39 Realtor Tax Deduction Worksheet

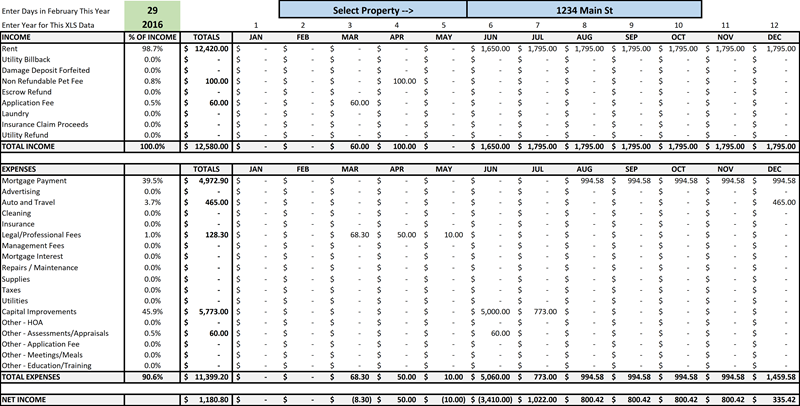

DOC Income Tax Deduction Checklist --- REALTORS Income Tax Deduction Checklist --- REALTORS Author: Joseph J. Gawalis Jr., MBA, CPA-NJ Last modified by: Joseph J. Gawalis Jr., MBA, CPA-NJ Created Date: 6/25/2004 2:27:00 PM Company: Accountancy Consultants of New Jersey, LLC Other titles: Income Tax Deduction Checklist --- REALTORS Tax Deduction Check List Download our 12 month expense worksheet Excel Worksheet. Tradesmen (Plumbers, Carpenters, etc.) Download our expense checklist PDF Download our expense checklist Excel Worksheet Download our 12 month expense worksheet Excel Worksheet. Other Tax Checklists. Rental Real Estate Deductions (Word Document)

16 Real Estate Tax Deductions for 2022 | 2022 Checklist Hurdlr This deduction is taken on Schedule A, Lines 5-6. Note that the 'Taxes and Licenses' deduction on Schedule C, Line 23, applies to sales tax on business income, real estate and property taxes on business assets, and taxes you pay on behalf of your employees. For Example. Philip is a successful real estate agent based in San Diego, California.

