43 income tax worksheet excel

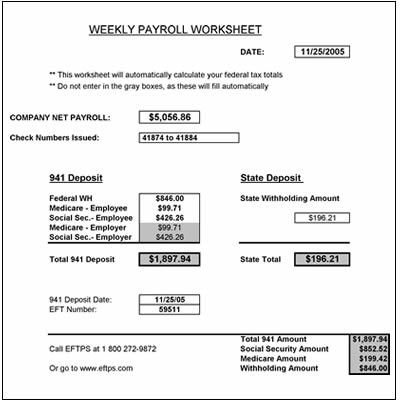

Income Tax Withholding Assistant for Employers | Internal ... The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees' wages. It will help you as you transition to the new Form W-4 for 2020 and later. Use the Income Tax Withholding Assistant if you typically use Publication 15-T to determine your ... Download Free Federal Income Tax Templates In Excel Prepare your Federal Income Tax Return with the help of these free to download and ready to use ready to use Federal Income Tax Excel Templates. These templates include Simple Tax Estimator, Itemized Deduction Calculator, Schedule B Calculator, Section 179 Deduction Calculator and much more. All excel templates are free to download and use.

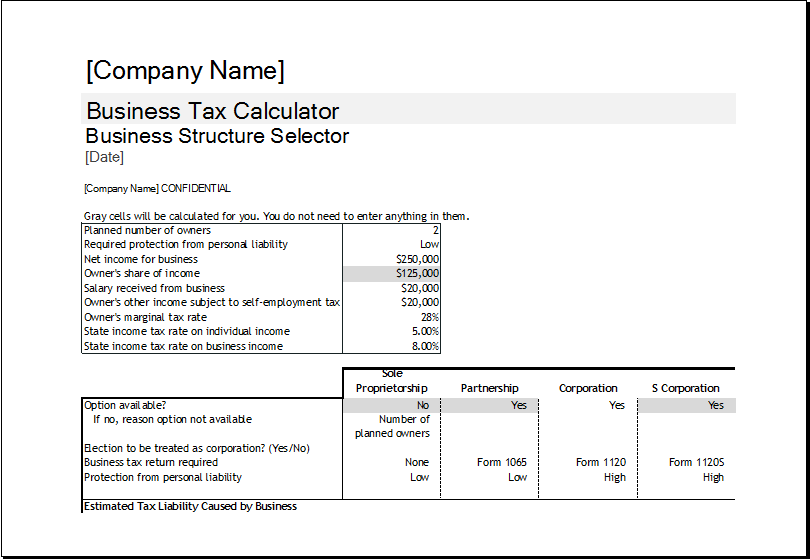

Tax Assistant for Excel - Free download and software ... Tax Assistant for Excel is a custom application written for Microsoft Excel and requires Microsoft Excel 2007/2010/2013. It simplifies your Federal Income Tax preparation by providing Excel...

