42 2014 tax computation worksheet

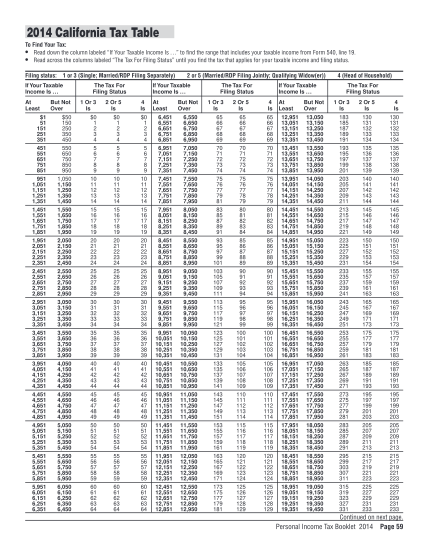

› tax-guide › state-taxesCalifornia Taxes – Tax Guide • 1040.com – File Your Taxes Online E-file your California personal income tax return online with 1040.com. These 2020 forms and more are available: California Form 540/540NR – Personal Income Tax Return for Residents and Nonresidents PDF Rhode Island Tax Rate Schedule 2014 RHODE ISLAND TAX COMPUTATION WORKSHEET RHODE ISLAND TAX RATE SCHEDULE 2014 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income (line 7) Over 0 59,600 135,500 But not over Pay--of the amount over 2,235.00 5,840.25 3.75% 4.75% 5.99% on excess 0 % 59,600 135,500..... 59,600 135,500 $$$ $ + + + CAUTION! The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income.

› forms › searchForms | Virginia Tax Form & Instructions for Underpayment of Estimated tax by Farmers and Fishermen Schedule CR: 2021 : Credit Computation Schedule for Forms 760, 760PY, 763 and 765 Schedule CR Instructions: 2021 : Credit Computation Schedule Instructions (For use with Forms 760, 760PY, 763 and 765) Schedule OSC: 2021

