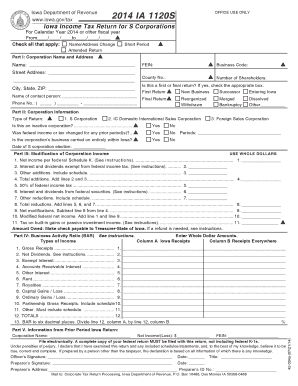

42 1120s other deductions worksheet

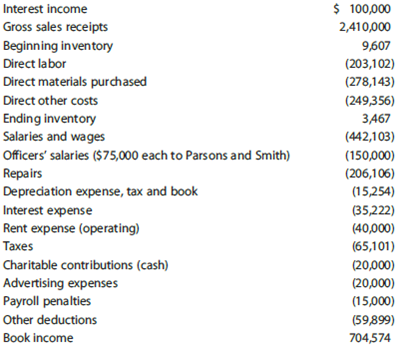

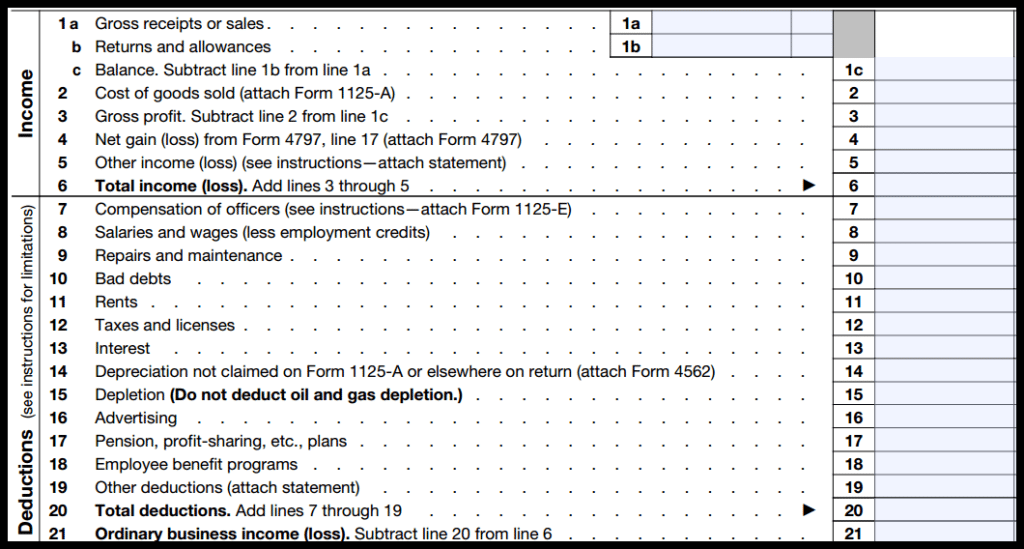

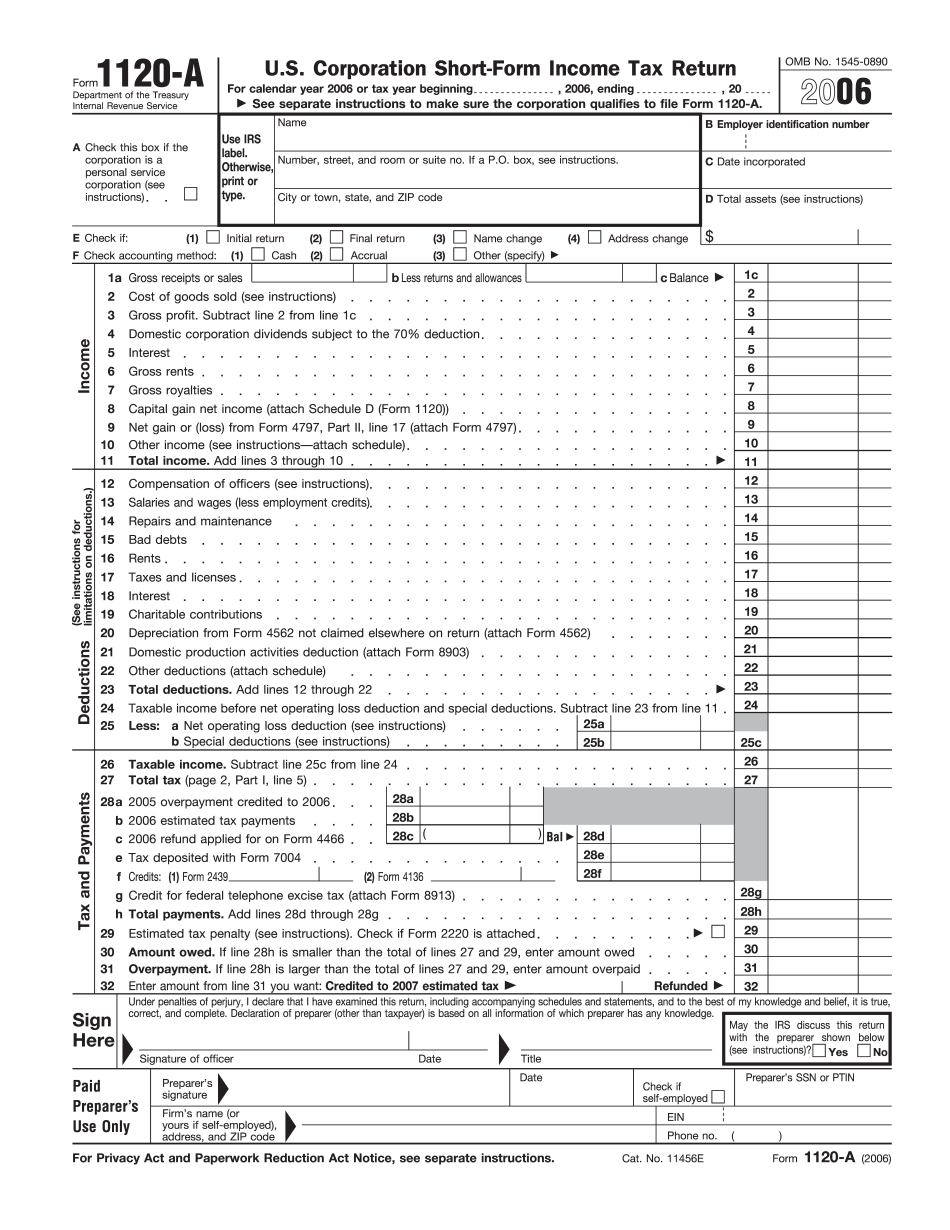

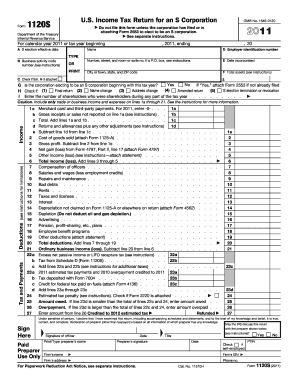

2020 Us 1120s Line 19 Other Deductions - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are 2020 instructions for form 1120 s, Forms required attachments, Fannie mae cash flow analysis calculator, Partners adjusted basis work outside basis tax, Fnma self employed income, Calculating income from 1040 k1 1120s s corporation, Tax work for self ... Other deductions (attach statement) Total deductions. Add lines 7 through 19 Ordinary business income (loss). Subtract line 20 from line 6 Excess net passive income or LIFO recapture tax (see instructions) Tax from Schedule D (Form 1120S) Add lines 22a and 22b (see instructions for additional taxes)

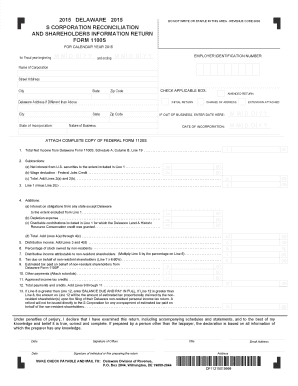

US 1120S Line 19 - Other Deductions 2015 Type: Created Date: 5/3/2016 10:10:40 AM ...

