40 clergy tax deductions worksheet

40 clergy tax deductions worksheet - Worksheet For Fun IRS Publication 517 Clergy worksheets related to income and deduction items for ministers and religious workers are included in individual tax returns. These worksheets are used to calculate: the minister's percentage of tax-free income (Worksheet 1, Figuring the Percentage of Tax-Free Income) seller counting his money PDF Housing Allowance Exclusion Worksheet Housing Allowance Exclusion Worksheet. This worksheet is designed to help a clergyperson determine the amount that he or she may exclude from gross income . pursuant to the provisions of Section 107 of the Internal Revenue Code (Code). Those provisions provide that "a minister of

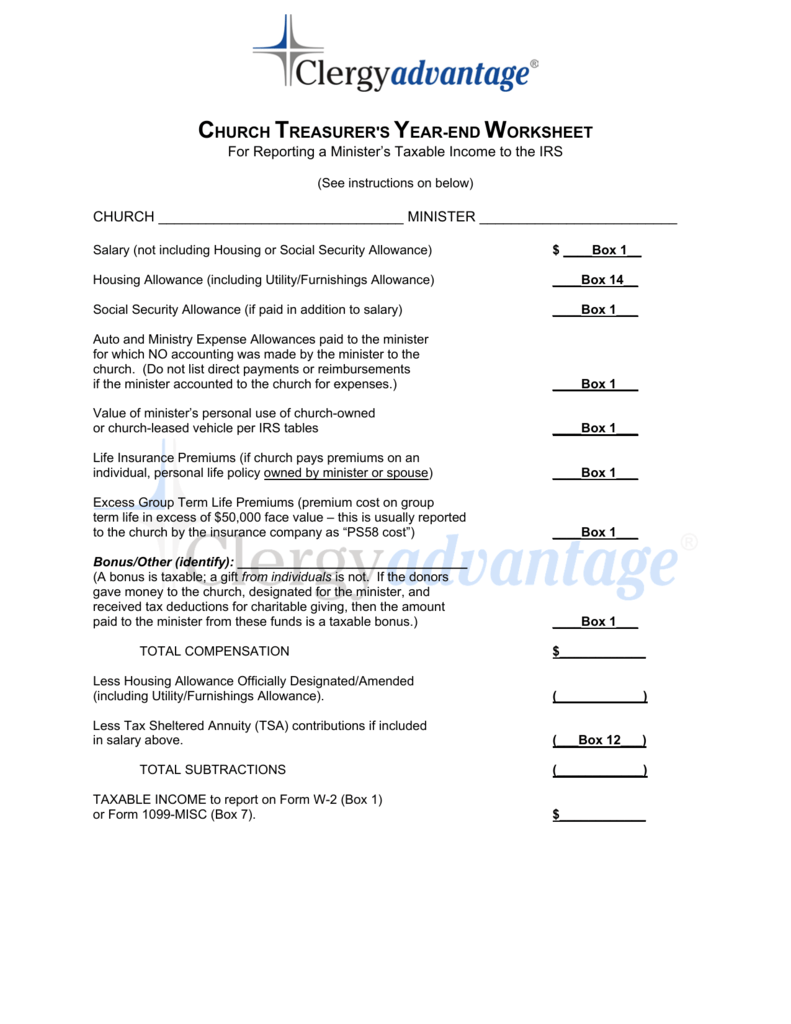

A Guide to Self-Employment Tax & Deductions for Clergy and ... A Guide to Self-Employment Tax & Deductions for Clergy and Ministers If you are a member of the clergy, you should receive a Form W-2, Wage and Tax Statement, from your employer reporting your salary and any housing allowance. Generally, there are no income or Social Security and Medicare taxes withheld on this income.

Clergy tax deductions worksheet

PDF 2021 Clergy Tax Return Preparation Guide - CPG A Supplement to the 2021 Clergy Tax Return Preparation Guide for 2020 Returns For the 2020 tax year, the Church Pension Group (CPG) is providing the 2021 Clergy Tax Return Preparation Guide for 2020 Returns and the 2021 Federal Reporting Requirements for Episcopal Churches, Schools, and Institutions Housing Allowance For Pastors 2022 - Yugyo Jan 23, 2022 · Clergy Tax Deductions Worksheet. Beginning on january 1, 2018. The actual housing allowance exclusion is the lower of: Regulations do specifically state that expenses for groceries, paper products, personal toiletries, personal clothing, and maid service cannot be. PDF Housing Allowance for Retired Ministers Worksheet Worksheet for Calculating . Housing Allowance Exclusion for Retired Ministers => Retain this sheet for your tax records. Under current law, retired ministers may exclude all or a portion of their church retirement pension from gross income as housing a llowance if the pension represents contributions made while performing services in the exercise

