39 va loan comparison worksheet

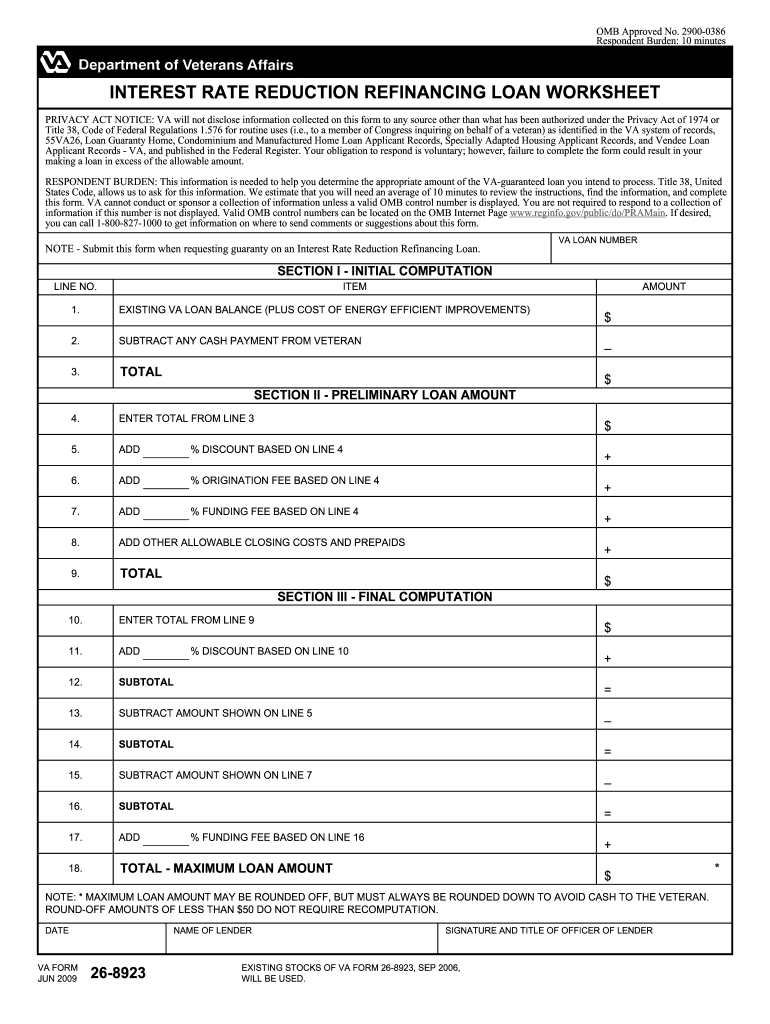

PDF Determining Recoupment Period for IRRRLs - Veterans Affairs Loan Type Fixed 5/1 Hybrid ARM Loan Term 30 years 30 years Interest Rate 5.00% 3.00% (initial) Similar to the previous example, the lender must calculate the monthly PI for recoupment using the initial rate on the new IRRRL when the new loan is an ARM. $4,436.49 (fees/expenses/closing costs) = $4,436.49 (net fees/expenses/closing PDF Interest Rate Reduction Refinance Loan Worksheet Department of Veterans Affairs April 12, 2017 . Washington, D.C. 20420 . Instructions for Completion of VA Form 26-8923, Interest Rate Reduction Refinance Loan Worksheet. 1. Purpose. This Circular clarifies the Department of Veterans Affairs' (VA) requirements

