39 realtor tax deduction worksheet

Automobile And Transportation. The best car for real estate agents will depend on your needs. This includes taxes. Automobiles can be a tricky tax deduction for real estate agents. Leave it to me; I've purchased over 15 cars in the last 11 years, so I'd know what a mess they make on deductions, especially when you change them out as frequently as I tend to do. Write your Real Estate Agent Tax Deductions Worksheet Form online is easy and straightforward by using CocoSign . You can simply get the form here and then fill in the details in the fillable fields. Follow the tips given below to complete the document. Fill out the blanks eSign the form using our tool Send the completed form

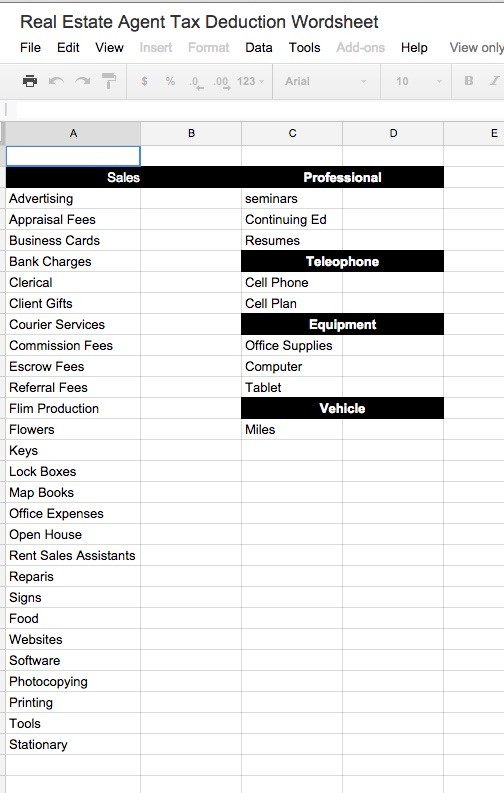

Real Estate Agent Tax Deductions Worksheet Excel - In mathematics, trainees are encouraged to establish logical reasoning and also important reasoning, as well as creativity, mystical along with rate higher, problem solving, and even communication abilities. Portions are used to split numbers on this worksheet.