Income tax worksheet excel

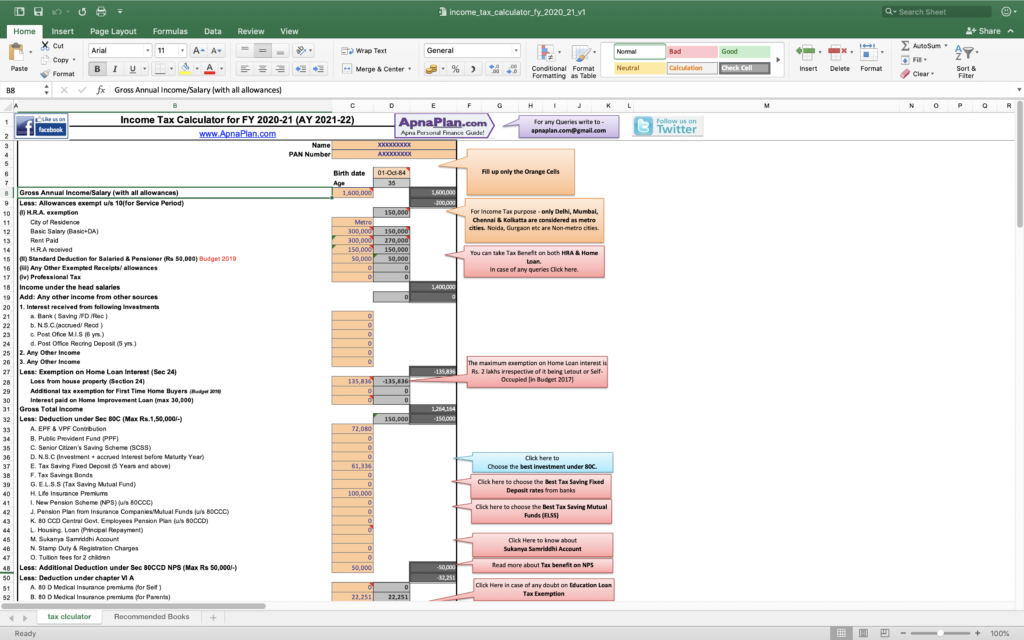

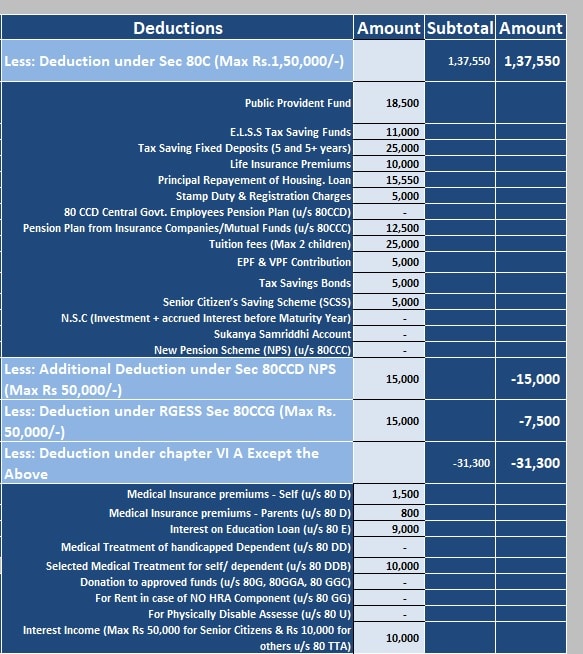

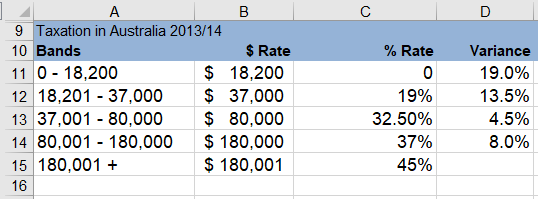

Income Tax Calculator Excel : AY 2021-22 - Karvitt Download Excel file to Calculate and compare Taxable Income and Income Tax Liability as per the Existing and New Regimes (Tax Provisions & Tax Rates) for AY 2021-22 (FY 2020-21). Save your calculations on your computer for future reference. Download Income Tax Calculator AY 2021-22 | 2022-23 in Excel Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 ... How to estimate your taxes using Excel Excel Formula to Calculate Tax Federal Tax: =VLOOKUP (TaxableIncome,FederalTaxTable,4) + (TaxableIncome - VLOOKUP (TaxableIncome,FederalTaxTable,1)) * VLOOKUP (TaxableIncome,FederalTaxTable,3) How to calculate income tax in Excel? - ExtendOffice Frequently, you can get the tax table with cumulative tax for each tax bracket. In this condition, you can apply the Vlookup function to calculate the income tax for a certain income in Excel.. Select the cell you will place the calculated result at, enter the formula =VLOOKUP(C1,A5:D12,4,TRUE)+(C1-VLOOKUP(C1,A5:D12,1,TRUE))*VLOOKUP(C1,A5:D12,3,TRUE) into it, and press the Enter key.

