39 mortgage insurance premiums deduction worksheet

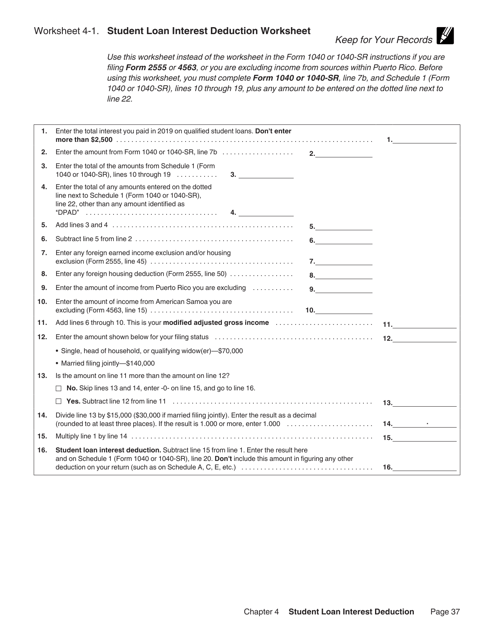

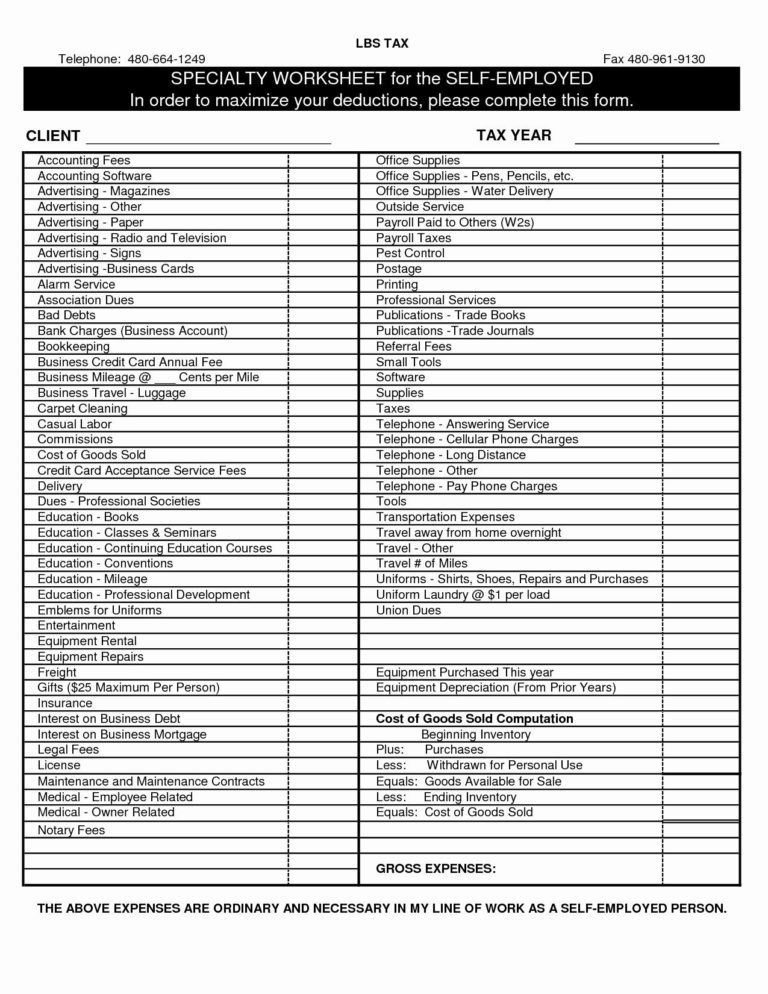

amortizable bond premium on taxable limitations on indebtedness. the mortgage is satisfied before its bonds acquired after October 22, 1986, Qualified mortgage insurance term, no deduction is allowed for the but before January 1, 1988) that is paid premiums. Enter (on the worksheet unamortized balance. See Pub. 936 for Mortgage insurance premiums: If your adjusted gross income (AGI) is less than $100,000 filing single, jointly or as head of household, mortgage insurance premiums are fully deductible. There's a phaseout above $100,000 ($50,000 if married and filing separately).

