41 nc 4 allowance worksheet

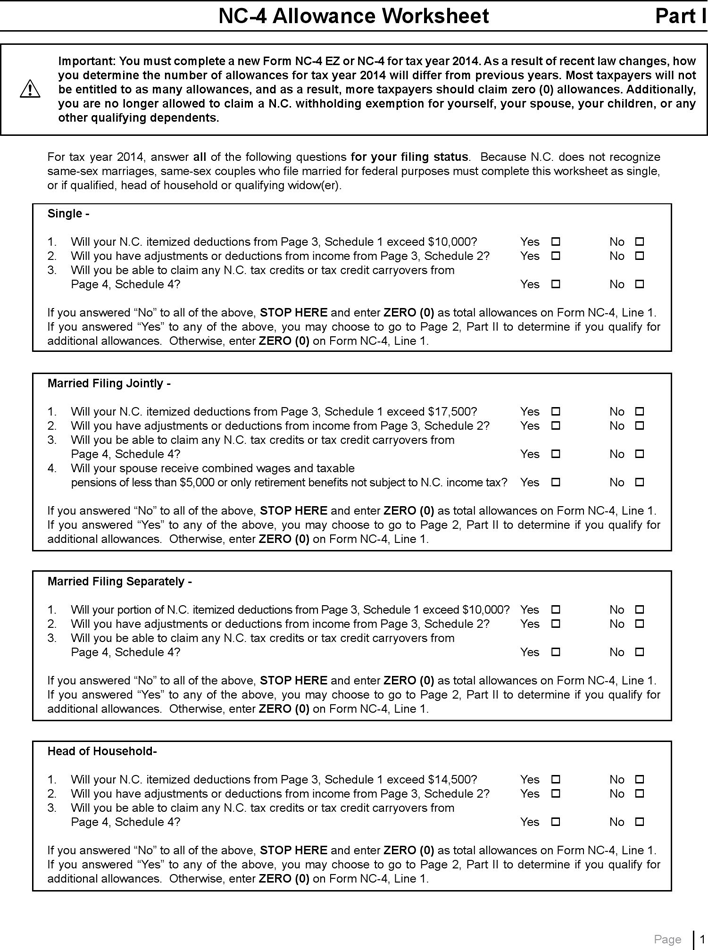

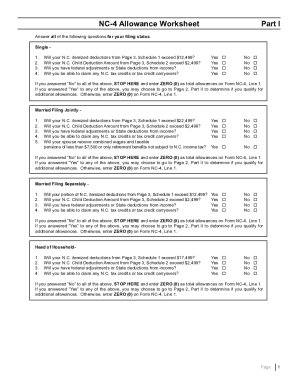

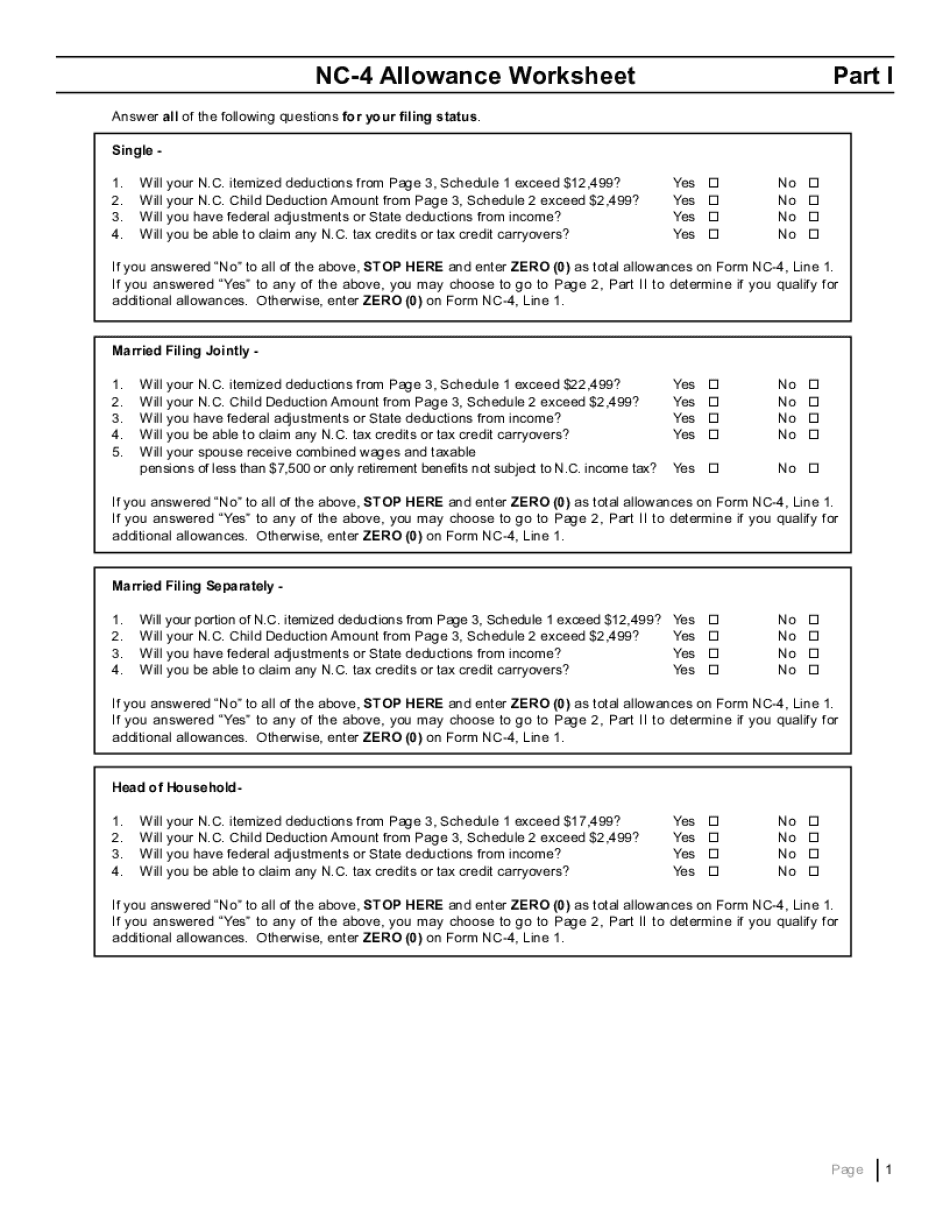

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4). Additional withholding allowances may be claimed if you expect to have allowable itemized deductions exceeding the standard deduction. Itemized deductions and NC. Nc 4 Allowance Worksheet Nidecmege Itemized deductions and NC. Nc 4 allowance worksheet. NC-4 Allowance Worksheet Part II. Tax credits or tax credit carryovers from Page 4 Schedule 3.

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

Nc 4 allowance worksheet

09.01.2022 · The following colleges, universities, and scholarship programs use CSS Profile and/or IDOC as part of their financial aid process for some or all of their financial aid applicants in the populations listed below. allowances you are entitled to claim. However, you may claim fewer allowances if you wish to increase the tax withheld during the year. If your withholding allowances decrease, you must file a new NC-4 with your employer within 10 days after the change occurs except that a new NC-4 is not required until the next year in the followng cases: 1. State: Travel: SPO-030B: Worksheet B Computation of Per Diem and Meal Allowance: 08/30/2017: State: Travel: SPO-030A: Worksheet A Airfare: 05/17/2018: State: Travel: SPO-030: Travel Approval Form: 08/09/2018: State: Travel: SPO-034: Certificate of Disposal: 11/28/2014: State: Inventory Management and Excess Property: SPO-026: Transfer of They each have …

Nc 4 allowance worksheet. Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 Line 1 of NC-4 You are no longer allowed to claim a N.C. withholding allowance for yourself, your spouse, your children, or any other dependents. Academia.edu is a platform for academics to share research papers. » Employee's Withholding Allowance Certificate NC-4 Employee's Withholding Allowance Certificate NC-4. Form NC-4 Employee's Withholding Allowance Certificate. Files. NC-4_Final.pdf. PDF • 488.48 KB - December 17, 2021 Taxes & Forms. Individual Income Tax; Sales and Use Tax; Withholding Tax ... Academia.edu is a platform for academics to share research papers.

