40 itemized deduction worksheet 2015

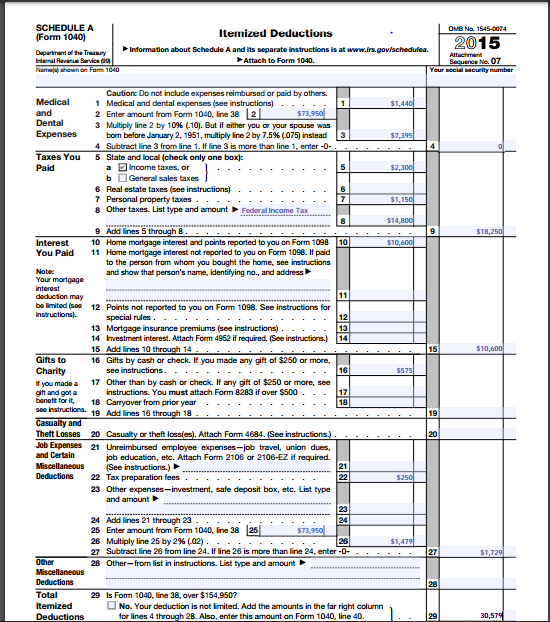

2015 Schedule A Itemized Deductions Worksheet - Math ... Miscellaneous itemized deductions in cluding the deduction for unreimbursed job expenses. 2015 itemized deductions worksheet for 2015 the standard deduction is 12600 on a joint return 9250 for a head of household and 6300 if you are single. Itemized deduction worksheet 2015. Itemized deductions also reduce your taxable income. PDF Schedule A - Itemized Deductions - IRS tax forms Schedule A - Itemized Deductions (continued) Select for mortgage interest reported on Form 1098. Enter amount from Form 1098F, box 1 (and box 2, if applicable). See Tab EXT, Legislative Extenders for Private Mortgage Insurance (if extended) Note: The deduction for home equity debt is dis-allowed as a mortgage interest deduction unless

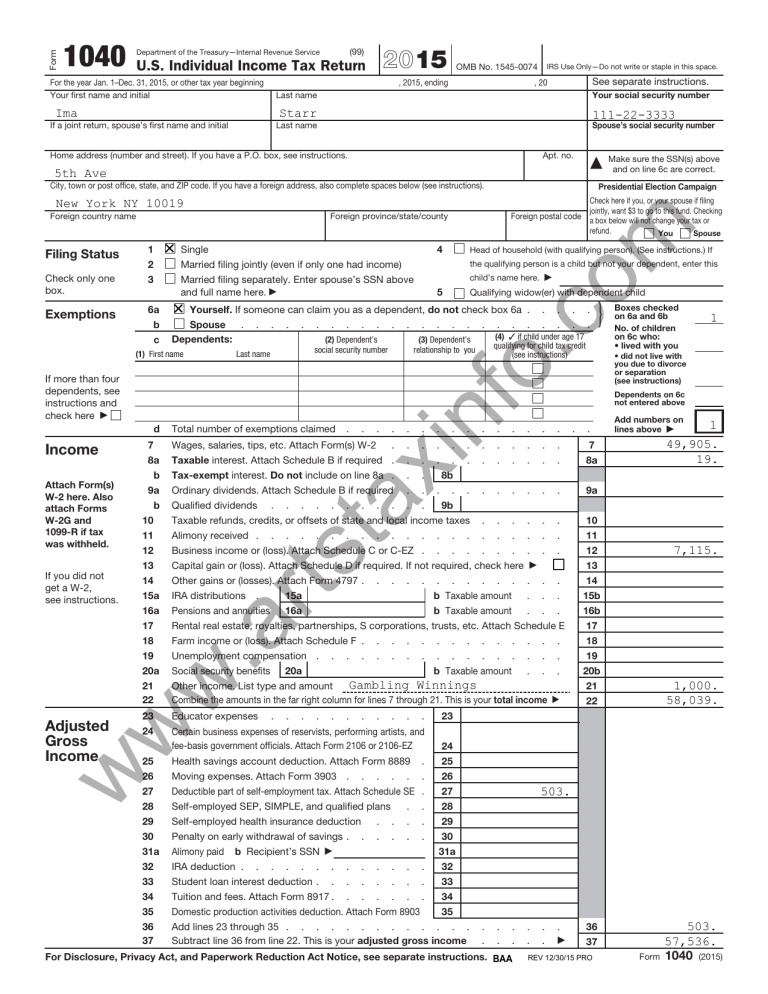

Beautiful Irs Itemized Deduction Worksheet - Goal keeping ... Discover learning games guided lessons and other interactive activities for children. 1040 forms itemized deductions worksheet 2015 irs itemized deduction worksheet form 2015 and federal income tax deduction worksheet are three of main things we will show you based on the post title.