Income tax worksheet excel. Federal Income Tax Form 1040 (Excel Spreadsheet) Income ... Complete your. US Federal Income Tax. Form 1040. using my Microsoft Excel. spreadsheet income tax calculator. PDF Farm Income & Expense Worksheet If you have income not included above, please detail on a separate page. **Bring in details of all COMMODITY CREDIT LOANS and transactions so that we can determine if: - during this tax year you had any CCC loans forfeited and if they were under election. - you reported as income all grain deliveries which were applied directly to a CCC loan. Publication 505 (2021), Tax Withholding and Estimated Tax ... Project the taxable income you will have for 2021 and figure the amount of tax you will have to pay on that income. Worksheet 1-4 Tax Computation Worksheets for 2021: Figure the amount of tax on your projected taxable income. Worksheet 1-5 Projected Withholding for 2021 Download Excel based - Income Tax Calculator for FY 2020 ... This excel-based Income tax calculator can be used for computing income tax on income from salary, pension, gifts, fixed deposit, and bank interest and you will get the result accordingly to your tax regime selection. Highlights of Changes in FY 2020-21 in Income Tax

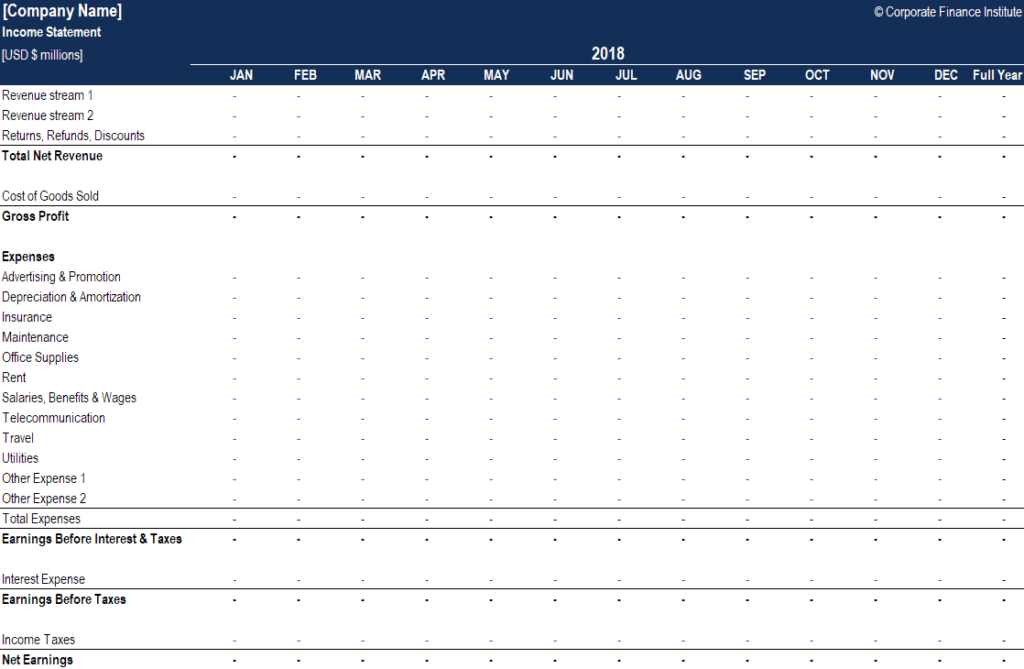

Income Tax Calculator FY 2020-21 (AY 2021-22) - Excel Download Download Income Tax Calculator FY 2020-21 (AY 2021-22) in Excel Format. This calculator is designed to work with both old and new tax slab rates released in the budget 2020. You can calculate your tax liabilities as per old and new tax slab. It will help you to make an informed decision to opt for a suitable tax structure. 42 rental income calculation worksheet - Worksheet Information Tax Returns Calculation PDF INCOME CALCULATION WORKSHEET - DUdiligence.com Step 1 Enter Monthly Gross Rental Income $ Step 2 Total Monthly Income used for qualifying = Subtotal from step 1 multiplied by 75% $ Step 3 Enter monthly PITI (principal, interest, taxes & insurance) $. Federal Income Tax Form 1040 (Excel Spreadsheet) Income ... This site makes available, for free, a spreadsheet that may be used to complete your U.S. Federal Income Tax Return. Download - Federal Income Tax Form 1040 (Excel Spreadsheet) Income Tax Calculator Federal Income Tax Form 1040 (Excel Spreadsheet) Income Tax Calculator Income Statement Template for Excel - Vertex42.com The first is a simple single-step income statement with all revenues and expenses lumped together. The second worksheet, shown on the right, is a multi-step income statement that calculates Gross Profit and Operating Income. Income Statement Essentials Net Income = Total Revenue - Total Expenses Revenues

