40 nc-4 allowance worksheet

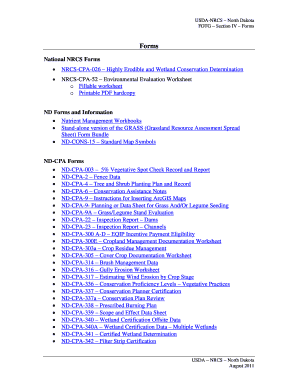

Employee's Withholding Allowance Certificate NC-4EZ - NCDOR Form NC-4EZ Web Employee's Withholding Allowance Certificate. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. Appointments are recommended and walk-ins are first come, first serve. PDF NC-4 NRA Web Nonresident Alien Employee's Withholding ... NC-4 NRA Allowance Worksheet Answer all of the following questions: 1. Will your charitable contributions exceed $2,499? Yes o Noo 2. Will you have adjustments or deductions from income, see Page 3, Schedule 1? Yes o Noo 3. Will you be able to claim any N.C. tax credits or tax credit carryovers from Page 4, Schedule 3?

PDF Frequently Asked Questions Re: Employee's Withholding ... completing the NC-4 Allowance worksheet? A15. No. Pre-tax items are not included in taxable income and similarly should not be included when completing the NC-4 Allowance worksheet. Q16. When do we send a NC-4EZ or NC-4 to the Department? A16. If an employee claims more than 10 allowances, you should forward this document to

Nc-4 allowance worksheet

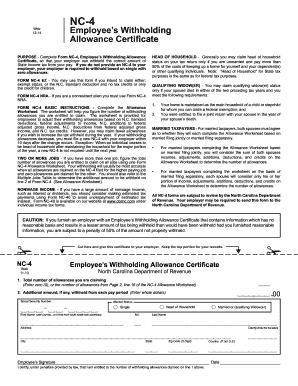

Employee's Withholding Allowance Certificate NC-4 | NCDOR Form NC-4 Employee's Withholding Allowance Certificate Files NC-4_Final.pdf PDF • 488.48 KB - December 17, 2021 Taxes & Forms Individual Income Tax Sales and Use Tax Withholding Tax Withholding Tax Forms and Instructions eNC3 - Web File Upload eNC3 eNC3 Waiver Information eNC5Q Withholding Tax Frequently Asked Questions PDF Form NC-4 Instructions for Completing Form NC-4 Web ... BASIC INSTRUCTIONS- Complete the Personal Allowances Worksheeton Page 2 of Form NC-4. An additional worksheet is provided on Page 2 for employees to adjust their withholding allowances based on itemized deductions, adjustments to income, or tax credits. PDF NC-4 Employee's Withholding - Acumen Fiscal Agent NC-4 Allowance Worksheet Answer all of the following questions for your filing status. Single - 1. Will your N.C. itemized deductions from Page 3, Schedule 1 exceed $15,249? Yes o No o 2. Will your N.C. Child Deduction Amount from Page 3, Schedule 2 exceed $2,499? Yes o No o 3. Will you have federal adjustments or State deductions from income?

Nc-4 allowance worksheet. Withholding Tax Forms and Instructions - NCDOR NC-5501: Request for Waiver of an Informational Return Penalty NC-4EZ: Employee's Withholding Allowance Certificate NC-4: Employee's Withholding Allowance Certificate NC-4 NRA: Nonresident Alien Employee's Withholding Allowance Certificate NC-4P: Withholding Certificate for Pension or Annuity Payments NC-1099M: Compensation Paid to a Payee NC-AC PDF NC-4 NRA Nonresident Alien Employee's Withholding ... NC-4 NRA Allowance Worksheet Answer all of the following questions: 1. Will your charitable contributions exceed $2,499? Yes o No o 2. Will you have adjustments or deductions from income, see Page 3, Schedule 1? Yes o No o 3. Will you be able to claim any N.C. tax credits or tax credit carryovers from Page 4, Schedule 3? PDF NC-4 Employee's Withholding - ComplyRight Allowance Worksheet to determine the number of allowances. • For married taxpayers completing the worksheet on the basis of portion of income, adjustments, additions, deductions, and credits on the Allowance Worksheet to determine the number of allowances. All NC-4 forms are subject to review by the North Carolina Department of Revenue. PDF NC-4 Employee's Withholding - Westfield Insurance Complete Form NC-4 so that your employer can withhold the correct amount of State income tax from your pay. BASIC INSTRUCTIONS. Complete the Personal Allowances Worksheeton Page 2. An additional worksheet is provided on Page 2 for employees to adjust their withholding allowances based on itemized deductions, adjustments to income, or tax credits.