Realtor tax deduction worksheet

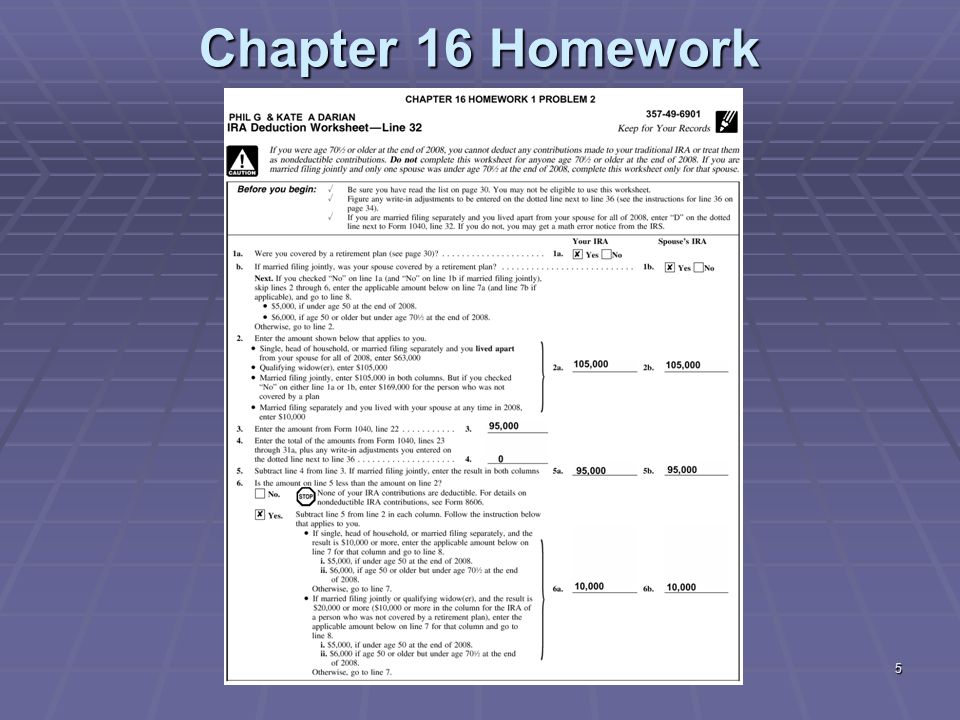

MIT - Massachusetts Institute of Technology a aa aaa aaaa aaacn aaah aaai aaas aab aabb aac aacc aace aachen aacom aacs aacsb aad aadvantage aae aaf aafp aag aah aai aaj aal aalborg aalib aaliyah aall aalto aam ... PDF Tax Worksheet for Self-employed, Independent contractors ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate. Types of Retirement Plans: Differences and Overview - The Balance Nov 29, 2021 · Contributions are made with pre-tax paycheck withdrawals, and the money grows tax-deferred until retirement. Early distributions can result in a hefty penalty, however. Unless you qualify for an exception, you’ll have to pay an additional 10% tax on the amount you withdraw from your SIMPLE IRA (similar to Traditional IRAs and 401(k) plans).

Realtor tax deduction worksheet. Haller Group AZ Tax Deduction Worksheet For Realtors ... Find the Haller Group AZ Tax Deduction Worksheet For Realtors you need. Open it up with cloud-based editor and begin editing. Fill the blank areas; concerned parties names, addresses and phone numbers etc. Customize the template with smart fillable areas. Add the day/time and place your electronic signature. PDF Deductions & Credits Worksheet - Donuts Use this worksheet to identify available deductions and tax credits and the information to send us. Please refer to the Help section (appendix) of this document for additional information and instructions. ... provide us a copy of your real estate tax bill showing payment(s). Tip: Real Estate Agent Tax Deduction Wordsheet - Google Sheets Sheet1 Sales,Professional Advertising,seminars Appraisal Fees,Continuing Ed Business Cards,Resumes Bank Charges,Teleophone Clerical,Cell Phone Client Gifts,Cell Plan Courier Services,Equipment Commission Fees,Office Supplies Escrow Fees,Computer Referral Fees,Tablet Flim Production,Vehicle Flowers 5.12.10 Lien Related Certificates - IRS tax forms May 12, 2010 · Letter 4053, Conditional Commitment to Subordinate Federal Tax Lien, and Form 669-D, Certificate of Subordination of Property from Federal Tax Lien. 6325(d)(3) It is determined that the United States will be adequately secured after subordination of a lien imposed by IRC § 6324B. Form 669-F, Certificate of Subordination of Federal Estate Tax Lien

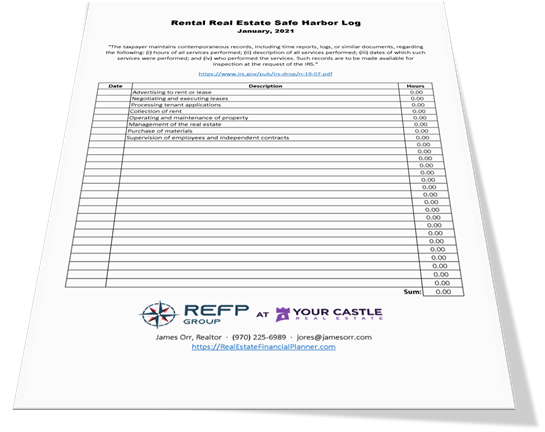

Realtor Tax Deductions Worksheet - Studying Worksheets Real Estate Agent Tax Deductions Worksheet 2021 - SignNow Houses 9 days ago Operation of your real estate business. In the Business section of Part 3 of the Realtors Deduction Worksheet enter your Realtor tax credits on the line beginning with Realtor and the amount of the. OTHER Applying For Tax Ein Obtaining an. PDF 19 2021 Itemized Deduction (Sch A) Worksheet National Tax Training Committee September 13, 2021 19 - 2021 Itemized Deduction (Sch A) Worksheet (type-in fillable) I donated a vehicle worth more than $500 I made more than $5,000 of noncash donations I paid interest on borrowings for investments I repaid income (taxed in prior year) over $3,000 Tax Deduction Worksheet For Realtors - Fill Out and Sign ... Follow the step-by-step instructions below to eSign your real estate agent tax deductions worksheet pdf: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done. Real Estate Agent Tax Deductions Worksheet 2021 - SignNow How you can fill out the Realtor tax deductions worksheet form on the web: To start the blank, utilize the Fill & Sign Online button or tick the preview image of the blank. The advanced tools of the editor will guide you through the editable PDF template. Enter your official identification and contact details.