1120s other deductions worksheet

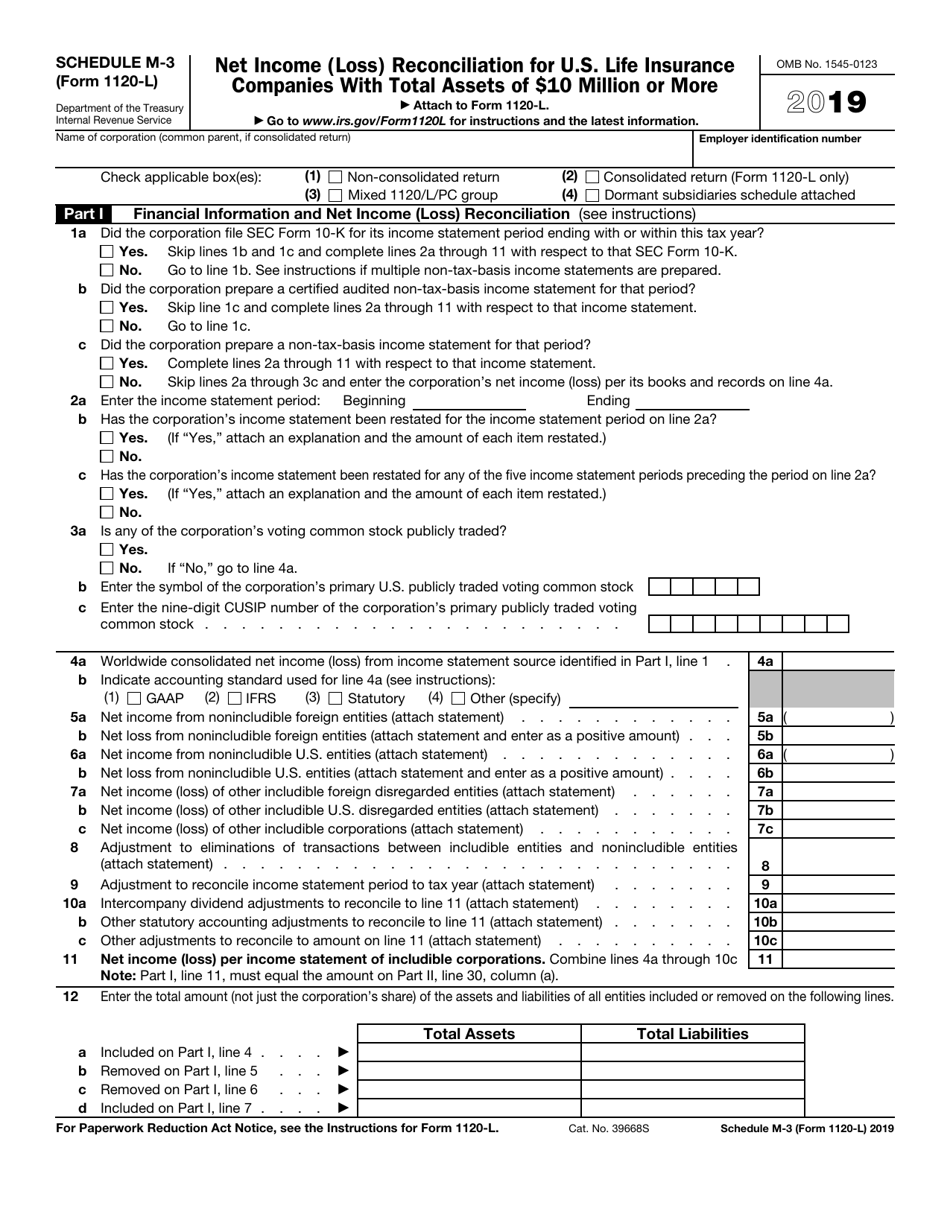

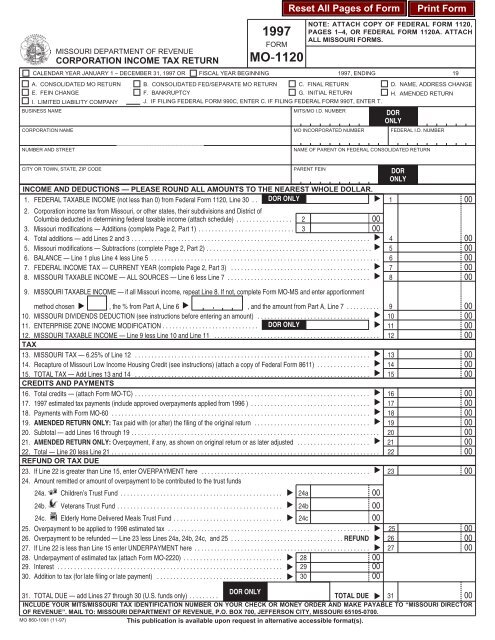

1120s Other Deductions - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are 2020 instructions for form 1120 s, Forms required attachments, Us 1120s line 19, Arthur dimarsky 32 eric ln staten island ny 10308 646 637, Corporation tax organizer form 1120, Self employment income work s corporation schedule, Instructions and work to schedule k 1, 2018 ... Use Form 1120-S to report the income, gains, losses, deductions, credits, and other information of a domestic corporation or other entity for any tax year covered by an election to be an S corporation. How To Make the Election. For details about the election, see Form 2553, Election by a Small Business Corporation, and the Instructions for Form 2553. Schedule M-3 is attached as a supporting statement to Form 1120S. 2. USE OF DATA. Form 1120S data is used by the IRS to determine if income and other related tax items have been properly figured and reported. A corporation tax on certain net passive income is figured by the S corporation on an attachment for line 22a of Form 1120S.

1120s other deductions worksheet. Creating a basic return for a Subchapter S Corporation is done in the Business Program of the TaxSlayer Pro by following the steps below. To assist your preparation of an 1120-S return review the Instructions for Form 1120-S, US Income Tax Return for an S Corporation. This publication contains line by line instructions detailing the transactions that need to be entered on each line of the 1120 ... Form 1120 Line 26 Other Deductions Worksheet - Also a well-read adult can become bewildered by the peculiar set of etymological policies that govern the English language.To stay clear of a similar destiny for your youngster, it's important that you immerse them in the language from a very early age. Form 1120S Department of the Treasury Internal Revenue Service U.S. Income Tax Return for an S Corporation Do not file this form unless the corporation has filed or is Go to the Income/Deductions > Business worksheet. In Section 7 - Other Depreciation and Amortization. Select Export.; A dialog box will appear. Choose option to "Export this grid to a Spreadsheet with all Data Entered."; A dialog box will appear to Save As. The name of the return and "Depreciation and Amortization (Form 4562)" will appear as the file name.

