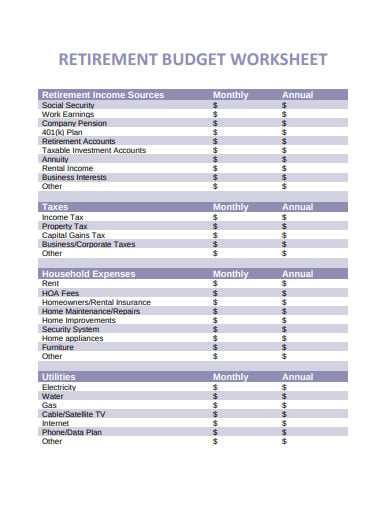

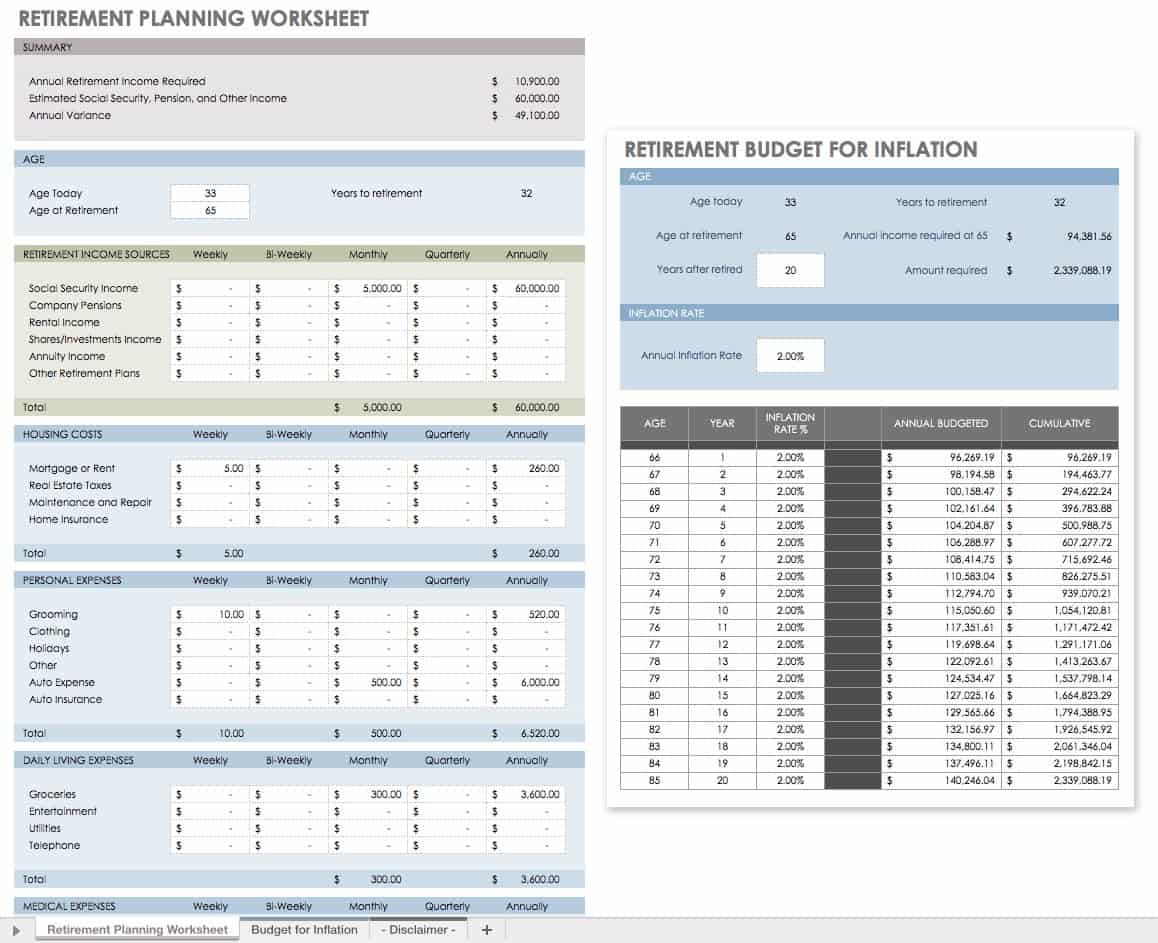

41 retirement income planning worksheet

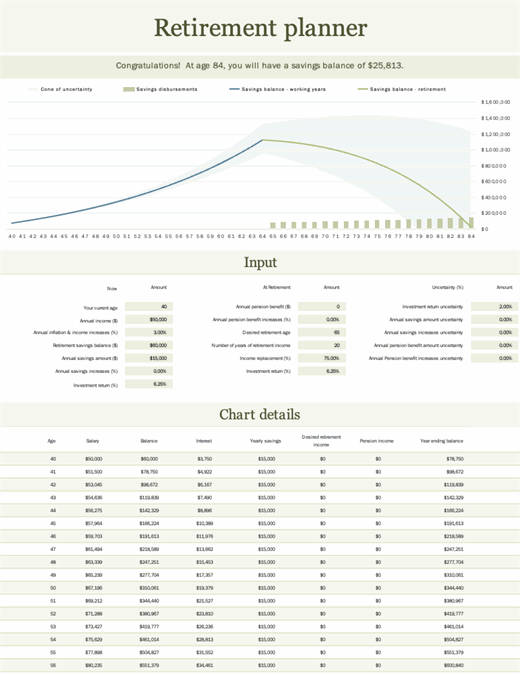

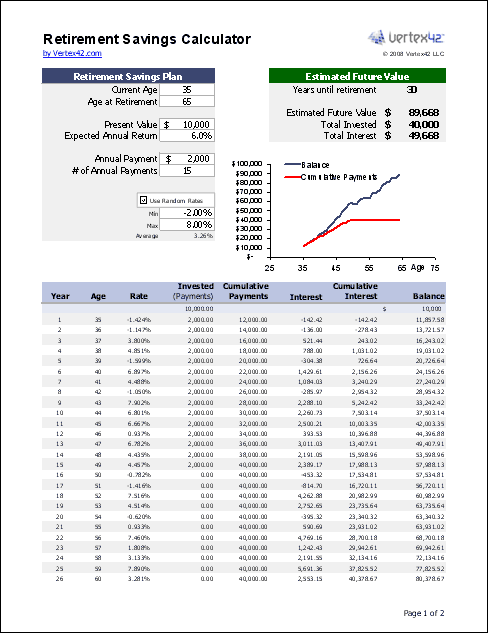

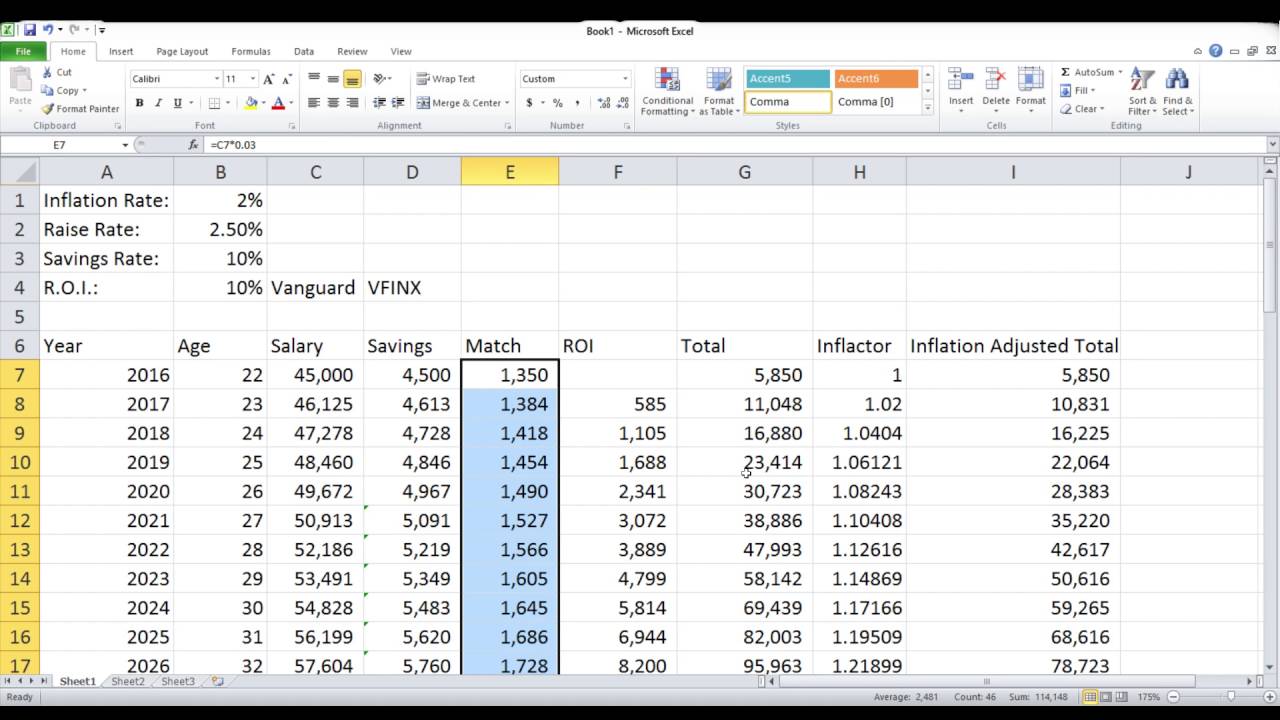

› retirement › how-to-createHow to Plan for Retirement | RamseySolutions.com Dec 22, 2021 · A couple with a household income of $56,000 could have around $1.1 million for retirement if they invest 15% of their income for 25 years. In 30 years, they could have $1.9 million—and that’s assuming they never got another raise during their working lifetimes. › retirement-plans › self-employedSelf-Employed Individuals – Calculating Your Own Retirement ... Nov 05, 2021 · A limit applies to the amount of annual compensation you can take into account for determining retirement plan contributions. This limit is $305,000 in 2022, $290,000 in 2021, $285,000 in 2020 and $280,000 in 2019 and is adjusted annually .

