41 self employment expenses worksheet

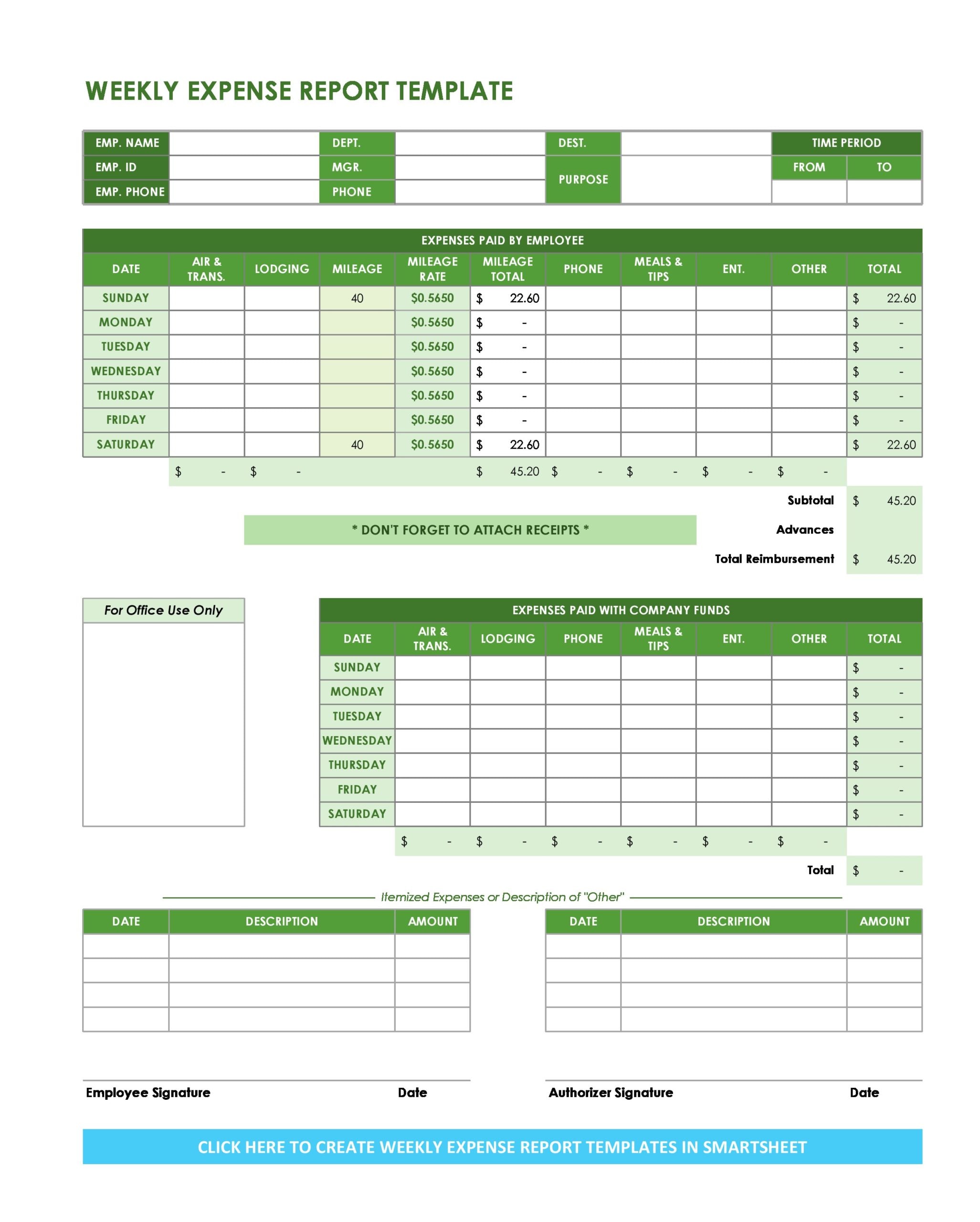

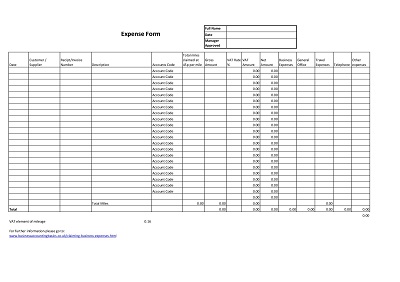

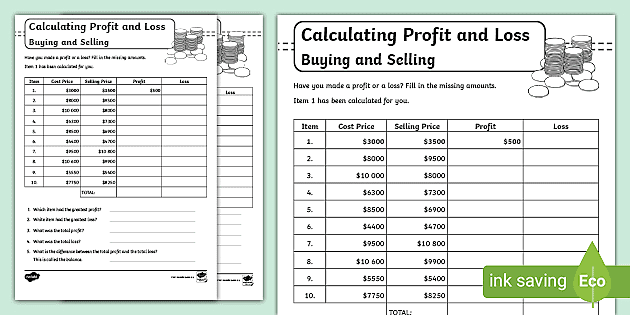

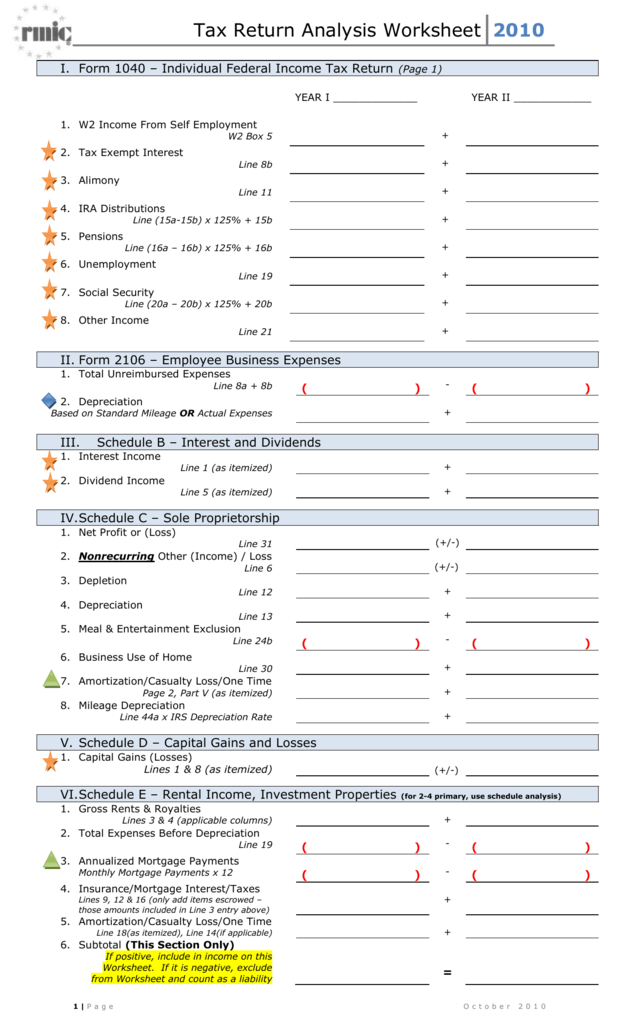

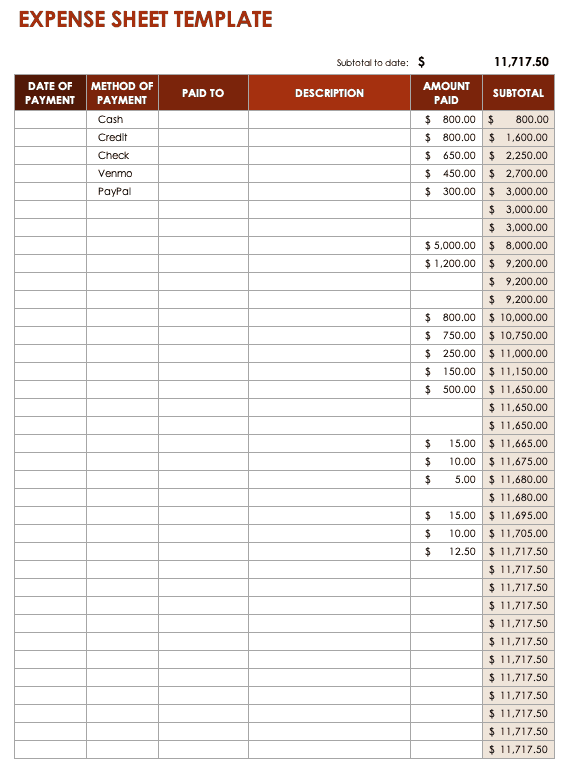

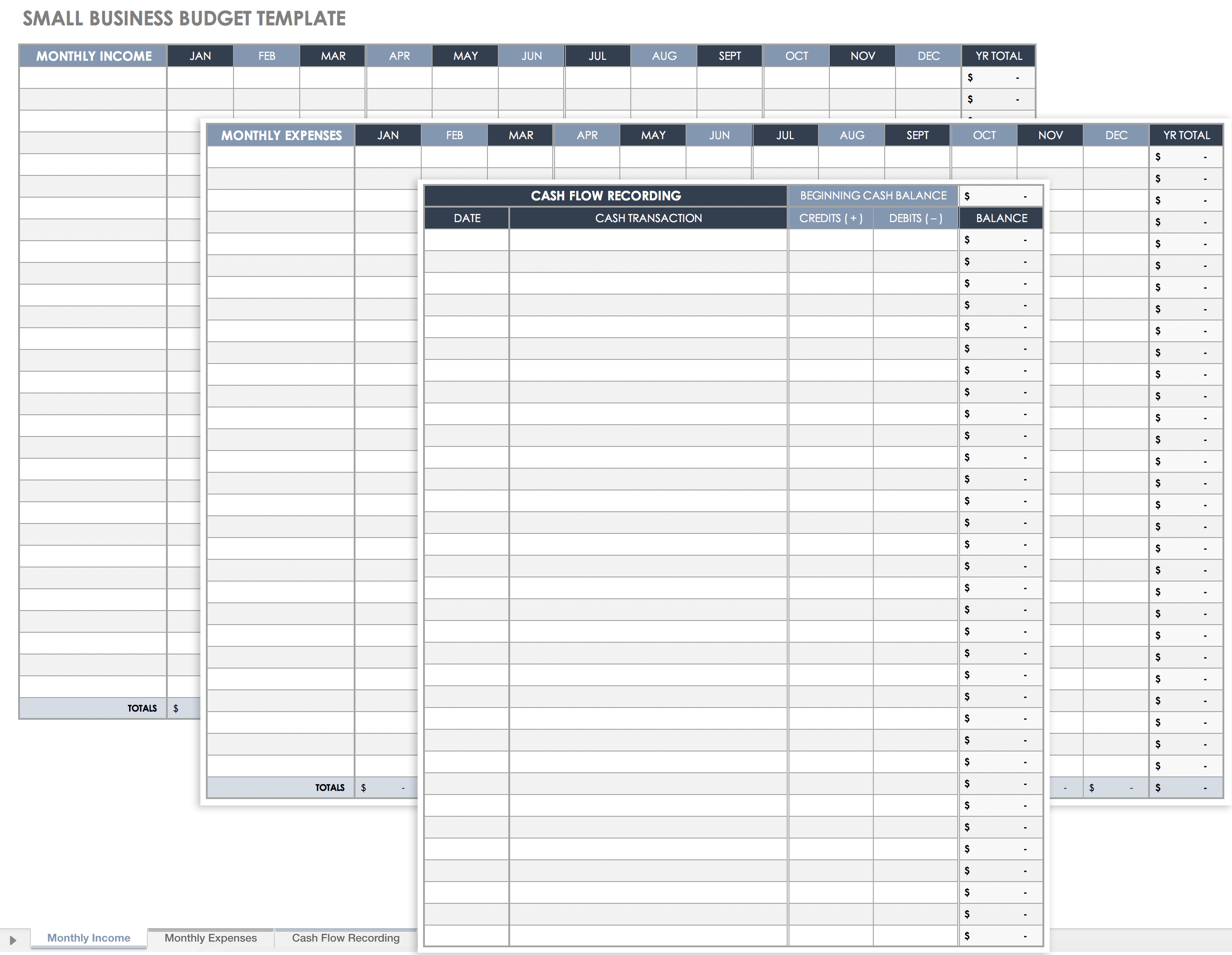

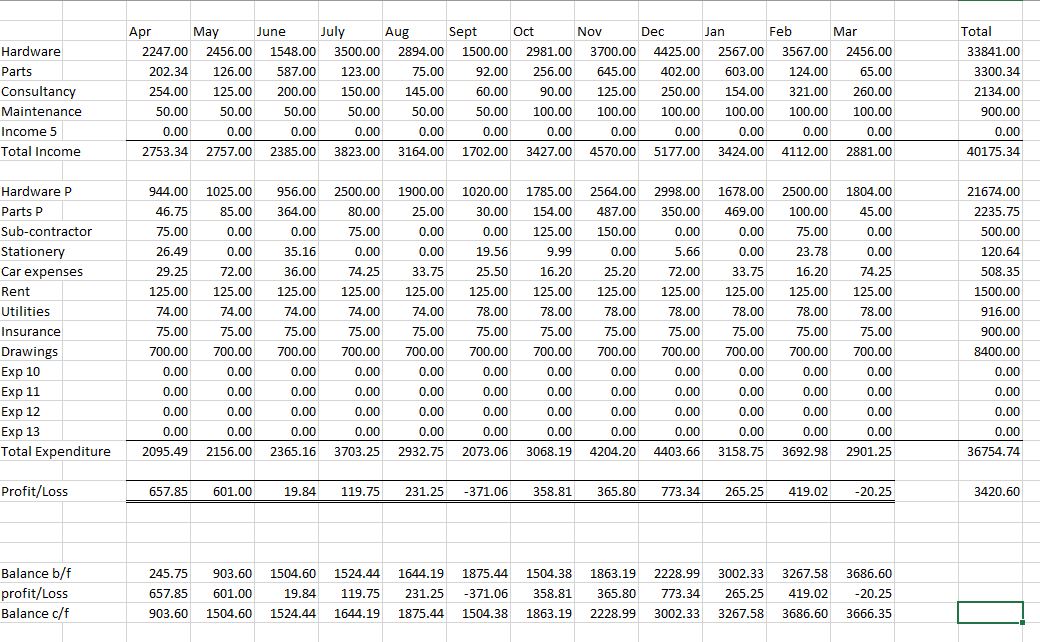

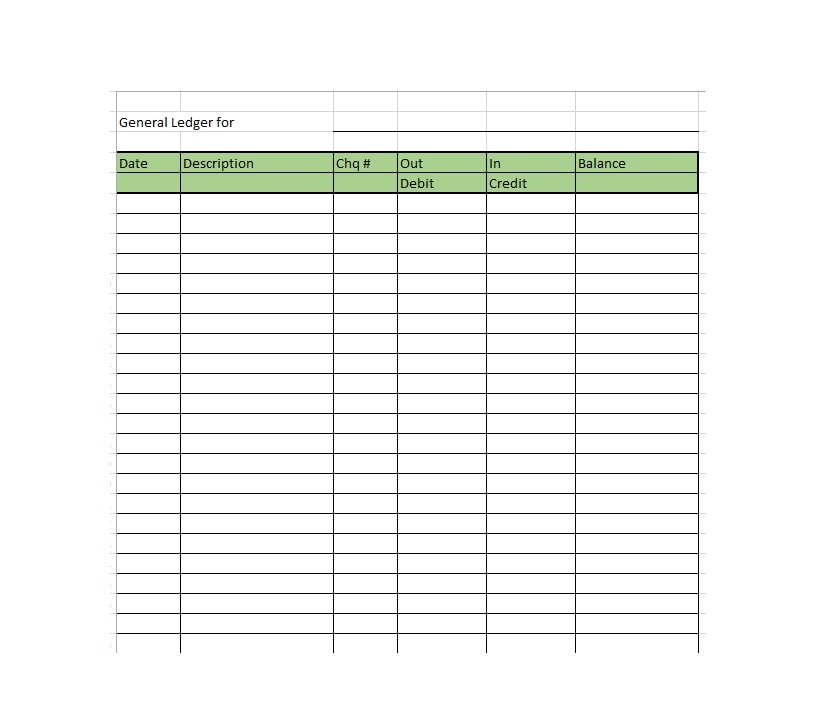

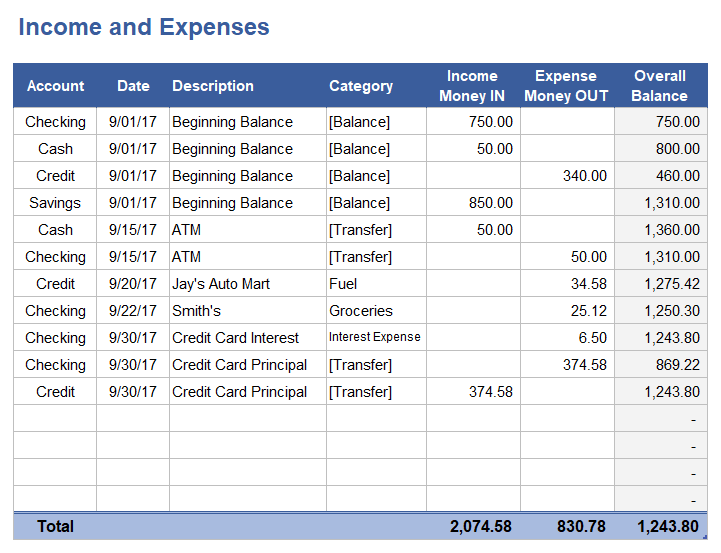

