40 qualified dividends and capital gain tax worksheet

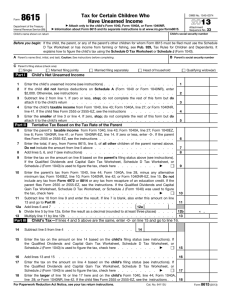

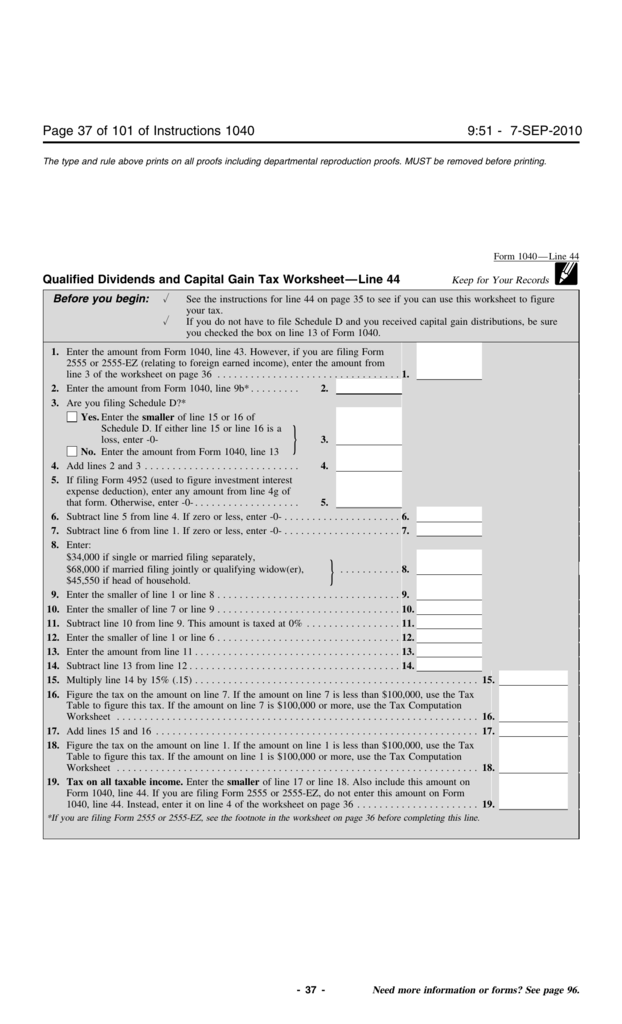

qualified dividends and capital gain tax worksheet - Search Jan 20, 2022 · IRS Form 1040 Qualified Dividends Capital Gains Worksheet Form 1040 Form is an IRS needed tax form needed from the US government for federal income taxes filed by citizens of United States. The qualified dividends and capital gain tax worksheet can be separated into... How Capital Gains and Qualified Dividends Are Taxed There are 4 advantages to taxpayers of capital gains taxes over the taxation of income earned from work To receive the preferential tax treatment for long-term capital gains, the taxpayer must use the Qualified Dividends and Capital Gains Tax Worksheet in the Form 1040 instructions.

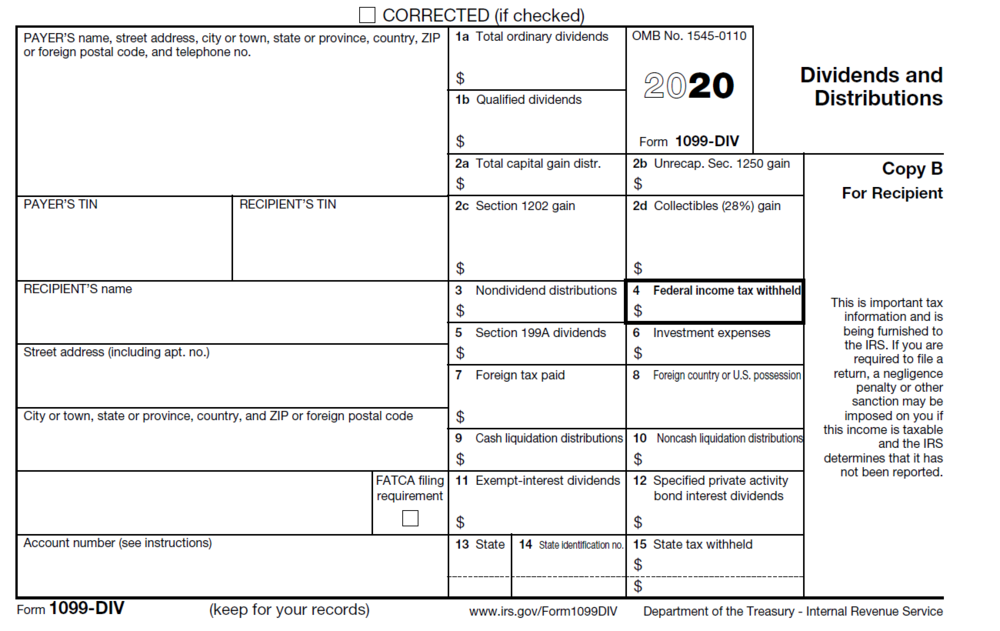

What is the difference between "ordinary dividends" and "qualified... Qualified dividends are taxed at the same tax rate that applies to net long-term capital gains, while non-qualified If you have qualified dividends, you should use the qualified dividends and capital gain tax worksheet in the Form 1040 instructions to calculate your tax and take advantage of the...