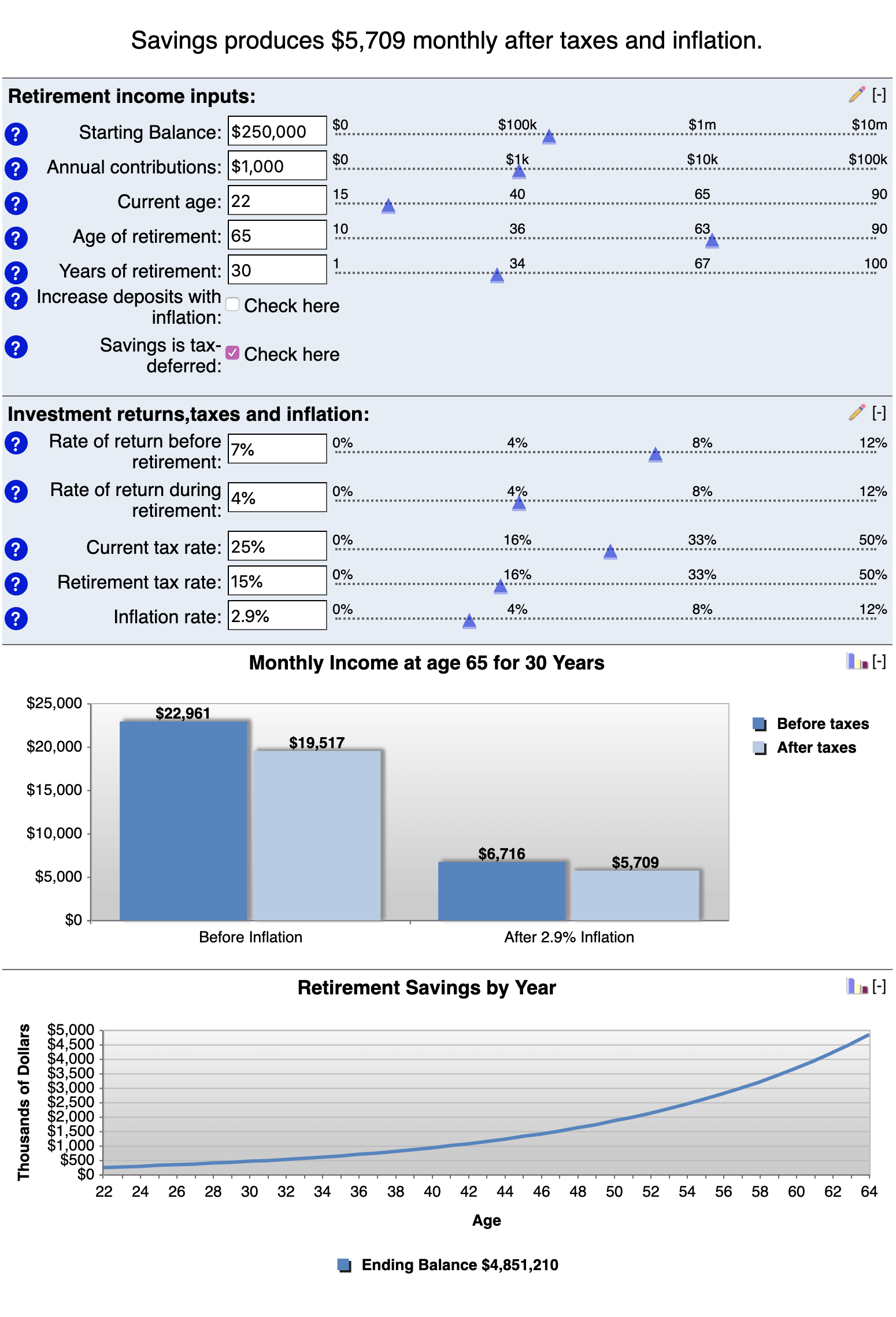

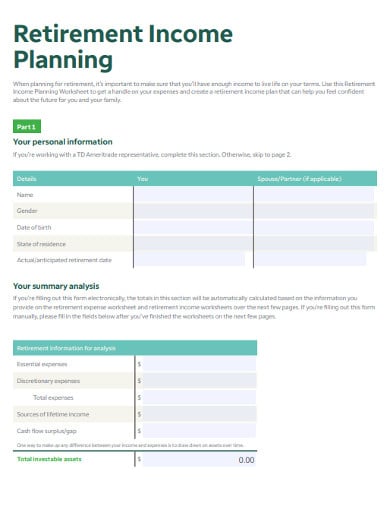

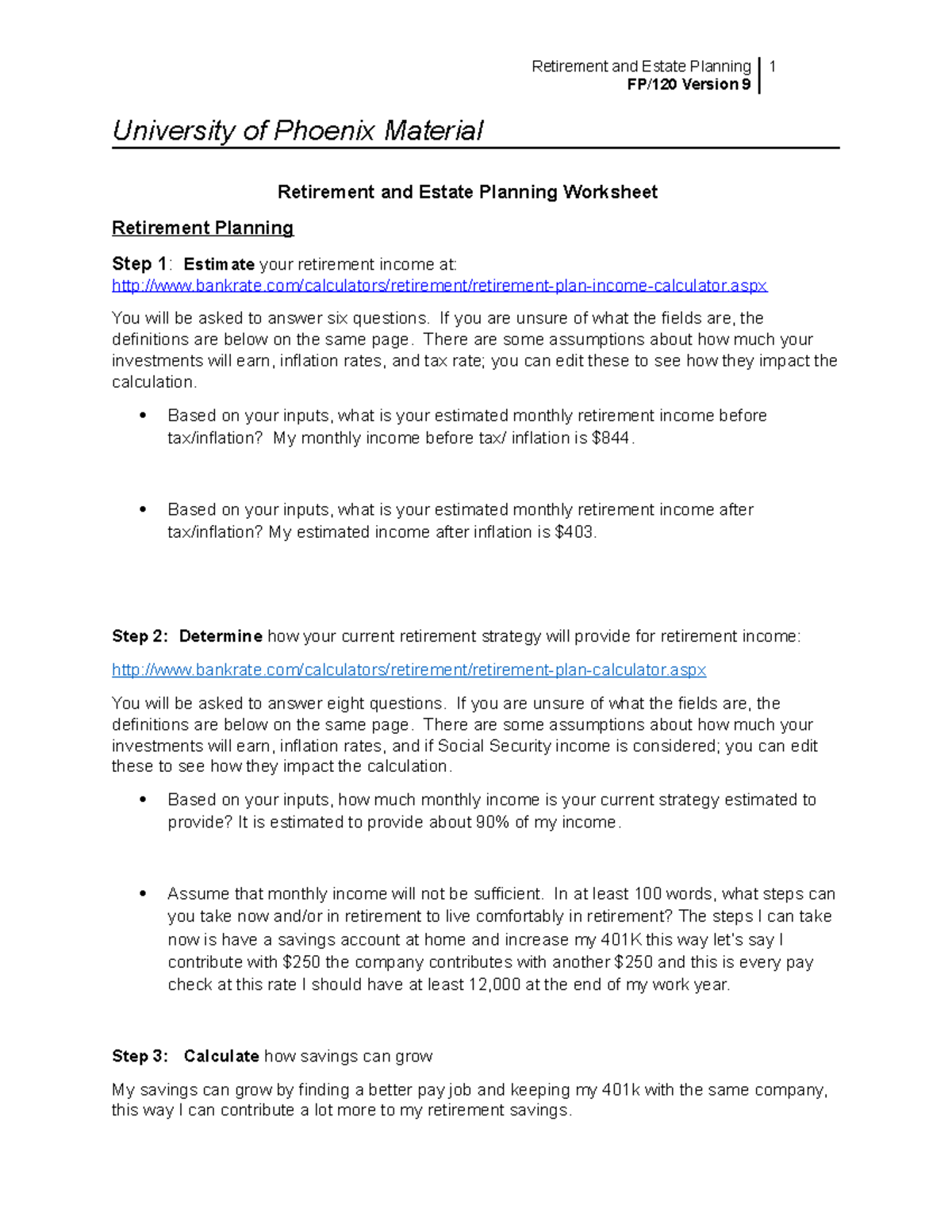

› retail-en_us › resourcesRetirement Income Planning Worksheet - TD Ameritrade Retirement income planning worksheet 3 Your sources of lifetime income List sources of monthly income that are guaranteed to last your entire life—for you and/or your spouse or partner (if applicable), no

Retirement income planning worksheet

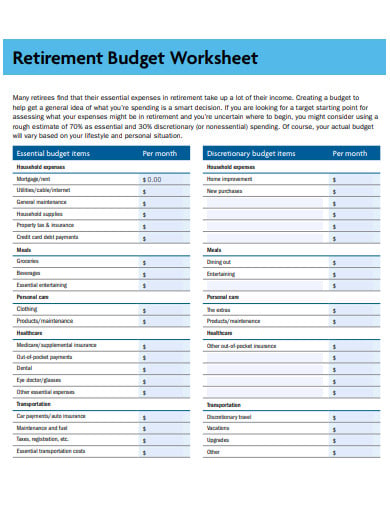

› forms › EstatePlanningWorksheetESTATE PLANNING WORKSHEET - Clemons Richter & Reiss, PC ESTATE PLANNING WORKSHEET . USING THIS ORGANIZER WILL ASSIST US IN DESIGNING . A PLAN THAT MEETS YOUR GOALS. ALL INFORMATION PROVIDED IS STRICTLY CONFIDENTIAL . For efficiency in planning, please bring with you each of the following: ♦ Any existing Wills and Codicils, Trusts, and other estate planning documents. ♦ Deeds for any real estate ... › planning-retirementPlanning for Retirement - New York City Employees' Retirement ... Dec 29, 2021 · Tips and Strategies for Retirement Planning The sources of