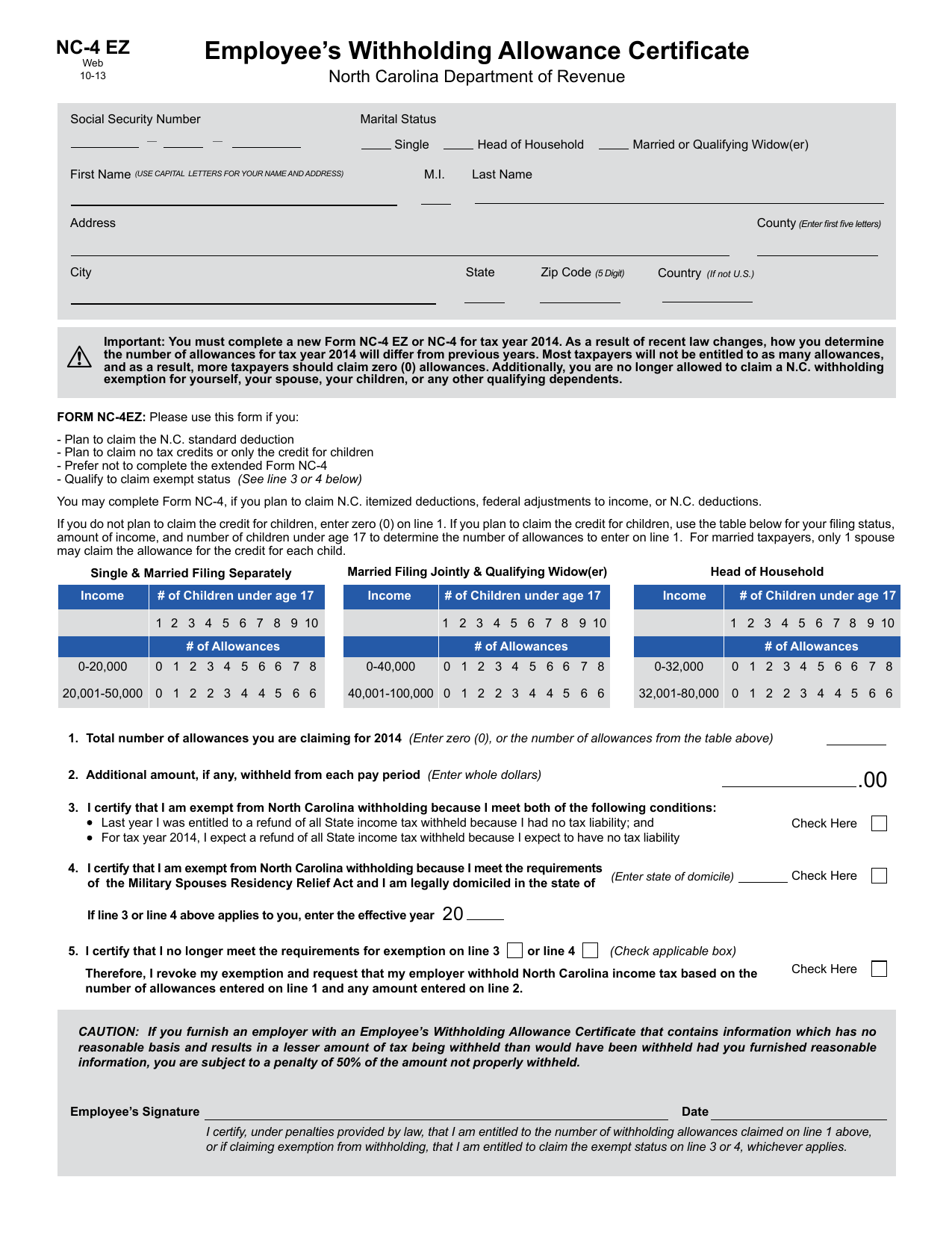

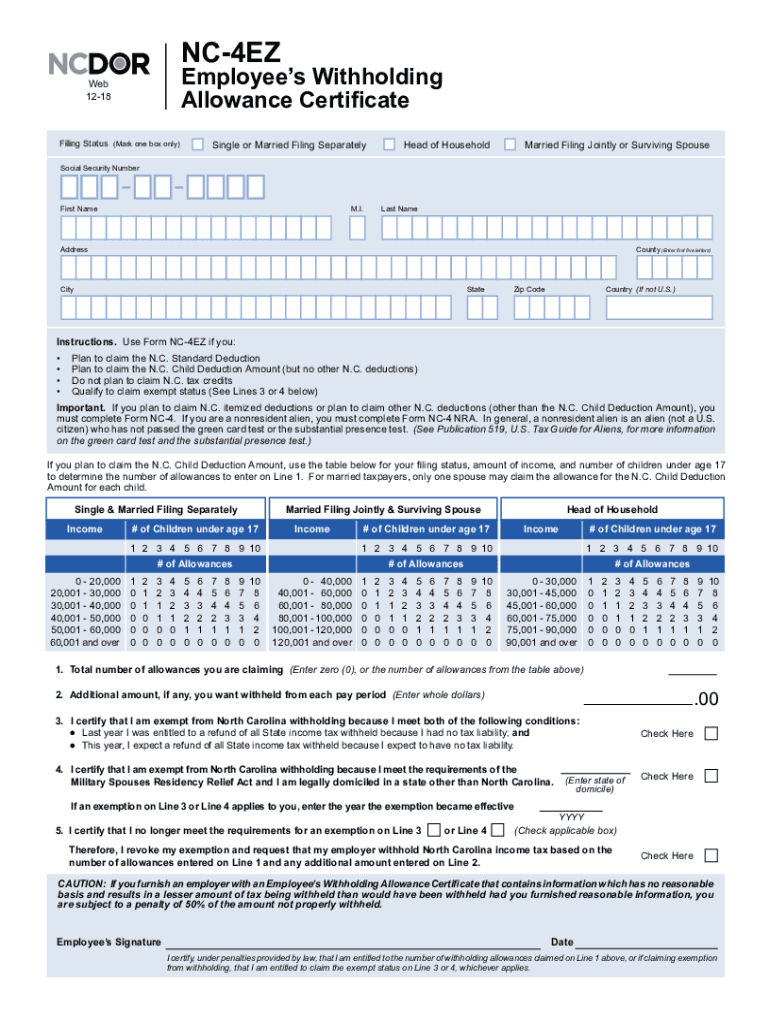

NC-4 Allowance Certificate 1. Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 17 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars) .00 Social Security Number Filing Status Items needed to fill out NC-4 EZ Form NC-4 EZ Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 Withholding allowance: There is no longer a mention of the "Amount for one withholding allowance" in the IRS documentation. Now, the amount is just listed in "Worksheet 1. Employer's Withholding Worksheet for Percentage Method Tables for Automated Payroll Systems". The amount is listed on line 1k as pictured below in Figure 2. This is amount is only used in … NC-4 NRA Allowance Worksheet Schedules Schedule 1 Estimated N.C. Child Deduction Amount A taxpayer who is allowed a federal child tax credit under section 24 of the Internal Revenue Code is allowed a deduction for each dependent child unless adjusted gross income exceeds the threshold amount shown below.

