39 income tax deduction worksheet

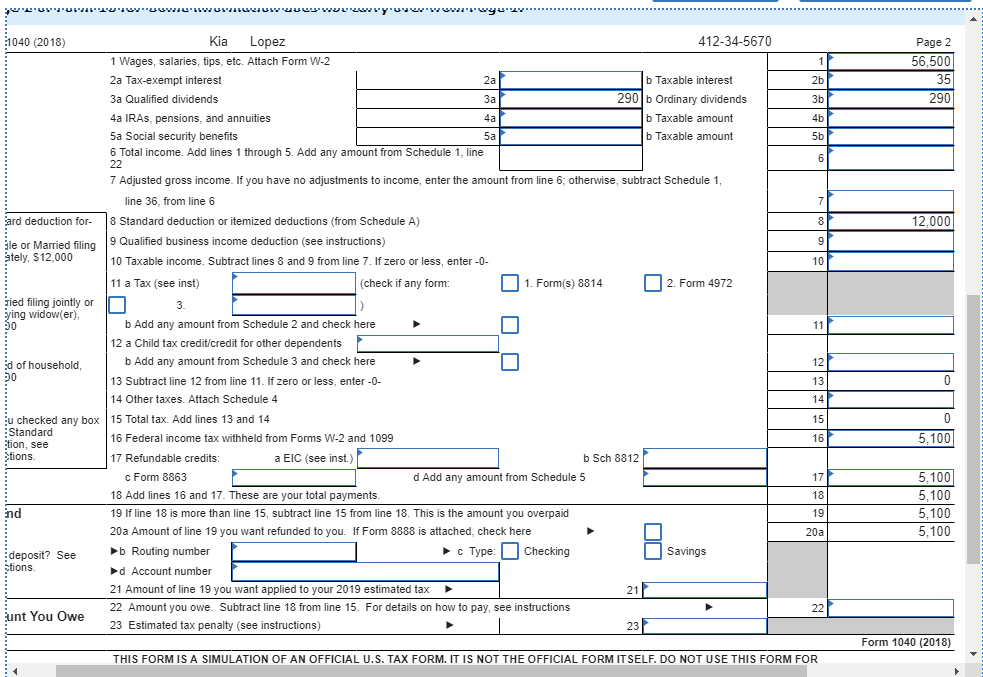

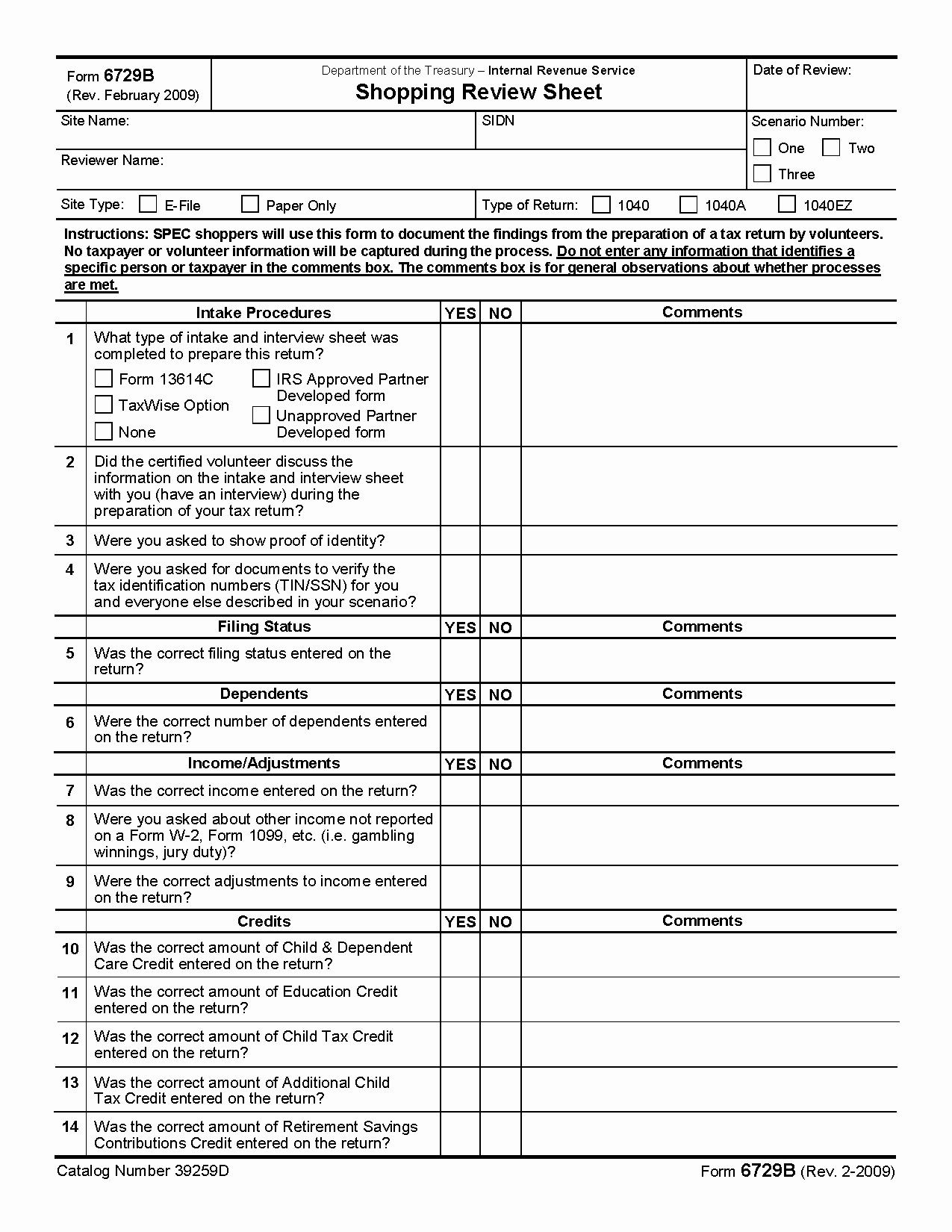

WORKSHEET C ADDITIONAL TAX WITHHOLDING AND ESTIMATED TAX. 1. Enter estimate of total wages for tax year 2021. 1. 2. Enter estimate of nonwage income (line 6 of Worksheet B). 2. 3. Add line 1 and line 2. Enter sum. 3. 4. Enter itemized deductions or standard deduction (line 1 or 2 of Worksheet B, whichever is largest). 4. 5. This Tax Withholding Estimator works for most taxpayers. People with more complex tax situations should use the instructions in Publication 505, Tax Withholding and Estimated Tax. This includes taxpayers who owe alternative minimum tax or certain other taxes, and people with long-term capital gains or qualified dividends.

Standard Deduction Chart for People Born Before January 2, 1956, or Who are Blind Standard Deduction (continued) Standard Deduction Worksheet for Dependents Use this worksheet only if someone else can claim you (or your spouse if filing jointly) as a dependent. Blind is defined in Tab R, Glossary and Index