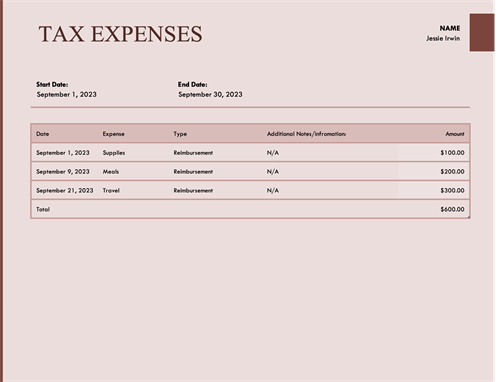

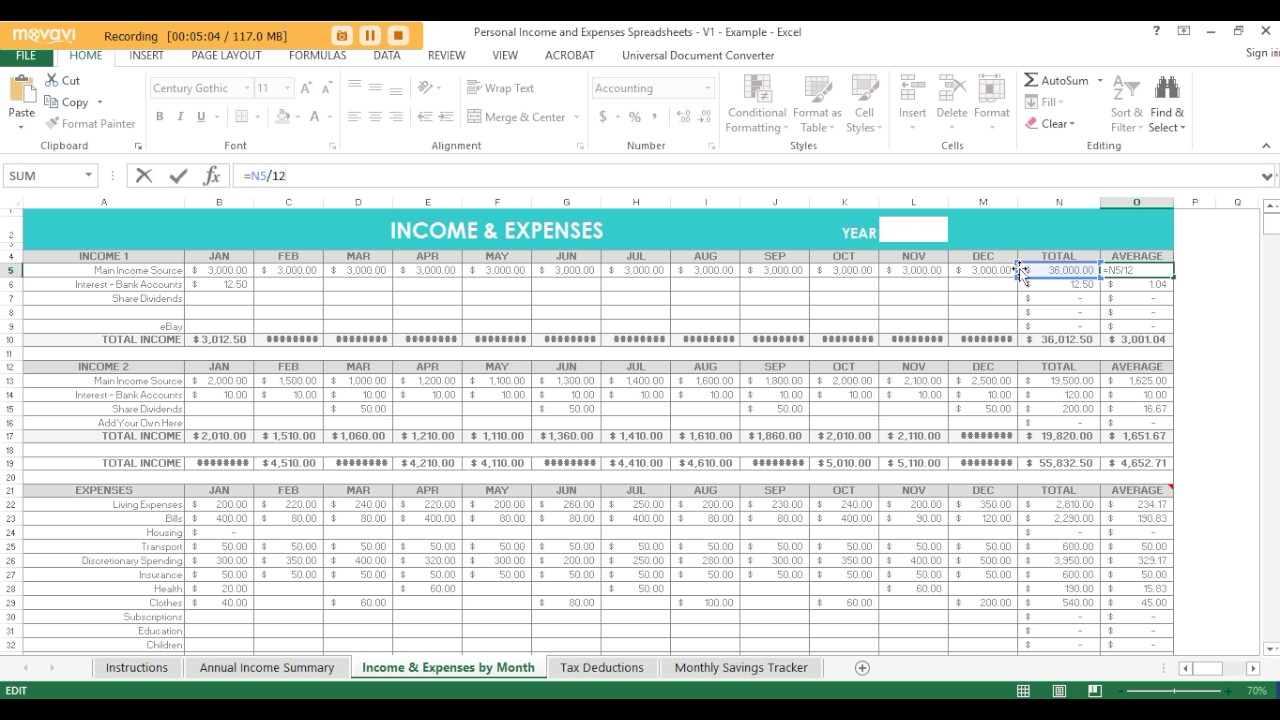

New downloadable assistant helps small ... - IRS tax forms Now available for download, without charge, on IRS.gov, the Income Tax Withholding Assistant for Employers is designed to help any employer who would otherwise figure withholding, manually, using a worksheet and either the percentage method or wage bracket tables found in Publication 15-T, Federal Income Tax Withholding Methods. Employers who ... Tax expense journal - templates.office.com Tax expense journal. Track your tax expenses with this accessible tax organizer template. Utilize this tax expense spreadsheet to keep a running total as you go. Take the stress out of filing taxes with this easy-to-use tax deduction spreadsheet. Computation Of Income Tax In Excel - Excel Skills Income Tax Calculations Template. Perform annual income tax & monthly salary calculations based on multiple tax brackets and a number of other income tax & salary calculation variables. The template design incorporates seven default tax brackets but you can add additional tax brackets if your region requires more tax brackets. Free Income and Expense Tracking Templates (for Excel) Excel calculations are dependent on how well the information was input. A Personal Expense Tracking template will typically have projected and actual figures for income, balance, and total expenses to create a more realistic record of finances. The actual figures are filled in at the end of the month after calculations.

Income Analysis Worksheet | Essent Guaranty Keep Your Career On The Right Track Our income analysis tools are designed to help you evaluate qualifying income quickly and easily. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you.

Free Rental Income and Expense Worksheet | Zillow Rental ... To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category.