Other Standard Deductions by State: Compare State Standard Deduction Amounts IRS Standard Deduction: Federal Standard Deductions North Carolina Income Tax Forms. North Carolina State Income Tax Forms for Tax Year 2021 (Jan. 1 - Dec. 31, 2021) can be e-Filed in conjunction with a IRS Income Tax Return. NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4). Step 2(b)—Multiple Jobs Worksheet (Keep for your records.) If you choose the option in Step 2(b) on Form W-4, complete this worksheet (which calculates the total extra tax for all jobs) on only ONE Form W-4. Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job. Note: NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

diabetic blood sugar range after eating 😚life expectancy. Jacklyn might have benefitted from participating in a diabetes support group or attending a summer camp with other youth with T1DM.

(From Line F of the Personal Allowances Worksheet on Page 2) Additional amount, if any, you want withheld from each pay period (Enter whole dollars) 2. • This year I expect a refund of all State income tax withheld because I expect to have no tax liability. ... NC-4 Web 10-12.

Worksheet 6: Exemption Allowance for Schedule NR : MI-1040CR: Homestead Property Tax Credit Claim : MI-1040CR-2: Veteran or Blind Homestead Credit Claim : MI-1040CR-7: Home Heating Credit Claim : Form 3174: Direct Deposit of Refund : Form 5049: Married, Filing Separately and Divorced/Separated Worksheet : MI-2210: Underpayment of Estimated …

Aug 26, 2021 · Open-Access: This article is an open-access article which was selected by an in-house editor and fully peer-reviewed by external reviewers.It is distributed in accordance with the Creative Commons Attribution Non Commercial (CC BY-NC 4.0) license, which permits others to distribute, remix, adapt, build upon this work non-commercially, and license their derivative works on different terms ...

Outer Banks, NC (MHA NC176) Port Angeles, WA (MHA WA308) ... 2022 Reserve IDT Subsistence Allowance: Breakfast - $2.55; Lunch - $4.65; Dinner - $4.65; Cadet COMRATS. The subsistence allowance is applicable when in a leave or temporary duty status, and is equal to the daily rate for an enlisted member receiving Basic Allowance for Subsistence (ENL-BAS). …

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 led for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 5).

18.04.2020 · For example, suppose you claimed 2 personal allowances. Your lowest paying job pays $35,000 a year, which corresponds to the number ";4" on the table. Since 2 is smaller than 4, enter "-0-" on your W-4. Then continue the worksheet to calculate any additional withholding.

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

The worksheets will help you figure the number of withholding allowances you are entitled to claim. However, you may claim fewer allowances if you wish to increase the tax withheld during the year. If your withholding allowances decrease, you must file a new NC-4 with your employer within 10 days after the change occurs except that a new NC-4 ...

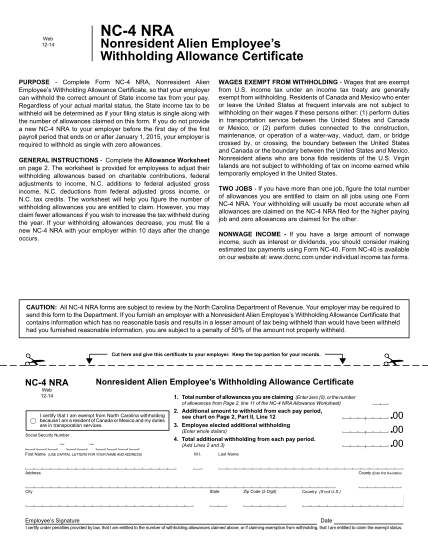

Withholding Allowance Certificate NC-4 NRA 1.Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 11 of the NC-4 NRA Allowance Worksheet) Additional amount to withhold from each pay period, see chart on Page 2, Part II, Line 12 2. Employee elected additional withholding (Enter whole dollars ...