Income tax deduction worksheet

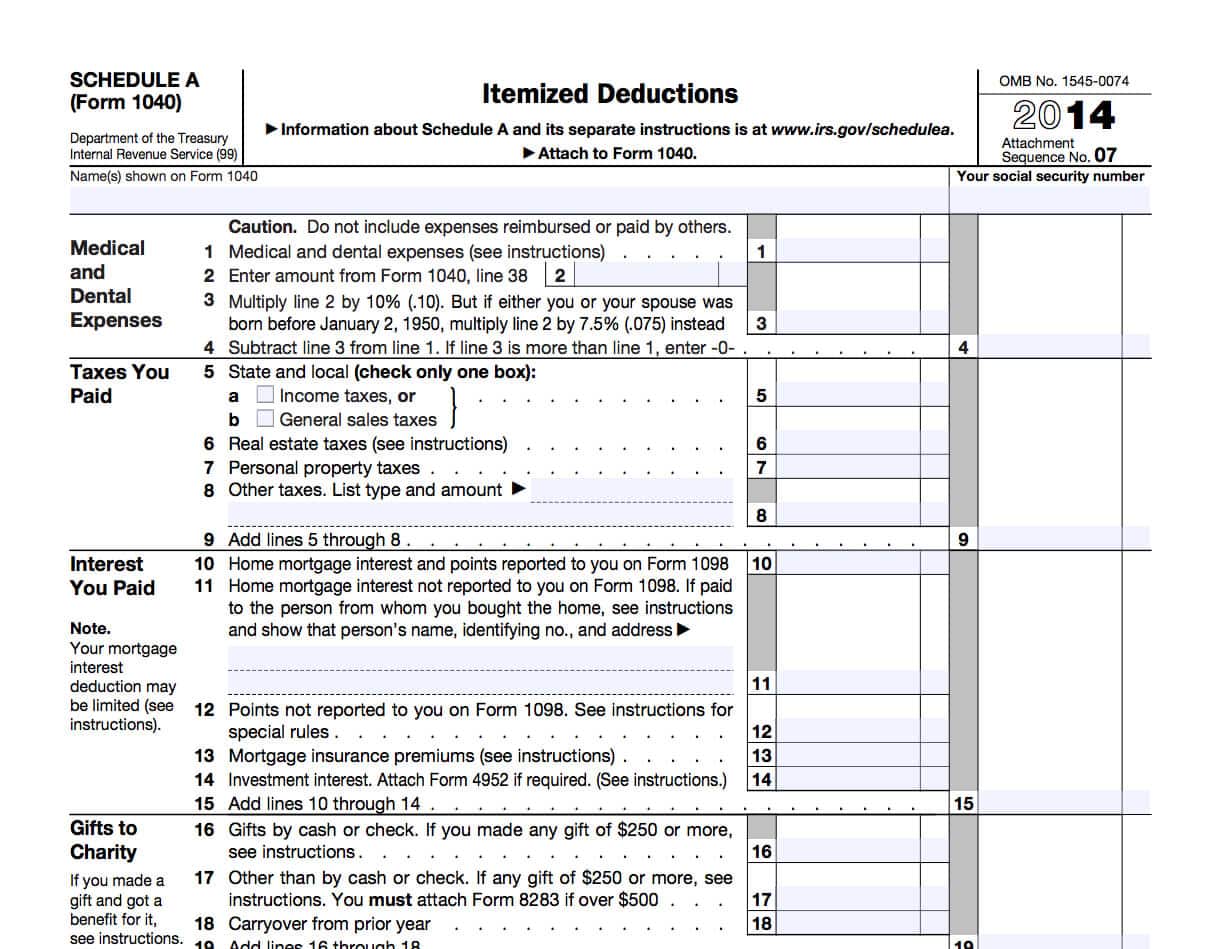

Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses, and 2020/2021 Tax Estimate Spreadsheet. If you are looking to find out if you will get a tax refund or if you owe money this year, here is a simple Excel spreadsheet that can help you estimate federal and state income taxes before you file your return in 2021. The formulas and spreadsheets shown and linked below take the new tax reform and tax cuts ... † The Historic Preservation Income Tax Credit is a new nonrefundable credit for taxable years 2020 to 2024 for substantial rehabilitation of a certifi ed historic structure. (Act 267, SLH 2019) † The Ship Repair Industry Tax Credit is a new nonrefundable credit for taxable years 2022 to 2026 for the construction of a new drydock at Pearl