Free Tax Forms & Worksheets | Tax Preparation & Bookkeeping The purpose of these forms and worksheets is so you can be as prepared as possible so the tax preparation process is quick and painless as possible. We have created over 25 worksheets, forms and checklists to serve as guidance to possible deductions. There are over 300 ways to save taxes and are presented to you free of charge.

How to calculate income tax in Excel? - ExtendOffice Frequently, you can get the tax table with cumulative tax for each tax bracket. In this condition, you can apply the Vlookup function to calculate the income tax for a certain income in Excel.. Select the cell you will place the calculated result at, enter the formula =VLOOKUP(C1,A5:D12,4,TRUE)+(C1-VLOOKUP(C1,A5:D12,1,TRUE))*VLOOKUP(C1,A5:D12,3,TRUE) into it, and press the Enter key.

Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 ... How to estimate your taxes using Excel Excel Formula to Calculate Tax Federal Tax: =VLOOKUP (TaxableIncome,FederalTaxTable,4) + (TaxableIncome - VLOOKUP (TaxableIncome,FederalTaxTable,1)) * VLOOKUP (TaxableIncome,FederalTaxTable,3)

Income Tax Calculator Excel : AY 2021-22 - Karvitt Download Excel file to Calculate and compare Taxable Income and Income Tax Liability as per the Existing and New Regimes (Tax Provisions & Tax Rates) for AY 2021-22 (FY 2020-21). Save your calculations on your computer for future reference. Download Income Tax Calculator AY 2021-22 | 2022-23 in Excel

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/Screenshot-2018-07-05-17.53.15.jpg?strip=all&lossy=1&ssl=1)

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-facebook.jpg?strip=all&lossy=1&ssl=1)

![Income Tax Calculator For FY 2020-21 [AY 2021-22] - Excel ...](https://www.apnaplan.com/wp-content/uploads/2020/02/New-Regime-Income-Tax-Slabs-for-FY-2020-21-AY-2021-22-1024x547.png)

:max_bytes(150000):strip_icc()/008-calculate-net-salary-using-microsoft-excel-6f17e9714d88440e812e9283d3fd61f1.jpg)

0 Response to "43 income tax worksheet excel"

Post a Comment