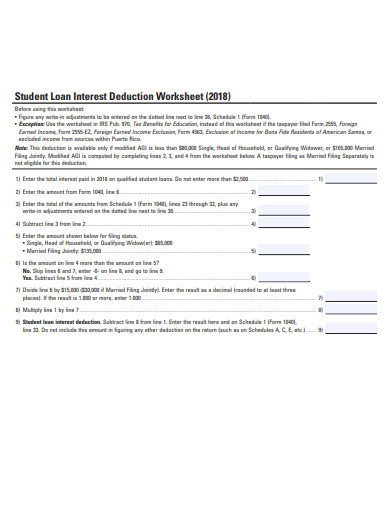

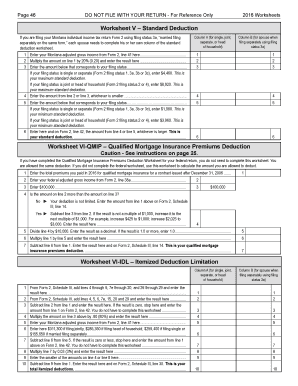

limited and you must use the worksheet below to figure your deduction. 1. Enter the total premiums you paid in 2017 for qualified mortgage insurance for a contract entered into on or after January 1, ... 2018 Qualified Mortgage Insurance Premiums Deduction Worksheet

Mortgage insurance premiums deduction worksheet

See Line 13 in the instructions for Schedule A (Form 1040) and complete the Mortgage Insurance Premiums Deduction Worksheet to figure the amount you can deduct. If your adjusted gross income is more than $109,000 ($54,500 if married filing separately), you cannot deduct your mortgage insurance premiums. Form 1098. Mortgage insurance premiums can increase your monthly budget significantly—an additional $83 a month or so at a 0.5% rate on a $200,000 mortgage. However, in 2006, Congress made these payments tax-deductible to help reduce the burden of these costs. The tax deduction was scheduled to last through the 2016 tax year, but it has been extended through at least 2021. Dec 23, 2021 — However, attached to this PDF is a worksheet that includes the tables that ... can't deduct insurance premiums paid by.1 page