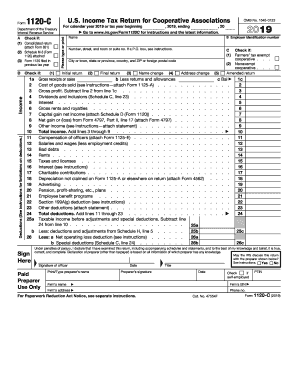

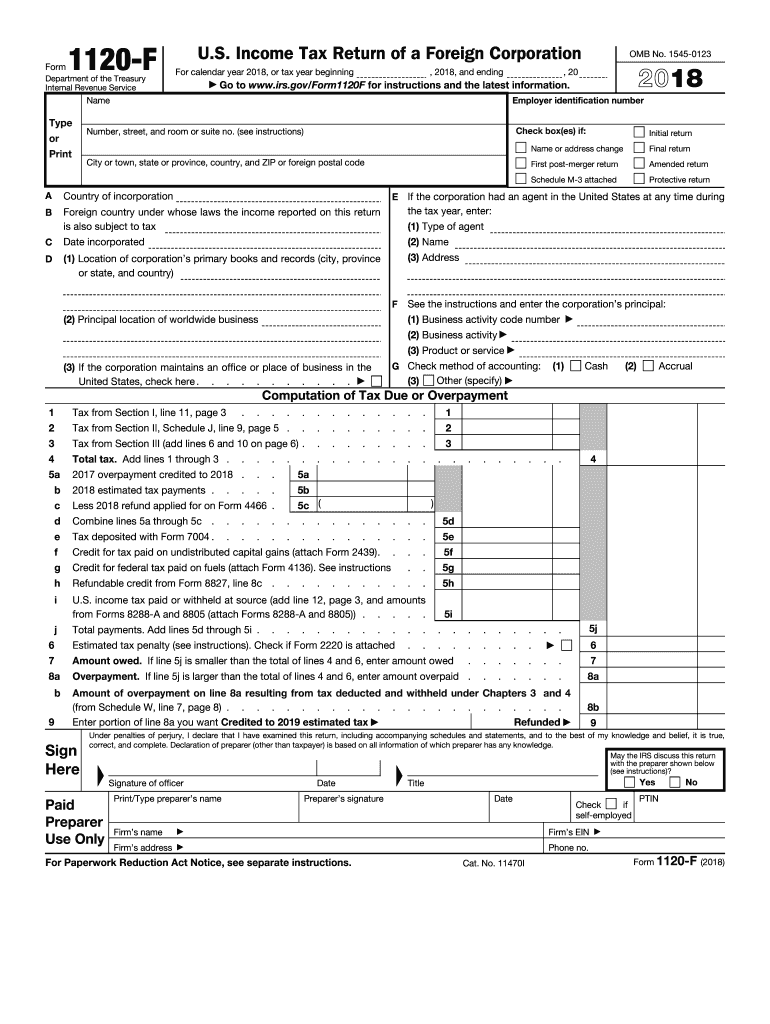

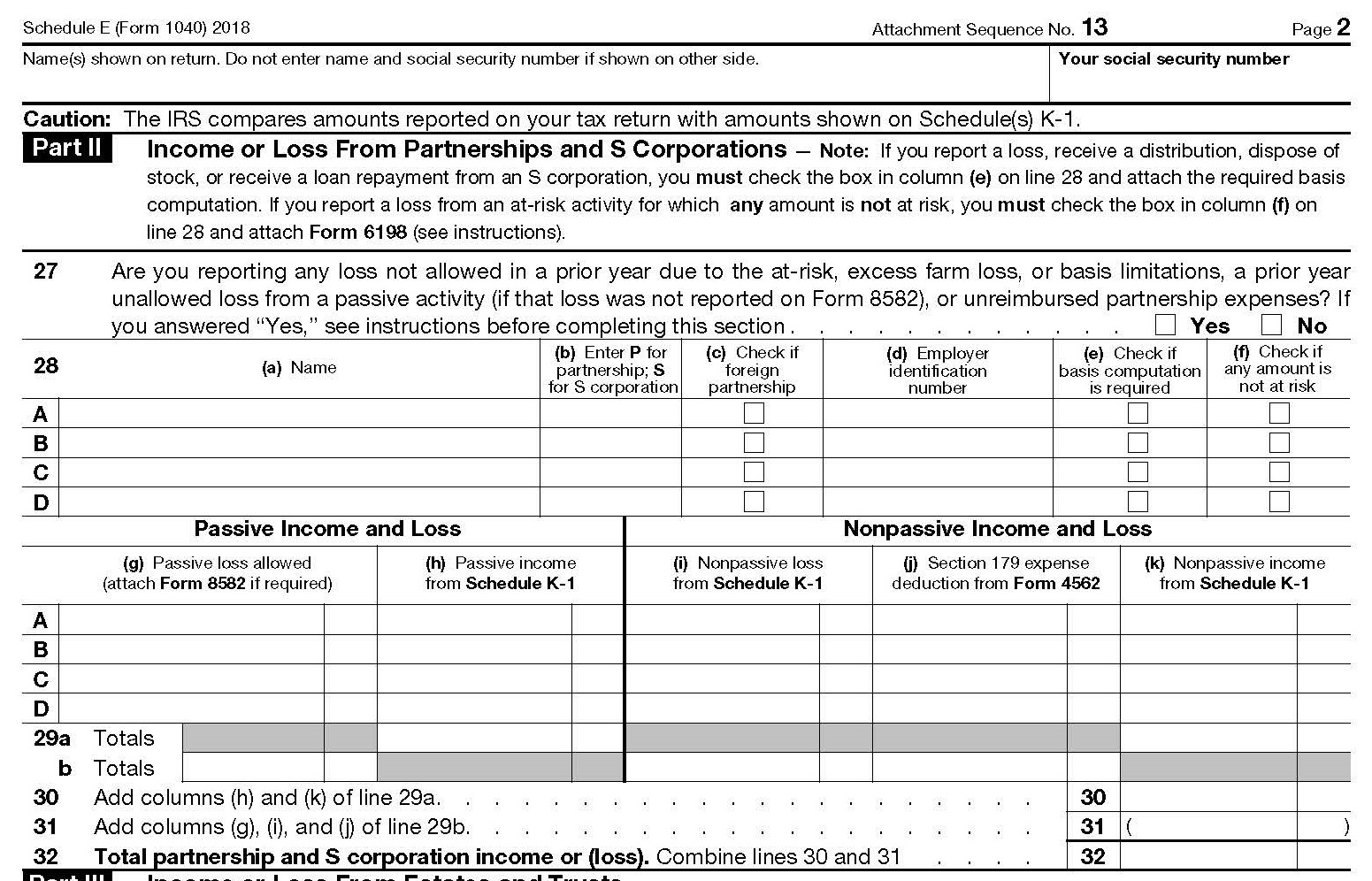

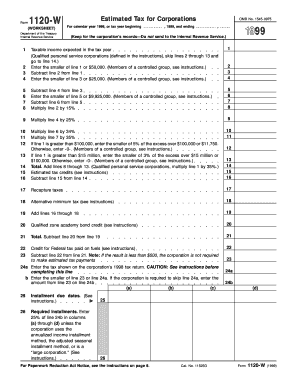

Form 1120-C: U.S. Income Tax Return for Cooperative Associations 2021 12/21/2021 Form 1120-F: U.S. Income Tax Return of a Foreign Corporation 2021 12/03/2021 Form 1120-F (Schedule H) Deductions Allocated To Effectively Connected Income Under Regulations Section 1.861-8 2021 Other Deductions Line 19 1120s - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are 2019 shareholders instructions for schedule k 1 form 1120 s, Income tax return for an s corporation omb 1545, Us 1120s line 19, 2018 form 1120 w work, Fannie mae cash flow analysis calculator, Form 91 income calculations calculator, Partners adjusted basis work ... Displaying top 8 worksheets found for - 1120 Line 26 Other Deductions. Some of the worksheets for this concept are 2019 form 1120, 2020 form 1120 w work, Schedule o 720 17030300 other additions and, Fannie mae cash flow analysis calculator, 2018 ia 1120f general instructions who must file federal, 2018 nonconformity adjustments work, Schedule analysis method sam calculator, Qualified business ... If the income, deductions, credits, or other information provided to any shareholder on Schedule K-1 is incorrect, file an amended Schedule K-1 (Form 1120-S) for that shareholder with the amended Form 1120-S. Also give a copy of the amended Schedule K-1 to that shareholder.