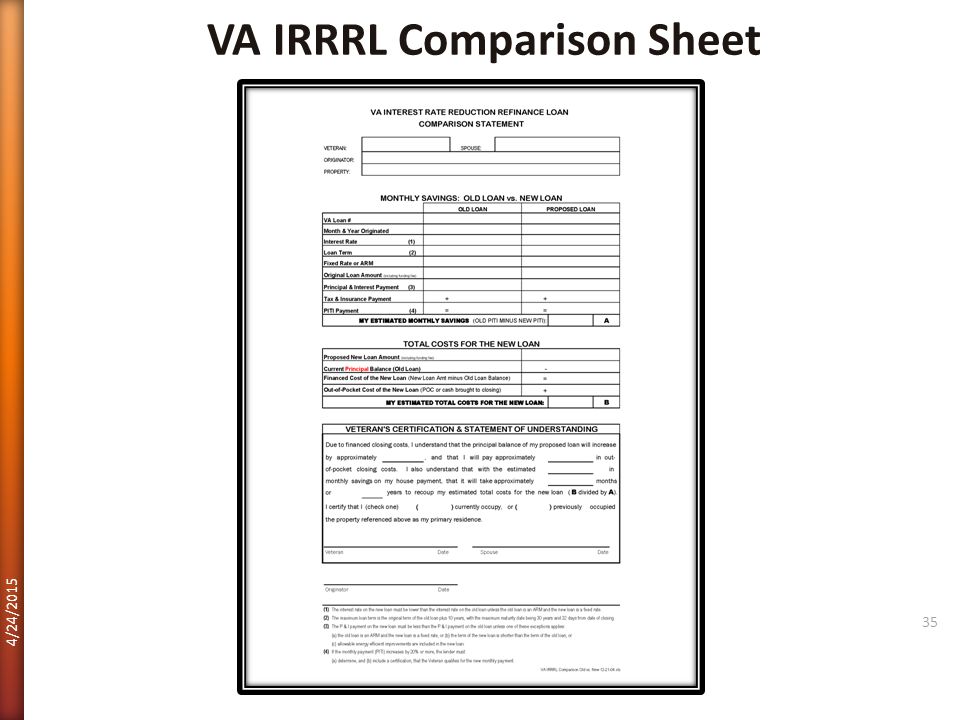

Lenders Sample Documents - VA Home Loans Lenders may use this sample document, provided it is on the lender's letterhead. See VA Lenders Handbook, Chapter 4, Section 1.#7. Old vs. New Loan Comparison and Certification. Lenders must include with every Interest Rate Reduction Refinance loan, a statement signed by the borrowers showing they understand the effects of the refinance.

Va loan comparison worksheet

Download Microsoft Excel Mortgage Calculator Spreadsheet ... By default this calculator is selected for monthly payments and a 30-year loan term. A person could use the same spreadsheet to calculate weekly, biweekly or monthly payments on a shorter duration personal or auto loan. Some of Our Software Innovation Awards! Since its founding in 2007, our website has been recognized by 10,000's of other websites. › warms › docsC&P Service Clinician's Guide - Veterans Affairs VA Forms 10-2364 or 10-2364a may be used to report the majority of audiometric tests conducted within the VA. VBA Worksheet 1305 (AUDIO), or its electronic equivalent, is used to record audiometric thresholds and rating narratives. Bankrate: Guiding you through life's financial journey Use Bankrate.com's free tools, expert analysis, and award-winning content to make smarter financial decisions. Explore personal finance topics including credit cards, investments, identity ...

Va loan comparison worksheet. About VA Form 26-8923 - Veterans Affairs About VA Form 26-8923. Form name: Interest Rate Reduction Refinancing Loan Worksheet. Related to: Housing assistance. Form last updated: January 4, 2022. PDF Loan Guaranty Service Quick Reference ... - Veterans Affairs Comparison of Loan being Refinanced to New Loan : The net tangible benefit(s) to the Veteran are auto-determined based on the comparison of the ... non-VA loan being refinanced then the criteria is met. If no, criteria is not met. If loan being refinanced is a VA loan, the question does ... en.wikipedia.org › wiki › Mortgage-backed_securityMortgage-backed security - Wikipedia A mortgage-backed security (MBS) is a type of asset-backed security (an 'instrument') which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment bank) that securitizes, or packages, the loans together into a security that investors can buy. Va Irrrl Loan Comparison Worksheet - Worksheet : Resume ... Va Irrrl Loan Comparison Worksheet. February 18, 2019 by Role. Advertisement. Advertisement. 21 Gallery of Va Irrrl Loan Comparison Worksheet. Va Loan Comparison Form Pdf. Va Loan Comparison Form. Va Irrrl Worksheet. Va Irrrl Net Tangible Benefit Worksheet. Va Irrrl Safe Harbor Worksheet.