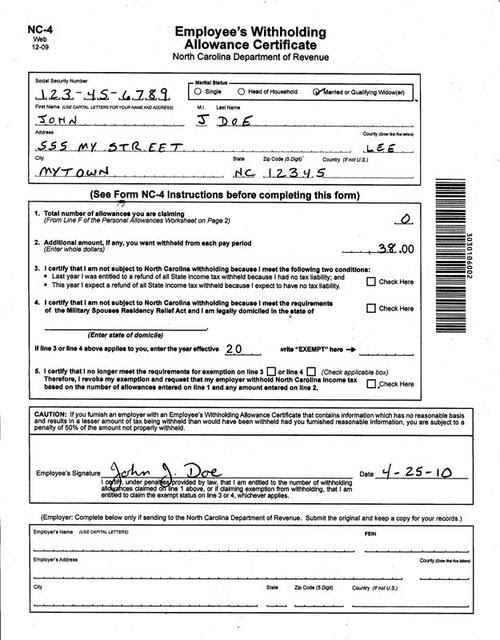

NC-4 Employee's Withholding - University of Colorado NC-4 Allowance Worksheet Answer allof the following questions for your filing status. Single - 1. Will your N.C. itemized deductions from Page 3, Schedule 1 exceed $12,499? Yes o No o 2. Will your N.C. Child Deduction Amount from Page 3, Schedule 2 exceed $2,499? Yes o No o 3. Will you have federal adjustments or State deductions from income? NC-4 NRA Part II NC-4 NRA Allowance Worksheet Schedules Schedule 1 Estimated N.C. Child Deduction Amount A taxpayer who is allowed a federal child tax credit under section 24 of the Internal Revenue Code is allowed a deduction for each dependent child unless adjusted gross income exceeds the threshold amount shown below. PDF NC-4 Employee's Withholding - Johnson C. Smith University 4. (See Form NC-4 Instructions before completing this form) Social Security Number First Name(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)M.I. Last Name Address County (Enter first five letters) City State Zip Code(5 Digit)Country (If not U.S.) 2 0 Employer's Name(USE CAPITAL LETTERS)FEIN Employer's Address County (Enter first five letters) PDF NC-4 Employee's Withholding - Hyde County, North Carolina NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 5).

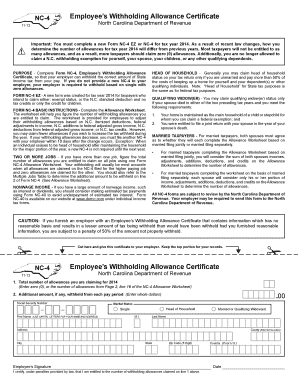

How to Fill Out The Personal Allowances Worksheet (W-4 ... The first few lines (1 -4) of the Form W-4 are used to convey personal identification. W-4 Line 5. Use W-4 line 5 to indicate the total number of allowances you're claiming (from the applicable worksheet on the following pages). W-4 Line 6. Use W-4 Line 6 to indicate an additional amount, if any, you want withheld from each paycheck. W-4 Line 7 PDF NC-4 12-14 Web Employee's Withholding Allowance Certificate NC-4 Allowance Worksheet Answer all of the following questions for your filing status. Single - 1. Will your N.C. itemized deductions from Page 3, Schedule 1 exceed $9,999? Yes o Noo 2. Will you have adjustments or deductions from income from Page 3, Schedule 2? Yes o Noo 3. PDF NC-4 Employee's Withholding Allowance Certificate NC-4 Employee's Withholding Allowance Certificate 1. Total number of allowances you are claiming for 2014 (Enter zero (0), or the number of allowances from Page 2, line 16 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars),. 00 Single Head of Household Married or Qualifying Widow(er) Nonresident Alien Employee's Withholding Allowance ... Complete Form NC-4 NRA, Nonresident Alien Employee's Withholding Allowance Certificate, so that your employer can withhold the correct amount of State income tax from your pay. Files. NC-4 NRA_Final.pdf. PDF • 456.23 KB - December 17, 2021 Taxes & Forms. Individual Income Tax ...