PDF Realtors Tax Deduction Worksheet - formspal.com Realtors Tax Deduction Worksheet Due to the overwhelming response to last month's Realtor "tax tip" article, Daszkal Bolton LLP has created this Realtors' Tax Deduction Worksheet to assist our clients in becoming more organized for taking advantage of tax deductible business expenses. Home Office Deduction Worksheet (Excel) - Keeper Tax The home office deduction gives you a tax write-off for such items as mortgage interest, rent, utilities, real estate taxes, maintenance, repairs, and other related expenses. While the home office deduction offers a significant benefit for those who are eligible, it can be difficult to track all of your expenses, especially when you are also ... PDF Itemized Deductions Worksheet - | Integrity in Tax ... Itemized Deductions Worksheet You will need: Tax information documents (Receipts, Statements, Invoices, Vouchers) for your own records. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your Federal and/or State return. Real Estate Agent Tax Deductions Worksheet Excel - Excel ... Real Estate Agent Tax Deductions Worksheet Excel - In mathematics, trainees are encouraged to establish logical reasoning and also important reasoning, as well as creativity, mystical along with rate higher, problem solving, and even communication abilities.Portions are used to split numbers on this worksheet. Psychological as well as reasoning capacities can be enhanced by studying these ...

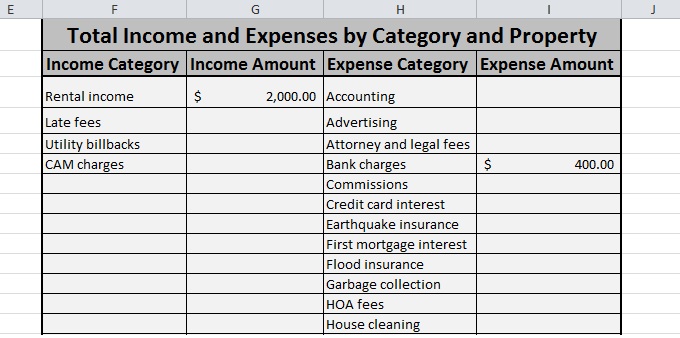

Real Estate Tax Deduction ≡ Fill Out Printable PDF Forms ... Real Estate Agent Expense Spreadsheet Details The real estate tax deduction form can be a valuable tool when filing your taxes. This form allows you to deduct the amount of property taxes that you have paid during the year. It is important to note that there are certain requirements that must be met in order to qualify for this deduction.

W-4 Form Basics: Changes, How to Fill One Out - Business 23-12-2021 · If you're filling out a W-4 for the first time in a while, you might notice some changes in the form that tells your employer how much tax to …

HUD | HUD.gov / U.S. Department of Housing and Urban ... 3.Tax Service Fee: A fee paid to a Tax Service agency to. assure payment of taxes to the proper jurisdiction. 4.Buyer's closing costs, even if seller pays the costs: a.If the seller pays for an item that is in. the buyer's column on the HUD-1, Settlement Statement (Example: recording of deeds, property survey or pest control

5 Tax Deductions When Selling a Home: Did ... - Realtor.com This deduction is capped at $10,000, Zimmelman says. So if you were dutifully paying your property taxes up to the point when you sold your home, you can deduct the amount you paid in property ...

Cyataxes Realtors Tax Deductions Worksheet - Fill and Sign ... Get the Cyataxes Realtors Tax Deductions Worksheet you need. Open it using the cloud-based editor and begin adjusting. Fill in the empty areas; concerned parties names, places of residence and phone numbers etc. Customize the template with smart fillable fields. Include the particular date and place your electronic signature.

Nj Property Tax Deduction Worksheet - Real Estate ... Discover Nj Property Tax Deduction Worksheet for getting more useful information about real estate, apartment, mortgages near you.

Financial Math Flashcards - Quizlet Sales tax is a tax like any other, so you can claim additional dependents and get a deduction on it. b. Businesses are allowed to charge a 1% fee for automatically calculating sales tax for you, so you should calculate the sales tax out yourself. c.

PDF REALTOR DEDUCTIONS - cpapros.com REALTOR DEDUCTIONS Client: ID # TAX YEAR SALES The Purpose of this worksheet is to help you organize Advertising your tax deductible business expenses. In order for an Appraisal Fees expense to be deductible, it must be considered an Business Cards "ordinary and necessary" expense. You may include Bank Charges other applicable expenses.

FREE Home Office Deduction Worksheet (Excel) For Taxes If you pay $100 in real estate taxes and use 10% of your home for business purposes then your home office deduction in relation to your real estate taxes is $10 (10% of $100). On the IRS form this section focuses on four expense categories: casualty losses, deductible mortgage interest, and real estate taxes.