Items needed to fill out NC-4 Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014

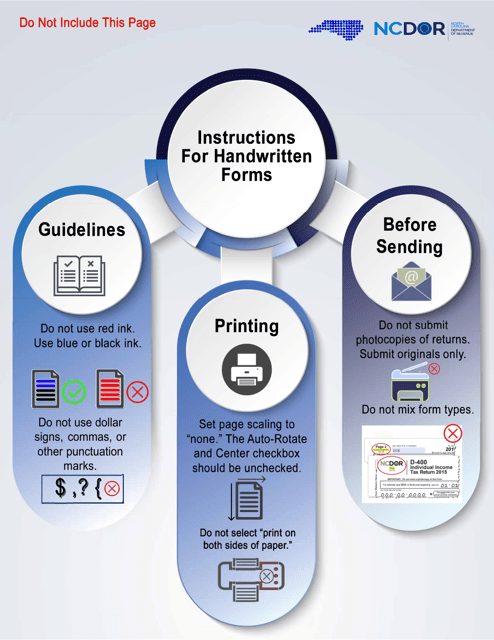

nc-4 allowance worksheet help. nc-4ez or nc-4. nc-4ez instructions. w4 ez. Create this form in 5 minutes! Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms. Get Form. How to create an eSignature for the ocopies of returns.

It will send you to the NC-4 Allowance Worksheet to determine the number to enter here. Find the secton for your Marital Status and answer all the questions for that section and follow its directions. It may send you back with a number to enter on Line 1 or send you to complete Part II of the Allowance Worksheet.

completing the NC-4 Allowance worksheet? A15. No. Pre-tax items are not included in taxable income and similarly should not be included when completing the NC-4 Allowance worksheet. Q16. When do we send a NC-4EZ or NC-4 to the Department? A16. If an employee claims more than 10 allowances, you should forward this document to

04.01.2022 · We are unable to fulfill requests made between December 20, 2021 and January 4, 2022 for tax forms and/or instructions due to missing information. To receive the requested forms and/or instructions, please complete the request form again. If you need assistance with completing the form, you may contact the Department at 1-877-252-3052. We apologize for …

NC-4 Allowance Worksheet For tax year 2014, answer all of the following questions for your filing status. Because N.C. does not recognize same-sex marriages, same-sex couples who file married for federal purposes must complete this worksheet as single, or if qualified, head of household or qualifying widow(er). Single - 1.

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 5).

Here is more information about the W-4 Worksheet, including how to fill out the W-4 allowance worksheet, line by line. Although it is late in the year, if you were disappointed in the size of your refund or you had an unexpected balance due when you filed your 2018 tax return, it is not too late to make changes for 2019.

NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 5).

02.06.2021 · You can use the W-4 to withhold extra money from your paycheck too. When you start a new job, your employer will hand the W-4 to you. Usually, you’ll receive a paper copy. You will be asked to write down how many allowances you want on the W-4 form and the attached worksheet. If you Googled, “Should I claim 0 or 1 on W-4?” then read on.

State: Travel: SPO-030B: Worksheet B Computation of Per Diem and Meal Allowance: 08/30/2017: State: Travel: SPO-030A: Worksheet A Airfare: 05/17/2018: State: Travel: SPO-030: Travel Approval Form: 08/09/2018: State: Travel: SPO-034: Certificate of Disposal: 11/28/2014: State: Inventory Management and Excess Property: SPO-026: Transfer of They each have …

allowances you are entitled to claim. However, you may claim fewer allowances if you wish to increase the tax withheld during the year. If your withholding allowances decrease, you must file a new NC-4 with your employer within 10 days after the change occurs except that a new NC-4 is not required until the next year in the followng cases: 1.

09.01.2022 · The following colleges, universities, and scholarship programs use CSS Profile and/or IDOC as part of their financial aid process for some or all of their financial aid applicants in the populations listed below.

/ScreenShot2021-02-05at6.15.36PM-5e31046e8de14a21a3719fd399a682b3.png)

/cloudfront-us-east-1.images.arcpublishing.com/gray/XDQFMUVP4NFPXECEUEKYBL5SIE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/XDQFMUVP4NFPXECEUEKYBL5SIE.jpg)

0 Response to "41 nc 4 allowance worksheet"

Post a Comment