Tracking your self-employed income and expenses - Viviane ... Worksheets Download the appropriate "Self-employed income and expense worksheet" in PDF or Excel format. Add up your self-employed income and enter in the income section of the worksheet. Add up your expenses using the categories in the worksheet and enter the amounts in the appropriate section of the worksheet. Spreadsheet Software PDF Monthly Expenses Worksheet - AARP If self-employed, business expense Calculate Your Total Monthly Expense: Total from Column A: $ _____ Total from Column B: + $ _____ Equals Total Monthly Expenses: $ _____ Title: Microsoft Word - Monthly_Expenses_Worksheet.doc Author: equalls Created Date: 12/19/2005 1:21:24 PM ...

PDF Clergy Income & Expense Worksheet Year CLERGY INCOME & EXPENSE WORKSHEET YEAR _____ NAME ... Self Employment Housing Allowance Weddings & Funerals ... Continue only if you take actual expense (must use actual expense if you lease) other regular place of business. Gas, oil, lube, repairs, tires, batteries, insurance, supplies, wash, wax, etc. ...

Self employment expenses worksheet

Free expenses spreadsheet for self-employed - Bonsai Expenses Spreadsheet for Self-Employed Whether it's for your own accounting or to manage your billable expenses, an expenses spreadsheet can help you stay organized and maximize your tax deductions in preparation for your self employment taxes. We've built it to help you get peace of mind and get on with your work. Self-Employed Tax Deductions Worksheet (Download FREE) The team at Bonsai organized this self-employed tax deductions worksheet (copy and download here) to organize your deductible business expenses for free. Simply follow the instructions on this sheet and start lowering your Social Security and Medicare taxes. Tax Worksheet for Self-employed, Independent contractors ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate.