How to claim your senior property tax exemption Apr 15, 2020 · Take advantage of tax breaks as a senior . Benjamin Franklin once said that one of life’s few certainties is taxes. When it comes to property taxes, retirees often find themselves in a unique ...

Realtor Tax Deductions And Tips You Must Know Realtor Tax Deductions Worksheet. Want our Realtor tax deduction worksheet? Check it out right here: Little-Known Realtor Tax Deductions . One of the key strategies in getting better tax returns is starting New Years Day. Your tax strategy starts from day #1. Keep is simple and keep every single receipt for transactions starting today!

Home Office Deduction Worksheet - Studying Worksheets There are two versions of this worksheet. This worksheet will help you track direct and indirect expenses for the home office deduction. Real estate taxes reported on line 7. Home Office Deduction Calculator 2021. Home Portion 25. Home Office Deduction Worksheet To deduct expenses for the business use of your home.

115 Popular Tax Deductions For Real Estate Agents For 2022 Automobile And Transportation. The best car for real estate agents will depend on your needs. This includes taxes. Automobiles can be a tricky tax deduction for real estate agents. Leave it to me; I've purchased over 15 cars in the last 11 years, so I'd know what a mess they make on deductions, especially when you change them out as frequently as I tend to do.

PDF Realtors Tax Deductions Worksheet - BOBBY'S BUSINESS SERVICES Realtors Tax Deductions Worksheet AUTO TRAVEL Your auto expense is based on the number of qualified business miles you drive. Expenses for travel between business locations or daily transportation expenses between your residence and temporary work locations are deductible; include them as business miles. Expenses for your trips between home and

PDF Realtor/Real Estate Agent - Tax Deduction Cheat Sheet REALTOR/REAL ESTATE AGENT - TAX DEDUCTION CHEAT SHEET Advertising Billboards Brochures/Flyers Business Cards Copy Editor Fees Direct Mail Email Marketing & Newsletters Graphic Designer Fees Internet Ads (Google, Facebook, etc) Leads/Mailing Lists ...

bern.zarowska-mazur.pl Feb 13, 2022 · You can apply for benefits by calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or by visiting your local Social Security office. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021.

Real Estate Agent Tax Deductions Worksheet Real Estate Agent Tax Deductions Worksheet 8/26 [MOBI] physician, The White Coat Investor is a high-yield manual that specifically deals with the financial issues facing medical students, residents, physicians, dentists, and similar high-income professionals. Doctors are highly-educated and extensively trained at making

What is this tax and interest deduction worksheet The tax and interest deduction worksheet shows the itemized deductions claimed for state and local taxes, including real estate taxes, and mortgage interest. You would only itemize if your total deductions were greater than the standard deduction for your filing status. However, these deductions can still be listed on your return.

bjc.edc.org data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAAKAAAAB4CAYAAAB1ovlvAAACs0lEQVR4Xu3XMWoqUQCG0RtN7wJck7VgEW1cR3aUTbgb7UUFmYfpUiTFK/xAzlQWAz/z3cMMvk3TNA2XAlGBNwCj8ma ...

Real Estate Professional Expense Worksheet 1711 Woodlawn Ave., Wilmington, DE 19806 (302-322-0452) - - - - 118 Astro Shopping Center, Newark DE 19711 - - - -

Types of Retirement Plans: Differences and Overview - The Balance Nov 29, 2021 · Contributions are made with pre-tax paycheck withdrawals, and the money grows tax-deferred until retirement. Early distributions can result in a hefty penalty, however. Unless you qualify for an exception, you’ll have to pay an additional 10% tax on the amount you withdraw from your SIMPLE IRA (similar to Traditional IRAs and 401(k) plans).

PDF Tax Worksheet for Self-employed, Independent contractors ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate.

MIT - Massachusetts Institute of Technology a aa aaa aaaa aaacn aaah aaai aaas aab aabb aac aacc aace aachen aacom aacs aacsb aad aadvantage aae aaf aafp aag aah aai aaj aal aalborg aalib aaliyah aall aalto aam ...

![1099 Excel Template [Free Download]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/5f63b7164b3b9866f01727c2_IRS-form-schedule-C.png)

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

![1099 Excel Template [Free Download]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/5f63b30151dff905f0198f6a_1099-template-excel.png)

0 Response to "39 Realtor Tax Deduction Worksheet"

Post a Comment