Realtor tax deduction worksheet

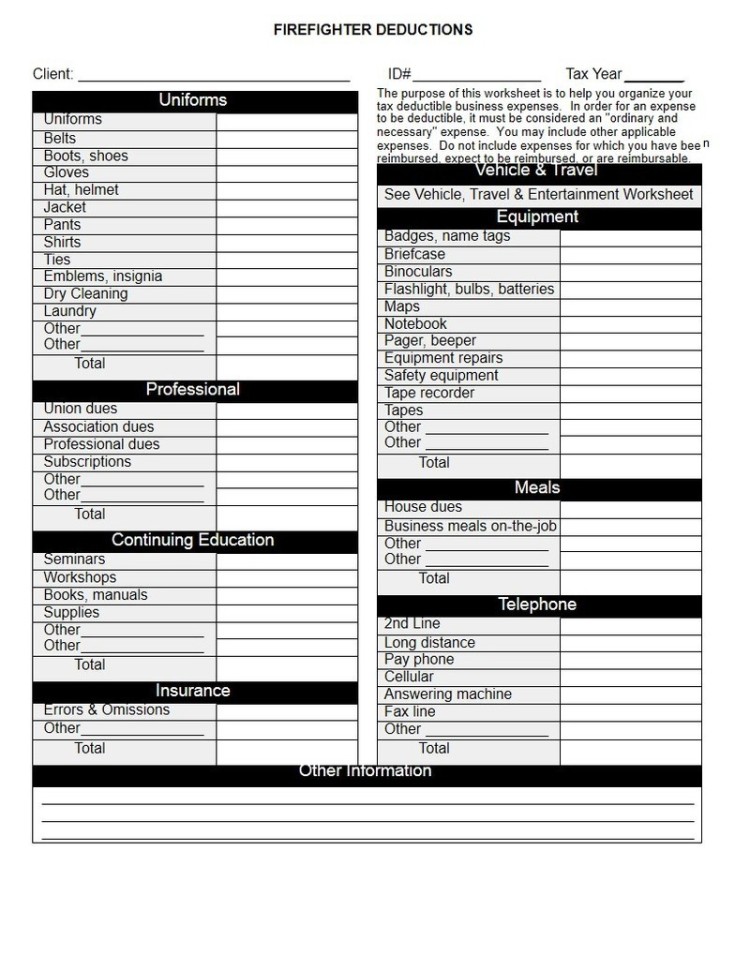

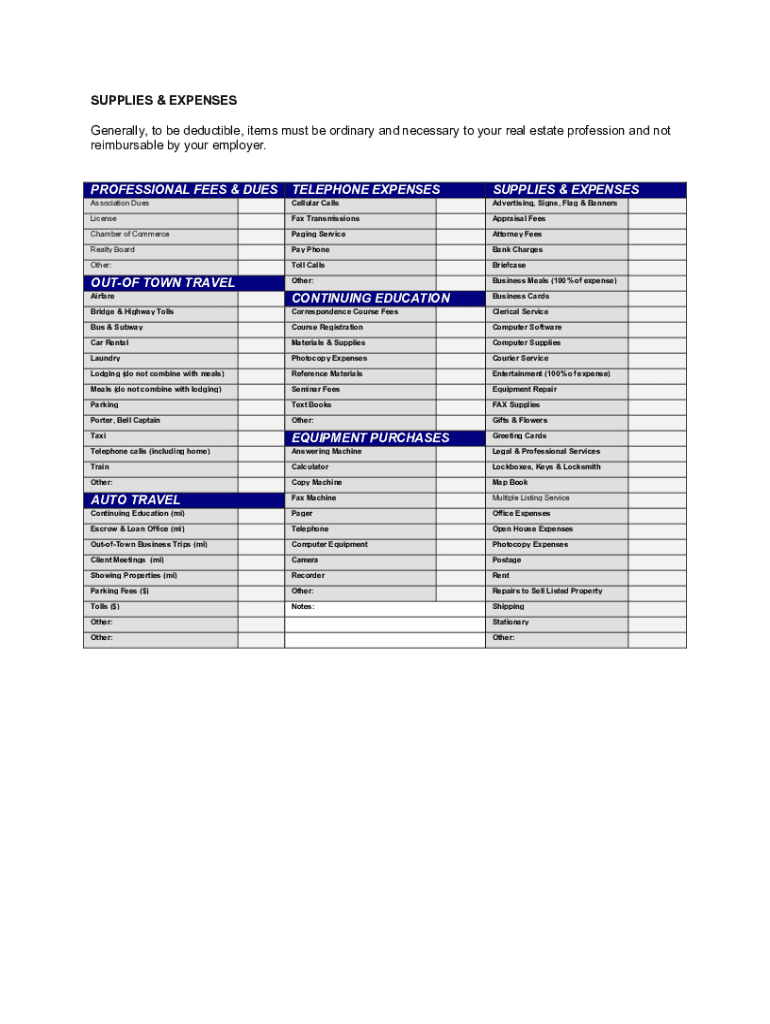

Tax regulations change often and specific circumstances may determine whether any item is relevant to your situation. This worksheet cannot substitute for tax knowledge or professional tax advice. Please Contact JP Tax Pros (915) 346-3780 or (915) 849-0617 with any specific questions Real Estate Agent Tax Deductions Worksheet 7/27 [EPUB] pay far less to the IRS! Tax Planning for Real Estate Agents-Alan Goldstein 2014-01-09 Knowing how the IRS treats Real Estate Agents is the first step in properly running your real estate career. This tax planning guide will cover the main tax areas that will help you to confidently run your Realtors Tax Deductions Worksheet AUTO TRAVEL Your auto expense is based on the number of qualified business miles you drive. Expenses for travel between business locations or daily transportation expenses between your residence and temporary work locations are deductible; include them as business miles. Expenses for your trips between home and