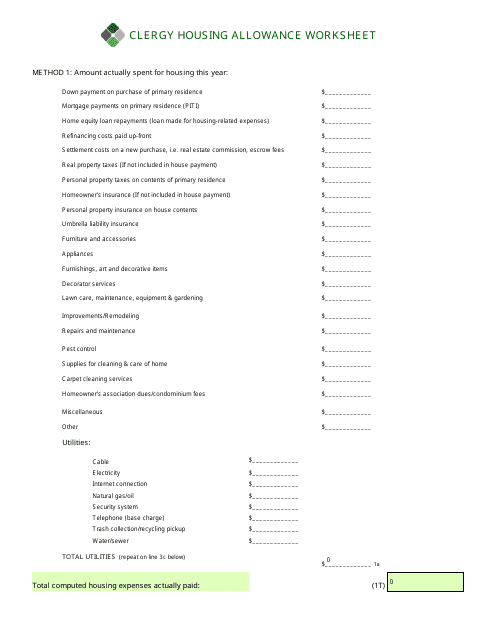

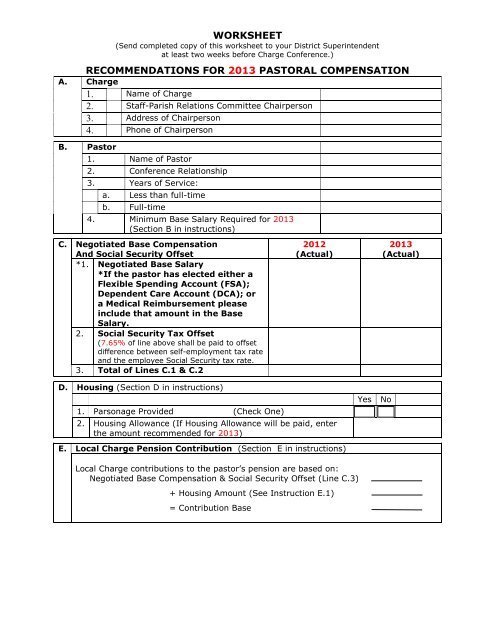

Clergy tax deductions worksheet. PDF Clergy Housing Allowance Worksheet CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____ NOTE: This worksheet is provided for educational purposes only. You should discuss your specific situation with your professional advisors, including the individual who assists with preparation of your final tax return. Topic No. 417 Earnings for Clergy | Internal Revenue Service Topic No. 417 Earnings for Clergy. A licensed, commissioned, or ordained minister is generally the common law employee of the church, denomination, sect, or organization that employs him or her to provide ministerial services. However, there are some exceptions, such as traveling evangelists who are independent contractors (self-employed) under ... PDF 2021 CLERGY SERVING 100% or 75% TIME deduction including any before or after tax personal pension contribution) $ b. ... 2021 CLERGY SERVING 100% or 75% TIME Worksheet 1 --Compensation Paid by Local Church Rev. 6/2020 Report travel, education, and other reimbursed expense in section A or B if given as a receipted purchase. If monies are T1223 Clergy Residence Deduction - Canada.ca If you are a clergy member, use this form to claim the clergy residence deduction. This form will help you calculate the expenses you can deduct. If you are a clergy member, use this form to claim the clergy residence deduction. This form will help you calculate the expenses you can deduct.

PDF Clergy Tax Worksheet Clergy Tax Worksheet PARSONAGE ALLOWANCE: Many members of the clergy are paid a cash "housing allowance," which they use to pay the expenses related to their homes (e.g. interest, real property taxes, utilities etc.). Alternatively, some may live in a parsonage owned by the church. Neither a cash allowance (to the extent it is used to pay for home W-4 Withholding Calculator for Clergy - Clergy Financial ... W-4 Withholding Calculator for Clergy. According to IRS rules, income tax withholding for ministers is voluntary. If you do not complete a W-4 form, or if you indicate "exempt", no federal tax will be withheld, and you should make quarterly estimated tax payments. Housing Allowance For Pastors 2022 - Sdnu 40 clergy tax deductions worksheet Worksheet Live from vintage-shoppe.blogspot.com. Therefore, current and retired pastors can receive a housing allowance. The housing allowance for pastors is not and can never be a retroactive. The housing allowance is the most PDF 2022 Clergy Tax Return Preparation Guide for 2021 Returns extended this deduction through 2021 and increased it to $600 for married couples filing a joint return. PRELIMINARY QUESTIONS. Below are several questions you should consider before preparing your 2021 federal tax return. Q. Must ministers pay federal income taxes? A. Yes. Ministers are not exempt from paying fed-eral income taxes. Q.

PDF Clergy Housing Allowance Worksheet NOTE: This worksheet is provided for educational and tax preparation purposes only. You should discuss your specific situation with your professional tax advisors. Clergy Financial Resources Rev. 11/2010 PDF Clergy Income & Expense Worksheet Year CLERGY BUSINESS EXPENSES (continued) EQUIPMENT PURCHASED Musical instruments, office equipment, office furniture, professional library, etc. Item Purchased Date Purchased Cost (including sales tax) Item Traded Additional Cash Paid Business Use Other Information 1099s: Amounts of $600.00 or more paid to individuals (not Clergy residence - Canada.ca Clergy residence deduction. If your employee is a member of the clergy, they may be able to claim a deduction from income for their residence when filing a personal income tax and benefits return. An employee who is a member of the clergy, a regular minister, or a member of a religious order can claim the clergy residence deduction if the ... PDF cannot - IRS tax forms An updated revision of this form, instruction, or publication is being finalized, and it will be posted here soon. We apologize for the inconvenience.