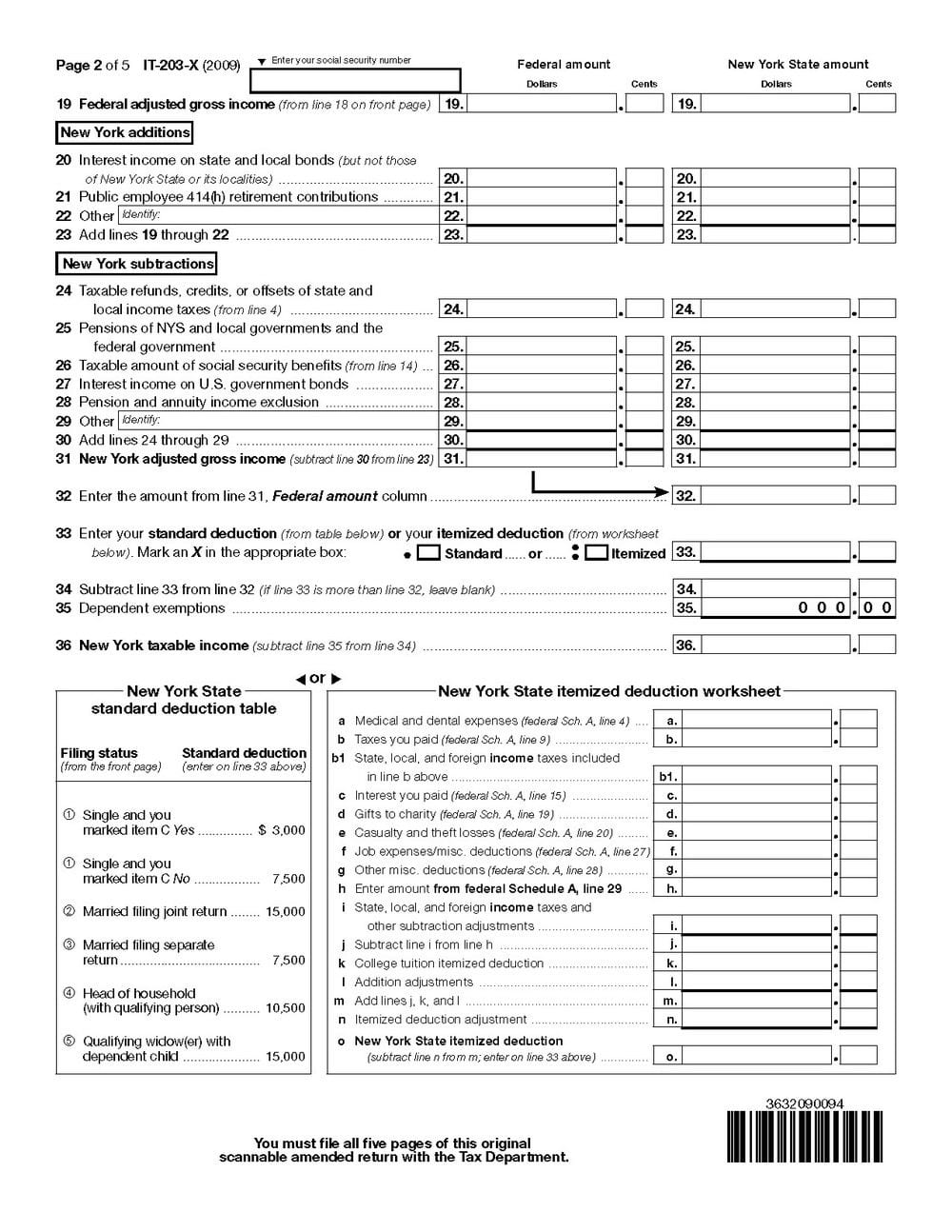

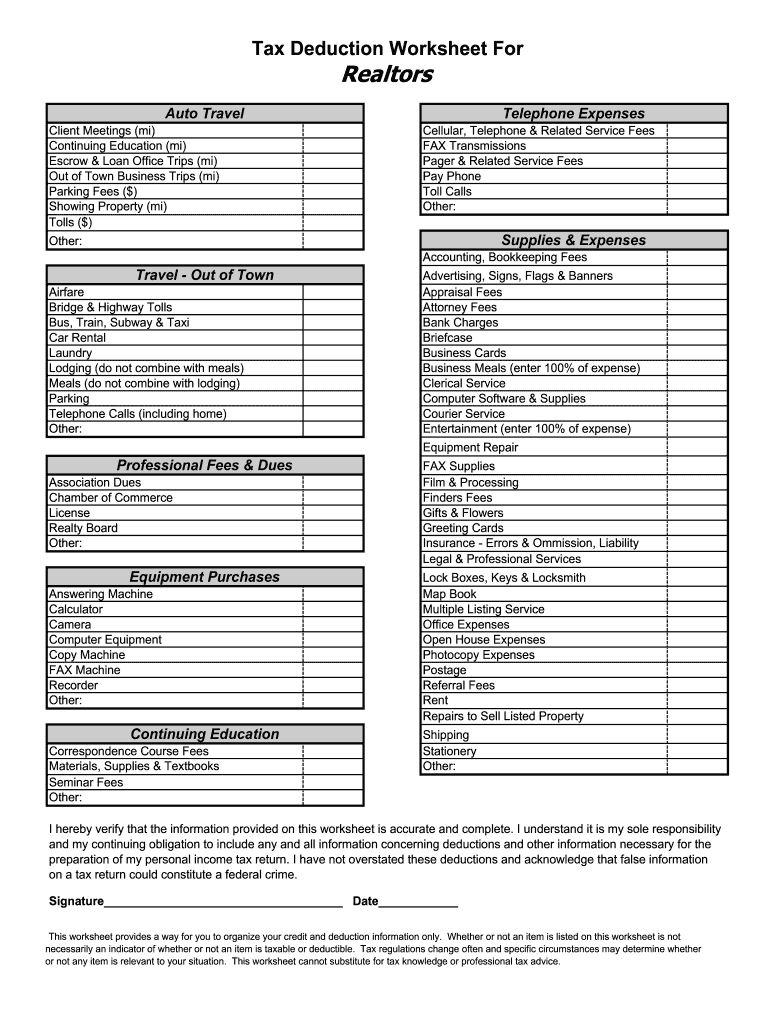

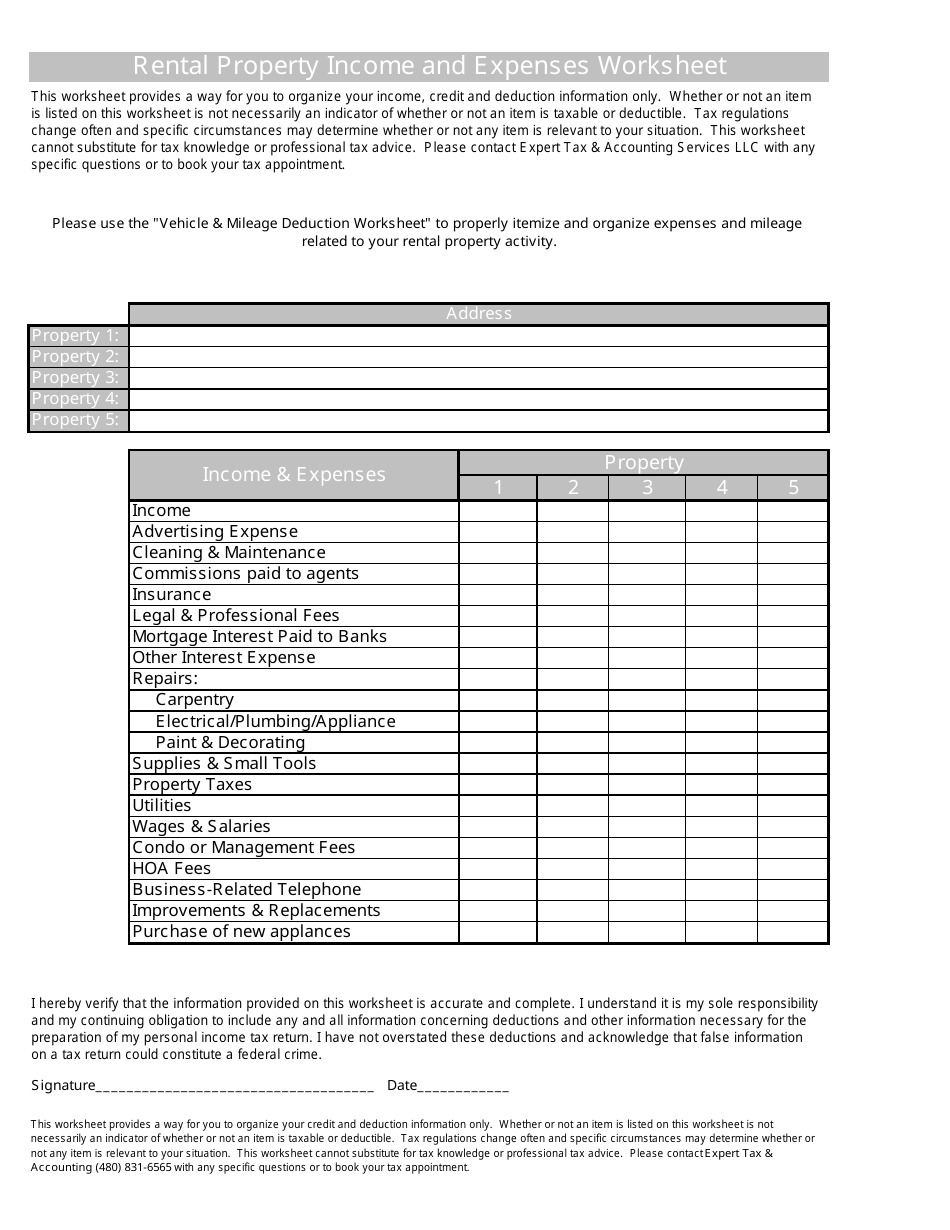

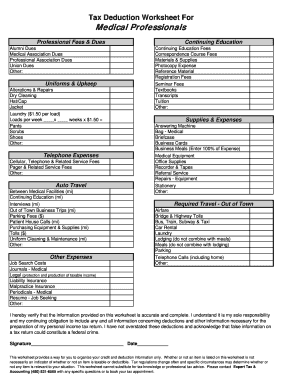

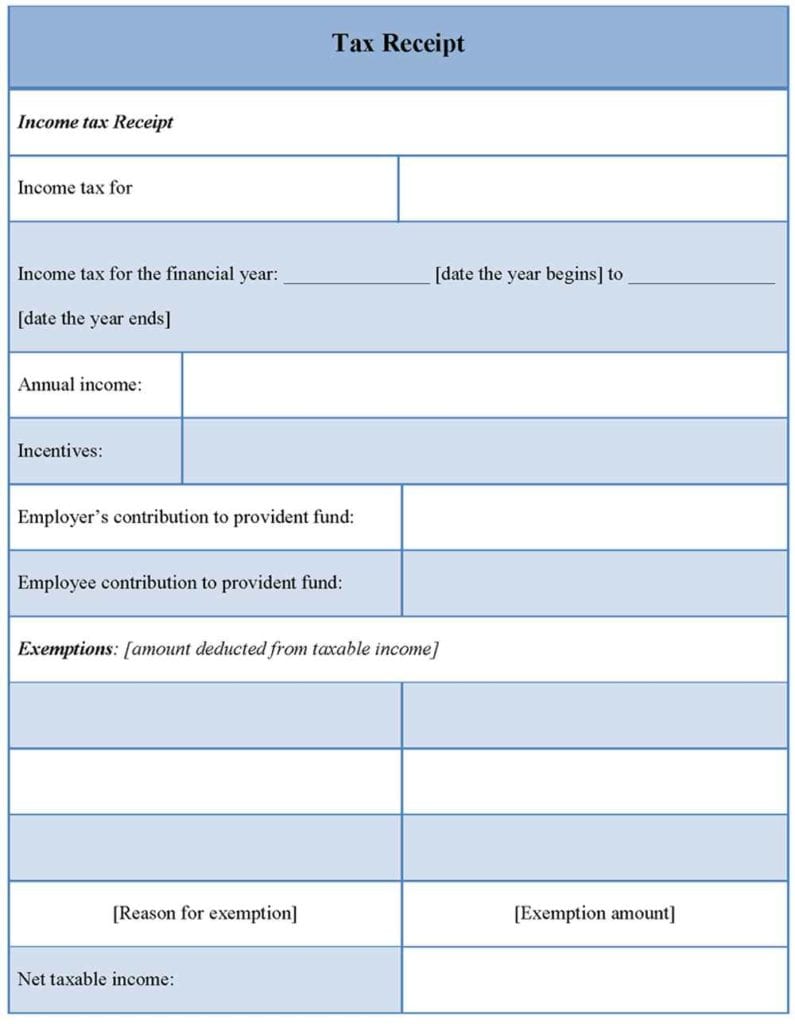

Income tax deduction worksheet. For federal income tax purposes, the itemized deduction rules for the interest you paid have changed from what was allowed as a deduction for tax year 2017. Your New York itemized deduction for the total interest you paid on line 15 is computed using the necessary for the preparation of my personal income tax return. I have not overstated these deductions and acknowledge that false information on a tax return could constitute a federal crime. This worksheet provides a way for you to organize your credit and deduction information only. Whether or not an item is listed on this worksheet is not Estimated Tax Worksheet: Income: ( Expand to