2014 tax computation worksheet

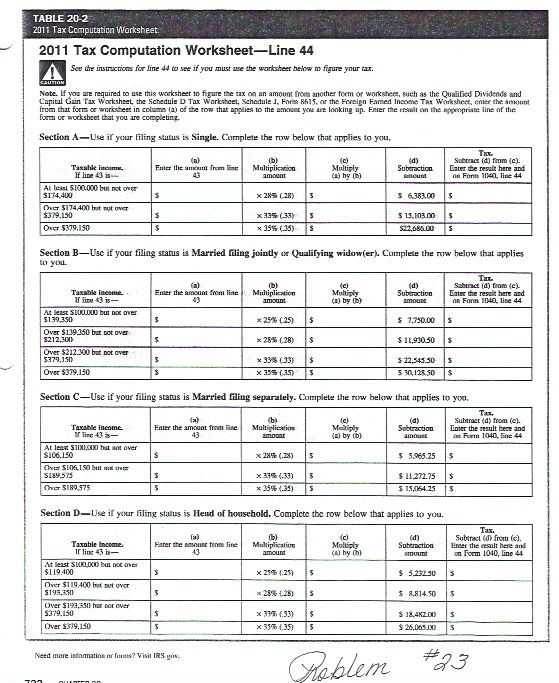

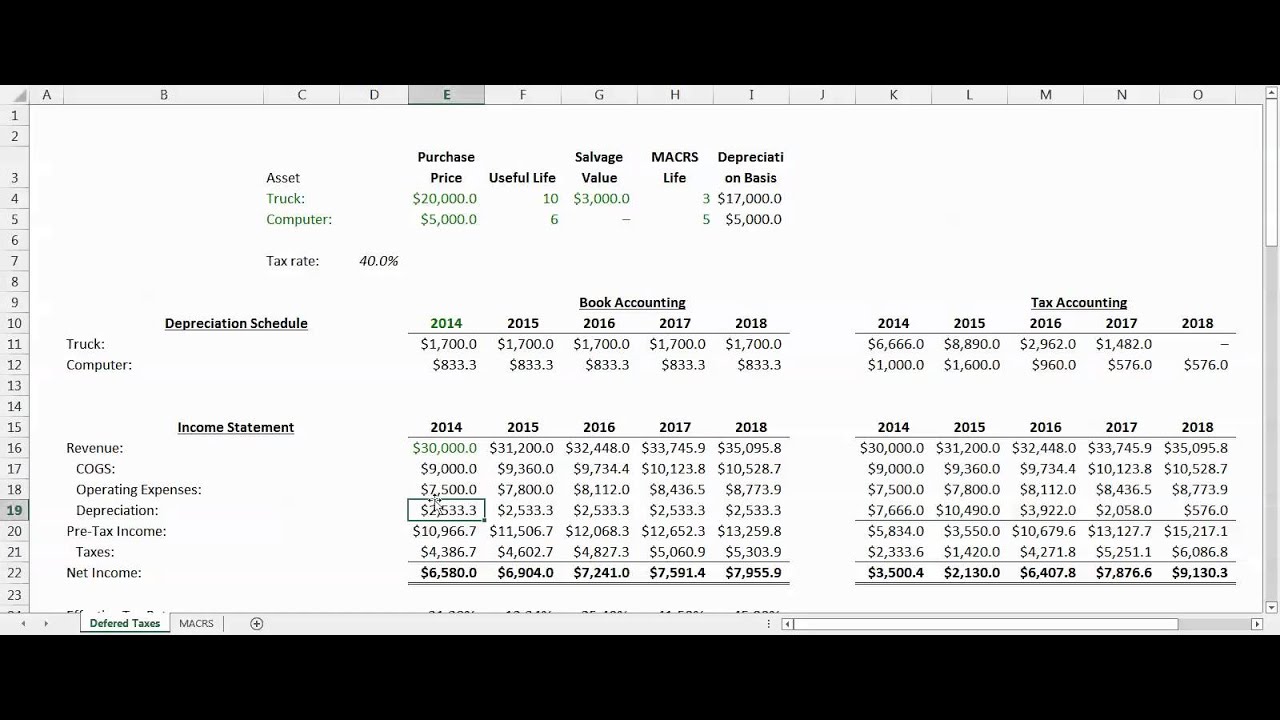

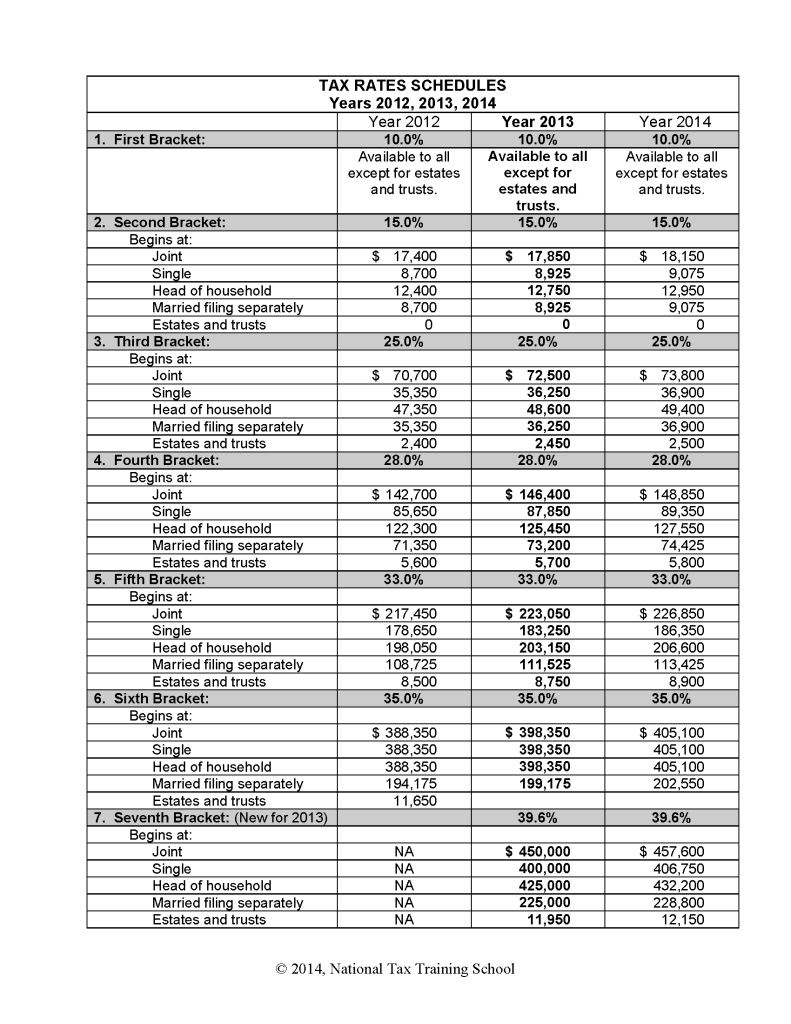

PDF 2021 Publication 17 - IRS tax forms Chapter 13. How To Figure Your Tax. Chapter 14. Child Tax Credit and Credit for Other Dependents. 2021 Tax Table. 2021 Tax Computation Worksheet. 2021 Tax Rate Schedules. Your Rights as a Taxpayer. How To Get Tax Help. Index. Where To File. Your Rights as a Taxpayer. Your Rights as a Taxpayer 10+ Creative Tax Computation Worksheet 2014 - Weavingaweb 2014 Form 1040 Instructions Draft Tax Table Resume Examples from Tax Computation Worksheet 2014. A year beginning in 2014. List of Tax Computation Worksheet 2014. A enter taxable income amount from line b multiplication amount c multiply a by b d subtraction amount e subtract d from c enter here and on line tax. PDF 2014 RI-1041ES Layout 1 - tax.ri.gov Your 2014 estimated income tax may be based upon your 2013 income tax liability. If you wish to compute your 2014 estimated income tax, use the enclosed estimated tax worksheet. WHEN AND WHERE TO MAKE ESTIMATES Make your first estimated payment for the period January 1, 2014 through December 31, 2014, on or before April 15, 2014.