1040-US: IRS Publication 517 Clergy Worksheets IRS Publication 517 Clergy worksheets related to income and deduction items for ministers and religious workers are included in individual tax returns. These worksheets are used to calculate: the minister's percentage of tax-free income (Worksheet 1, Figuring the Percentage of Tax-Free Income)

40 clergy tax deductions worksheet - Worksheet Live Clergy tax deductions worksheet. Clergy residence - Canada.ca To claim the deduction, the employee has to fill out Parts A and C of Form T1223, Clergy Residence Deduction. You have to fill out Part B and sign the form to certify that this employee has met the required conditions.

1040-US: IRS Publication 517 Clergy Worksheets IRS Publication 517 Clergy worksheets related to income and deduction items for ministers and religious workers are included in individual tax returns. These worksheets are used to calculate: the minister's percentage of tax-free income (Worksheet 1, Figuring the Percentage of Tax-Free Income)

Tax Deduction Check List - cpa-services.com Profession Specific Deduction Checklist (to be used only by experienced tax preparers) Actors, Performers, ... Download our 12 month expense worksheet Excel Worksheet. Ministers and the Clergy. Download our expense checklist PDF ... Download our 12 month expense worksheet Excel Worksheet. Other Tax Checklists. Rental Real Estate Deductions ...

PDF Ministers Income/Deduction Worksheet Items listed on this worksheet in either section must be paid by you or your spouse and you must keep receipts for expenses for a minimum of 5 years after you file your taxes. Rev. 03/03/2021 Page 1 of 2 . Ministers Income/Deduction Worksheet . Client Name _____ Tax Year _____

43 clergy housing allowance worksheet - Worksheet Information HOUSING ALLOWANCE EXCLUSION WORKSHEET This worksheet is designed to help a retired clergyperson determine the amount that he or she may exclude from gross income pursuant to the provisions of section 107 of the Code. Those provisions provide that "a minister of the gospel" may exclude a "housing allowance" from his or her gross income.

PDF Minister'S Housing Expenses Worksheet AGFinancial is a DBA of Assemblies of God Ministers Benefit Association 062821 MINISTER'S HOUSING EXPENSES WORKSHEET ANNUAL HOUSING EXPENSES Rent (if a primary residence was ented for all or part of the year) $ Down payment on a home $ Remodeling and improvements $ Installment payments on a mortgage loan to purchase or improve your home $

Clergy expenses - Intuit Clergy expenses. Unreimbursed business expenses are treated just like they are for regular employees -- they are deductible if you itemize your deductions on schedule A and they are subject to the 2% exclusion rule. They get entered on the deductions and credits interview, and you need TurboTax Deluxe or higher.

40 clergy tax deductions worksheet - Worksheet Live these worksheets are used to calculate: the minister's percentage of tax-free income (worksheet 1, figuring the percentage of tax-free income) the allowable deduction of expenses for church-related income reported on schedule c (worksheet 2, figuring the allowable deduction of schedule c or c-ez expenses) how a member of the clergy or religious …

PDF PC - Associates, Riley & Courtesy Ministers and the Clergy Courtesy of Riley & Associates, PC - - 978-463-9350 Courtesy of Riley & Associates, PC - - 978-463-9350. Title: Clergy Expense Worksheet.xlsx Author: Peter Jason Riley Created Date:

PDF MMBB - 2021 Clergy Tax Return Preparation Guide for 2020 ... 2 Clergy Tax Return Preparation Guide for 2020 Returns income of $104,000 for joint filers and $65,000 for a single person or head of household.

PDF Housing Allowance for Retired Ministers Worksheet Worksheet for Calculating . Housing Allowance Exclusion for Retired Ministers => Retain this sheet for your tax records. Under current law, retired ministers may exclude all or a portion of their church retirement pension from gross income as housing a llowance if the pension represents contributions made while performing services in the exercise

Housing Allowance For Pastors 2022 - Yugyo Jan 23, 2022 · Clergy Tax Deductions Worksheet. Beginning on january 1, 2018. The actual housing allowance exclusion is the lower of: Regulations do specifically state that expenses for groceries, paper products, personal toiletries, personal clothing, and maid service cannot be.

PDF 2021 Clergy Tax Return Preparation Guide - CPG A Supplement to the 2021 Clergy Tax Return Preparation Guide for 2020 Returns For the 2020 tax year, the Church Pension Group (CPG) is providing the 2021 Clergy Tax Return Preparation Guide for 2020 Returns and the 2021 Federal Reporting Requirements for Episcopal Churches, Schools, and Institutions

0 Response to "40 clergy tax deductions worksheet"

Post a Comment