Itemized deduction worksheet 2015

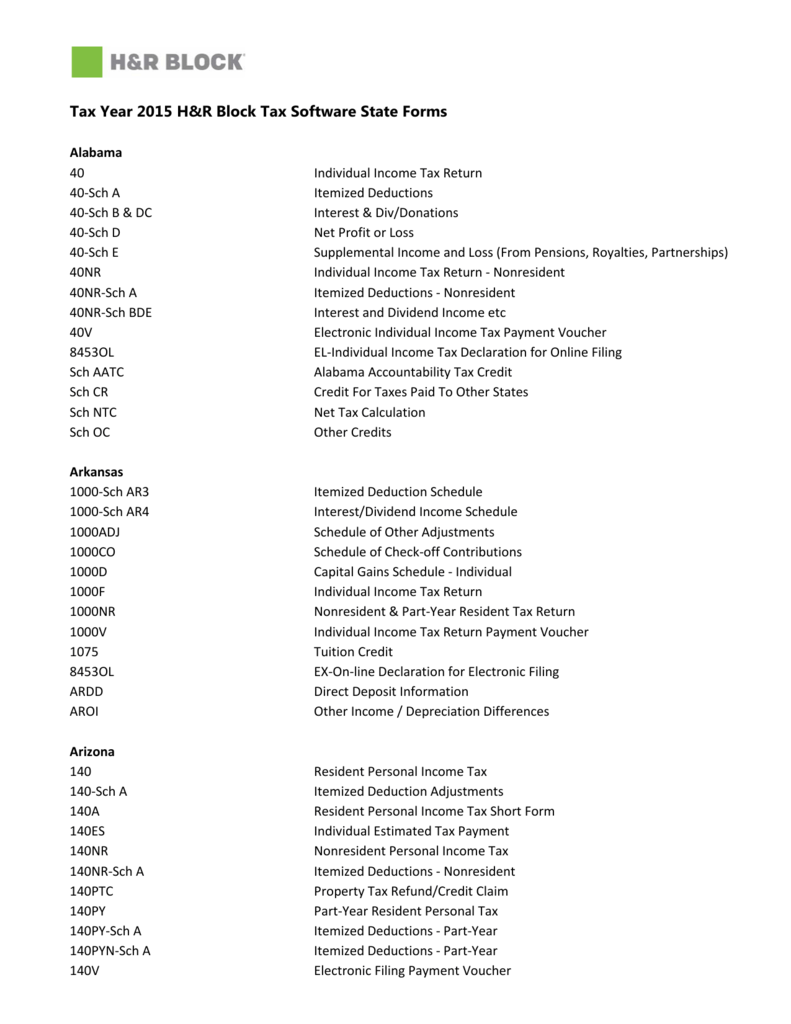

PDF Arkansas Individual Income Tax Itemized Deduction Schedule TOTAL ITEMIZED DEDUCTIONS: 28. Is Form AR1000/AR1000NR, Line 28(A and B), over $159,950 (over $79,975 if married filing separately on separate returns)? ... Add amounts on Lines 4, 7, 12, 18, 19, 20, 26, and 27 and enter the total here. YES. Your deduction may be limited. Use worksheet on page 20 of booklet to calculate allowable amt.; enter ... PDF 2014 Itemized Deductions Worksheet 2014 ITEMIZED DEDUCTIONS WORKSHEET For 2014 the "Standard Deduction" is $12,400 on a Joint Return, $9,100 for a Head of Household, and $6,200 if you are Single. If you normally itemize your personal deductions or even think that itemized deductions might benefit you this year, we will need to know the following expenses. PDF Itemized Deductions Limitation Worksheet - 1040.com $154,950 for married filing separately for 2015. Subtract line 6 from line 5 Multiply line 7 by 3% (.03) Enter the smaller of line 4 or line 8 Enter the amount for your carryback year as follows: For 2008 and 2009, divide line 9 by 1.5; For 2006 and 2007, divide line 9 by 3.0; or For all other carryback years, enter -0-. Subtract line 10 from ...