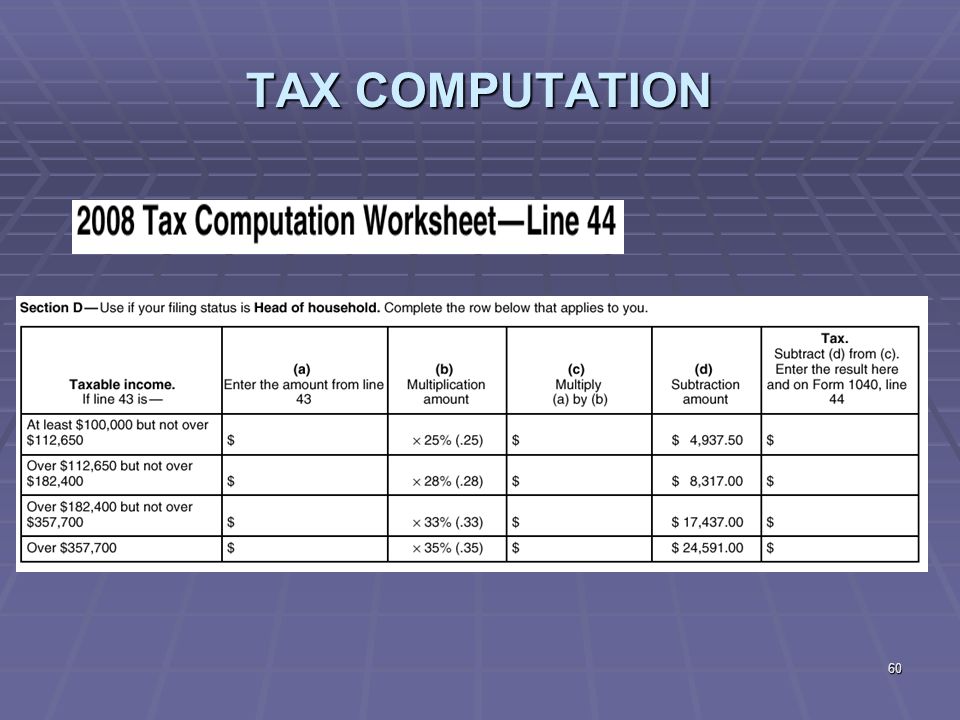

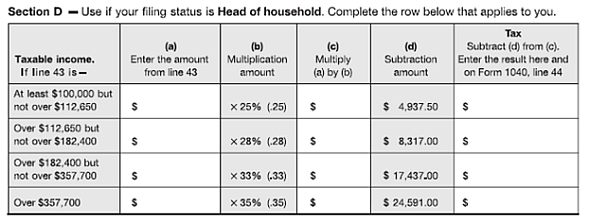

2014 tax computation worksheet. PDF Resident Individual Income Tax Return RI income tax from Rhode Island Tax Table or Tax Computation Worksheet..... 8 9a 8 RI percentage of allowable Federal credit from page 2, RI Sch I, line 22 ... 2014 estimated tax payments and amount applied from 2013 return..... 14b Property tax relief credit from RI-1040H, line 7 or 14. Attach RI-1040H 14c Tax Computation Worksheet 2014 In Excel - Excel Sheet Online Tax Computation Worksheet 2014 In Excel - In mathematics, trainees are motivated to establish logical reasoning and also important thinking, in addition to creative thinking, heavy along with price higher, issue fixing, or even communication abilities. Fractions are made use of to separate numbers on this worksheet. PDF 2019 Tax Computation Worksheet - Wolters Kluwer Tax. Subtract (d) from (c). Enter the result here and on the entry space on line 12a. Section D—Taxable income.Use if your filing status is Head of household. Complete the row below that applies to you. If line 11b is— (a) Enter the amount from line 11b (b) Multiplication amount (c) Multiply (a) by (b) (d) Subtraction amount Tax. Subtract (d) from (c). Prior Year Products - IRS tax forms Tax Table, Tax Computation Worksheet, and EIC Table 2021 Inst 1040 (Tax Tables) Tax Table, Tax Computation Worksheet, and EIC Table 2020 Inst 1040 (Tax Tables) ... 2014 Inst 1040 (Tax Tables) Tax Table and Tax Rate Schedules 2013 Inst 1040 (Tax Tables) Tax Table and Tax Rate Schedules 2012 Inst 1040 (Tax Tables) ...

PDF Ri-1041 Tax Computation Worksheet 2014 a year beginning in 2014. RI-1041 TAX COMPUTATION WORKSHEET 2014 BANKRUPTCY ESTATES use this schedule If Taxable Income-RI-1041, line 7 is: $0 $0.00 (a) Enter Taxable Income amount from RI-1041, line 7 (b) Multiplication amount (c) Multiply (a) by (b) (d) Subtraction amount (e) Subtract (d) from (c) Enter here and on RI-1041, line 8 TAX $596.00 $2,276.20 $59,600 How do I display the Tax Computation Worksheet? - Intuit The Tax Computation Worksheet does not appear as a form or worksheet in TurboTax. The calculation is done internally. You can see the Tax Computation Worksheet on page 89 of the IRS instructions for Form 1040. Be sure to read the paragraph at the top of the worksheet regarding what amount to enter in column (a). Tax Computation Worksheet 2014 In Excel - Templates ... Tax Computation Worksheet 2014 Usa. Tax Computation Worksheet. Tax Computation Worksheet 2014-15. Tax Calculation Worksheet 2014 Xls. Capital Gains and Losses Worksheet 2014. Tax Table Worksheet 2014. Child Tax Credit Worksheet Part 2 2014. 2014 Capital Gains Carryover Worksheet. Excel Vba Column Width In Centimeters. Publication 505 (2021), Tax Withholding and Estimated Tax ... Tax Computation Worksheet for 2021 (Continued) c. Married Filing Jointly or Qualifying Widow(er). Use this worksheet to figure the amount to enter on Worksheet 1-3, line 4, if you expect your filing status for 2021 to be Married Filing Jointly or Qualifying Widow(er). Expected Taxable Income (a)

Tax Computation Worksheet 2014 Usa - Templates : Resume ... Tax Computation Worksheet 2014 In Excel. Tax Table Worksheet 2014. Child Tax Credit Worksheet Part 2 2014. 2014 Capital Gains Carryover Worksheet. Capital Gains Worksheet for 2014. Qualified Dividends and Capital Gain Tax Worksheet Line 24. Plate Tectonics Concept Map Worksheet. Best Resume Writing Books 2013. › publications › p590aPublication 590-A (2021), Contributions to ... - IRS tax forms Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021). USA Tax Calculator 2014 | US iCalculator™ The 2014 Tax Calculator uses the 2014 Federal Tax Tables and 2014 Federal Tax Tables, you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.. iCalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. › forms › 20172017 Personal Income Tax Booklet 540 | FTB.ca.gov Complete the Use Tax Worksheet or use the Use Tax Lookup Table on page 15 and 16, to calculate the amount due. Extensions to File. If you request an extension to file your income tax return, wait until you file your tax return to report your purchases subject to use tax and make your use tax payment. Interest, Penalties and Fees

PDF Ri-1041 Tax Computation Worksheet 2014 a year beginning in 2014. RI-1041 TAX COMPUTATION WORKSHEET 2014 BANKRUPTCY ESTATES use this schedule If Taxable Income-RI-1041, line 7 is: $0 $0.00 (a) Enter Taxable Income amount from RI-1041, line 7 (b) Multiplication amount (c) Multiply (a) by (b) (d) Subtraction amount (e) Subtract (d) from (c) Enter here and on RI-1041, line 8 TAX $596.00 $2,276.20 $59,600

PDF 2014 Publication 17 - IRS tax forms 2014 Publication 17 - IRS tax forms ... 17.