Document Update: VA IRRRL Loan Comparison Statement ... The "VA IRRRL Loan Comparison Statement" (Cx14501, renamed from "VA Refinance Loan Comparison") has been modified as follows: Updated the title at the top of the document to "VA Interest Rate Reduction Refinancing Loan Comparison Statement". Matched the labeling and format of the "Previous Loan", "Proposed Loan", and "Time ... PDF VA (Veterans Administration) Loan Program VA Worksheet ... add the VA Funding Fee to the base loan amount, if the property has sufficient equity plus entitlement. The maximum total loan amount, including any financed funding fee, for any rate/term refinance or IRRRL transaction is $417,000. This worksheet should not be used for IRRRLs, as VA issues a minimum guaranty of 25% on all IRRRLs. › taxes › sales-tax-deductionSales Tax Deduction: What It Is, How To Take Advantage - Bankrate Sep 22, 2021 · The worksheet in those instructions also helps you calculate the tax under different scenarios, such as if you lived in different states or if the local tax rate changed during the course of the year. VA Loan Calculators, Tools, and Worksheets 3.2 VA Loans; 3.3 FHA Loans; 3.4 USDA Loans; 3.5 Conventional Loans; 3.6 Loan Comparison Chart; 4 Starting The VA Mortgage Process Open Section. 4.1 Where to Start: Lender or Real Estate Agent? 4.2 VA Loan Eligibility; 4.3 VA Loan Entitlement; 4.4 VA Loan Limits; 4.5 VA Loan Prequalification; 4.6 VA Loan Preapproval; 4.7 Finding a VA Lender; 5 ...

Indentured Servants In The U.S. | History Detectives - PBS Indentured servants first arrived in America in the decade following the settlement of Jamestown by the Virginia Company in 1607. The idea of indentured servitude was born of a … PDF VA Recoupment Calculation Worksheet Job Aid This job aid includes a representation of the Recoupment Calculation Worksheet Job AidVA on page 1, along with instructions for completing each field on the form. Date: FAMC Loan Number: Veteran: Spouse: Lender: Property: Unpaid Principal Balance of current VA loan: Comparison: OLD Loan vs. NEW Loan Va Loan Comparison Form - Fill Online, Printable, Fillable ... va interest rate reduction refinance loan comparison statement veteran: spouse: originator: property: monthly savings: old loan vs. new loan old loan proposed loan va loan # month & year originated Fill va fillable irrrl worksheet: Try Risk Free PDF Volume XIV Chapter 3 - VA.gov Home | Veterans Affairs Added link for VA Form 10079a, Personal Travel in Conjunction with Official Travel Cost Comparison Worksheet. OFP (047G) General policy update. August 2021 Appendix D: Constructive Travel Updated to clarify when a cost comparison is required (including personal travel), costs required to be included, and applicable travel segments. OFP (047G)