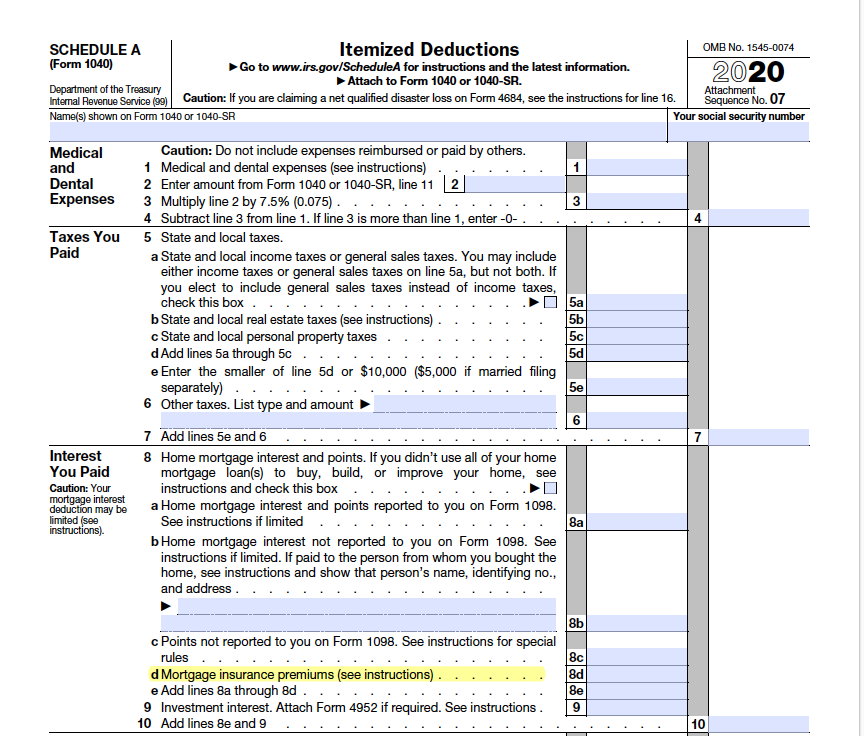

Mortgage insurance premiums deduction worksheet. deduction for mortgage insurance premiums is not allowed as a New York itemized deduction for tax year 2021. Lines 10 and 11 – Home mortgage interest A home mortgage is any loan that is secured by your main home or second home. It includes first and second mortgages, home equity loans, and refinanced mortgages. mortgage interest, including points and mort-gage insurance premiums. It also explains how to report deductible interest on your tax return. Part II explains how your deduction for home mortgage interest may be limited. It contains Table 1, which is a worksheet you can use to figure the limit on your deduction. Comments and suggestions. We welcome 24.01.2020 · For tax years 2007 through 2017, when taxpayers itemized deductions, they could deduct the cost of premiums for mortgage insurance on a qualified personal residence as home mortgage interest. This deduction has been retroactively extended back to 2018 and through 2020. If you paid premiums for mortgage insurance in 2018 or were amortizing prepaid … Mortgage insurance premiums you paid or accrued on any mortgage insurance contract issued before January 1, 2007, are not deductible. Limit on amount you can deduct. You cannot deduct your mortgage insurance premiums if the amount on Form 740-NP, line 8, is more than $109,000 ($54,500 if married filing separate returns). If the amount on Form 740-NP, line 8, is more than $100,000 ($50,000 if married filing separate returns), your deduction is limited and e worksheet below to figure your ...

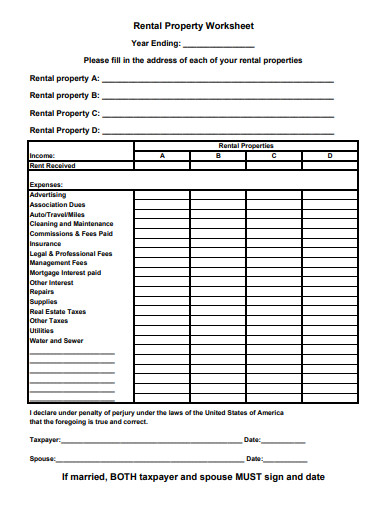

Enter the total premiums you paid in 2020 for qualified mortgage insurance for a contract issued after December 31, 2006 Enter the amount from Form 1040 or 1040-SR, line 11 Enter $100,000 ($50,000 if married filing separately) Is the amount on line 2 more than the amount on line 3? Your deduction isn't limited. Enter the amount from line 1 of this worksheet on Schedule A, line 8d. Don't complete the rest of this worksheet. Subtract line 3 from line 2. The reason the Qualified Mortgage Insurance Premium isn't being allowed is because of the limit on the amount you can deduct: The limit is $109,000 ($54,500 if Married Filing Separately). If the amount is more than $100,000 ($50,000 if Married Filing Separately), your deduction is limited, and you must use the worksheet to figure your deduction. your expenses for mortgage interest, mortgage insurance premiums, and real estate taxes are deductible under the normal rules. No deduction is allowed for ...34 pages Oct 25, 2021 — on points, mortgage insurance premiums, and how to report deductible ... Worksheet To Figure Your Qualified Loan Limit and Deductible.19 pages

2018 Qualified Mortgage Insurance Premiums Deduction Worksheet ... You cannot deduct your mortgage insurance premiums if the amount on Form 740-NP, line 8, is more than $109,000 ($54,500 if married filing separate returns). If the amount on Form 740-NP, line If your adjusted gross income on Form 1040 or 1040-SR, line 11, is more than $109,000 ($54,500 if married filing separately), you cannot deduct your mortgage insurance premiums. Otherwise, figure your deductible mortgage insurance premiums for the current year using the rules explained under Mortgage Insurance Premiums in Part I. If the amount on Form 1040 or 1040-SR, line 11, is $100,000 or less ($50,000 or less if married filing separately), enter the full amount of your qualified mortgage ... Fresh Mortgage Insurance Premiums Deduction Worksheet The loan may be a mortgage to buy your home or a second mortgage. Otherwise the IRS provides a Mortgage Insurance Premiums Deductible Worksheet on its website to help you calculate how much of a deduction youre entitled to claim as well as an interactive calculator online. of the limited itemized deduction worksheet..... 17: 18 If your total on Line 17 was limited, enter the amount from Part B, Line 15 of the limited ... mortgage interest deduction. The mortgage insurance premiums deduction is reported on Line 8d of the Virginia Schedule A. What's New: For taxable years beginning on or after January 1,