Capital Gains and Losses and Built-in Gains. 2020. 12/22/2020. Inst 1120-S (Schedule D) Instructions for Schedule D (Form 1120S), Capital Gains and Losses and Built-In Gains. 2020. 01/12/2021. Form 1120-S (Schedule K-1) Shareholder's Share of Income, Deductions, Credits, etc. Sep 11, 2016 · 1120s other deductions worksheet. 2018 1120s other deductions. Displaying all worksheets related to 1120s other deductions. Some of the worksheets for this concept are 2018 form 1120s us 1120s line 19 6717 form 1120s 2018 part i shareholders share of instructions for form 1120s s corporate 1120s instructions and work to schedule k 1 schedule k 1 form n 35 rev 2017 shareholders share of schedule a itemized deductions. Line 26. Other Deductions. Attach a statement, listing by type and amount, all allowable deductions that are not deductible elsewhere on Form 1120. Enter the total on line 26. Examples of other deductions include the following. See Pub. 535 for details on other deductions that may apply to corporations. This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The ... Other income reported on Schedule F represents income received by ... as reported in Schedule L of Form 1120S, end of year column. This deduction is not ...

The K-1 Edit Screen has two distinct sections entitled 'Heading Information' and 'Income, Deductions, Credits, and Other Items.' The K-1 1120-S Edit Screen has a line for each box on found on the Schedule K-1 (Form 1120-S) that the taxpayer received. A description of the items contained in boxes 11 and 12, including each of the Codes ...