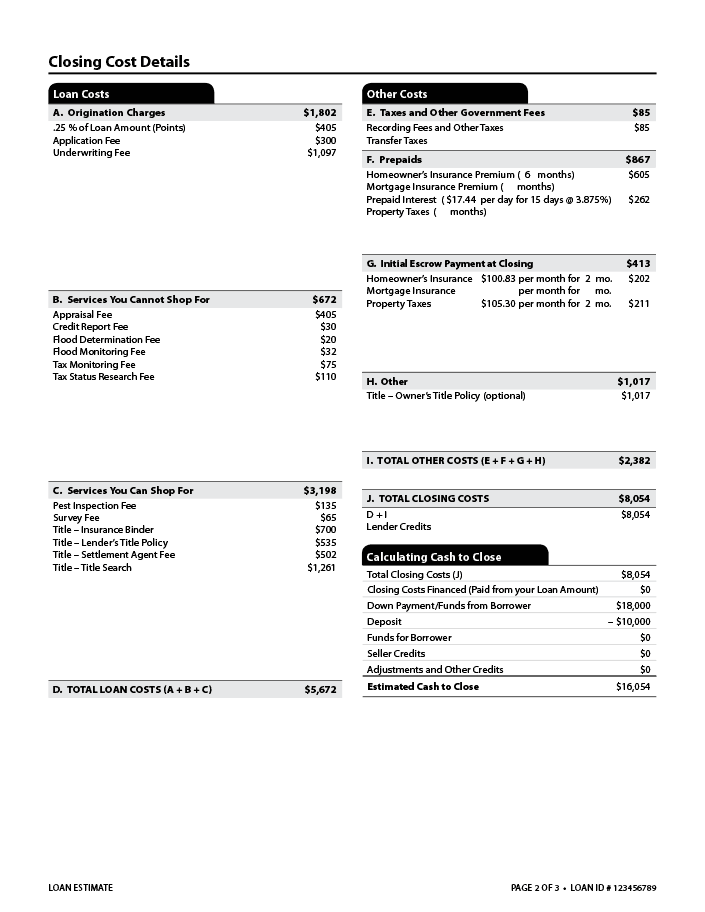

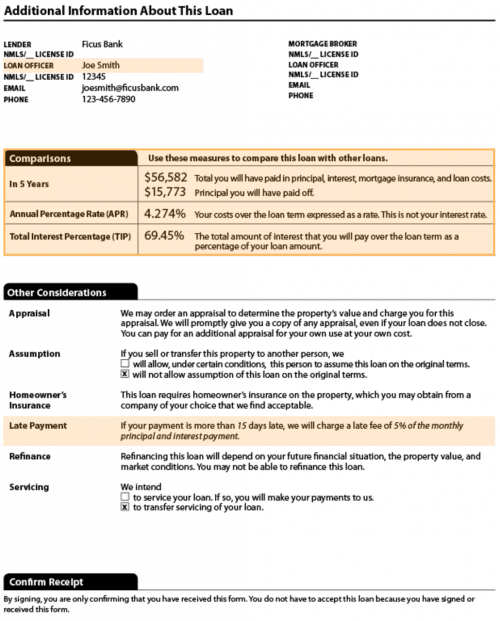

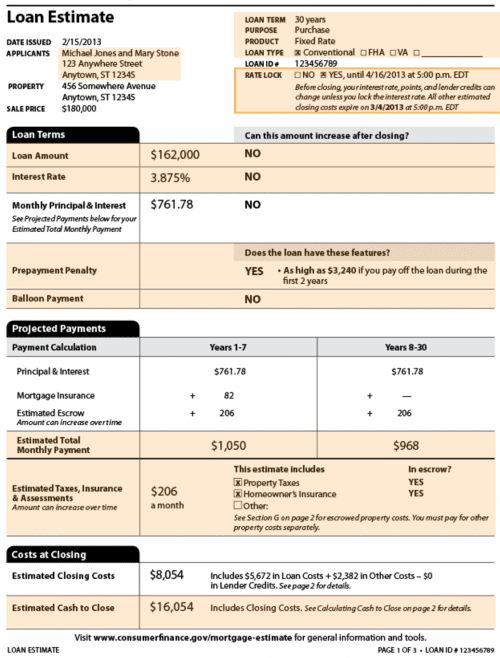

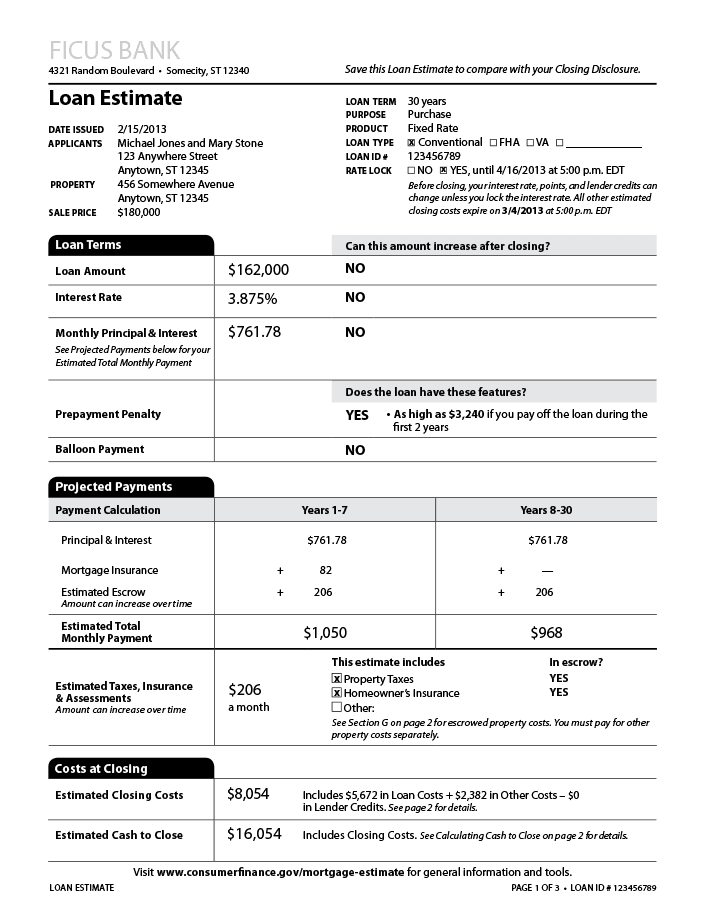

Cash To Close: Breaking It Down - Rocket Mortgage 06.07.2020 · If you get a certain type of government-backed loan (like a VA loan or a USDA loan), you may not need to have a down payment. Credits: If you’ve already put down money for your down payment with your lender or you’ve already paid closing costs, you’ll see a deduction in your cash to close. Remember to keep careful records so you can discuss any discrepancies …

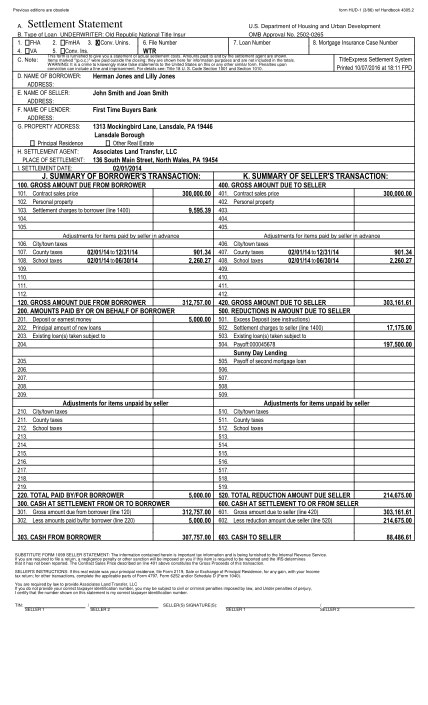

PDF VA Refinance Comparison Disclosure - VDMC.net Lenders must maintain copies of all loan origination records of VA guaranteed home loans for at least 2 years from the date of loan closing. The Borrower(s) should also keep a copy of the certification as part of his/her loan records. Sections I and IV - Refinance Loan Comparison

PDF VA Guaranteed Home Loan Cash-Out Refinance Comparison ... The new loan refinances an interim loan to construct, alter, or repair the primary home The new loan amount is equal to or less than 90 percent of the reasonable value of the home The new loan refinances an adjustable rate mortgage to a fixed rate loan Payment savings on rate/term refinance will recoup the loan costs within 36 months

PDF Va-guaranteed Home Loan Cash-out Refinance Comparison ... VA-GUARANTEED HOME LOAN CASH-OUT REFINANCE COMPARISON CERTIFICATION Borrower(s): Date: Loan Number: Property Address: Lender/Broker: Loan Originator: PROPOSED REFINANCE LOAN Sections I through III should be completed within 3 business days of the loan application. Please note that the information provided in these sections represent an estimate ...