PDF How to fill out the NC-4 EZ - One Source Payroll Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 Please fill out header Be sure to fill in Marital Status Header 3 Line 1 of NC-4 EZ Enter zero (0) or the number of allowances from the table on the next slide. 4

PDF Nc 4 Employee S Withholding 9 16 Allowance Certificate NC-4 Web Employee's Withholding 12-18 Allowance Certificate PURPOSE - Complete Form NC-4 so that your employer can withhold the correct amount of State income tax from your pay. If you do not provide an NC-4 to your employer, your employer is required to withhold based on the filing status, "Single" with zero allowances.

PDF NC-4 - iCIMS NC-4 Allowance Certificate 1. Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 17 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars) .00 Social Security Number Filing Status

PDF How to fill out the NC-4 - One Source Payroll Items needed to fill out NC-4 Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 Line 1 of NC-4 You are no longer allowed to claim a N.C. withholding allowance for yourself, your spouse, your children, or any other dependents.

PDF Nc-4 NC-4 Allowance Worksheet Answer all of the following questions for your filing status. Single - 1. Will your N.C. itemized deductions from Page 3, Schedule 1 exceed $13,249? Yes o No o 2. Will your N.C. Child Deduction Amount from Page 3, Schedule 2 exceed $2,499? Yes o No o 3. Will you have federal adjustments or State deductions from income?

pros and cons worksheet printable - Edit, Fill, Print & Download Best Online Forms in Word & PDF ...

Employee's Withholding Allowance Certificate NC-4 | NCDOR Form NC-4 Employee's Withholding Allowance Certificate. NC-4-Web.pdf. PDF • 429.87 KB - January 04, 2021 Withholding, Individual Income Tax. Categorization and Details. Forms. Document Entity Terms. Withholding. Individual Income Tax. Document Organization. files. Date Published: Last Updated: January 4, 2021.

PDF Employee's Withholding Allowance Certificate NC-4 North ... Personal Allowances Worksheet FormNC-4 If claiming exempt, the statement is effective for one calendar year only and a new statement must be completed and given to your employer by next February 15. If you meet all of the above conditions, enter the year effective and write "EXEMPT" here.................... Are you a full-time student?

PDF NC-4 Employee's Withholding 11-15 Allowance Certificate NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

PDF NC-4 Employee's Withholding - Rowan-Salisbury School System If line 3 or line 4 above applies to you, enter the year effective and write "EXEMPT" here 1. Total number of allowances you are claiming (From Line F of the Personal Allowances Worksheet on Page 2) Additional amount, if any, you want withheld from each pay period (Enter whole dollars) 2.

PDF NC-4 Employee's Withholding - Acumen Fiscal Agent NC-4 Allowance Worksheet Answer all of the following questions for your filing status. Single - 1. Will your N.C. itemized deductions from Page 3, Schedule 1 exceed $15,249? Yes o No o 2. Will your N.C. Child Deduction Amount from Page 3, Schedule 2 exceed $2,499? Yes o No o 3. Will you have federal adjustments or State deductions from income?

PDF Form NC-4 Instructions for Completing Form NC-4 Web ... BASIC INSTRUCTIONS- Complete the Personal Allowances Worksheeton Page 2 of Form NC-4. An additional worksheet is provided on Page 2 for employees to adjust their withholding allowances based on itemized deductions, adjustments to income, or tax credits.

Employee's Withholding Allowance Certificate NC-4 | NCDOR Form NC-4 Employee's Withholding Allowance Certificate Files NC-4_Final.pdf PDF • 488.48 KB - December 17, 2021 Taxes & Forms Individual Income Tax Sales and Use Tax Withholding Tax Withholding Tax Forms and Instructions eNC3 - Web File Upload eNC3 eNC3 Waiver Information eNC5Q Withholding Tax Frequently Asked Questions

0 Response to "40 nc-4 allowance worksheet"

Post a Comment