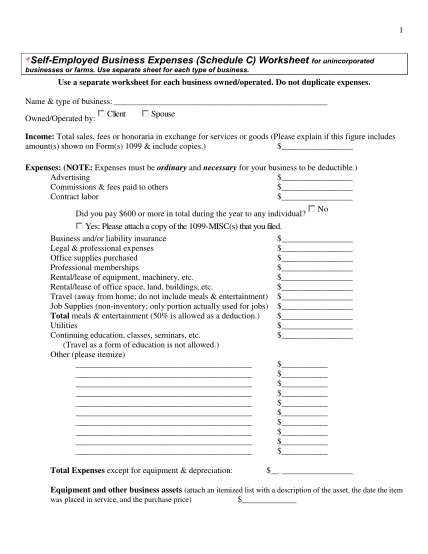

Self employment expenses worksheet. tax year 2020 Part 1: Business Income and Expenses Schedule C Worksheet for Self-Employed Filers and Contractors – tax year 2020. This document will list and explain the information and documentation that we ...6 pages DOCX c101374920.preview.getnetset.com SPECIALTY WORKSHEET for the SELF-EMPLOYED. To maximize your deductions, please complete this form. ... Maintenance and Maintenance Contracts; Accounting Software. Medical - Employees Related. Advertising - Business Cards. Medical - Owner Related (1040 Only) Advertising - Magazines . Notary Fees. ... Transportation Expenses. Education ... SELF EMPLOYMENT INCOME WORKSHEET 18. Total Expenses I , certify that on , I have reviewed and verified the receipts used to calculate the allowable expenses listed above. Total Self Employment Income d. Total Itemized Transportation Costs (sum of lines i-vi.) PDF Self-employed Tax Organizer Part 12: SELF-EMPLOYED BUSINESS EXPENSES A deductible business expense is one that is ordinary (commonly accepted in your industry) and necessary (helpful and appropriate even if not indispensable) for a particular business. Keep bank and credit card statements, but note these are not enough to verify expenses in case of audit.

Solved: Self employment tax in community property state Self employment tax in community property state. No, although you split self-employment income between spouses, the self-employment tax stays with the spouse who paid it. **Say "Thanks" by clicking the thumb icon in a post. **Mark the post that answers your question by clicking on "Mark as Best Answer". View solution in original post. 1. 2. Self Employed Tax Deductions Worksheet - Fill Out and Sign ... The way to complete the Self employment income expense tracking worksheet form online: To start the blank, use the Fill & Sign Online button or tick the preview image of the form. The advanced tools of the editor will direct you through the editable PDF template. Enter your official contact and identification details. PDF Self Employment Income Worksheet Self Employment Income Worksheet . Self Employed Applicants Name: _____ Home Address: _____ ... Allowable expenses that can be deducted from income are listed below within the worksheet. Tacoma Public Utilities does not allow the same business deductions as the IRS. Schedule C Worksheet Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors ... I certify that I have listed all income, all expenses, and I have documentation to back up the figures entered on this worksheet. For tax year _____ Printed Name_____ Signature_____ Date _____ ...

PDF Sole Proprietorship/ Self-employed Worksheet Automobile Deductions worksheet for self-employment or unreimbursed employee business expenses (Standard Mileage Deduction) Car and Truck Expenses: Vehicle 1: Year/make/model of vehicle_____ Total miles for the year_____ Business miles for the year_____ ... Self-Employed Individuals Tax Center | Internal Revenue ... Self-employed individuals generally must pay self-employment tax (SE tax) as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. In general, anytime the wording "self-employment tax ... PDF Self-employment Income Worksheet: S Corporation (Schedule ... Title: Self-Employment Income Worksheet: S Corporation \(Schedule K-1 [Form 1120S] and Form 1120S\) Author: DHS/DMS Keywords: department health services, dhs, division medicaid services, dms, bureau enrollment policy systems, beps, self-employment income worksheet partnership, schedule k-1, 1120s, sei, taxes, income, internal revenue service, irs, f-16035, f16035 PDF Self-employed Income and Expense Worksheet SELF-EMPLOYED INCOME AND EXPENSE WORKSHEET TAXPAYER NAME SSN PRINCIPAL BUSINESS OR PROFESSION BUSINESS NAME EMPLOYER ID NUMBER BUSINESS ADDRESS BUSINESS ENTITY (CIRCLE ONE) INDIVIDUAL SPOUSE JOINT BUSINESS CITY, STATE, ZIP CODE INCOME EXPENSES $ GROSS RECEIPTS OR SALES $ ADVERTISING $ RETURNS & ALLOWANCES AUTO & TRAVEL $