PDF 2014 Net Profit Tax Worksheets - Phila WORKSHEETS A, B and C 2014 NET PROFITS TAX RETURN These are worksheets only. Do not file these worksheets with your return. Instructions for Worksheets A and B. Enter on Line 1 the net income or loss from the appropriate Federal Tax return(s) or if applicable, the Profit and Loss Statement. Examples of Line 2 adjustments (not all inclusive): Federal Form 1040, Schedule "C" filers - add back to net income any taxes based on net income which have been deducted in arriving at reported net ...

Tax Computation Worksheet 2020 - Askworksheet Tax Computation Worksheet 2014 Homeschooldressag Wonderful Tax Computation Since Elect In 2020 Computers Tablets And Accessories Computers For Sale Computer . The Budget Planner Is A Simple But Powerful Budgeting Spreadsheet Designed For Personal Budge Budget Worksheets Excel Budget Spreadsheet Budgeting Worksheets .

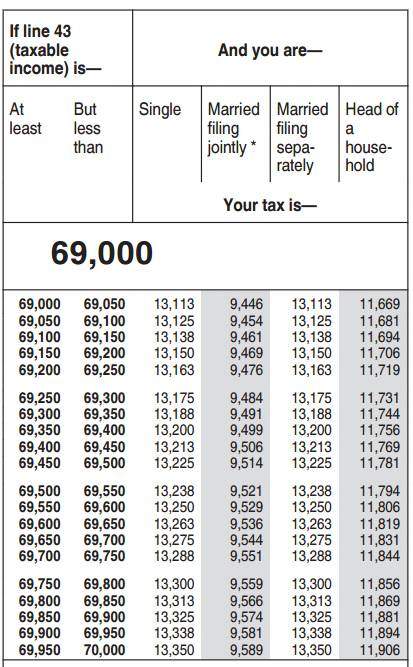

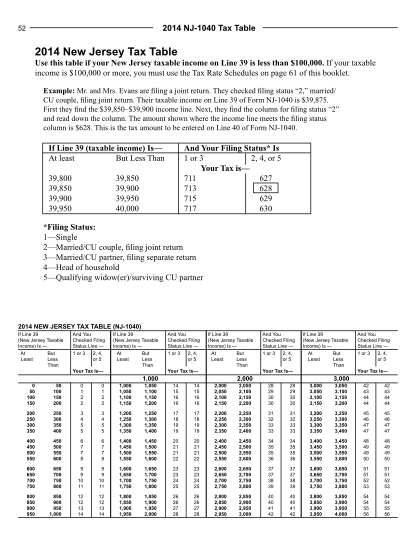

PDF 2014 Instruction 1040 - TAX TABLE - IRS tax forms 2014 Tax Table k! See the instructions for line 44 to see if you must use the Tax Table below to figure your tax. At Least But Less Than SingleMarried ling jointly* Married ling sepa-rately Head of a house-hold

PDF Ri-1041 Tax Computation Worksheet 2015 Compute the tax on Form RI-1040 or Form RI-1040NR using the Bankruptcy Estate tax computation worksheet above. 6. Attach Form RI-1040 or Form RI-1040NR to RI-1041. 7. Complete only the identification area at the top of Form RI-1041. 8. Enter the name of the individual in the following format: "John Q. Public Bankruptcy Estate." 9.

› pub › irs-pdf2021 Instruction 1040 TAX AND EARNED INCOME CREDIT TABLES $2,641. This is the tax amount they should enter in the entry space on Form 1040, line 16. If line 15 (taxable income) is— ... Worksheet - 14 -! Tax. ...

› business › corporate-income-andCorporate Income and Franchise Tax Forms | DOR Apr 07, 2014 · 83-180 | Application for Automatic Six Month Extension for Corporate Income & Franchise Tax Return 83-300 | Corporate Income Tax Voucher 83-305 | Interest and Penalty on Underestimate of Corporate Income Tax

PDF 2020 Tax Computation Worksheet—Line 16 Complete the row below that applies to you. Taxable income. If line 15 is—. (a) Enter the amount from line 15 (b) Multiplication amount (c) Multiply (a) by (b) (d) Subtraction amount. Tax. Subtract (d) from (c). Enter the result here and on the entry space on line 16. At least $100,000 but not over $163,300.