enter details.) Adjustments to Income: ( Expand to enter details.) Deductions: ( Expand to enter itemized deductions.) Choose which to use... Smaller of above or ... Use 100 % of 2020 's amount from the line above. Use 100% of the 2021 estimated total tax. Tax Preparation Fee $ Please sign your name Date SCHEDULE A TAX DEDUCTION WORKSHEET MEDICAL EXPENSES CONTRIBUTIONS PLEASE SIGN BELOW MISCELLANEOUS ADJUSTMENTS TO INCOME TAXES PAID CASUALTY INTEREST PAID Form 914 Rev. 2 (12/06)

The $15,200 excluded from income is all of the $5,000 unemployment compensation paid to your spouse, plus $10,200 of the $20,000 paid to you. If your modified AGI is $150,000 or more, you can't exclude any unemployment compensation. Use the Unemployment Compensation Exclusion Worksheet to figure your modified AGI and the amount to exclude. FARM INCOME & EXPENSE WORKSHEET NAME SS # / FEDERAL ID # ... The amount a dependent child can earn and pay no tax changes yearly as the; standard deduction changes. You must file W-2s, 943s, etc. Keep payroll records of hours worked and duties and pay regularly. i. Cash method farmers may elect to include crop insurance and disaster payments in ... income.pdf This downloadable file contains worksheets for, wages and pensions, IRA distributions, interest and dividends, Miscellaneous income (tax refunds, social security, unemployment, other income). Don't forget to attach W-2's and 1099 forms to you worksheets. DAY CARE PROVIDERS WORKSHEET For the tax year _____ Welcome back for another tax preparation adventure. This past year the IRS has launched a campaign of new audits and is concentrating on small business owners. We have seen an increase in the number of audits, along with an increase in the scrutiny of deductions that are allowed.