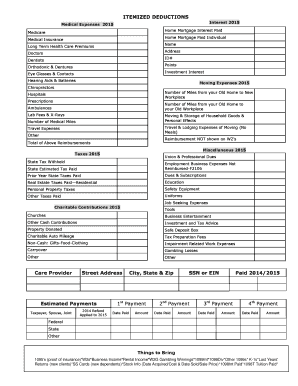

•Insurance premiums for medical and dental care, including premiums for qualified long-term care insurance con-tracts as defined in Pub. 502. But see Limit on long-term care premiums you can deduct, later. Reduce the insurance premiums by any self-employed health insurance deduction you claimed on Schedule 1 (Form 1040), line 16. You

Mortgage Insurance Premiums Deduction Worksheet 2/4 Kindle File Format Individual Income Tax - Department of Revenue The Internal Revenue Service has issued retroactive extensions of several tax matters that include the following: treatment of mortgage insurance premiums as qualified residence interest, exclusion

Qualified Mortgage Insurance Premiums Deduction Form 2 Worksheet VI (Obsolete) St No ap le s Clear Form 2018 Montana Individual Income Tax Return Form 2 For the year Jan 1 - Dec 31, 2018 or the tax year beginning M M D D 2 0 1 8 and ending M M D D 2 0 Y Y First name and initial Last name Social security number Deceased?

For taxpayers filing Form N-11, the deduction for mortgage interest premiums and other deductible interest will be added together in Worksheet A-3 in the 2020 Form N-11 Instructions and reported on Form N-11, line 21c. Mortgage Insurance Premiums Enter the qualified mortgage insurance premiums you paid under a mortgage insurance

You can't deduct insurance premiums paid by making a pre-tax reduction to your employee ... State and Local General Sales Tax Deduction Worksheet—Line 5a ...

You cannot deduct your mortgage insurance premiums if the amount of Form 740, line 9, is more than $109,000 ($54,500 if married filing separately on a combined return or separate returns). If the amount of Form 740, line 9, is more than $100,000 ($50,000 if married filing separately on combined return or separate returns), your deduction is limited and you must use the worksheet below to figure your deduction. 1.

Contact the mortgage insurance issuer to determine the deductible amount if it isn't included in box 5 of Form 1098. Limit on amount you can deduct. You can't deduct your mortgage insurance premiums if the amount on Form 1040, line 38, is more than $109,000 ($54,500 if married filing separately).

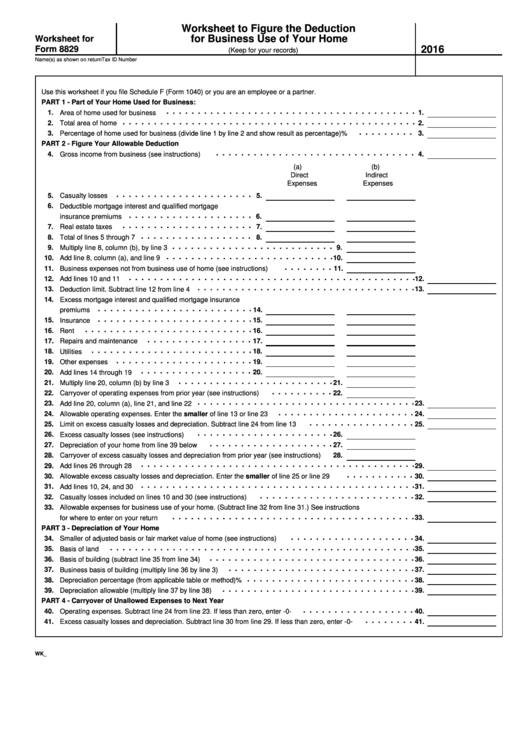

Instead, complete the Worksheet To Figure the. Deduction for Business Use of Your Home in Pub. ... the Mortgage Insurance Premiums Deduction Worksheet for.6 pages

Expired deduction for mortgage in-surance premiums. At the time these instructions went to print, the deduction for mortgage insurance premiums had expired. You can't claim a deduction for amounts paid or accrued after 2017. To find out if legislation extended the de-duction so you can claim it on your 2018 return, go to IRS.gov/ScheduleA.