Of The Best 2014 Tax Computation Worksheet - Goal keeping ... Tax Computation Worksheet 2014 15. 0 000 a Enter Taxable Income amount from RI-1041 line 7 b Multiplication amount c Multiply a by b d Subtraction amount e Subtract d from c Enter here and on RI-1041 line 8 TAX 59600. The 2014 version of the spreadsheet includes both pages of Form 1040 as well as these supplemental schedules.

revenue.nebraska.gov › about › 2020-income-tax-forms2020 Income Tax Forms | Nebraska Department of Revenue Form 3800N - Nebraska Employment and Investment Credit Computation for All Tax Years. View Forms. Form 1040XN, 2020 Amended Nebraska Individual Income Tax Return. Form. Form NOL, Nebraska Net Operating Loss Worksheet Tax Year 2020. Form. Form 1040N-ES, 2021 Nebraska Individual Estimated Income Tax Payment Voucher. Form

2014 Tax Tables: What They Mean for Your Taxes | The ... Strangely, the IRS requires taxpayers earning less than $100,000 to use its official tax tables rather than simply calculating an amount using the tax computation worksheet. The tax table breaks ...

Of The Best Tax Computation Worksheet 2014 - Goal keeping ... List of Tax Computation Worksheet 2014. Enter the year 2. 2014 Federal Tax Tax Computation Worksheet for Line44. 0 000 a Enter Taxable Income amount from RI-1041 line 7 b Multiplication amount c Multiply a by b d Subtraction amount e Subtract d from c Enter here and on RI-1041 line 8 TAX 59600.

Tax Computation Worksheet 2014 - Templates : Resume Sample ... Tax Computation Worksheet 2014. 2014 tax putation worksheet exiting the eu the financial 3 21 3 individual in e tax returns 3 21 3 individual in e tax returns tutorial 2 2 acct1112 management accounting uwa studocu 3 21 3 individual in e tax returns 3 21 3 individual in e tax returns 3 21 3 individual in e tax returns 3 21 3 individual in e tax ...

Tax Computation Worksheet 2014-15 - Templates : Resume ... Tax Computation Worksheet 2014 In Excel. Tax Table Worksheet 2014. Child Tax Credit Worksheet Part 2 2014. 2014 Capital Gains Carryover Worksheet. Capital Gains Worksheet for 2014. Qualified Dividends and Capital Gain Tax Worksheet Line 24. Plate Tectonics Concept Map Worksheet.

2014 Income Tax Forms - Nebraska Department of Revenue Form 1041N, Electing Small Business Trust Tax Calculation Worksheet. Form. Form 3800N - Nebraska Employment and Investment Credit Computation for All Tax Years. View Forms. Form 7004N, Application for Automatic Extension of Time to File Nebraska Corporation, Fiduciary, or Partnership Return. Form. Form 4797N, 2014 Special Capital Gains Election ...

1040 (2021) | Internal Revenue Service - IRS tax forms Tax Table or Tax Computation Worksheet. Form 8615. Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for ...

PDF Maryland Resident Income 2014 502 Tax Return COM/RAD-009 Your signature Date Preparer's PTIN (required by law) Signature of preparer other than taxpayer Spouse's signature Date Address of preparer

PDF 2014 RI-1041ES Layout 1 - tax.ri.gov Your 2014 estimated income tax may be based upon your 2013 income tax liability. If you wish to compute your 2014 estimated income tax, use the enclosed estimated tax worksheet. WHEN AND WHERE TO MAKE ESTIMATES Make your first estimated payment for the period January 1, 2014 through December 31, 2014, on or before April 15, 2014.

10+ Creative Tax Computation Worksheet 2014 - Weavingaweb 2014 Form 1040 Instructions Draft Tax Table Resume Examples from Tax Computation Worksheet 2014. A year beginning in 2014. List of Tax Computation Worksheet 2014. A enter taxable income amount from line b multiplication amount c multiply a by b d subtraction amount e subtract d from c enter here and on line tax.

PDF 2021 Publication 17 - IRS tax forms Chapter 13. How To Figure Your Tax. Chapter 14. Child Tax Credit and Credit for Other Dependents. 2021 Tax Table. 2021 Tax Computation Worksheet. 2021 Tax Rate Schedules. Your Rights as a Taxpayer. How To Get Tax Help. Index. Where To File. Your Rights as a Taxpayer. Your Rights as a Taxpayer

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/Screenshot-2018-07-05-17.53.15.jpg?strip=all&lossy=1&ssl=1)

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/tax_diagram.gif?strip=all&lossy=1&resize=550%2C300&ssl=1)

0 Response to "42 2014 tax computation worksheet"

Post a Comment