Itemized deduction worksheet 2015. PDF Itemized Deductions Worksheet - integrityintaxllc.com Itemized Deductions Worksheet You will need: Tax information documents (Receipts, Statements, Invoices, Vouchers) for your own records. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your Federal and/or State return. 42 itemized deduction worksheet 2015 - Worksheet Was Here The Standard Mileage Rate for operating expenses of a vehicle for medical reasons is 23 cents per mile. 2015 itemized deductions worksheet for 2015 the standard deduction is 12600 on a joint return 9250 for a head of household and 6300 if you are single. The amounts will be reported on the Schedule KPI KS or KF you received from the entity. PDF 2015 737 Worksheet -- California RDP Adjustments Worksheet ... There are other itemized deductions that are also subject to the 2% limitation rule and some itemized deductions are subject to an overall limitation rule . Get federal Publication 17, Your Federal Income Tax, Part Five, Standard Deduction and Itemized Deductions . ... 2015 737 Worksheet -- California RDP Adjustments Worksheet Recalculated ... PDF Itemized Deductions - IRS tax forms Itemized Deductions 20-1 Itemized Deductions Introduction This lesson will assist you in determining if a taxpayer should itemize deductions. Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. Objectives At the end of this lesson, using your resource materials, you will be able to:

43 itemized deductions worksheet 2015 - Worksheet Database Worksheet For Net State Income Taxes, Line 9 of Missouri Itemized Deductions 2015 TAX CHART If Missouri taxable income from Form MO-1040A, Line 10, is less than $9,000, use the chart to figure tax; Prior Year Products - IRS tax forms 2021. Solved: Itemized deduction worksheet? You can view your Scheule A: Itemized Deductions by taking the following steps: 1.) In the upper right-hand corner, click Forms. 2.) On the left-hand side, click O pen Form. 3.) Type Schedule A into the search bar. You can also view your Form 1040 while in Forms mode by finding it on the listed menu. PDF Schedule A - Itemized Deductions - IRS tax forms Schedule A - Itemized Deductions (continued) To enter multiple expenses of a single type, click on the small calculator icon beside the line. Enter the first description, the amount, and Continue. Enter the information for the next item. They will be totaled on the input line and carried to Schedule A. If taxpayer has medical insurance PDF Attach to Form 1040. Your deduction is not limited. Add the amounts in the far right column for lines 4 through 28. Also, enter this amount on Form 1040, line 40.}.. Yes. Your deduction may be limited. See the Itemized Deductions Worksheet in the instructions to figure the amount to enter. 30 . If you elect to itemize deductions even though they are less than your ...

MO-A Individual Income Tax Adjustments - Missouri ... 2015. FORM. MO-A. ATTACH TO FORM MO‑1040. ATTACH A COPY OF YOUR FEDERAL. RETURN. ... Total federal itemized deductions from Federal Form 1040, Line 40 . Prior Year Products - IRS tax forms 2021. Form 1040 (Schedule A) Itemized Deductions. 2021. Inst 1040 (Schedule A) Instructions for Schedule A (Form 1040 or Form 1040-SR), Itemized Deductions. 2020. Form 1040 (Schedule A) Itemized Deductions. LOUISIANA FILE ONLINE Fast. Easy. Absolutely Free. EXCESS FEDERAL ITEMIZED DEDUCTIONS – Subtract Line 8B from Line 8A. ... 2015 Louisiana School Expense Deduction Worksheet. Your Name.13 pages PDF Iowa Department of Revenue 2015 IA 104 This worksheet computes the amount of itemized deductions to enter on line 26 of the IA Schedule A. Step 1 Complete the IA Schedule A, lines 1-25. Step 2 Re-compute the federal Itemized Deduction Worksheet: 1. Enter the sum of lines 3, 8, 13, 17, 18, 24, and 25 from the IA Schedule A .................1. 2.

2015 Instructions for Schedule A (Form 1040) - Internal ... 2015 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

About Schedule A (Form 1040), Itemized Deductions ... About Schedule A (Form 1040), Itemized Deductions. Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

PDF Qualified Health Ins Premiums Worksheet 2015 - Missouri QUALIFIED HEALTH INSURANCE PREMIUMS WORKSHEET FOR MO-A, LINE 12 Complete this worksheet and attach it, along with proof of premiums paid, to Form MO-1040 if you included health insurance premiums paid as an itemized deduction or had health insurance premiums withheld from your social security benefits.