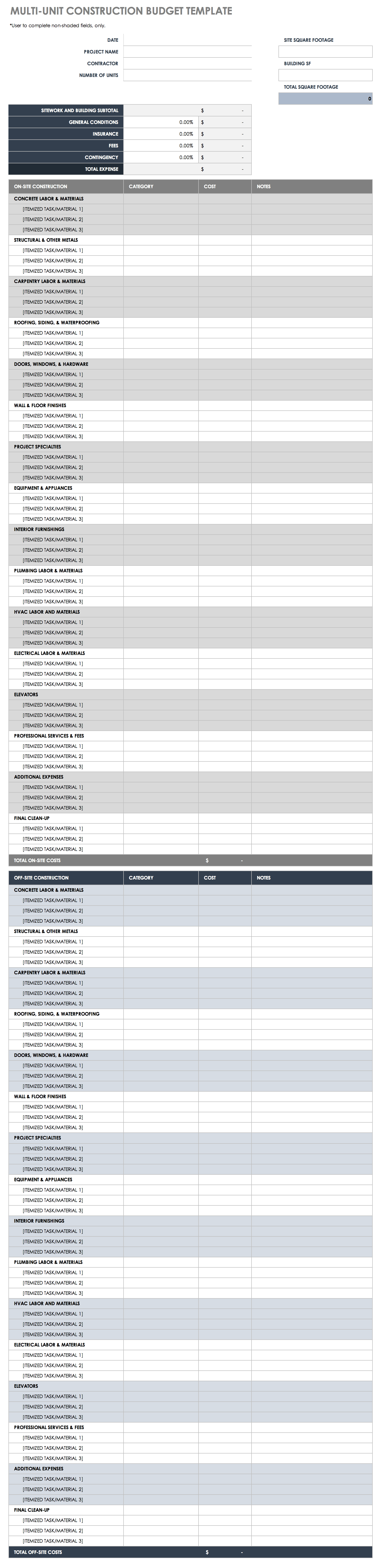

39 self employed business expenses worksheet - Worksheet ... self-employed business expenses worksheet The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money. There is the worksheet that will involve in it the expenses done on the business and its related affair.

Self Employment Income Expense Tracking Worksheet Excel ... Get the Self Employment Income Expense Tracking Worksheet Excel you require. Open it using the online editor and begin editing. Fill out the empty fields; engaged parties names, places of residence and phone numbers etc. Change the blanks with smart fillable areas. Add the particular date and place your electronic signature.

(Schedule C) Self-Employed Business Expenses Worksheet ... (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse Income: Total ...

SELF-EMPLOYED WORKSHEET - NI Direct SELF-EMPLOYED WORKSHEET FOR RATES HOUSING BENEFIT/RATE RELIEF APPLICATION (4.0). Page 1 of 4 ... details of your income and expenses? From. DD/MM/YYYY.4 pages

PDF Self Employment Monthly Sales and Expense Worksheet SELF EMPLOYMENT - MONTHLY SALES AND EXPENSE WORKSHEET DSHS 07-098 (REV. 09/2015) Worksheet Self Employment Monthly Sales and Expense NAME MONTH CLIENT ID NUMBER 1. Self Employment Income You must tell us about your monthly self employment income. • If you provide us copies of your business ledgers or profit and loss statements, you do not

SELF-EMPLOYMENT WORKSHEET ELF-EMPLOYMENT WORKSHEET . Please provide 3 months of all self -employment gross monthly income and expenses: Applicant Name (First & Last Name) Date of Birth Type of Work: Month Annual . Gross Income Total $ $ $ $ Deductible Expense: Advertising Car/Truck Expenses Commissions/Fees Contract Labor Depletion Depreciation Employee Benefit Programs ...