Realtor tax deduction worksheet. Your Realtors Tax Deduction Worksheet is a blank template for you to use as a guide to help you determine which expenses are eligible for tax deduction. Get a Real Estate Agent Tax Deductions Worksheet 0 template with signNow and complete it in a few simple clicks. Get form Book as follows 1 give the date and business purpose of each trip 2 note the place to which you traveled 3 record the number of business miles and 4 record your car s odometer reading at both the beginning and end of the tax ... Tax Deduction Worksheet For Realtors Auto Travel Telephone Expenses Client Meetings (mi) Cellular, Telephone & Related Service Fees business financial statement template You must complete this Business Financial Statement and attach a copy of your most current Income Statement and Balance Sheet along with a copy of your 1711 Woodlawn Ave., Wilmington, DE 19720 (302-322-0452) - - - - 118 Astro Shopping Center, Newark DE 19711 - - - -

If you pay $100 in real estate taxes and use 10% of your home for business purposes then your home office deduction in relation to your real estate taxes is $10 (10% of $100). On the IRS form this section focuses on four expense categories: casualty losses, deductible mortgage interest, and real estate taxes. Realtor Tax Deductions Worksheet. Want our Realtor tax deduction worksheet? Check it out right here: Little-Known Realtor Tax Deductions . One of the key strategies in getting better tax returns is starting New Years Day. Your tax strategy starts from day #1. Keep is simple and keep every single receipt for transactions starting today! Itemized Deductions Worksheet You will need: Tax information documents (Receipts, Statements, Invoices, Vouchers) for your own records. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your Federal and/or State return. This will give you the final total that you can claim at the end of year to reduce your taxes.This worksheet allows you to itemize your tax deductions for a given year.Use this spreadsheet in excel to record your monthly bills for the home.

The taxpayer would use the Home Office Deduction worksheet on the Schedule A. In order to take full advantage of the home office deduction the space must be. Check out this offer. Examples include your utility bills mortgage interest or rent insurance HOA real estate taxes repairs pest control trash removal security and maintenance. This is an ultimate guide to tax deductions for real estate agents that'll help you lower your tax bill and keep more of your hard-earned money! Licences & fees. Your state license renewal, MLS dues, and professional memberships, are deductible. Property marketing. REALTOR/REAL ESTATE AGENT - TAX DEDUCTION CHEAT SHEET Advertising Billboards Brochures/Flyers Business Cards Copy Editor Fees Direct Mail Email Marketing & Newsletters Graphic Designer Fees Internet Ads (Google, Facebook, etc) Leads/Mailing Lists ... Get the Cyataxes Realtors Tax Deductions Worksheet you need. Open it using the cloud-based editor and begin adjusting. Fill in the empty areas; concerned parties names, places of residence and phone numbers etc. Customize the template with smart fillable fields. Include the particular date and place your electronic signature.