PDF Form IT-203-B:2015:Nonresident and Part-Year Resident ... And College Tuition Itemized Deduction Worksheet Name(s) and occupation(s) as shown on Form IT-203 Your social security number Complete all parts that apply to you; see instructions (Form IT-203-I). Submit this form with your Form IT-203. Schedule A - Allocation of wage and salary income to New York State Nonworking days included in line 1a:

PDF TAXABLE YEAR California Adjustments — Nonresidents or Part ... 2015 California Adjustments — Nonresidents or Part-Year Residents SCHEDULE CA (540NR) Important: Attach this schedule behind Long Form 540NR, Side 3 as a supporting California schedule. Name(s) as shown on tax return . SSN or ITIN. Part I Residency Information Complete all lines that apply to you and your spouse/RDP for taxable year 2015 ...

PDF 2015 I-128 Instructions for Completing Wisconsin Schedule I See the listing under Section B of ITEMS REQUIRING ADJUSTMENT for other itemized deductions that require adjustment. 2015 HSA Worksheet 1. Balance of HSA as of December 31, 2010, less amount distributed in 2011-2014. (This is the amount from line 3 of the worksheet in the 2014 Schedule I instructions.) ............. 1. 2.

15_1040 sched 2_download.indd - Maine.gov 1 Total itemized deductions from federal Form 1040, Schedule A, line 29 . ... 2015 Worksheet for Maine Schedule 2, line 2a.

PDF 2021 Instructions for Schedule A - IRS tax forms 2021 Instructions for Schedule AItemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses, and

PDF Itemized Deductions Checklist - Affordable Tax Itemized Deductions Checklist Medical Expenses Medical expenses are generally deductible if they exceed 10% of your income or 7.5% of your income if you are over the age of 65. Some common medical expenses: Doctor/Dentist Fees Drug/Alcohol Treatment Cost of Guide Dogs Handicap Access Devices for Disabled Hospital Fees

PDF 2015 SCHEDULE CA (540) California Adjustments - Residents Schedule CA (540) 2015 Side 1 TAXABLE YEAR 2015 California Adjustments — Residents SCHEDULE CA (540) Important: Attach this schedule behind Form 540, Side 5 as a supporting California schedule. Name(s) as shown on tax return. SSN or ITIN. Part I. Income Adjustment Schedule Section A - Income. A

PDF 2021 Schedule A (Form 1040) - IRS tax forms Itemized Deductions . 16. Other—from list in instructions. List type and amount .