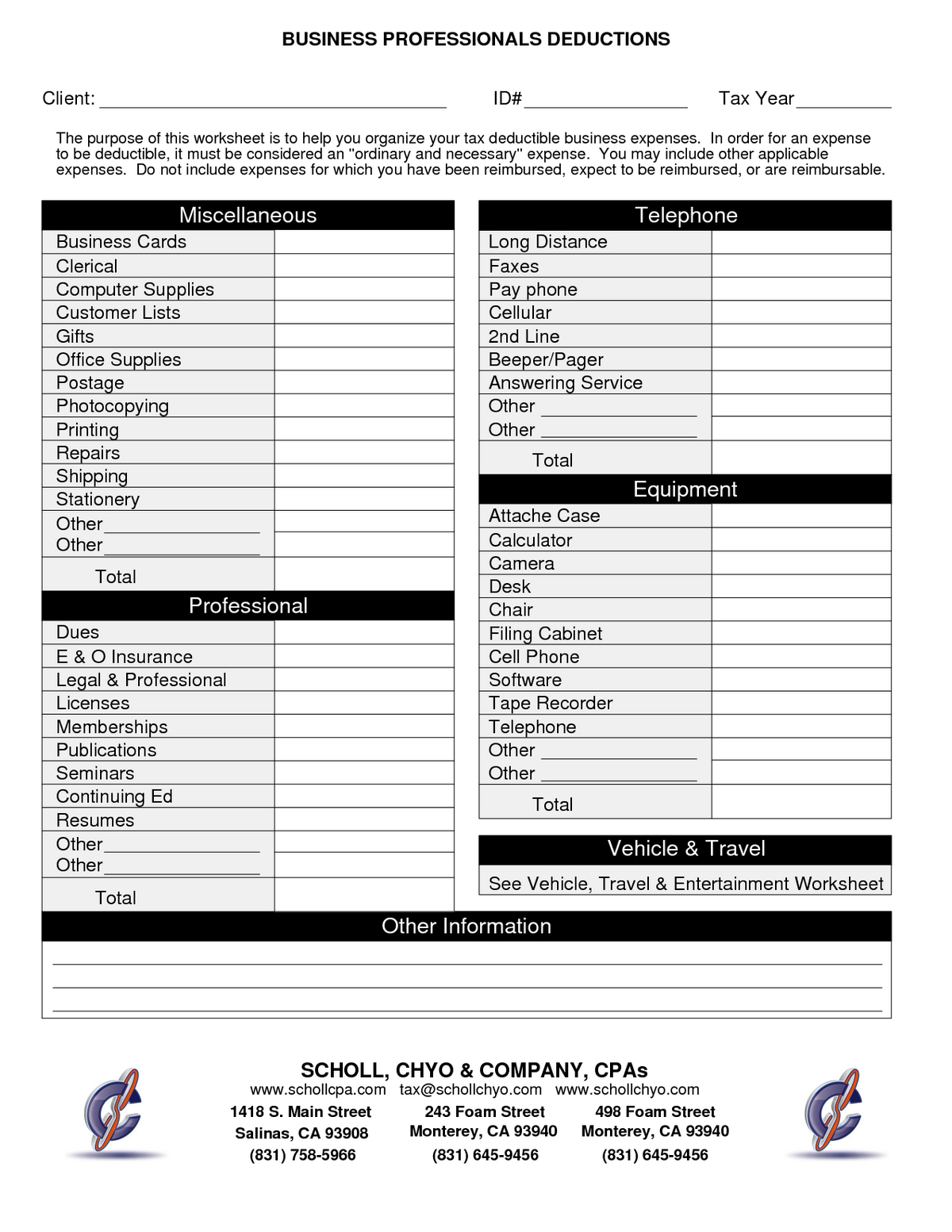

were on a pre-tax basis) • Funeral, burial, or cremation expenses • Health savings account payments for medical expenses • Operation, treatment, or medicine that is illegal under federal or state law • Life insurance or income protection policies, or policies providing payment for loss of life, limb, sight, etc. • Maternity clothes exemption from withholding if your income exceeds $950 and includes more than $300 of unearned Basic instructions. If you are not exempt, complete the Personal Allowances Worksheet below. The worksheets on page 2 further adjust your withholding allowances based on itemized deductions, certain credits, adjustments to income, The purpose of these forms and worksheets is so you can be as prepared as possible so the tax preparation process is quick and painless as possible. We have created over 25 worksheets, forms and checklists to serve as guidance to possible deductions. There are over 300 ways to save taxes and are presented to you free of charge. IRS Standard Tax Deductions 2021, 2022. by Annie Spratt. These standard deductions will be applied by tax year for your IRS and state return(s) respectively. As a result of the latest tax reform, the standard deductions have increased significantly, however many other deductions got discontinued as a result of the same tax reform. If all this reading is not for you, simply estimate your 2021 ...

Itemized Deductions Worksheet You will need: Tax information documents (Receipts, Statements, Invoices, Vouchers) for your own records. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your Federal and/or State return.

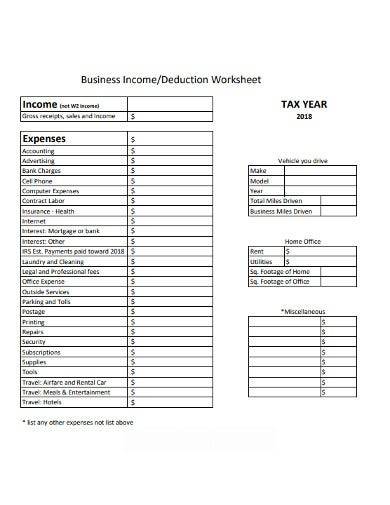

Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate.