Instructions for Schedule H (Form 1120-F), Deductions Allocated To Effectively Connected Income Under Regulations Section 1.861-8 2021 12/20/2021 Form 1120-F (Schedule I) Interest Expense Allocation Under Regulations Section 1.882-5 2021 12/16/2021 Inst 1120-F (Schedule I) ...

Now repeat the process for any other shareholders (luckily since we're 50/50, this is very easy to do for us) and compile your return. It should look like this: Form 1120S pages 1-5; Form 1125-A; Form 1125-E; Statement of Explanation for 2019 Form 1120S Line 19 Other Deductions; Statement of Explanation for 2019 Form 1120S Schedule L Line 14 ...

Schedule K-1 (Form 1120-S) - Health Deduction Worksheet. Health Insurance Premiums for a more than 2% shareholder of a S-Corporation are reported in Box 14 of the individual's Form W-2 Wage and Tax Statement. To get the amount reported in Box 14 to transfer to Line 16 of the individual's Schedule 1 (Form 1040) Additional Income and Adjustments ...

form 1120 line 26 other deductions worksheet. Reap the benefits of a electronic solution to generate, edit and sign documents in PDF or Word format on the web. Turn them into templates for multiple use, include fillable fields to collect recipients? data, put and request legally-binding electronic signatures. Do the job from any gadget and share docs by email or fax.

2019 Other Deductions Supporting Details For Form 1120 - Displaying top 8 worksheets found for this concept. Some of the worksheets for this concept are Income tax return for an s corporation omb 1545, 2019 instructions for form 1120 s, 1120 s income tax return for an s corporation, Form it 2012019resident income tax returnit201it201, 1120s ...

1120s Other Deductions 2020 - Displaying top 8 worksheets found for this concept. Some of the worksheets for this concept are 2020 instructions for form 1120 s, Corporation tax organizer form 1120, 2020 ia 1120s income tax return for s corporations, 20 purpose of schedule k 1 general instructions, Engagement letter for 2020 s, Schedule a itemized deductions, Fannie mae cash flow analysis calculator, Tax work for self employed independent contractors.

Attachment 5, Form 1120S, Schedule L Balance Sheets per Books, Line 14 (b): Other assets at beginning of tax year (ItemizedOtherAssetsSchedule) Description Beginning Amount Spec House 913 . Attachment 6, Form 1120S, Schedule L Balance Sheets per Books, Line 18 (b) & (d): Other current Liabilities

Displaying top 8 worksheets found for - Other Deductions Supporting Details For Form 1120. Some of the worksheets for this concept are Us 1120s line 19, Corporate 1120, 1120s income tax return for an s corporation omb no, 2019 form 1120 w work, Instructions for filing 2010 federal form 1065 sample return, Instructions for form 1120s, 6717 form 1120s 2018 part i shareholders share of ...

Other information may be required depending on the type of corporation and the number of employees at the company during the tax year. Form 1120-S and S corporations S Corporations are a form of corporate structure that allows a business to pass its income, losses, deductions, and credits through to shareholders for federal tax purposes.

Personal holding company tax (attach Schedule PH (Form 1120)) Other taxes. Check if from: Form 4255 Form 8611 Form 8697 Form 8866 Form 8902 Other (attach schedule) Add lines 7 through 9. Enter here and on page 1, line 31 (see instructions) Check accounting method: Cash Accrual Other (specify) See the instructions and enter the: Business ...

Schedule M-3 is attached as a supporting statement to Form 1120S. 2. USE OF DATA. Form 1120S data is used by the IRS to determine if income and other related tax items have been properly figured and reported. A corporation tax on certain net passive income is figured by the S corporation on an attachment for line 22a of Form 1120S.

Use Form 1120-S to report the income, gains, losses, deductions, credits, and other information of a domestic corporation or other entity for any tax year covered by an election to be an S corporation. How To Make the Election. For details about the election, see Form 2553, Election by a Small Business Corporation, and the Instructions for Form 2553.

1120s Other Deductions - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are 2020 instructions for form 1120 s, Forms required attachments, Us 1120s line 19, Arthur dimarsky 32 eric ln staten island ny 10308 646 637, Corporation tax organizer form 1120, Self employment income work s corporation schedule, Instructions and work to schedule k 1, 2018 ...

0 Response to "42 1120s other deductions worksheet"

Post a Comment