Qualified dividends and capital gain tax worksheet

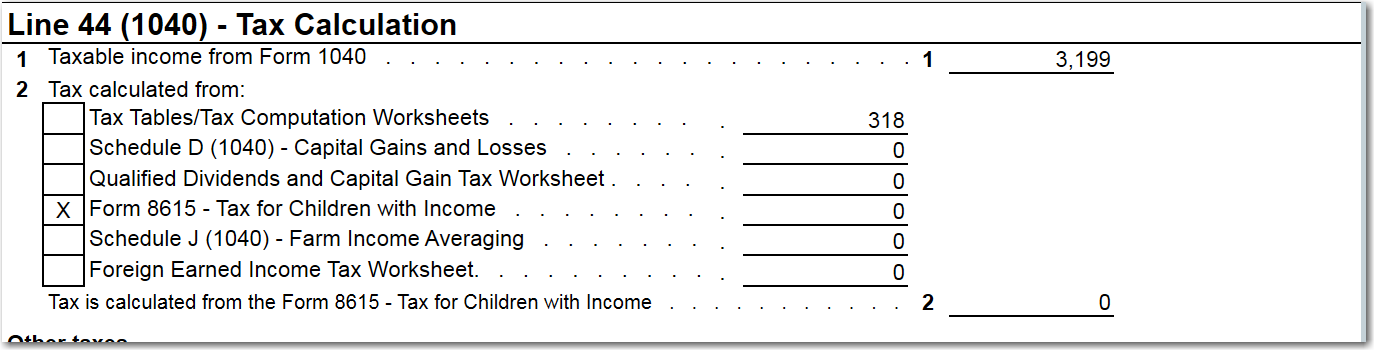

Form 1040A....line 9B....qualified dividends...is the amount I have qualified dividends of 4484 and ordinary dividends of 4636 which includes the qualified figure. My tax bracket was 10% - If I unde… read more. I don't know how to fill out the schedule d tax worksheet or qualified dividends and capital gain tax worksheet … read more. qualified dividends tax worksheet. Search, Edit, Fill, Sign, Fax... Fill Qualified Dividends And Capital Gain Tax Worksheet Instructions, download blank or editable online. 2016 Qualified Dividends and Capital Gain Tax WorksheetLine44 See Form 1040 instructions for line 44 to see if you can use this worksheet to figure your tax. What is a Qualified Dividend Worksheet? | Money Inc IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without...

Qualified dividends and capital gain tax worksheet. Qualified Dividends - Fidelity Since 2003, certain dividends known as qualified dividends have been subject to the same tax rates as long-term capital gains, which are lower than Qualified dividends are generally dividends from shares in domestic corporations and certain qualified foreign corporations which you have held for at... Qualified Dividends And Capital Gain Tax Worksheet, Jobs... Tools or Tax ros e a Qualified Dividends and Capital Gain Tax Worksheet (2019) •Form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer's tax. PDF Investment | 48 Reporting Capital Gains and Losses This generally includes interest, dividends, capital gains, and other types of distributions including mutual fund dis-tributions. Line 6; also use Form 8949, Schedule D, and the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet. FORM1040 Yale University Qualified Dividends and Capital Gain... Child tax credit Credit for other dependents Sign Here Under penalties of perjury, I declare that I have examined this return and accompanying schedules and No. 17146N Schedule B (Form 1040) 2018 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Keep...

If I can't see my Qualified Dividends and Capital Gain Tax... ...you have capital gains or qualified dividends the tax is not taken from the tax table but is calculated separately from schedule D. The tax will be from Turbo Tax desktop and found that they instead used the Schedule D worksheet to calculated my taxes rather than the Qualified Dividend and... 2021-22 Capital Gains Tax Rates and Calculator - NerdWallet Short-term capital gains tax is a tax on profits from the sale of an asset held for one year or less. The short-term capital gains tax rate equals your ordinary income tax Rather than reinvest dividends in the investment that paid them, rebalance by putting that money into your underperforming investments. Qualified Dividends and Capital Gains Worksheet.pdf - 2016... 2016 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1.

What is a Qualified Dividend Worksheet? | Money Inc IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without... qualified dividends tax worksheet. Search, Edit, Fill, Sign, Fax... Fill Qualified Dividends And Capital Gain Tax Worksheet Instructions, download blank or editable online. 2016 Qualified Dividends and Capital Gain Tax WorksheetLine44 See Form 1040 instructions for line 44 to see if you can use this worksheet to figure your tax. Form 1040A....line 9B....qualified dividends...is the amount I have qualified dividends of 4484 and ordinary dividends of 4636 which includes the qualified figure. My tax bracket was 10% - If I unde… read more. I don't know how to fill out the schedule d tax worksheet or qualified dividends and capital gain tax worksheet … read more.

:max_bytes(150000):strip_icc()/1099-DIV-ffc2266fbad34acd9de5359089733572.jpg)

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

0 Response to "40 qualified dividends and capital gain tax worksheet"

Post a Comment