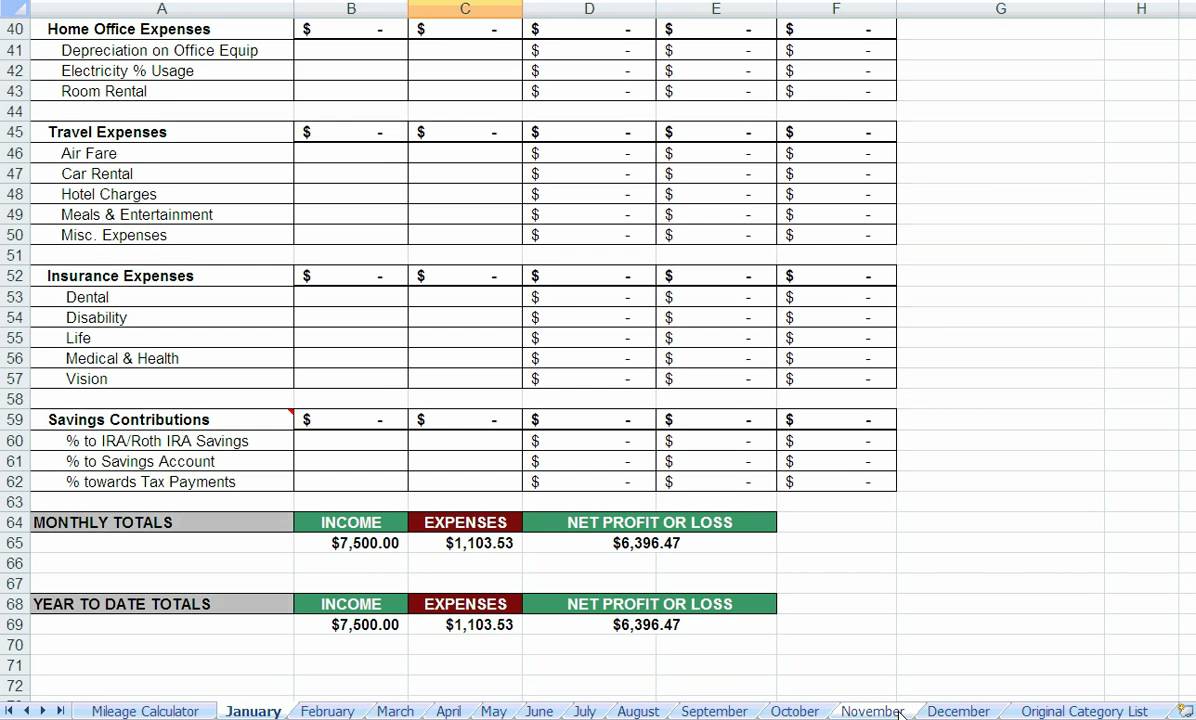

Download our 12 month expense worksheet Excel Worksheet. Tradesmen (Plumbers, Carpenters, etc.) Download our expense checklist PDF Download our expense checklist Excel Worksheet Download our 12 month expense worksheet Excel Worksheet. Other Tax Checklists. Rental Real Estate Deductions (Word Document)

The Car and Truck Expenses Worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate Vehicle Expense Worksheet. Please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. Realtor Tax Deduction Worksheet.

How you can fill out the Real estate agent tax deductions worksheet form on the web: To start the blank, utilize the Fill & Sign Online button or tick the preview image of the blank. The advanced tools of the editor will guide you through the editable PDF template. Enter your official identification and contact details.

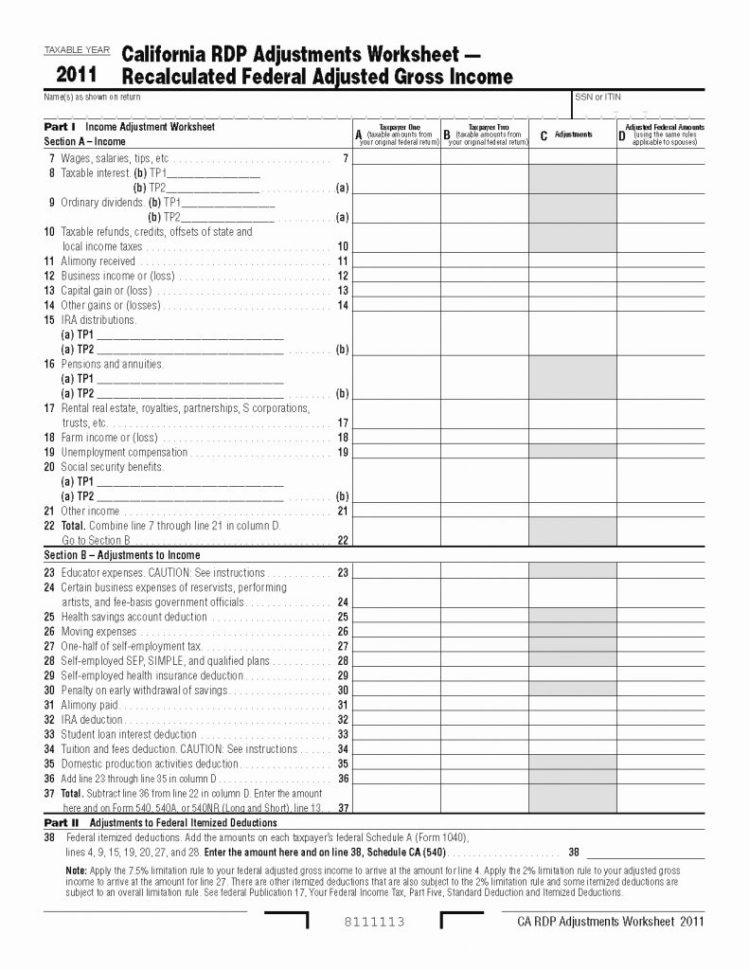

The tax and interest deduction worksheet shows the itemized deductions claimed for state and local taxes, including real estate taxes, and mortgage interest. You would only itemize if your total deductions were greater than the standard deduction for your filing status. However, these deductions can still be listed on your return.

