recapture Subtraction Modification: Included: Worksheets for Tax Credits: Worksheets for Tax Credits Claimed on Form 1120ME, Schedule C: Included: 2220ME (PDF) Underpayment of Estimated Tax by Corporations or Financial Institutions: Included: 2220ME Annualized Worksheet (PDF)

DOC Sales Tax and Discount Worksheet At best buy they have a 42" TV that sells for $1250 and is on sale for 15% and sales tax is 6.5%. What is the final cost. If your cell phone bill was $67.82 and there is a 7.5% late fee, how much will your bill be? If you go out to eat with 3 friends and your meal was $72.50, there is 6.75% sales tax and you should tip the waiter 15%.

azdor.gov › files › FORMS_TPT_10649f-WorksheetCWorksheet C, Sale of Motor Vehicle to Nonresident Under A.R.S ... NOTE: The imposition of CITY PRIVILEGE (“SALES”) TAX is NOT affected by A.R.S. § 42-5061(U), and applies at the full rate. As this worksheet computes only STATE and COUNTY tax, city tax must be computed separately. This is a for fillable version used for a fillable, calculating pdf. Please do not overwrite this page; edit only.

0 Response to "40 calculating sales tax worksheet pdf"

Post a Comment