Printable Self Employed Tax Deductions Worksheet Self-employed business expenses worksheet The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money. Quick guide on how to complete printable self employed tax deductions worksheet Forget about scanning and printing out forms.

15 Tax Deductions and Benefits for the Self-Employed IRS Publication 587: Business Use of Your Home (Including Use by Day-Care Providers): A document published by the Internal Revenue Service (IRS) that provides information on how taxpayers who use ...

PDF SELF EMPLOYED INCOME/EXPENSE SHEET - CPA Accounting SELF EMPLOYED INCOME/EXPENSE SHEET NAME OF PROPRIETOR BUSINESS ADDRESS BUSINESS NAME FEDERAL I.D. NUMBER Automobile Mileage (Adequate records required) COST OF GOODS SOLD (If Applicable) Beginning of the Year Inventory End of Year Inventory Purchases Other:

PDF 2021 Self-Employed (Sch C) Worksheet - cotaxaide.org 2021 Self-Employed (Sch C) Worksheet (type-in fillable) (Complete a separate worksheet for each business) Business owner's name: _____ If you checked any of the above, please stop here and speak with one of our Counselors. If you checked none of these above, please continue by completing the worksheet below for each business.

PDF Self-employment Expense Worksheet Revised 10/2018 SELF-EMPLOYMENT EXPENSE WORKSHEET Applicant's name: _____ Name of self-employed person: _____

PDF Self-Employed/Business Monthly Worksheet - Mirto CPA Self-Employed/Business Name of Proprietor Social Security Number Monthly Worksheet Principal Business or Profession, Including Product or Service Income January February March April May June July August Sept October Nov Dec TOTALS Gross Sales Expenses January February March April May June July August Sept October Nov Dec TOTALS Accounting Advertising

Cash Flow Analysis (Form 1084) - Fannie Mae Line 2a - Interest Income from Self-Employment: Identify interest income paid to the borrower from the borrower's business. Review Schedule B, Part I and/or IRS Schedule K-1 or Form 1099-Int to confirm the payer is the same entity as the borrower's business. Line 2b - Dividends from Self-Employment:

Tax Worksheet for Self-employed, Independent contractors ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate.

Self-Employed Tax Deductions Worksheet (Download FREE) The team at Bonsai organized this self-employed tax deductions worksheet (copy and download here) to organize your deductible business expenses for free. Simply follow the instructions on this sheet and start lowering your Social Security and Medicare taxes.

Free expenses spreadsheet for self-employed - Bonsai Expenses Spreadsheet for Self-Employed Whether it's for your own accounting or to manage your billable expenses, an expenses spreadsheet can help you stay organized and maximize your tax deductions in preparation for your self employment taxes. We've built it to help you get peace of mind and get on with your work.

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

.png)

![Business Accounting: Income and Expenses [Self Employed Accounting Spreadsheet Template]](https://i.ytimg.com/vi/As6h2lcssCI/mqdefault.jpg)

![Free Household Budget Worksheet [Excel, Word, PDF] - Best ...](https://www.bestcollections.org/wp-content/uploads/2021/04/household-budget-worksheet-for-wisconsin-works.jpg)

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fc922f6c345b025c4868_1099-excel-template.png)

:strip_icc()/how-to-make-a-budget-1289587-Final2-updated-17bbe4528d38430ca42f4138f599ed56.png)

0 Response to "41 self employment expenses worksheet"

Post a Comment