income you may have for your retirement are often compared to a 3-legged stool: one leg is your pension, the second leg is Social Security, and the third leg is your personal savings. investor.vanguard.com › retirement › incomeUse a retirement planning worksheet | Vanguard Income taxes, if your income is lower than when you were working full-time. Certain lifestyle expenses, if you plan to cook more instead of eating out, for example. Debt payments, if you paid off your mortgage or other loans before retiring. Life insurance, if you decide to drop it once you retire.

Retirement income planning worksheet. › Pages › active_member_planningPlanning for Retirement - Texas Planning for Retirement Retiring can be a simple process if you plan ahead. ... Retirement Income and Expenses Worksheet. Step 3 30-60 DAYS prior to retirement date ... investor.vanguard.com › retirement › incomeUse a retirement planning worksheet | Vanguard Income taxes, if your income is lower than when you were working full-time. Certain lifestyle expenses, if you plan to cook more instead of eating out, for example. Debt payments, if you paid off your mortgage or other loans before retiring. Life insurance, if you decide to drop it once you retire. › planning-retirementPlanning for Retirement - New York City Employees' Retirement ... Dec 29, 2021 · Tips and Strategies for Retirement Planning The sources of income you may have for your retirement are often compared to a 3-legged stool: one leg is your pension, the second leg is Social Security, and the third leg is your personal savings. › forms › EstatePlanningWorksheetESTATE PLANNING WORKSHEET - Clemons Richter & Reiss, PC ESTATE PLANNING WORKSHEET . USING THIS ORGANIZER WILL ASSIST US IN DESIGNING . A PLAN THAT MEETS YOUR GOALS. ALL INFORMATION PROVIDED IS STRICTLY CONFIDENTIAL . For efficiency in planning, please bring with you each of the following: ♦ Any existing Wills and Codicils, Trusts, and other estate planning documents. ♦ Deeds for any real estate ...

/financial-advisor-talking-to-couple-on-sofa-175139840-59ac6878685fbe0010301fae.jpg)

0 Response to "41 retirement income planning worksheet"

Post a Comment