Realtors Tax Deduction Worksheet Due to the overwhelming response to last month s Realtor tax tip article Daszkal Bolton LLP has created this Realtors Tax Deduction Worksheet to assist our clients in becoming more organized for taking advantage of tax deductible business expenses.

Sheet1 Sales,Professional Advertising,seminars Appraisal Fees,Continuing Ed Business Cards,Resumes Bank Charges,Teleophone Clerical,Cell Phone Client Gifts,Cell Plan Courier Services,Equipment Commission Fees,Office Supplies Escrow Fees,Computer Referral Fees,Tablet Flim Production,Vehicle Flowers

realtor tax deduction worksheet. Easy Agent PRO - Better Digital Marketing. 26k followers. Small Business Tax. Real Estate Business. Real Estate Marketing. Finance Business. Budget Spreadsheet Template. Business Budget Template. Real Estate Quotes. Real Estate Tips. Business Tax Deductions ...

Realtors Tax Deductions Worksheet AUTO TRAVEL Your auto expense is based on the number of qualified business miles you drive. Expenses for travel between business locations or daily transportation expenses between your residence and temporary work locations are deductible; include them as business miles. Expenses for your trips between home and

Commissions are subject to a variety of taxes Federal Income Tax (Average 25%) Self Employment Tax (15.3%) State Income Tax (DC: 8.5%/MD: 7.5%/VA 5.75%) Total Tax: 46%-49% Reduce your taxes by tracking your tax deductions (see page 2) Learn how to stay organized (bookkeeping, filing systems, etc.) Contribute to deductible retirement plans (401K or SEP)

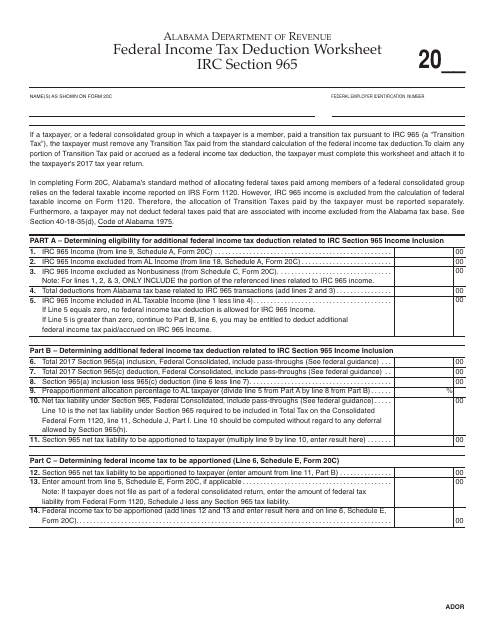

This deduction is taken on Schedule A, Lines 5-6. Note that the 'Taxes and Licenses' deduction on Schedule C, Line 23, applies to sales tax on business income, real estate and property taxes on business assets, and taxes you pay on behalf of your employees. For Example. Philip is a successful real estate agent based in San Diego, California.

Realtors Tax Deductions Worksheet AUTO TRAVEL Your auto expense is based on the number of qualified business miles you drive. Expenses for travel between business locations or daily transportation expenses between your residence and temporary work locations are deductible; include them as business miles. Expenses for your trips between home and

Real Estate Agent Tax Deductions Worksheet 7/27 [EPUB] pay far less to the IRS! Tax Planning for Real Estate Agents-Alan Goldstein 2014-01-09 Knowing how the IRS treats Real Estate Agents is the first step in properly running your real estate career. This tax planning guide will cover the main tax areas that will help you to confidently run your

Tax regulations change often and specific circumstances may determine whether any item is relevant to your situation. This worksheet cannot substitute for tax knowledge or professional tax advice. Please Contact JP Tax Pros (915) 346-3780 or (915) 849-0617 with any specific questions

0 Response to "39 realtor tax deduction worksheet"

Post a Comment