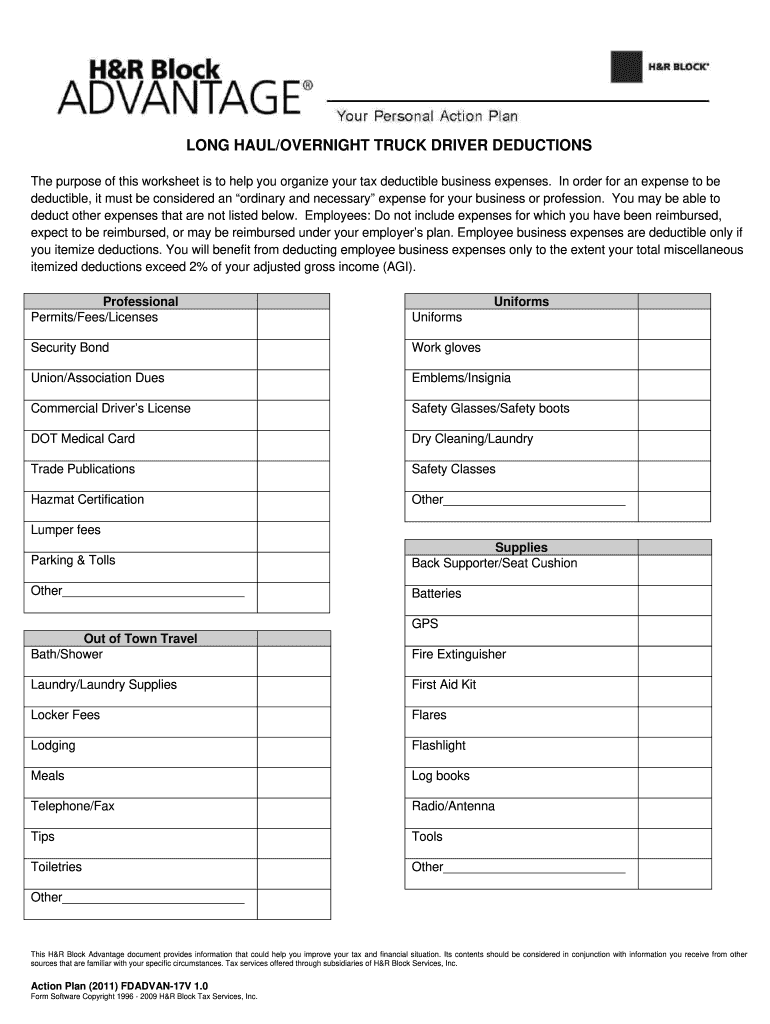

PDF 2015 Itemized Deductions Worksheet 2015 ITEMIZED DEDUCTIONS WORKSHEET For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250 for a Head of Household, and $6,300 if you are Single. If you normally itemize your personal deductions or even think that itemized deductions might benefit you this year, we will need to know the following expenses.

PDF Forms & Instructions California 540 2015 Personal Income ... Last day to file or e-file your 2015 tax return to avoid a late filing penalty and interest computed from the original due date : ... deduction or itemized deductions you can claim . Computing your tax: ... (Use the California Standard Deduction Worksheet for Dependents on page 11 to figure your standard deduction.)

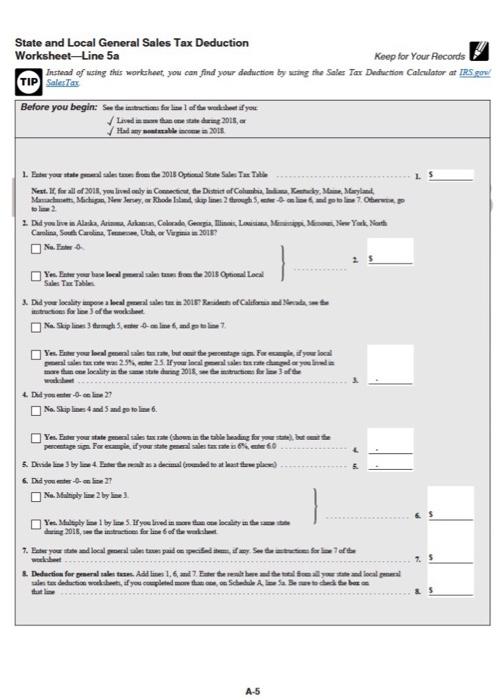

Deduction | Iowa Department Of Revenue For tax year 2015, the itemized deduction for state sales and use tax is allowed on the Iowa Schedule A. If a taxpayer claimed an itemized deduction for state sales and use tax paid on the Federal return, the taxpayer must claim the itemized deduction for state sales and use tax paid on the Iowa return.

PDF Itemized Deductions Limitation Worksheet - 1040.com $154,950 for married filing separately for 2015. Subtract line 6 from line 5 Multiply line 7 by 3% (.03) Enter the smaller of line 4 or line 8 Enter the amount for your carryback year as follows: For 2008 and 2009, divide line 9 by 1.5; For 2006 and 2007, divide line 9 by 3.0; or For all other carryback years, enter -0-. Subtract line 10 from ...

PDF 2014 Itemized Deductions Worksheet 2014 ITEMIZED DEDUCTIONS WORKSHEET For 2014 the "Standard Deduction" is $12,400 on a Joint Return, $9,100 for a Head of Household, and $6,200 if you are Single. If you normally itemize your personal deductions or even think that itemized deductions might benefit you this year, we will need to know the following expenses.

PDF Arkansas Individual Income Tax Itemized Deduction Schedule TOTAL ITEMIZED DEDUCTIONS: 28. Is Form AR1000/AR1000NR, Line 28(A and B), over $159,950 (over $79,975 if married filing separately on separate returns)? ... Add amounts on Lines 4, 7, 12, 18, 19, 20, 26, and 27 and enter the total here. YES. Your deduction may be limited. Use worksheet on page 20 of booklet to calculate allowable amt.; enter ...

0 Response to "40 itemized deduction worksheet 2015"

Post a Comment