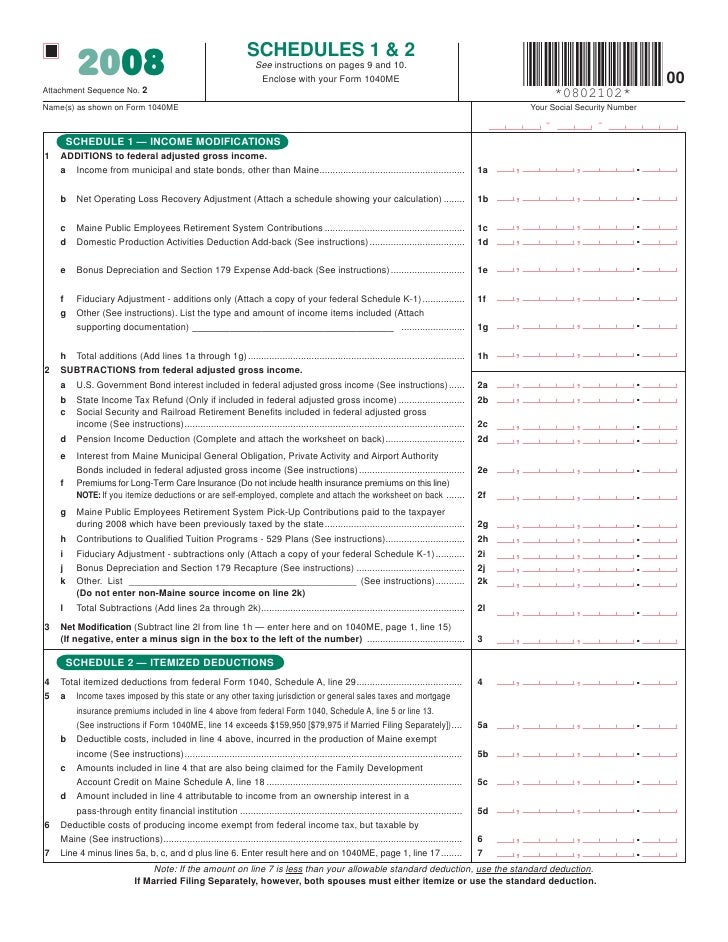

$6,000 state income tax deduction. Worksheet 4-1. State income tax addback for tax years 2018 and later Example A Example B a) Enter the total state and local tax deduction from federal Form 1040, Schedule A, line 5e. $ $ 4,500 $ 10,000 b ) Enter an y local income tax deduction included on federal Form 1040, Schedule A, line 5 a . $ $ 0 $ 500

Use this quiz/worksheet combo to assess your understanding of tax liability and deductions. The questions will quiz you on how your tax liability is calculated and an important aspect of the tax...

Form W-4 (1997) Page 2 Deductions and Adjustments Worksheet Note: Use this worksheet only if you plan to itemize deductions or claim adjustments to income on your 1997 tax return. Enter an estimate of your 1997 itemized deductions. These include qualifying home mortgage interest,

2021 Tax Return Checklist in 2022. Step 1: Before you start preparing your return on eFile.com, download or print this page as you collect the forms, receipts, documents, etc. necessary to prepare and e-file your taxes. If you miss an important form on your tax return, such as income or deduction form, you will have to prepare a tax amendment ...

Federal Income Tax Deduction Worksheet. Title: 40 Booklet TY 2020.qxp Created Date: 1/25/2021 4:02:53 PM ...

To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category.

Worksheet 1: Reconciliation statement. The Reconciliation statement worksheet (PDF, 93KB) This link will download a file is available to download.. Worksheet 1A: Net small business income. The Net small business income worksheet (PDF, 75KB) This link will download a file is available to download.. Worksheet 2: Distribution of income from other partnerships and share of net income from trusts

Complete the Personal Exemption Worksheet on page 2 to further adjust your ... c.Enter the estimated amount of your itemized deductions (excluding state and local income taxes) that exceed the amount of your standard deduction, alimony payments, allowable childcare expenses, qualified ... income tax information with the Internal Revenue Service ...

payments for that income. If you prefer to pay estimated tax rather than having tax on other income withheld from your paycheck, see Form 1040-ES, Estimated Tax for Individuals. Step 4(b). Enter in this step the amount from the Deductions Worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2022 ...

† The Historic Preservation Income Tax Credit is a new nonrefundable credit for taxable years 2020 to 2024 for substantial rehabilitation of a certifi ed historic structure. (Act 267, SLH 2019) † The Ship Repair Industry Tax Credit is a new nonrefundable credit for taxable years 2022 to 2026 for the construction of a new drydock at Pearl

2020/2021 Tax Estimate Spreadsheet. If you are looking to find out if you will get a tax refund or if you owe money this year, here is a simple Excel spreadsheet that can help you estimate federal and state income taxes before you file your return in 2021. The formulas and spreadsheets shown and linked below take the new tax reform and tax cuts ...

Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses, and

0 Response to "39 income tax deduction worksheet"

Post a Comment