A doctor discusses medical information with a teenage girl, who is wearing a head scarf, and her father. Pediatric, childhood, AYA.

Use the Worksheet The IRS provides you with a "Qualified Mortgage Insurance Premiums Deduction Worksheet" to fill out to determine limitations for deducting mortgage insurance. Again, this applies if your AGI exceeds $100,000, or $50,000 for married filing separately.

You will need to complete the Qualified Mortgage Insurance Premiums Deduction Worksheet found in the instructions for Schedule A (Form 1040) in order to determine the percentage. If your adjusted gross income is higher than $109,000 ($54,500 if married, filing separately), then you are unable to take this tax deduction.

If you did not claim an itemized deduction for mortgage insurance premiums on your federal income tax return, compute the amount to include on line 11 of Form IT-196 as if you had, using federal instructions and guidance. 1/13/2020: IT-196-I: 2019 On page 2, 1st column, disregard the Note under the Interest you paid section.

on points, mortgage insurance premiums, and how to report deductible interest on your tax re-turn. Generally, home mortgage interest is any in-terest you pay on a loan secured by your home (main home or a second home). The loan may be a mortgage to buy your home, a second mortgage, a line of credit, or a home equity loan.

Looking for Mortgage Insurance Premiums Deduction WorksheetLine 13 to fill? CocoDoc is the best place for you to go, offering you a marvellous and easy to edit version of Mortgage Insurance Premiums Deduction WorksheetLine 13 as you ask for. Its complete collection of forms can save your time and increase your efficiency massively.

mortgage interest, including points and mort-gage insurance premiums. It also explains how to report deductible interest on your tax return. Part II explains how your deduction for home mortgage interest may be limited. It contains Table 1, which is a worksheet you can use to figure the limit on your deduction. Comments and suggestions. We welcome

Qualified Mortgage Insurance Premiums Deduction Worksheet See the instructions for line 4 above to see if you must use this worksheet to figure your deduction. RESERVED. 42A740-A (10-18) Page 4 of 5 Schedule A-740 (2018) Instructions for Schedule A FullYear Resident

creased standard deduction, re-port amounts only on line 28 as instructed. See Increased Standard De-duction Reporting, later. Mortgage insurance premiums. The deduction for mortgage insurance premi-ums has been extended through 2017. You can claim the deduction on Line 13 for amounts that were paid or accrued in 2017.

1. Enter your income from: line 2 of the "Standard Deduction Worksheet for Dependents" in the instructions for federal Form 1040 or 1040-SR. 1. 2. Minimum standard deduction. 2. $1,100. 3. Enter the larger of line 1 or line 2 here. 3.

See Line 13 in the instructions for Schedule A (Form 1040) and complete the Mortgage Insurance Premiums Deduction Worksheet to figure the amount you can deduct. If your adjusted gross income is more than $109,000 ($54,500 if married filing separately), you cannot deduct your mortgage insurance premiums. Form 1098.

Dec 23, 2021 — However, attached to this PDF is a worksheet that includes the tables that ... can't deduct insurance premiums paid by.1 page

Mortgage insurance premiums can increase your monthly budget significantly—an additional $83 a month or so at a 0.5% rate on a $200,000 mortgage. However, in 2006, Congress made these payments tax-deductible to help reduce the burden of these costs. The tax deduction was scheduled to last through the 2016 tax year, but it has been extended through at least 2021.

See Line 13 in the instructions for Schedule A (Form 1040) and complete the Mortgage Insurance Premiums Deduction Worksheet to figure the amount you can deduct. If your adjusted gross income is more than $109,000 ($54,500 if married filing separately), you cannot deduct your mortgage insurance premiums. Form 1098.

.png)

0 Response to "39 mortgage insurance premiums deduction worksheet"

Post a Comment