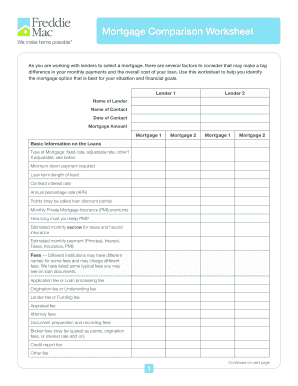

PDF LOAN COMPARISON WORKSHEET - dfi.wa.gov Loan Type (check one) FHA Conventional Rate: % Fixed Loan Purpose (check one) Purchase Refinance APR: % ARM Loan Term: P&I Pymt: Prepayment Penalty Yes No Balloon Payment Yes No Document courtesy of Seattle/King County Coalition for Responsible Lending 1-877-RING DFI LOAN COMPARISON WORKSHEET Borrower's Name: Loan Officer: Lender:

VA IRRRL Cost Recoupment Worksheet VA IRRRL Cost Recoupment Worksheet This worksheet is REQUIRED for all VA Interest Rate Reduction Refinance loans. File Name: Loan Number: MONTHS TO RECOUP The following calculates the total number of months to recoup all fees and charges financed as part of the loan or paid at closing.

Va Irrrl Comparison Worksheet - Fill and Sign Printable ... The tips below will help you fill in Va Irrrl Comparison Worksheet easily and quickly: Open the document in our feature-rich online editor by clicking on Get form. Fill out the necessary boxes which are marked in yellow. Hit the green arrow with the inscription Next to jump from field to field. Use the e-autograph tool to e-sign the document.

PDF LOAN ANALYSIS - Veterans Benefits Administration Your obligation to respond is required in order to determine the veteran's qualifications for the loan. SECTION A - LOAN DATA. OMB Control No. 2900-0523 Respondent Burden: 30 minutes Expiration Date: 08/31/2022 VA FORM AUG 2019. 26-6393. SUPERSEDES VA FORM 26-6393, JUN 2016, WHICH WILL NOT BE USED. 1. NAME OF BORROWER 2. AMOUNT OF LOAN

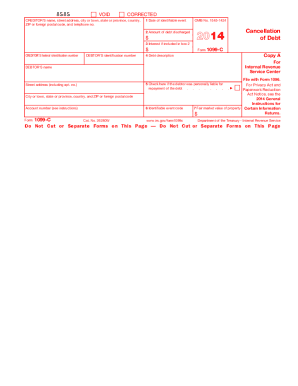

PDF Interest Rate Reduction Refinancing Loan Worksheet va form jun 2009. enter total from line 3. 26-8923. existing stocks of va form 26-8923, sep 2006, will be used. _ 5. total. 7. + + 6. add % origination fee based on line 4 + add % discount based on line 10 + subtotal. 15. = total - maximum loan amount. 16. subtract amount shown on line 7 _ signature and title of officer of lender. 17. $ + *

Va Loan Comparison Worksheet - Fill and Sign Printable ... Find the Va Loan Comparison Worksheet you require. Open it up using the online editor and begin altering. Complete the blank areas; concerned parties names, addresses and numbers etc. Customize the template with unique fillable areas. Add the day/time and place your electronic signature. Simply click Done following double-examining everything.

Editable Wells Fargo Bank Statement Template - Fill Online ... However this worksheet does not replace the RMA form and should not be faxed or mailed to Wells Fargo Home Mortgage. Homeowner Assistance Get help with mortgage payment challenges Count on us to work with you through these difficult times. Here s how to get help 1. Request assistance 2. Understand the process 3.

PDF VA-Guaranteed Home Loan Cash-Out Refinance Comparison ... Exhibit A Circular 26-19-05 February 14, 2019 VA-Guaranteed Home Loan Cash-Out Refinance Comparison Certification PROPOSED REFINANCE LOAN Sections I through III should be completed within 3 business days of the loan application.

Debt-to-Income Ratio Calculator for Mortgage Approval: DTI ... “The Bureau proposes to amend the General QM definition in Regulation Z to replace the DTI limit with a price-based approach. The Bureau is proposing a price-based approach because it preliminarily concludes that a loan’s price, as measured by comparing a loan’s annual percentage rate to the average prime offer rate for a comparable transaction, is a strong …

VA IRRRL Net Tangible Benefit Worksheet VA IRRRL Net Tangible Benefit Worksheet Revised 06.25.2019 All other VA requirements for guaranteeing an IRRRL are met, including the requirements related to exemption of income verification are satisfied. All VA loans are considered QM, but not all IRRRL loans have safe harbor.

PDF Interest Rate Reduction Refinancing Loan Worksheet va form dec 2021. enter total from line 3. 26-8923. supersedes va form 26-8923, jul 2021, which will not be used. - 5. total. 7. + + 6. add % origination fee based on line 4 + add % discount based on line 10 + subtotal. 15. = total - maximum loan amount. 16. - subtract amount shown on line 7. signature and title of officer of lender (sign ...

PDF Short Form - VA Refinance Loan Comparison and Net Tangible ... VA Refinance Loan Comparison and Net Tangible Benefit Information The US Department of Veterans Affairs (VA) published a Final Rule addressing VA guaranty requirements for cash-out refinancing loans with applications taken on 2/15/2019 and after. The Rule introduces 2 types of cash-out loans, a Net Tangible Benefit (NTB) disclosure requirement, and

VA IRRRL Comparison Worksheet - YouTube VA IRRRL Worksheet - VA IRRRL Comparison Worksheethttps:// this video, Jeff gives a great example of the VA IRRRL Compa...

› education › homebuyingVA Loan Closing Costs - Complete List of Fees to Expect Like every mortgage, the VA loan comes with closing costs and fees. VA loan closing costs average anywhere from 3 to 5 percent of the loan amount, but can vary significantly depending on where you're buying, the lender you're working with, seller concessions and more.

docs.google.com › spreadsheetsGoogle Sheets: Sign-in Access Google Sheets with a free Google account (for personal use) or Google Workspace account (for business use).

PDF VA LOAN SUMMARY SHEET - DUdiligence.com va loan summary sheet 1. va's 12-digit loan number 2. veteran's name (first, middle, last) 3. veteran's social security number 4. gender of veteran (check one) male female 5. veteran's date of birth (mm/dd/yyyy) native hawaiian or pacific islander 6b. race (may select more than one) not hispanic or latino american indian or alaskan native black ...

PDF VA IRRRL Loan Comparison Worksheet - Newfi Wholesale Title: Microsoft Word - VA Loan Comparison Worksheet - Newfi 2020-06-10.docx Created Date: 20200610220730Z

VA Loan Comparison Worksheet - YouTube About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new features Press Copyright Contact us Creators ...

Bankrate: Guiding you through life's financial journey Use Bankrate.com's free tools, expert analysis, and award-winning content to make smarter financial decisions. Explore personal finance topics including credit cards, investments, identity ...

› warms › docsC&P Service Clinician's Guide - Veterans Affairs VA Forms 10-2364 or 10-2364a may be used to report the majority of audiometric tests conducted within the VA. VBA Worksheet 1305 (AUDIO), or its electronic equivalent, is used to record audiometric thresholds and rating narratives.

Download Microsoft Excel Mortgage Calculator Spreadsheet ... By default this calculator is selected for monthly payments and a 30-year loan term. A person could use the same spreadsheet to calculate weekly, biweekly or monthly payments on a shorter duration personal or auto loan. Some of Our Software Innovation Awards! Since its founding in 2007, our website has been recognized by 10,000's of other websites.

0 Response to "39 va loan comparison worksheet"

Post a Comment